Featured

Purchase Private Health Insurance

Medicare is a federal health insurance program for. Its important to note that if youre travelling interstate your cover may vary.

Hong Kong Reasons For Not Renewing Private Health Insurance 2016 Statista

Hong Kong Reasons For Not Renewing Private Health Insurance 2016 Statista

In some limited cases insurance companies sell private health plans outside Open Enrollment that count as qualifying health coverage.

Purchase private health insurance. During the annual Open Enrollment Period you can buy health insurance on the marketplace or change plans if you bought health insurance on the marketplace last year. Some policies may include cover as standard whereas on others its an optional extra. Generally the coverage you need is for visitors to Canada You need to confirm with the insurance company that they have insurance plans for people who do not have OHIP.

Its recommended you check with your state ambulance service. If youre ineligible you can purchase insurance from a private health fund or through the state ambulance service. STM plans are low-cost alternatives to the expensive ACA options.

They will cover a part of your premiums Whenever your employer provides you the choice to register for an employer-sponsored medical insurance program. Thats the place to start when looking for your options. It is a good idea to purchase private health insurance for the 3 months that you are not covered by OHIP Health Card or if you are not eligible for OHIP.

If it is theyll approve your claim and your GP will book your appointment the. These plans meet all the requirements of the health care law including covering pre-existing conditions providing free preventive care and not capping annual benefits. Find insurance coverage for you and your family before age 65.

If your employer does not offer you health insurance as part of an employee benefits program you might be considering buying your health insurance through a private medical insurance provider. Aetna offers health insurance as well as dental vision and other plans to meet the needs of individuals and families employers health care providers and insurance agentsbrokers. Not all health related expenses are covered by private insurance.

For private health insurance that people purchase themselves in the individualfamily market the Affordable Care Act created premium subsidies and cost-sharing reductions which make coverage and care much more affordable than they would otherwise be. If they need to theyll refer you to a specialist. View individual and family plans.

Depending on your level of cover it can be used to pay for everything from private hospital stays to diagnostic procedures surgery physiotherapy and more. With private health insurance you may be able to choose private hospitals or specialists which might not be available on the NHS. While these plans do not cover pre-existing conditions and typically offer very little in the way of.

You simply enter in your information including your income and the site provides your health plan options including estimated costs and factors in subsidies. If you have one of these plans you wont. After this youll need to tell your insurance provider that you want to claim and theyll confirm whether the treatment you want or need is covered by your policy.

Private health insurance purchased on your own not through an employer is significantly more expensive. Due to recent changes in the law these plans are now able to be purchased for 36 months at a time in many states. They are 100 real health insurance with large PPO networks.

The average premium for UK private health insurance is 1435 per year source. But you might pay much less than that for health insurance depending on the two factors that influence the cost. Medicare and Medicaid also offer health care coverage to some residents in the United States.

The path to healthy. According to eHealth Insurance the average cost of an individual plan purchased. The best time for most people to apply for health insurance is during the annual Open Enrollment Period that runs from November 1st through December 15th in 2020.

If youre looking for individual or family health insurance prior to age 65 youll find UnitedHealthcare offers many choices to fit your needs. You can also find additional insurance products to round out your coverage. How Purchasing Private Health Insurance Works Some Americans gain insurance by joining in a group health insurance plan through their employers.

Any like-for-like comparison is tricky for health insurance policies as there are so many variables. Although statutory health insurance schemes cover your family and kids at no extra cost private health insurance is usually purchased on an individual basis. Health insurance also known as private medical insurance is a policy that covers the cost of private healthcare.

For example Queensland and Tasmanian residents who have free ambulance cover in their state may not be covered when in Victoria or another state. There are many benefit levels available to suit all budgets. How to buy private health insurance With any insurance the most important factor is ensuring it is fit for purpose and meets your needs.

If you have a spouse or children you would like to cover as well you should take this into consideration when deciding whether to opt for statutory or private health insurance. How to buy individual health insurance. The health insurance marketplace is the ACA exchanges website making it simple for people to compare individual health plans.

The Path To Purchase For Private Health Insurance How Providers Can Reach And Engage Aussies Online Think With Google

The Path To Purchase For Private Health Insurance How Providers Can Reach And Engage Aussies Online Think With Google

Statutory Health Insurance In Germany A Health System Shaped By 135 Years Of Solidarity Self Governance And Competition The Lancet

Statutory Health Insurance In Germany A Health System Shaped By 135 Years Of Solidarity Self Governance And Competition The Lancet

Coronavirus Outbreak Can Drive Private Health Insurance Adoption In China Says Globaldata Globaldata

Private Health Insurance In Germany Private Krankenversicherung

Private Health Insurance In Germany Private Krankenversicherung

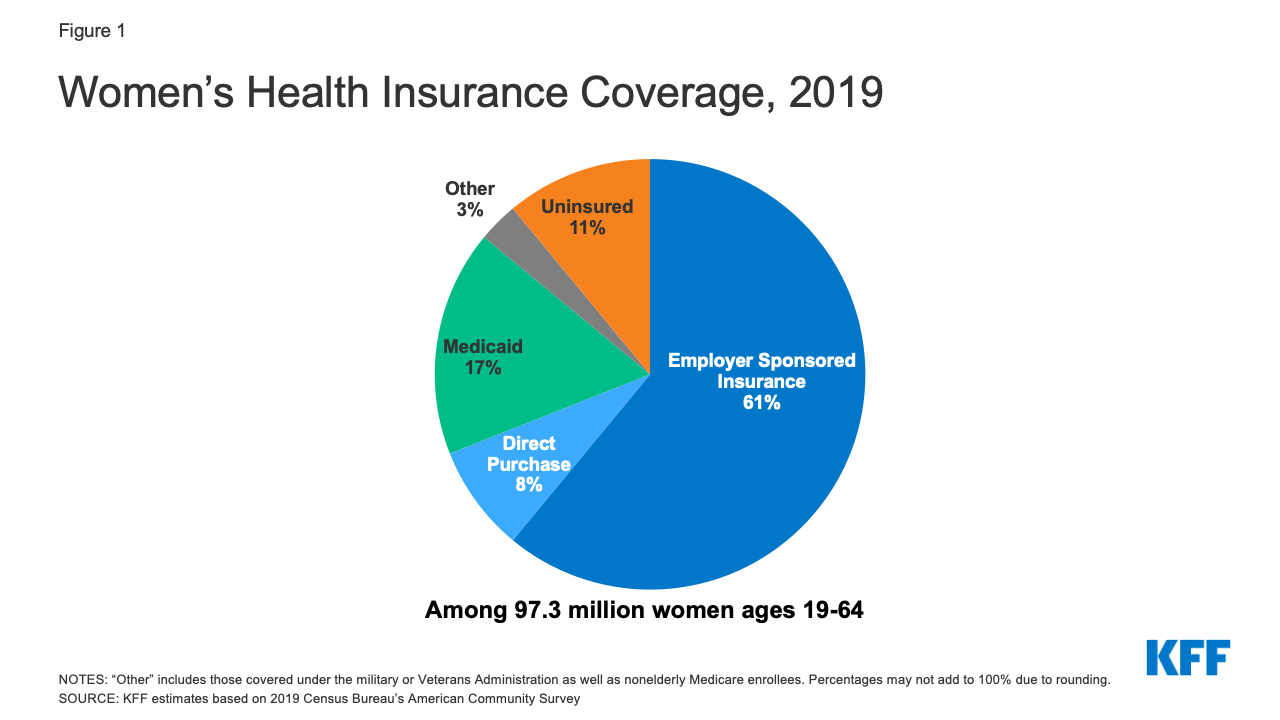

Women S Health Insurance Coverage Kff

Women S Health Insurance Coverage Kff

What Is Private Health Insurance

What Is Private Health Insurance

Logistic Regression Analysis For The Purchase Of Private Health Insurance Download Table

Logistic Regression Analysis For The Purchase Of Private Health Insurance Download Table

Health Insurance In Germany A Guide For Expats Expatica

Health Insurance In Germany A Guide For Expats Expatica

The Path To Purchase For Private Health Insurance How Providers Can Reach And Engage Aussies Online Think With Google

The Path To Purchase For Private Health Insurance How Providers Can Reach And Engage Aussies Online Think With Google

The Path To Purchase For Private Health Insurance How Providers Can Reach And Engage Aussies Online Think With Google

The Path To Purchase For Private Health Insurance How Providers Can Reach And Engage Aussies Online Think With Google

Ahp Analysis Of Determinants In Private Health Insurance Purchase Download Table

Ahp Analysis Of Determinants In Private Health Insurance Purchase Download Table

Student Health Insurance For Studying In Germany Guide

Student Health Insurance For Studying In Germany Guide

Comments

Post a Comment