Featured

Aggregate Health Insurance

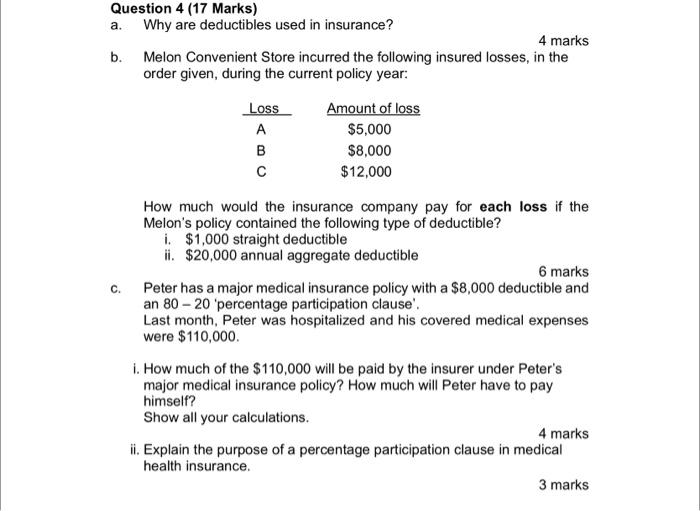

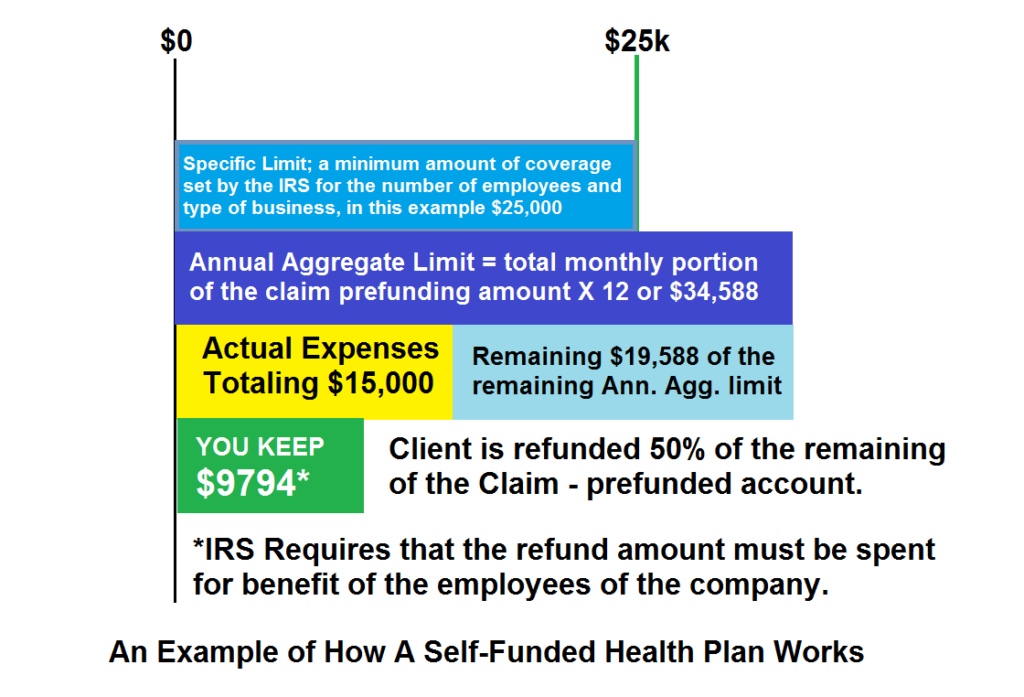

It works differently than the more common embedded deductibles used in non-HDHP health insurance. The annual aggregate limit is the maximum amount of coverage an insurance policy provides over a policy year.

An aggregate deductible refers to the system most high-deductible health plans HDHPs have traditionally used for family deductibles.

Aggregate health insurance. Under an aggregate deductible family health insurance plan the total family deductible must be paid out-of-pocket before health insurance starts paying for the health care services incurred by any family member. Under this policy the insurance carrier reimburses the employer after the end of the contract period for aggregate claims. In this paper I argue that the aggregate impact of health insurance may be.

Offering a diversified lineup of competitive products to help you achieve your financial goals. An aggregate is part of how a policy limit is reflected in the contract. Today its results are generally accepted as the gold standard and are widely used in both academic and applied contexts Cutler and Zeckhauser 2000 Zweifel and Manning 2000.

This form of stop-loss provides a ceiling to the amount that an employer would pay in expenses on the entire plan on an aggregate basis during a contract period. Aggregate stop loss insurance is often used by employers with self-funded insurance plans. You may be able to obtain assistance from a lawyer or paralegal.

Health insurance on health care utilization and spending. Aggregate stop-loss insurance is a type of insurance that protects the insured if the total number of claims under a specific coverage in their policy ends up being higher than anticipated. With self-funded insurance the employer assumes all financial risk when providing his or her employees with healthcare coverage.

So 3 claims of. The aggregate stop-loss insurance is usually added to employer insurance policies that cover employees that opt into the policy. The aggregate insurance definition is the most your policy will pay for all losses you sustain over a given period of time usually a year.

Once covered expenses reach the annual aggregate the policy stops paying out benefits even if subsequent legitimate claims are filed. The stop-loss coverage usually includes the. I rarely see it used in individual major medical plans except for those plan designs that are HSA qualified.

It is found in a wide variety of insurance types such as auto health and property. If you answered NO to health questions 1-3 and your Aggregate coverage is 500000 or less then Life Insurance coverage starts on the date you applied for coverage. The term is used often in self funded employer group plans where the employer is funding the claims up to an aggregate cap if they have purchased medical stop loss coverage.

In many cases it is the same as the aggregate. With an aggregate deductible there is no embedded deductible for each individual family member to meet. Our staff cant provide legal advice interpret the law or conduct research.

If you apply for Life Insurance and the Aggregate of your insured Limit is 50000 or less Life Insurance coverage starts on the date you applied for coverage. Aggregate means all or total. Generally a limit of 10000003000000 means 1000000 per covered claim with 3000000 aggregate in a policy year subject to the terms of the contract.

Lets look at how they work as well as some recent changes to the rules for plans with aggregate deductibles. Individual Life and Health Insurance Savings and Retirement Group Benefits Investment Management.

Health Insurance Products New Generation Alliancenext Care New

Health Insurance Products New Generation Alliancenext Care New

Combined Aggregate Embedded What Does Bcbsil Mean Resource Brokerage Health Insurance Blog

Combined Aggregate Embedded What Does Bcbsil Mean Resource Brokerage Health Insurance Blog

Medical Stop Loss Insurance Captive Funding Solutions

Medical Stop Loss Insurance Captive Funding Solutions

Alc Health International Medical Insurance Healthcare For Expatriates

Alc Health International Medical Insurance Healthcare For Expatriates

Aggregate Coverage Information On The National Health Insurance Download Table

Aggregate Coverage Information On The National Health Insurance Download Table

Support For Private Health Insurance Seven Point Scale Aggregate Model Download Table

Support For Private Health Insurance Seven Point Scale Aggregate Model Download Table

Health Insurance Self Funding Is A Tactic Not A Strategy Jim Edholm

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

Embedded Deductibles Source Of Consumer Confusion Center On Health Insurance Reforms

:max_bytes(150000):strip_icc()/healthcare-data-7e64c1e9b49146e588e5e5dee43a12b4.jpg) Aggregate Deductible Definition

Aggregate Deductible Definition

Group Health Insurance Self Funded Plans Blue Line Financial Management

Group Health Insurance Self Funded Plans Blue Line Financial Management

Health Insurance Products New Generation Alliancenext Care New

Health Insurance Products New Generation Alliancenext Care New

/GettyImages-1029298450-195365e2e74a463696e5629cdfa815f7.jpg) Aggregate Deductible Definition

Aggregate Deductible Definition

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

Comments

Post a Comment