Featured

- Get link

- X

- Other Apps

Health Insurance For Pre Existing Mental Health Conditions

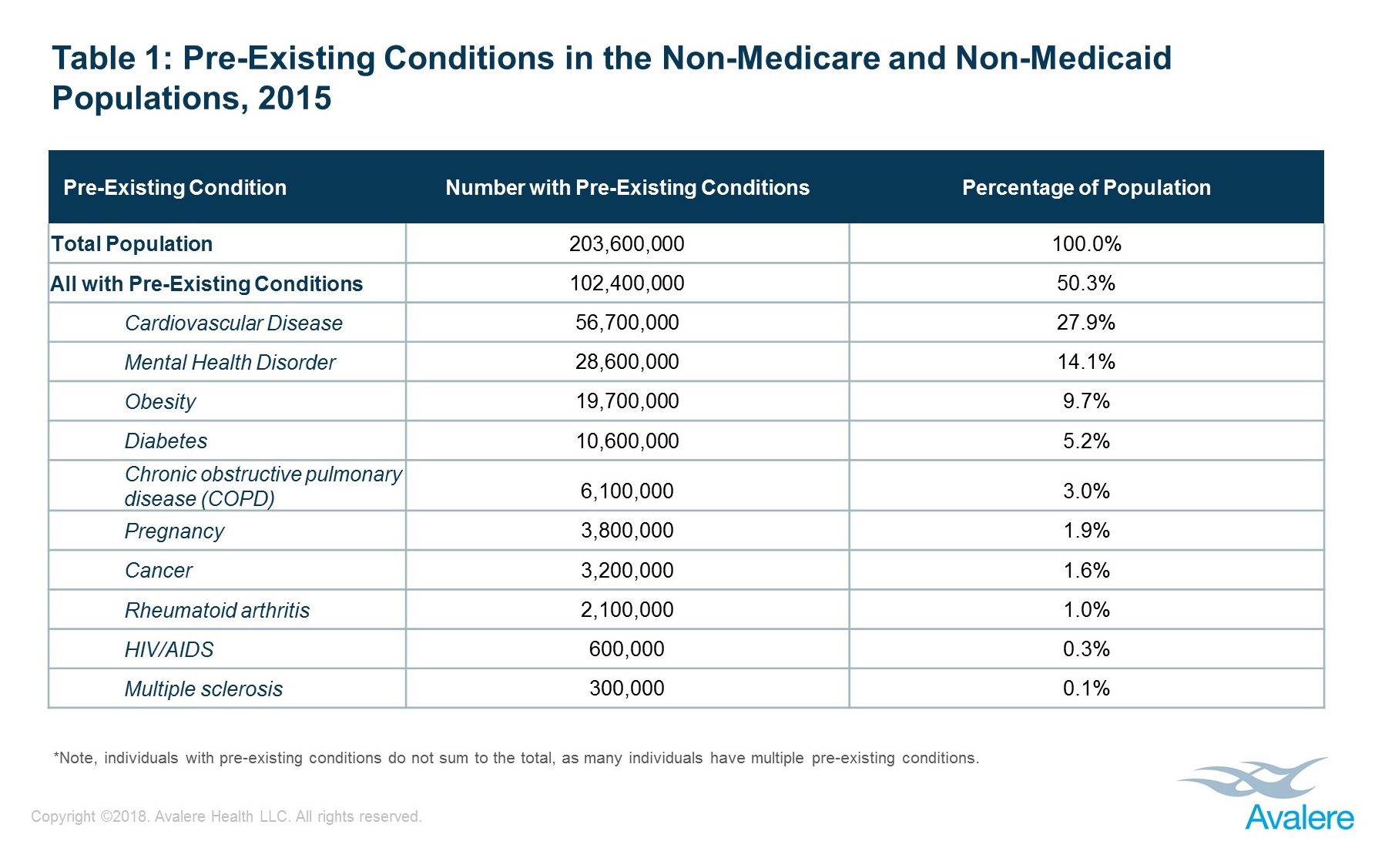

Alzheimers disease or dementia. This long-term care may extend over the life of many health plans.

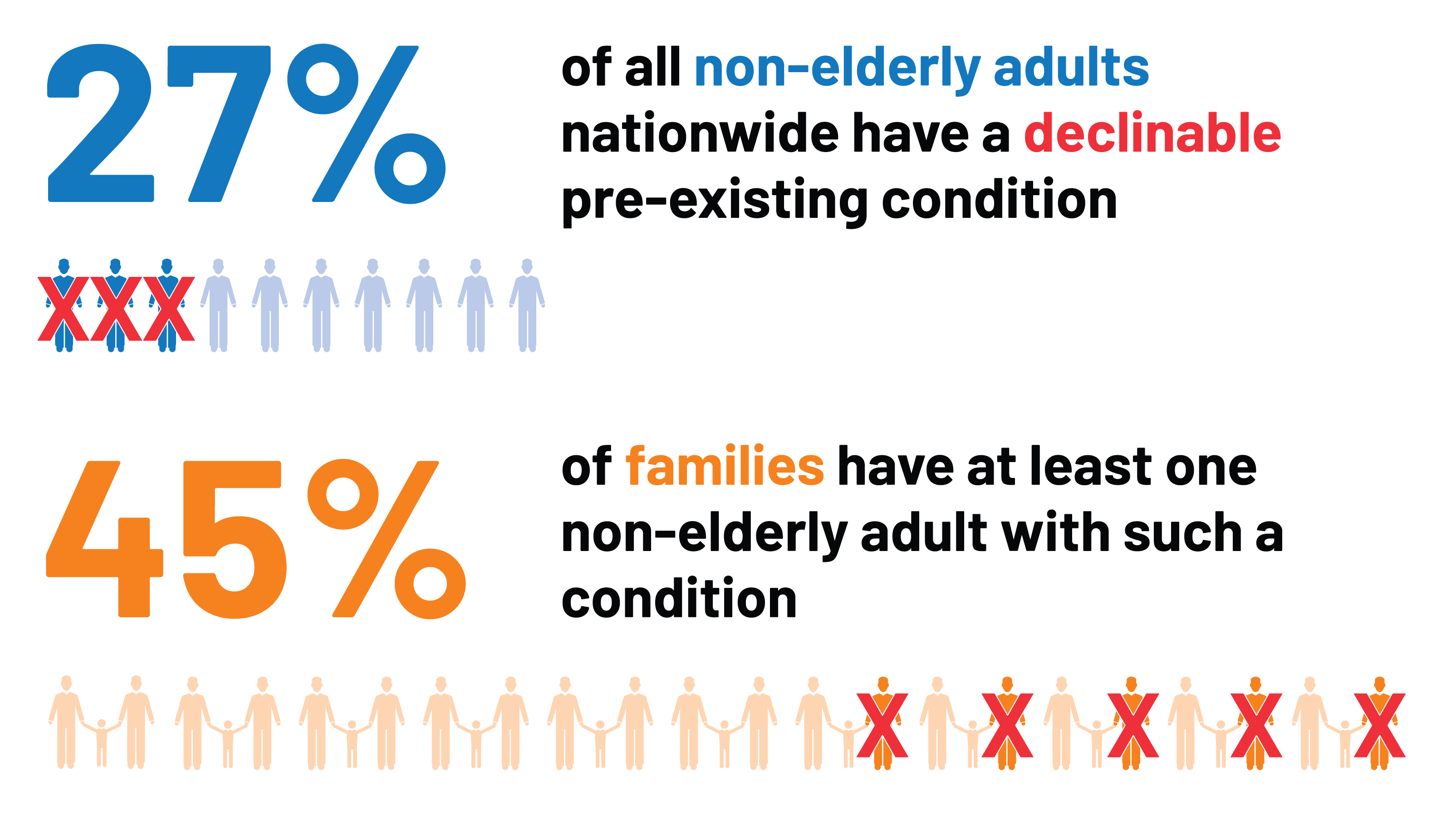

Because of the Affordable Care Act you are guaranteed coverage of pre-existing conditions if you enroll in a health insurance plan that starts on or after January 1 2014.

Health insurance for pre existing mental health conditions. Here at General Medical Healthcare we understand the need for flexibility which is why our Private Health Insurance policies can offer cover for certain pre-existing conditions. Some insurance policies do not cover pre-existing conditions this means that they will not pay out on a claim related to a pre-existing condition sometimes this can include mental health problems. With the ACA prohibiting insurers from discriminating against those with pre-existing conditions people experiencing new symptoms of mental illness.

At Pre Existing Conditions we are pleased to provide you with this useful guide to finding life insurance if you have issues with your Mental Health. Mental Health and Life Insurance. Our pre-existing conditions cover for private medical insurance can provide you with the reassurance you need knowing that if you have a flare-up of one of your conditions covered then youll be able to.

AIDS or tested positive for HIV. Anorexia nervosabulimia within the last five years. For many insurance products disclosing pre-existing mental health conditions is very importance.

Finds life travel and other types of insurance for people with pre-existing medical conditions including a range of mental health problems. These providers will ask you a wide range of questions about your past and current mental health before making a decision about the. We have listed alphabetically several financial advisers brokers and insurers who all claim they can provide insurance cover for people with pre-existing mental health conditions.

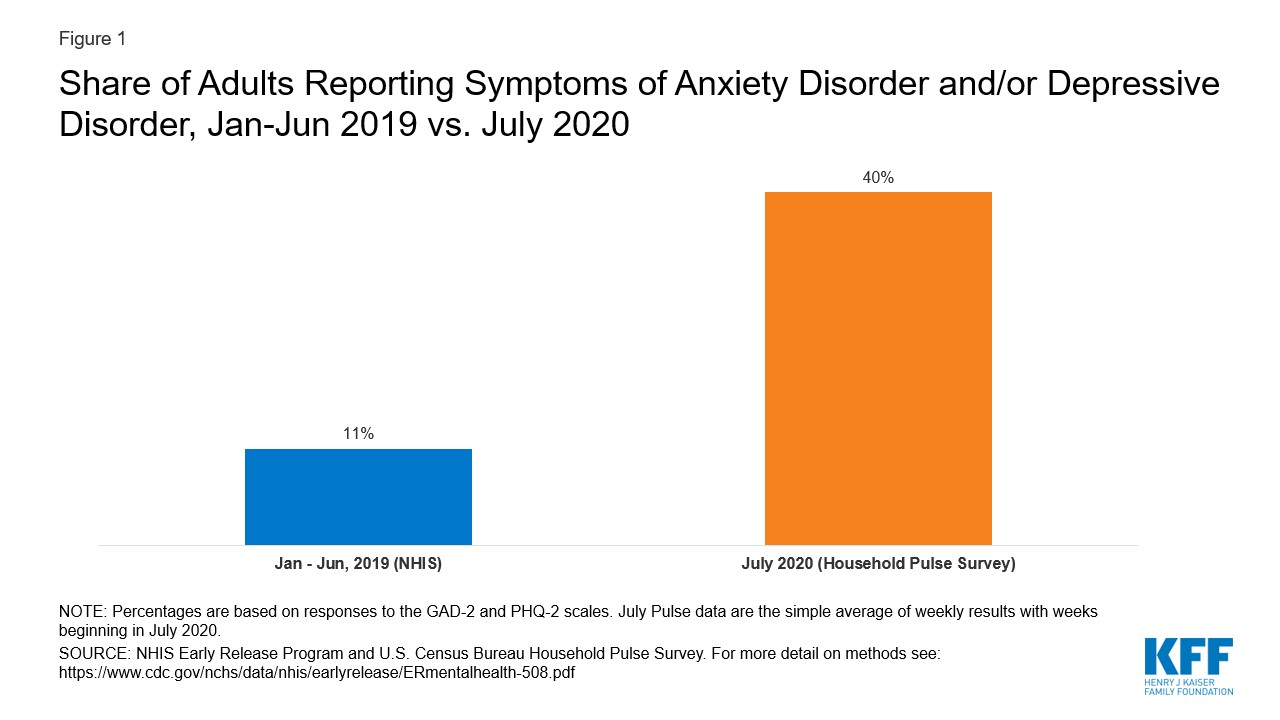

Within this guide we aim to answer some frequently asked questions about Mental Health Life Insurance such as. Like other pre-existing conditions depression is often a long-term condition that may require on-going care and treatment. That includes chronic conditions or long-term treatment for an issue that might have.

Sometimes you can get a. Can I obtain life insurance with a Mental Health issue. Aneurism abdominal or aortic Angina.

In health insurance terms depression is a pre-existing condition if you have seen a provider for it or been diagnosed with it during a specified period of time before you sign up for a new health plan. You can still submit a Health Coverage Choice application if you have one of these conditions and meet the Health Coverage Choice eligibility criteria. Some specialist insurers provide cover specifically for people with pre-existing medical conditions including mental health issues.

However several insurance providers offer specialist insurance cover for people with pre-existing mental health conditions. Anxiety depression or mood disorder. You will have to declare any pre-existing medical conditions if you take out health insurance.

Q-Super for example imposes a two-year exclusion for pre-existing conditions and will only pay a significantly reduced benefit. Are Pre-Existing Mental Health Conditions Covered by Health Insurance. You can find information on the type of coverage you may need how to find the right insurer a list of specialist insurance providers for people with mental health conditions what your rights are and how to make a complaint about an insurer.

The insurance cover in your new super account may not allow for mental health claims on any pre-existing health issues. Consult your plan documents for your carriers appeal procedures. You may get the quickest results by elevating.

If that doesnt work you can go to your states insurance commissioners office to. Most insurers define pre-existing conditions as anything youve had medical assistance for including consultations and medication within the five years prior to buying a policy. Most health insurance policies do not cover you for pre-existing conditions - read more about insurance and pre-existing mental health conditions.

Insurance companies cannot deny you health coverage based on a pre-existing condition including pregnancy. This insurance and mental health guide offers help for people living with a pre-existing mental health condition. A pre-existing medical condition is any condition you have at the time you apply for insurance.

Comments

Post a Comment