Featured

What Does Medigap G Cover

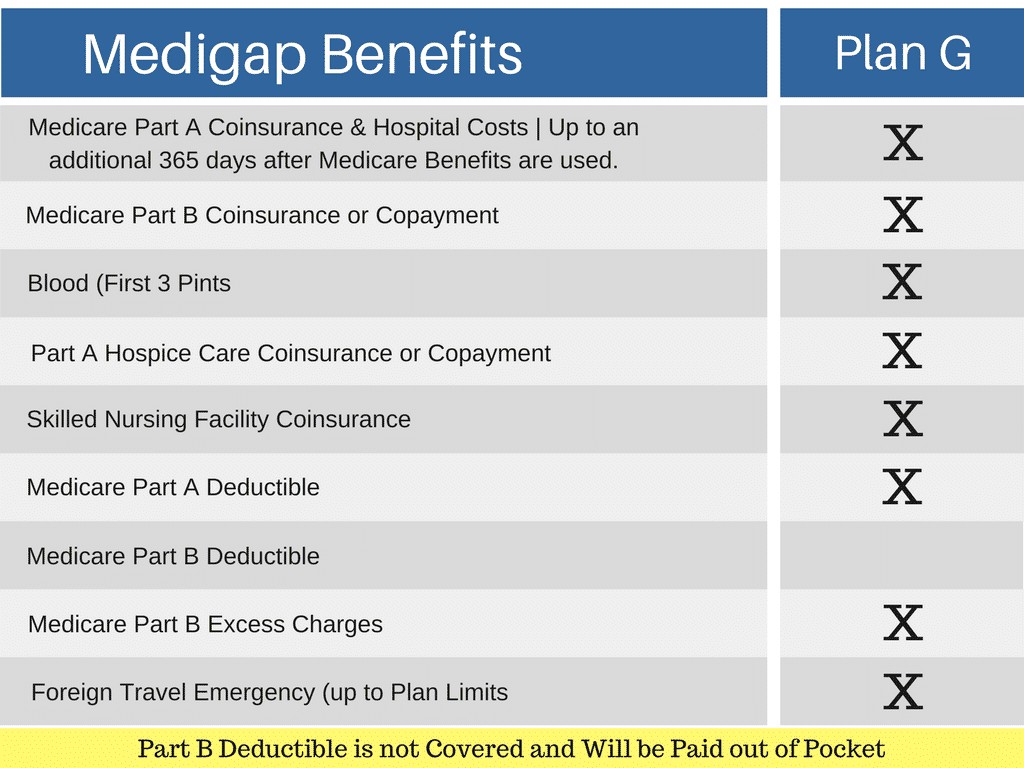

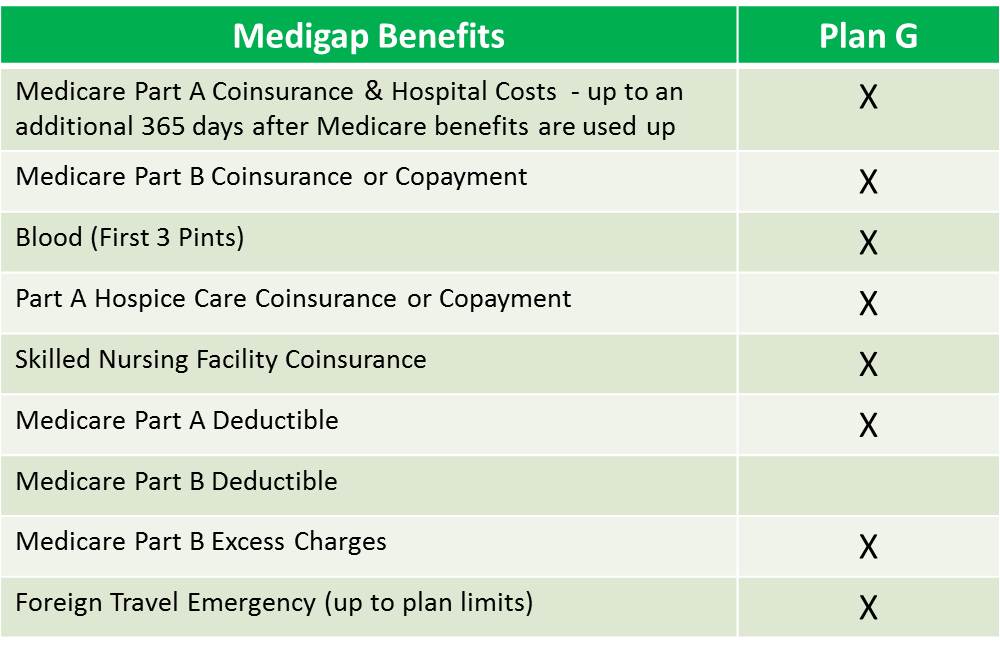

These plans administered by private medical insurance companies help cover out-of-pocket costs in Medicare. It covers all the gaps in Original Medicare other than Part Bs deductible.

United American Medicare Supplement Boomer Benefits

United American Medicare Supplement Boomer Benefits

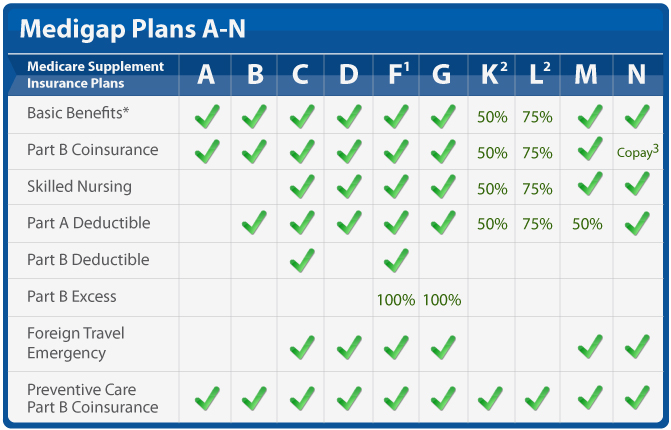

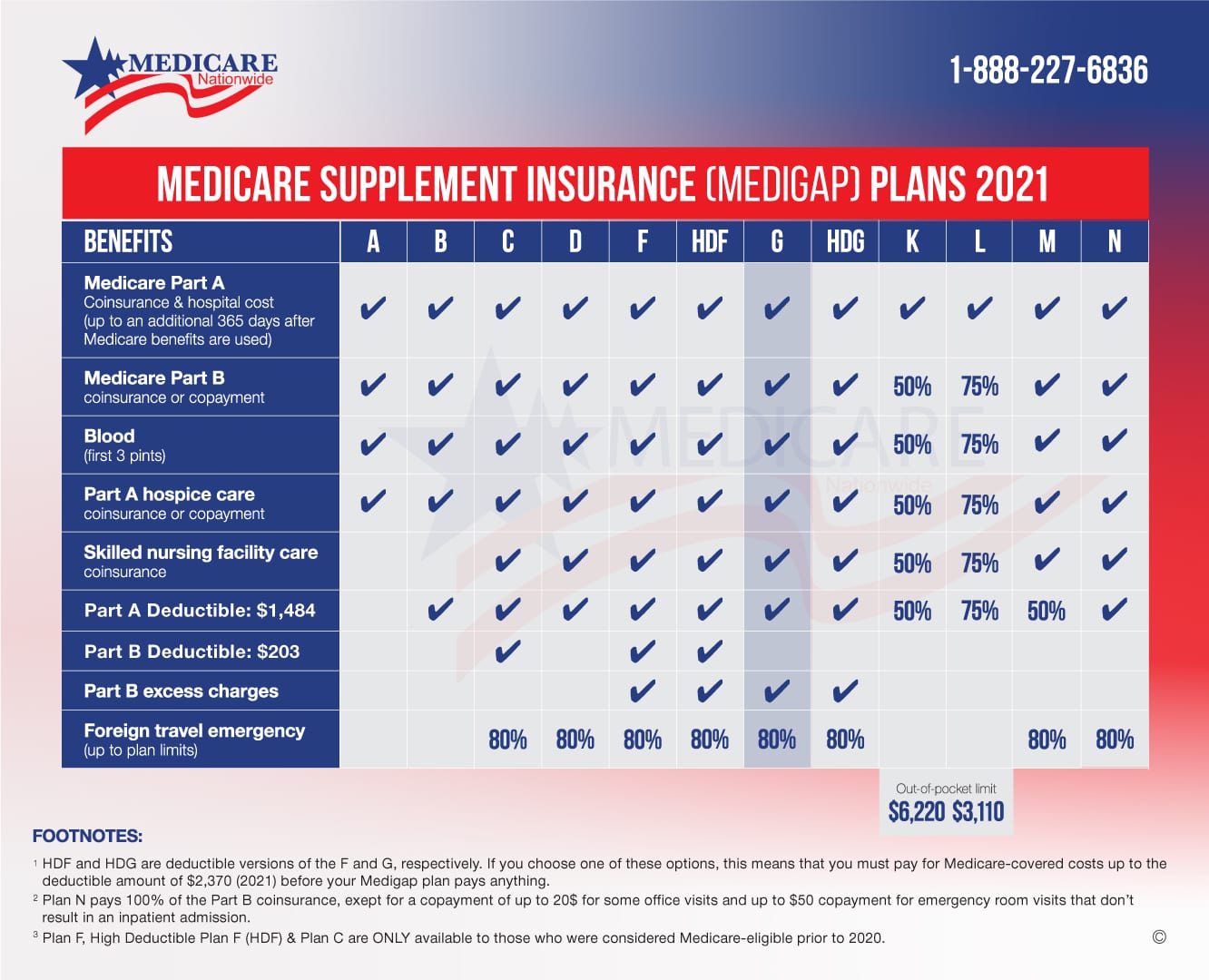

Medigap as a standard coverage of ten plans designed by Medicare such that every plan is offered in the same manner wherever you may be.

What does medigap g cover. 365 additional hospitalization days. Medigap Plan G is the same as Medicare Supplement Plan G. Medigap policies are a system of 10 standardized Medigap plans with designations A B C D F G K L M and N.

Medicare Plan G is a Medigap Supplement Insurance plan to help pay expenses from Medicare Part A and Part B. In some cases Medigap will also cover. Medigap Plan G offers the second-best coverage in the Medicare Supplement realm making it the second-most popular plan among Medicare beneficiaries.

Some Medigap plans can help extend the period of coverage for skilled nursing facility stays. So what does Plan G cover. Plan G covers everything that Medicare Part A and B cover at 100 except for the Part B deductible.

Supplemental insurance plans are provided by private insurers and while all Medigap insurers must offer the same benefits for each Medigap plan they carry not. Plan G covers 100 of the gaps or out of pocket costs in Medicare with the exception of the Medicare Part B deductible which is 203 in 2021. Each of these plans can provide for healthcare based on the ability to provide from the list given by MedicareThe expenses covered are.

Plan G is one of only two supplement plans that cover Part B excess charges extra charges from doctors who dont participate in Medicare. First 3 pints of blood for a transfusion. A person is eligible to enroll during the Open.

If you qualify for Original Medicare you may be able to enroll in Plan G. A Small Deductible Big Savings. Plan G covers many costs and this is why its the second most popular supplemental insurance plan behind Plan F.

Medigap is supplemental insurance plan sold by private companies to help cover original Medicare costs such as deductibles copayments and coinsurance. This deductible is 203 in 2021. Medigap is Medicare supplemental insurance sold by private companies to help cover original Medicare costs such as deductibles copayments and coinsurance.

Medicare Plan G also called Medigap Plan G is an increasingly popular Supplement for several reasons. In many states costs also vary based on your gender and whether you smoke or vape. They are designed to provide more coverage for Ordinary Medicare in addition to all or part of the expenditure that Medicare does not cover like visual dental pharmaceutical or long-term coverage.

Medigap plans may also reduce out-of-pocket costs for hospice services not fully covered by Medicare Part A. If you shop rates at Boomer Benefits we can often find a Supplement Plan G that saves quite a bit in. What does Plan G Cover.

Medigap insurance can help cover costs that Original Medicare does not. 3 Request a quote in your area. In particular Medigap Plan G covers all your Medicare coverage gaps except the Part B deductible.

This means that once you have paid your Part B deductible each year Medigap will cover 100 out of pocket costs after that no matter how many times you use receive Medicare-approved health care services. Premium costs vary widely depending on where you live. Medicare Plan G covers more than most Medicare supplement insurance Medigap plans.

Medigap Plan G is a Medicare supplement. Here is a list of what Medigap can cover. Nationwide network of doctors and hospitals.

What Does Plan G Cover. Covers Medicare Part A and Part B deductibles. Since medical bills can stack up quickly having this supplemental insurance can be vital.

What Does Medigap Cover. Medigap plans fill in the gaps of Original Medicare however each Medigap plan offers different coverage. People who frequently travel to foreign countries.

Plan G covers 80 of emergency health care costs while in another country after you pay a 250 deductible. Medigap policies only cover one person so your spouse will need to buy their own policy. What a Medigap plan does is supplement your Original Medicare benefits.

It is also called Medigap Plan G. Federal law doesnt require that companies sell Medigap policies to those under age 65. Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used Medicare Part B coinsurance or copayment Blood first 3 pints Part A hospice care coinsurance or copayment Skilled nursing facility care coinsurance Part A.

You can add this supplemental insurance to your Original Medicare insurance. First Plan G covers each of the gaps in Medicare except for the annual Part B deductible. Medigap is another name for Medicare Supplement.

Medicare Supplement Plans Texas Illustrated Guide To Medicare In Texas

Medicare Supplement Plans Texas Illustrated Guide To Medicare In Texas

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G Calogero Essentiel

Medicare Plan G What You Need To Know Ensurem

Medicare Plan G What You Need To Know Ensurem

Does Medicare Supplement Plan G Cover Chiropractors

Does Medicare Supplement Plan G Cover Chiropractors

Medicare Supplement Plan G What Are The Facts Gomedigap

Medicare Supplement Plan G What Are The Facts Gomedigap

High Deductible Plan G What Are The Facts Gomedigap

High Deductible Plan G What Are The Facts Gomedigap

Choosing Between Medigap Plan G And Plan N 65medicare Org

Choosing Between Medigap Plan G And Plan N 65medicare Org

Medigap Plan G Medicare Supplement Plan G 65medicare Org

Medigap Plan G Medicare Supplement Plan G 65medicare Org

Medicare Plan G Review Medicare Nationwide

Medicare Plan G Review Medicare Nationwide

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

Medigap Plan G Tupelo Ms Bobby Brock Insurance

Medigap Plan G Tupelo Ms Bobby Brock Insurance

Comments

Post a Comment