Featured

- Get link

- X

- Other Apps

Epo Vs Ppo Vs Hmo

Lets take a look at some of the most common differences between these two types of health insurance plans. Costs are kept low because providers charge a fee that has been negotiated with your EPO plan ahead of time.

What S The Difference Between Hmo Ppo Pos And Epo Insurance Justworks

What S The Difference Between Hmo Ppo Pos And Epo Insurance Justworks

In-network versus out-of-network care.

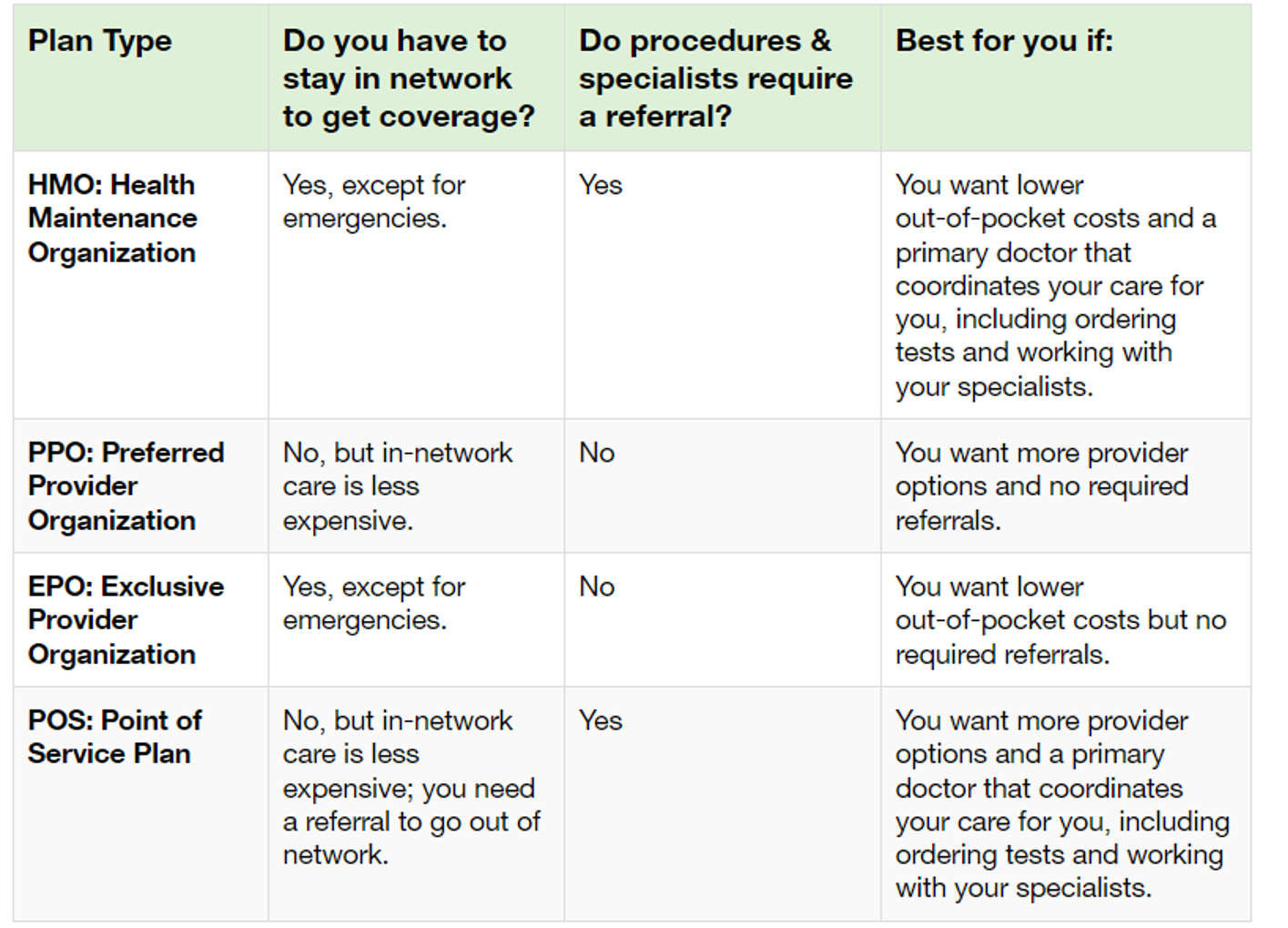

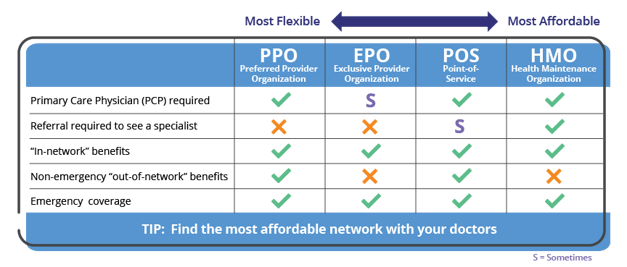

Epo vs ppo vs hmo. HMOs offered by employers often have lower cost-sharing requirements ie lower deductibles copays and out-of-pocket maximums than PPO options offered by the same employer although HMOs sold in the individual insurance market often have out-of-pocket costs that are just as high as the available PPOs. This may be an HMO PPO or EPO and is a classification for the type of network your plan offers. Health plans sold through Covered California fall in these three categories.

Like a PPO you do not need a referral to get care from a specialist. Some of these plans provide more flexibility in which providers you can while see while others might require you to get permission or pre-authorization from the insurance company before you can have a medical procedure. PPO health plans have access to those negotiated rates.

You can self-refer to an in-network provider when a medical need arises. HMOs have lower premiums and out-of-pocket expenses but less flexibility. Whats the difference between an HMO PPO and EPO.

The HMO on the other hand has a network which is very localized in nature and consists of local hospitals and physicians in the geographic vicinity of the insured. EPOs are similar to HMOs in that you must stay within your network emergency care is an exception however with an EPO you generally do not need to select a Primary Care Physician nor receive a referral to see a specialist. 7 Differences Between an HMO vs.

The ABCs of Health Insurance. For some however an HMO health maintenance organization or PPO preferred provider organization might be a better fit. Difference Between HMO and EPO HMO vs EPO HMO and EPO are both health insurance schemes.

The main difference between EPO and PPO plans and Health Maintenance Organizations HMOs is the need for a Primary Care Physician PCP in an HMO. This type of plan gives you a little more freedom than an HMO plan. This means that in an HMO planyou do not contact the insurer to get pre-authorization for treatment but must be referred to a specialist by a PCP who is a member of the HMOs network.

They differ when it comes to things like costs and provider networks the doctors hospitals labs and so on that your plan covers. If the alphabet soup of health insurance jargon still has you scratching your head take heart. Need to stay in network for care limited network You dont need to choose a PCP or need a referral so in that sense its similar to a PPO but you will only receive coverage for providers in your network.

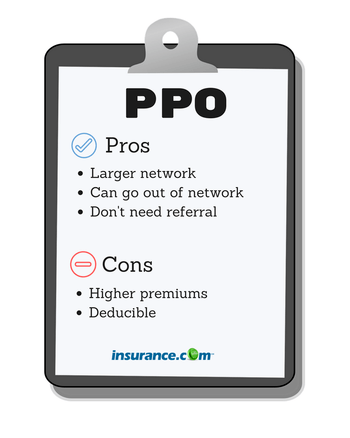

Other parts of an EPO plan are similar to an HMO such as having a limited network of doctors and hospitals. PPO stands for preferred-provider organization. PPOs are also fairly rare in the individual market.

An Exclusive Provider Organization EPO is a lesser-known plan type. Unlike HMOs EPOs usually do not require patients to select a primary care physician and do not require referrals to see specialists. But like an HMO you are responsible for paying out-of-pocket if you seek care from a.

This video will help you choose the right type of plan based on your specific medical and provider needs. EPOs generally offer a little more flexibility than an HMO and are generally a bit less pricey than a PPO. A PPOs premiums are usually much higher than an HMO and HDHP but that comes with greater flexibility.

When considering their difference the HMO can be termed as an insured product which. Well there are several technical differences between HMO and EPO. HMO stands for Health Maintenance Organization and EPO stands for Exclusive Provider Organization.

An HMO is a health maintenance organization a PPO is a preferred provider organization and an EPO is an exclusive provider organization. What is a PPO. EPO also provides access to a network of providers.

Like HMOs these plans do not pay for out-of-network care except in some emergency circumstances. They may or may not require referrals from a primary care physician. Like HMOs EPOs cover only in-network care but networks are generally larger than for HMOs.

Forty-seven percent of enrollees in employer-based health plans are in a PPO. IN-NETWORK COVERAGE As compared to EPO and HMO PPO plans have a wider network of hospitals and physicians for the insured to get treatment from. Many often wonder what all the different health pla.

PPO HMO EPO exclusive provider organization and POS point of service plans have different benefits and costs. Similar to an EPO a PPO network is made up of those doctors and facilities that have negotiated lower rates on the services they perform.

What S The Difference Between Hmo Pos Epo And Ppo Plans E D Bellis

Hmo Vs Ppo Which Plan Is Best For You

Hmo Vs Ppo Which Plan Is Best For You

Individual And Family Health Plans Wilson Consulting Group

Individual And Family Health Plans Wilson Consulting Group

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Pin On Obama Care Health Insurance

Pin On Obama Care Health Insurance

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between An Hmo Vs Ppo Xcelhr

Epo Vs Ppo Difference And Comparison Diffen

Epo Vs Ppo Difference And Comparison Diffen

Know Your Options Individual Health Insurance In Tennessee

Know Your Options Individual Health Insurance In Tennessee

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Ppo Or Epo I Just Don T Know

Hmo Ppo Or Epo I Just Don T Know

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

Comments

Post a Comment