Is Copay Part Of Deductible

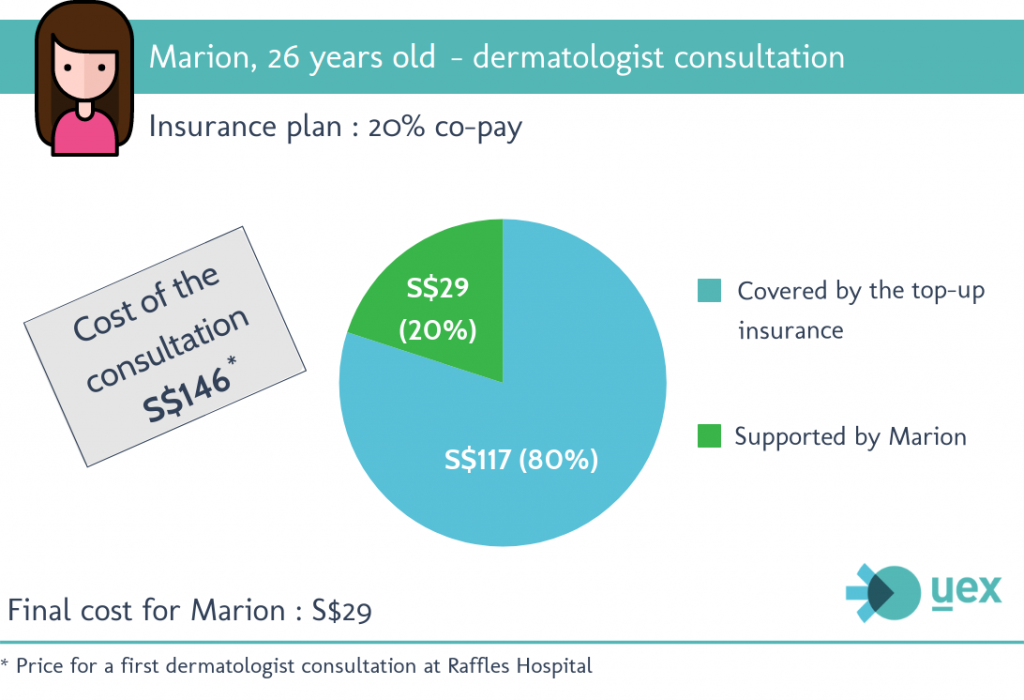

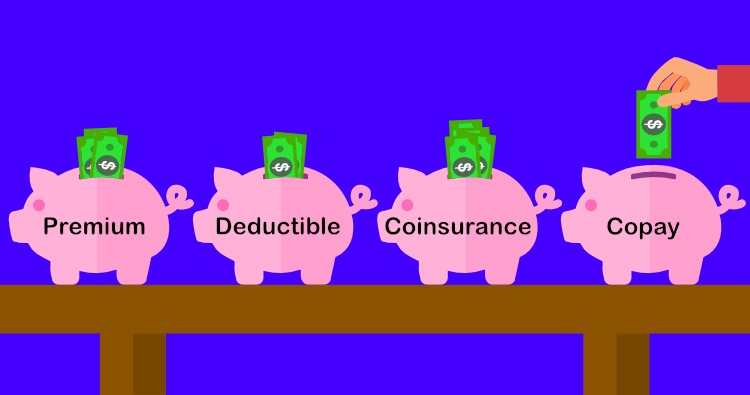

Difference between Copay and Deductible Copay is the fixed amount that you have to pay towards your treatment. Even though its called coinsurance it operates like a copay.

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Understanding Deductibles Out Of Pocket Maximums Health Insurance

A co-payment is a specific amount that you pay at the doctors office before you meet your deductible.

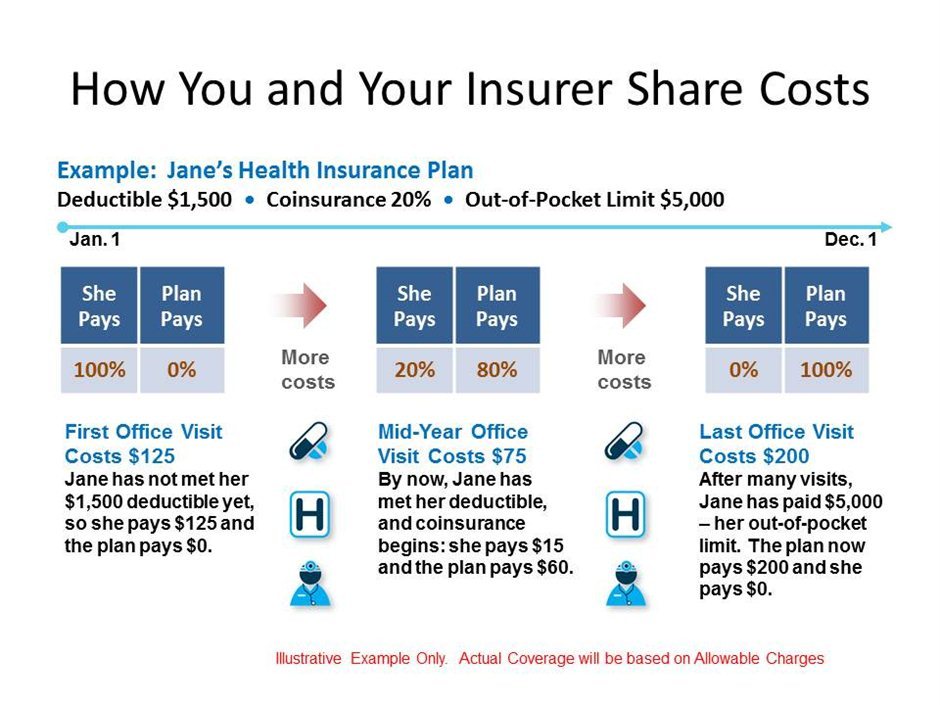

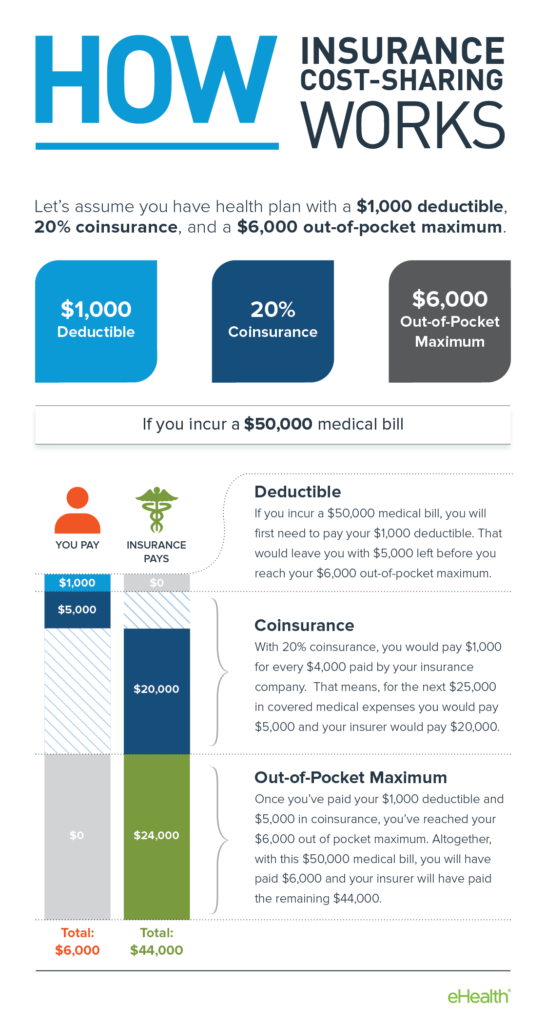

Is copay part of deductible. However as of 2014 copays do count towards your out of pocket maximum. The maximum often doesnt count premiums and any. Coinsurance is a portion of the medical cost you pay after your deductible has been met.

A copay after deductible is a flat fee you pay for medical service as part of a cost-sharing relationship in which you and your health insurance provider must pay for your medical expenses. In this example Saras deductible would be 5200. Most health plans have three types of out-of-pocket costs.

It can be a fixed amount per the nature of treatment of a fixed percentage. Summary of deductible and Copay The co-payments and deductible payments are both fixed and this means that none of them will change regardless of the total of your healthcare costs. If you see the doctor frequently or fill prescriptions routinely copayments that are credited toward your deductible will help but again remember that even if theyre not counted towards your deductible theyre probably still counting towards your plans maximum out-of-pocket amount.

This may be considered a copayment too by some insurers. These two are very different from a third cost-sharing method known as co-insurance where you owe a certain percentage of the amount and not a fixed amount. Coinsurance What is coinsurance.

As healthcare costs have risen insurance companies have steadily increased the amount of copays. If your plan includes copays you pay the copay flat fee at the time of service at the pharmacy or doctors office for example. You may not always have a copay however.

What is a copay. Any copayments or coinsurances are also factored into your out-of-pocket maximum. Remember that most health.

Your plan may have a 0 copay for seeing your doctor for example in which case you would not have to pay a copay each time you visit your doctor. Deductible is a fixed amount like Rs 5000 or Rs 10000 that you are required to pay before the claim process arises. The deductible is the amount that you need to pay as a share towards your medical bill upon which your policy comes into effect.

A lot of insurances charge something different from copay and deductible and require individuals to pay a percentage of certain expenses. The challenging part to actually lowering your taxes with co-pays is racking up enough to actually earn a tax write-off. Policyholders often get confused between co-payment and deductible because both require them to make payment during the claim process.

Your deductible is part of your out-of-pocket maximum. Deductibles coinsurance and copays are all examples of cost sharing. A deductible is the amount you pay for a service before the plan shares the cost of the service with you.

The deductible is the dollar amount you pay for covered health care services before your insurance plan starts to pay. Depending on how your plan works what you pay in copays may count toward meeting your deductible. You may have a copay before youve finished paying toward your deductible.

Your plan determines what your copay is for different types of services and when you have one. Also in many cases insurance companies dont count copays as fulfilling part of the patients deductible expenses. The amount can vary by the type of service.

Coinsurance is a percentage of a providers charge that you may be required to pay after youve met the deductible. The medical expenses deduction only allows you to claim expenses in excess of 10 percent of your adjusted gross income -- any amounts under that threshold arent deductible. A copay is a fixed amount of money established by an insurance plan as a cost sharing measure for certain health services.

An annual deductible copays and coinsurance. A deductible is defined as the amount you owe for health care services your health plan covers before your health plan begins to pay. Coinsurance is a way.

Copayments add up. But these two clauses are completely different from each other. A deductible is the amount of money you must pay out-of-pocket toward covered benefits before your health insurance company starts paying.

In most cases your copay will not go toward your deductible. Copays do not count towards your deductible for most plans. Everything You Need to Know.

Saras plan wont start paying any of her hospitalhealth care bills until she has paid her 5200 deductible for the plan benefit year. A copay is a fixed amount you pay for a health care service usually when you receive the service. After meeting a deductible of 1484 Medicare Part A beneficiaries can expect to pay coinsurance for each day of an inpatient stay in a hospital mental health facility or skilled nursing facility.

For example if your plan has a 1000 deductible you pay the first 1000 of covered services before your insurance kicks in. What is a deductible.

What The Hell Is A Deductible Co Insurance And Co Pay Anyway Robbins Rehabilitation East Physical Therapy In Easton Pa Philipsburg Nj And Lebanon Nj

What The Hell Is A Deductible Co Insurance And Co Pay Anyway Robbins Rehabilitation East Physical Therapy In Easton Pa Philipsburg Nj And Lebanon Nj

Benefits A Z What Is A Deductible

Benefits A Z What Is A Deductible

Coinsurance Everything You Need To Know Harris Insurance

Coinsurance Everything You Need To Know Harris Insurance

Copay Vs Deductible How Does Insurance Work Aeroflow Healthcare

Copay Vs Deductible How Does Insurance Work Aeroflow Healthcare

Small Business Health Insurance Copayment

Small Business Health Insurance Copayment

Coinsurance And Medical Claims

Coinsurance And Medical Claims

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

So What S The Difference Between A Premium Deductible Copay Coinsurance And Max Out Of Pocket

So What S The Difference Between A Premium Deductible Copay Coinsurance And Max Out Of Pocket

25 Unique Deductible Copay And Coinsurance Example

How Do Health Insurance Deductibles Work

How Do Health Insurance Deductibles Work

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Montana

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Montana

Coinsurance And Medical Claims

Coinsurance And Medical Claims

Comments

Post a Comment