Featured

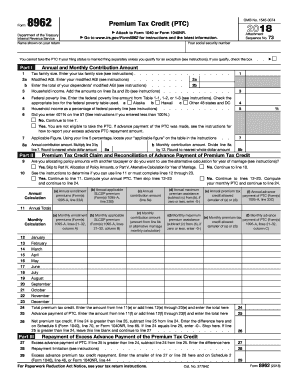

Download Irs Form 8962

Fill out securely sign print or email your 2019 Form 8962. The idea of having to pay someone to file their taxes for them certainly.

Form 8962 Edit Fill Sign Online Handypdf

Form 8962 Edit Fill Sign Online Handypdf

Covered California CoveredCA States Exchanges and He.

Download irs form 8962. Click on the product number in each row to viewdownload. Other Federal Other Forms. If you received a letter from the IRS requesting Form 8962.

Click on column heading to sort the list. For most people the thought of having to file their income taxes is enough to make them cringe. With Form 8962 you are reconciling the tax credit you are entitled to with any advance credit payments or.

Tax Form 1095A 1095B 1095C FTB 3895 Form 8962. The IRS may also ask for a signed copy of the second page of your tax return and a copy of the 1095-A that the Marketplace sent to you. We last updated the Premium Tax Credit in January 2021 so this is the latest version of Form 8962 fully updated for tax year 2020.

If necessary print out the document. Fill out securely sign print or email your 04 Department of the Treasury Internal Revenue Service. Start a free trial now to save yourself time and money.

Online methods make it easier to to organize your doc management and boost the productivity within your workflow. Add all allocated policy amounts and non-allocated policy amounts from Forms 1095-A if any to compute a combined total for each month. Once you download the Form 8962 in your phone you can transfer it to your pc using bluetooth or USB connection.

If you filled out the form during one of the previous years itll make an example of form 8962 filled out. When youre done in TurboTax youll need to print out Form 8962 and mail or fax it to the IRS along with any other items requested in their letter IRS Letter 12C. If you didnt receive a Form 1095-A sign in to your Healthcaregov account to download a copy.

Available for PC iOS and Android. 15 Zeilen Wed welcome your feedback. Form 8962 irs EDWARDSFRANKLandCAROLJ 2017 Pages 1 50 Flip PDF Download Photo PDF Semiconductor Quantum Dots for Memories and Simple IRS Form 8962 Download Fillable PDF or Fill line Premium Download IRS Form 8962 Free Download Create Edit Fill and Print 2019 IRS Form 8962 Download Fillable PDF or Fill line Premium Format form 8962.

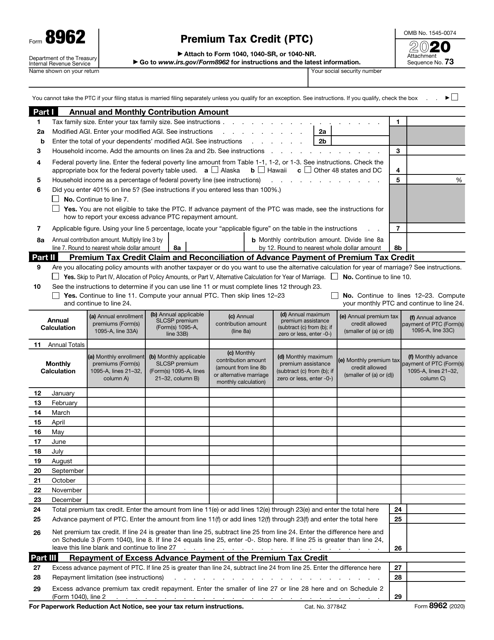

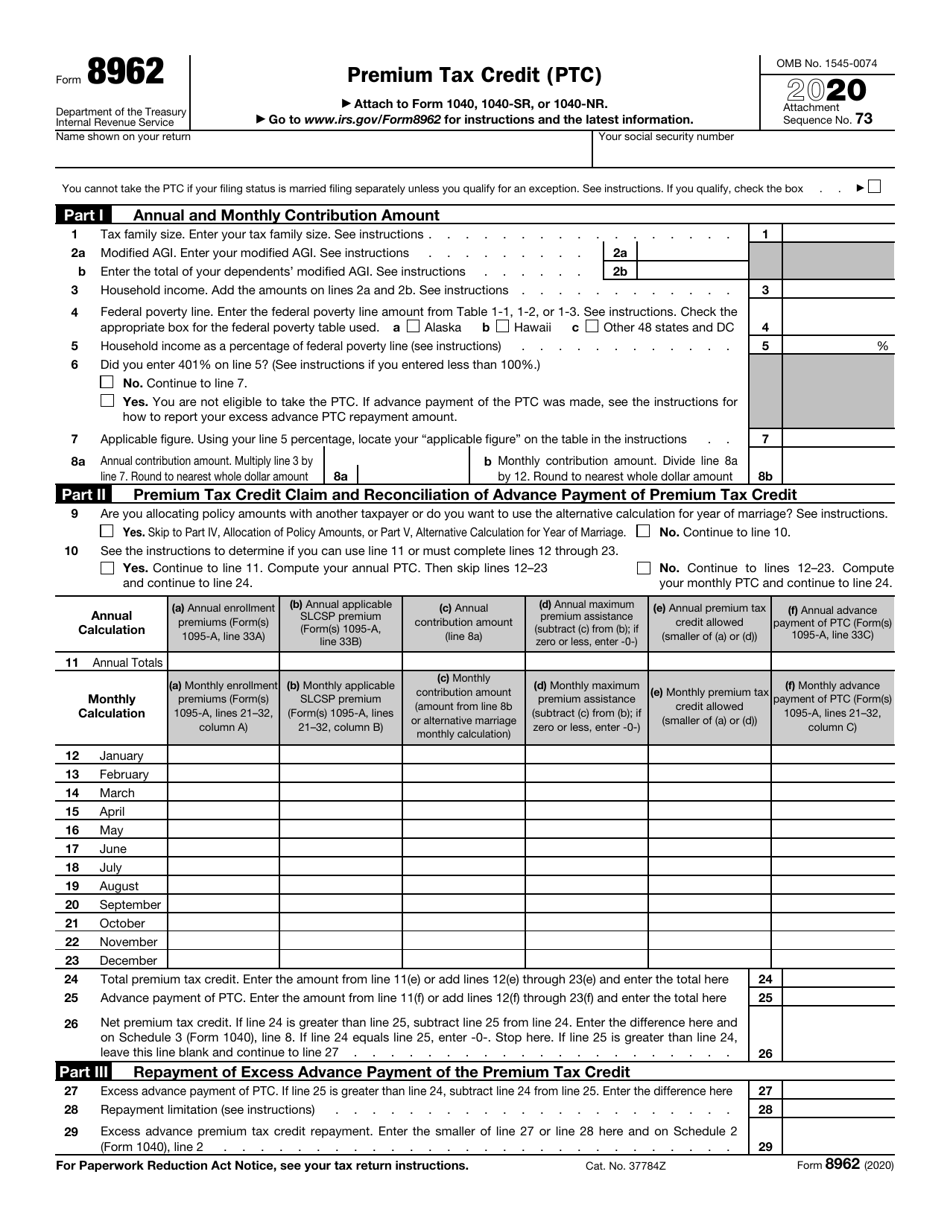

You can download or print current or past-year PDFs of Form 8962 directly from TaxFormFinder. Irs Form 8962 Printable. IRS Form 8962 Format IRS Form 8962 allows filers to calculate their Premium Tax Credit PTC amount and to mediate that amount with any Advance Premium Tax Credit APTC payments that have been made by the filer throughout the year so that to recoup some of the money that had spent on Marketplace health insurance premiums.

Your Form 1095-A may include amounts in dollars and cents. Available for PC iOS and Android. Health Insurance Tax Credit.

Be sure to use the functionality of Adobe Reader when saving and printing a file. Thank you for visiting our website. Print your forms and mail the requested forms to the IRS.

Compute the amounts for lines 1223. You may be able to enter information on forms. This applies only to current year taxes Credit Karma Tax no longer supports preparing.

Multiply the amounts on Form 1095-A by the allocation percentages entered by policy. Premium Tax Credit PTC instantly with SignNow. You can print other Federal tax forms here.

The PTC is meant to help people recoup some of the money they spent on Marketplace health insurance premiums by lowering their tax burden. The most secure digital platform to get legally binding electronically signed documents in just a few seconds. Its also advisable to have an IRS form 8962 instructions file.

You should round the amounts on Form. Form 8962 and the IRS electronic filing program provides for entries of dollars only. Forms and Publications PDF Enter a term in the Find Box.

Download the created IRS 8962 Form to your device and forward it via email fax or sms. IRS Tax Return 2021. Start a free trial now to save yourself time and money.

Entering amounts from Form 1095-A. Select a category column heading in the drop down. The most secure digital platform to get legally binding electronically signed documents in just a few seconds.

Download IRS Form 8962 Premium Tax Credit PTC for Windows to get an IRS Form 8962. To claim the Premium Tax Credit PTC you must file IRS Form 8962 with your federal income tax return. To avoid making common mistakes on your Form 8962 and on your income tax return carefully review all of the following before attaching Form 8962 to your tax return.

Enter the combined total for each month on lines 1223 columns a b and f. Once youve got it follow the instructions below for your version of TurboTax.

8962 Form 2021 Irs Forms Zrivo

8962 Form 2021 Irs Forms Zrivo

How To Fill Out The Form 8962 In 2019 Update Youtube

How To Fill Out The Form 8962 In 2019 Update Youtube

How To Fill Out Irs Form 8962 Correctly

How To Fill Out Irs Form 8962 Correctly

Irs Form 8962 Free Download Create Edit Fill Print Wondershare Pdfelement

Irs Form 8962 Free Download Create Edit Fill Print Wondershare Pdfelement

Irs 8962 For 2015 Pdf Available For Editing Pdfsimpli

Irs 8962 For 2015 Pdf Available For Editing Pdfsimpli

Aca Affordable Care Act Information Vita Resources For Volunteers

Aca Affordable Care Act Information Vita Resources For Volunteers

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png) Form 8962 Premium Tax Credit Definition

Form 8962 Premium Tax Credit Definition

Https Www Irs Gov Pub Irs Prior I8962 2016 Pdf

Form 8962 Fill Out And Sign Printable Pdf Template Signnow

Form 8962 Fill Out And Sign Printable Pdf Template Signnow

Aca Affordable Care Act Information Vita Resources For Volunteers

Aca Affordable Care Act Information Vita Resources For Volunteers

Irs Form 8962 Download Fillable Pdf Or Fill Online Premium Tax Credit Ptc 2020 Templateroller

Irs Form 8962 Download Fillable Pdf Or Fill Online Premium Tax Credit Ptc 2020 Templateroller

Irs Form 8962 Download Fillable Pdf Or Fill Online Premium Tax Credit Ptc 2020 Templateroller

Irs Form 8962 Download Fillable Pdf Or Fill Online Premium Tax Credit Ptc 2020 Templateroller

Https Www Irs Gov Pub Irs Prior F8962 2014 Pdf

Irs Form 8962 Premium Tax Credit Community Tax

Irs Form 8962 Premium Tax Credit Community Tax

Comments

Post a Comment