Featured

Why Is Ppo Better Than Hmo

More flexibility to use providers both in-network and out-of-network. A PPO may be better if you already have a doctor or medical team that you want to keep but who dont belong to your plan network.

Take The Guessing Game Out Of Ppo Vs Hmo Learn More At Larusatax Com Dental Plans Dental Insurance Medical Information

Take The Guessing Game Out Of Ppo Vs Hmo Learn More At Larusatax Com Dental Plans Dental Insurance Medical Information

Like an HMO a PPO may charge a copayment for each office visit and there is usually no paperwork to complete.

Why is ppo better than hmo. A PPO plan can be a better choice compared with an HMO if you need flexibility in which health care providers you see. Fact 2 PPO plans as preferred again would suggest tend to be much more expensive than HMO plans. Medicare HMO PPO Medicare also has both PPO and HMO options.

This makes HMO plans a more economical choice than PPOs. PPO plans offer savings against traditional plans with some flexibility retained. The network of physicians is often much larger than an HMO and members can refer themselves to physicians outside of the network although you may pay a higher copayment for this service.

An HMO is a Health Maintenance Organization while PPO stands for Preferred Provider Organization. PPO stands for Preferred Provider Organization. PPO plans generally come with a higher monthly premium than HMOs.

Both HMO and PPO plans rely on using in-network providers. Generally speaking an HMO might make sense if lower costs are most important and if you dont mind using a PCP to manage your care. Unlike most HMO health plans you wont likely need to select a primary care physician and you wont usually need a referral from that physician to see a specialist.

In terms of use traditional plans usually give the subscriber greatest flexibility and cost the most. What is better HMO or PPO. Unlike an HMO PPO plans give participants the freedom to seek care from any.

PPOs are more flexible and provide greater coverage but come with a higher price tag and probably a deductible. As the word preferred would suggest participants have more flexibility and options associated with the plan making it preferred. After reading about the differences between HMOs and PPOs it may seem like the PPO sounds hands down better than the HMO.

But the major differences between the two plans. An HMO generally only covers care received from the plans contracted providers known as. A PPO network will likely be larger giving you a greater selection of in-network doctors specialists and facilities to choose from.

Is a PPO worth it. The biggest advantage that PPO plans offer over HMO plans is flexibility. HMOs offered by employers often have lower cost-sharing requirements ie lower deductibles copays and out-of-pocket maximums than PPO options offered by the same employer although HMOs sold in the individual insurance market often have out-of-pocket costs that are just as high as the available PPOs.

The differences besides acronyms are distinct. Many HMO providers are paid on a per-member basis regardless of the number of times they see a member. PPOs offer participants much more choice for choosing when and where they seek health care.

Why would a person choose a PPO over an HMO. The most significant disadvantage for a PPO plan compared to an HMO is the price. The PPO does not require the use of a primary care physician PCP or a referral to see a.

Is HMO better than PPO. HMOs tend to be more affordable but youll usually get less coverage and more restrictions. Regarding its freedom to see both in-network and out-of-network providers and its options to see specialists without a referral it does seem more flexible.

There also may be some. Is HMO better than PPO. However PPO plans offer flexibility by covering out-of-network providers at a higher cost.

PPO plans generally come with a higher monthly premium than HMOs. HMO plans typically limit flexibility and out-of-pocket costs. You can usually visit specialists without a referral including out-of-network specialists.

If flexibility and choice are important to you a PPO plan could be the better choice.

Hmo Vs Ppo What S The Difference

Hmo Vs Ppo What S The Difference

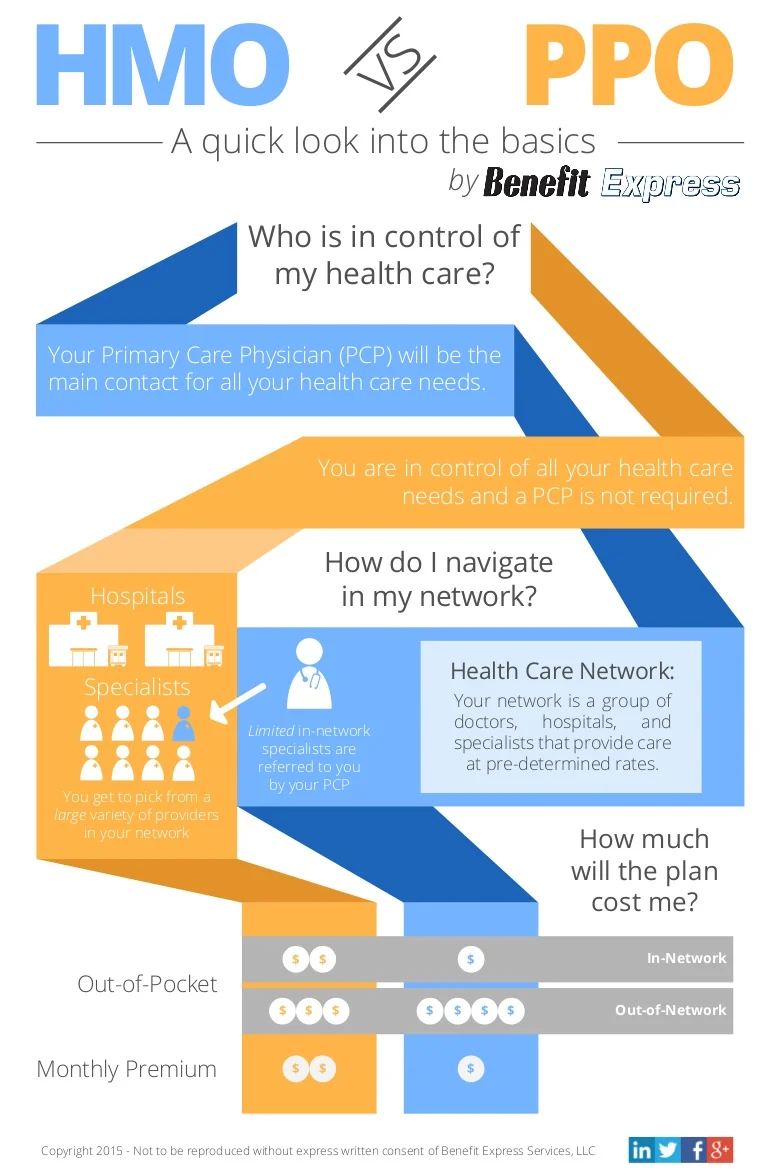

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between An Hmo Vs Ppo Xcelhr

What S The Difference Between Hmo And Ppo

What S The Difference Between Hmo And Ppo

Hmo Vs Ppo Which Plan Is Best For You

Hmo Vs Ppo Which Plan Is Best For You

Hmo Vs Ppo Benefits Cost Comparison

Hmo Vs Ppo Benefits Cost Comparison

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

How Do Commerical Ppo Vs Hmo Insurance Plans Work Dr Wenjay Sung Podiatrist

How Do Commerical Ppo Vs Hmo Insurance Plans Work Dr Wenjay Sung Podiatrist

Hmo Vs Ppo Selecting The Right Plan For Your Employees Clarity Benefit Solutions

Hmo Vs Ppo Selecting The Right Plan For Your Employees Clarity Benefit Solutions

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between An Hmo Vs Ppo Xcelhr

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Hmo Vs Ppo Health Insurance Plans Selecting The Right Plan For Your Needs San Diego Financial Literacy Center

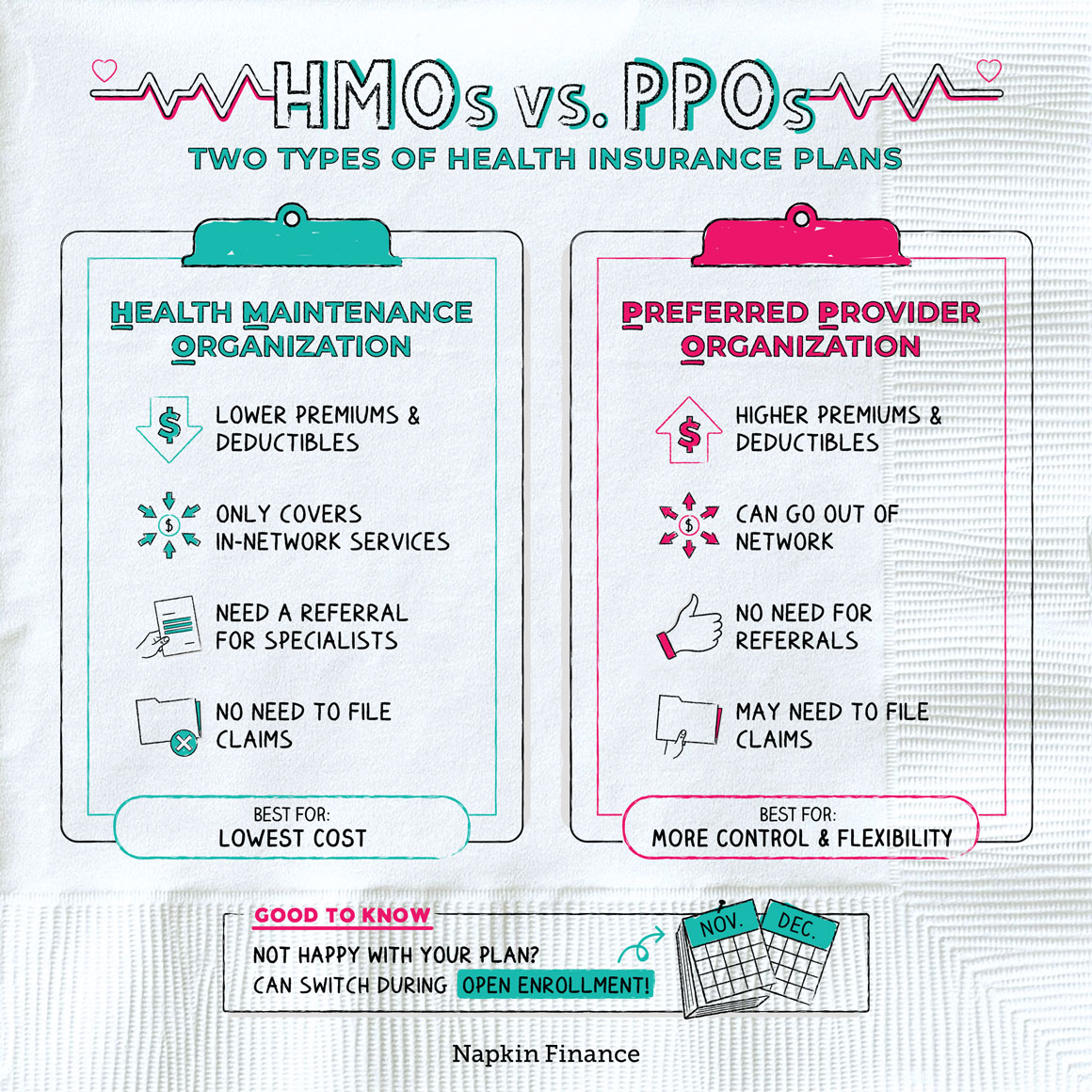

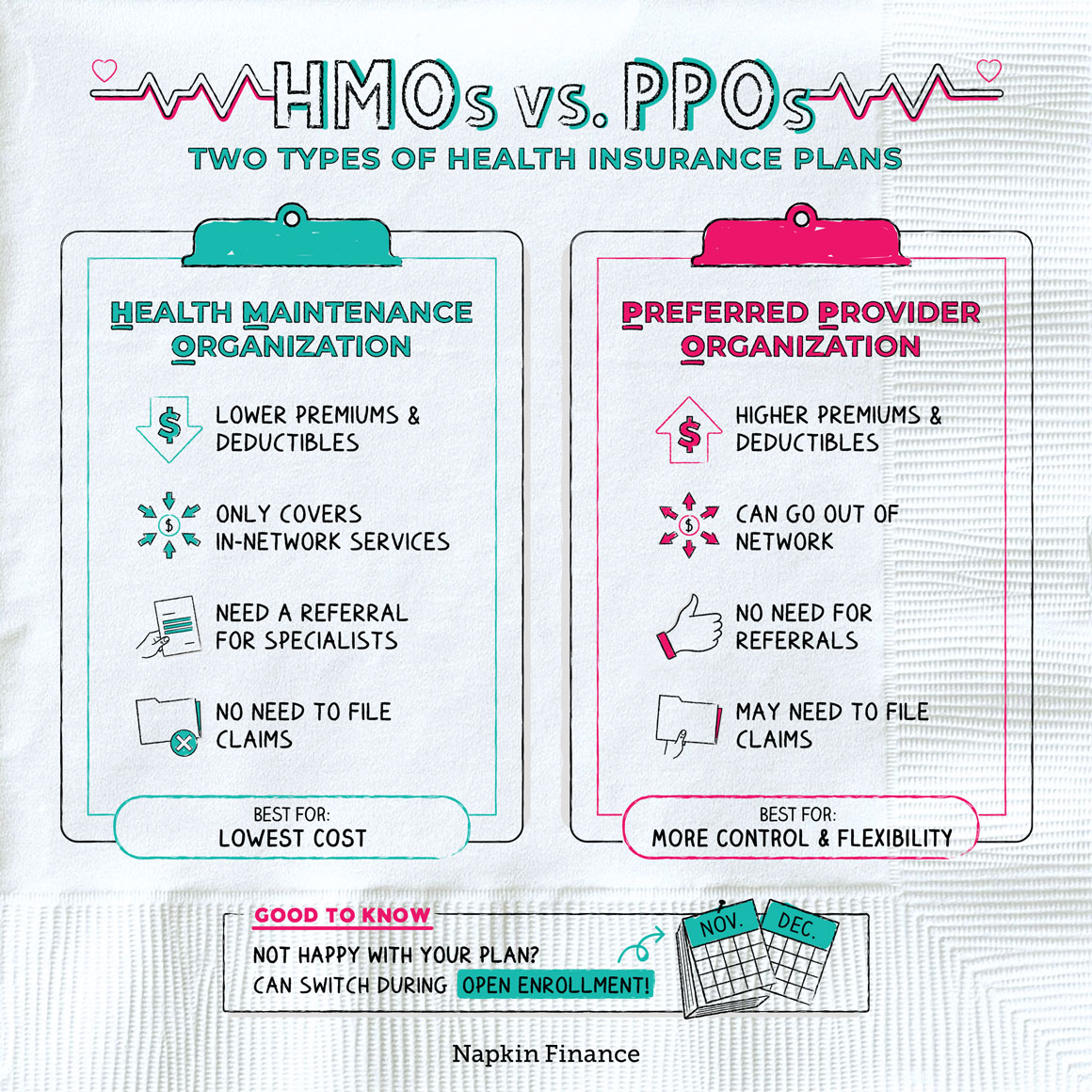

Hmo Vs Ppo Health Insurance Plans Napkin Finance

Hmo Vs Ppo Health Insurance Plans Napkin Finance

Comments

Post a Comment