Featured

Anthem Blue Cross Ambulance Coverage

Beginning with dates of service on and after September 1 2018 Anthem Blue Cross Anthem will reimburse appropriate and medically necessary care billed under HCPCS code A0998 Ambulance response and treatment no transport by Emergency Medical Service EMS providers. This page outlines the basis for reimbursement if the service is covered by an Anthem members benefit plan.

An Independent Licensee of the Blue Cross and Blue Shield Association Ambulance and Medical Transport Services facility is not covered.

Anthem blue cross ambulance coverage. URGENT NON-ROUTINE AFTER HOURS CARE 40 Copayment per visit. National PPO BlueCard PPO This summary of benefits is a brief outline of coverage designed to help you with the selection process. Medicare Blue.

AMBULANCE You pay 200 Copayment per trip for ground Ambulance. Service is covered by a members Anthem Blue Cross and Blue Shield Anthem benefit plan. Patients across the nation need to examine the details about emergency care coverage in their health insurance plans especially if they are covered by Anthem Unicare Blue Cross Blue Shield or.

Rocky Mountain Hospital and Medical Service Inc. You pay 10 for non-laboratory. Transportation from a facility other than a hospital skilled nursing facility or rehabilitation facility to the members home is not covered.

Is covered under a members benefit plan is not a determination that you will be reimbursed. Enrollment in Anthem Blue Cross and Blue Shield depends on contract renewal. Non-emergency ambulance services are limited to a maximum benefit of 50000 per occurrence.

Members having both Medicare Part B and Service Benefit coverage have covered medical costs for ground ambulance transportation for costs associated with treatment of a heart attack and hip replacement when using Preferred providers. Read more about how Blue Cross of Idaho is dedicated to being the best choice for healthcare coverage at competitive prices. Save Time With Live Chat Find the information you need about your health care benefits by chatting with an Anthem representative in real-time.

These exceptions include provider and ambulance referrals services delivered to patients under the age of 15 visits associated with an outpatient or inpatient admission emergency room visits that occur because a patient is either out of state or the appropriate. Industry practices are constantly changing and Anthem reserves the right to review and revise these policies periodically. Non-emergent transport includes an ambulance that is required to take a member from home residence to facility to receive care or from a facility to home after receiving care.

This includes physicians and all provider types including but not limited to ambulance transport ground and air ambulatory surgical centers behavioral health services physical medicine providers and ancillary providers. As a contracted provider with Anthem Blue Cross Anthem in California please remember that you are obligated when medically appropriate to refer Anthem members to in-network providers. Keep in mind that determination of coverage under a members plan does not necessarily ensure reimbursement.

GeoBlue Medical Insurance for Travel Short-term and long-term international health plans are available for your urgent travel needs. Anthem Blue Cross. The HCPCS code is billed when.

Coverage Guidelines Ambulance services are covered as outlined by each Blue Cross members benefit design or. This summary does not reflect each and every benefit exclusion and limitation which may apply to the coverage. You pay 10 per trip for air Ambulance.

Out-of-Network care is paid as In-Network. The determination that a service The determination that a service procedure item etc. Reviewed by medical director.

Medical policies and clinical utilization management guidelines help us determine if a procedure is medically necessary. HMO products underwritten by. Enrollment in Anthem Blue Cross and Blue Shield depends on contract renewal.

Anthem Blue Cross and Blue Shield is the trade name of. Of course I would like a cheaper way to get to the hospital in an emergency but this article doesnt seem to actually offer one. The bill for the ambulance ride was 69600.

Anthem Blue Cross says the 51000 helicopter ride wasnt medically necessary But doctors amid a medical emergency believed otherwise. HMO products underwritten by HMO Colorado Inc. Anthem Contracted Ambulance Providers May 1 2019 Administrative As a contracted provider with Anthem Blue Cross and Blue Shield Anthem in Indiana Kentucky Missouri Ohio andor Wisconsin please remember that you are obligated when medically appropriate to refer Anthem members to in-network providers.

As of January 1 Anthem said it would always pay for ER visits based on certain conditions. Oct 1 2018 Administrative. Anthem Blue Cross and Blue Shield is a DSNP plan with a Medicare contract and a contract with the state Medicaid program.

It also includes an ambulance that is needed for a behavioral health condition. Anthem Blue Cross and Blue Shield is a DSNP plan with a Medicare contract and a contract with the state Medicaid program. The insurance company Blue Cross Blue Shield paid 10574 nowhere close to the 80 medicare supposedly pays.

Doctors ordered an air ambulance flight. Rocky Mountain Hospital and Medical Service Inc. Anthem Blue Cross and Blue Shield is the trade name of.

Https Www Anthem Com Ca Shared F2 S2 T1 Pw E245496 Pdf Refer Provider

Https Www Anthem Com Provider Noapplication F0 S0 T0 Pw G368979 Pdf Refer Ahpmedprovider

Https Www Bcbstx Com Provider Pdf Medicalpolicies Futurechanges 1001 005web Pdf

Https Www Anthem Com Provider Noapplication F0 S0 T0 Pw B142659 Pdf Refer Ahpmedprovider State Mo

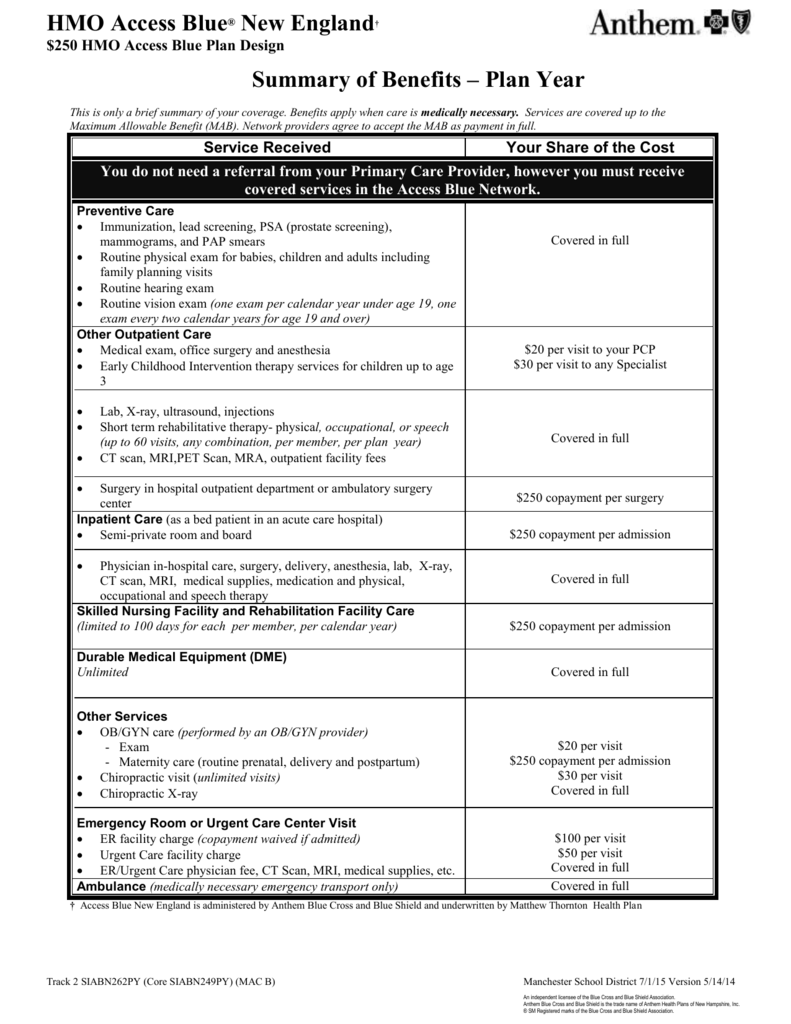

Https Www Anthem Com Agent Nh F4 S3 T0 Pw A033121 Pdf 3frefer Ahpemployer State Nh

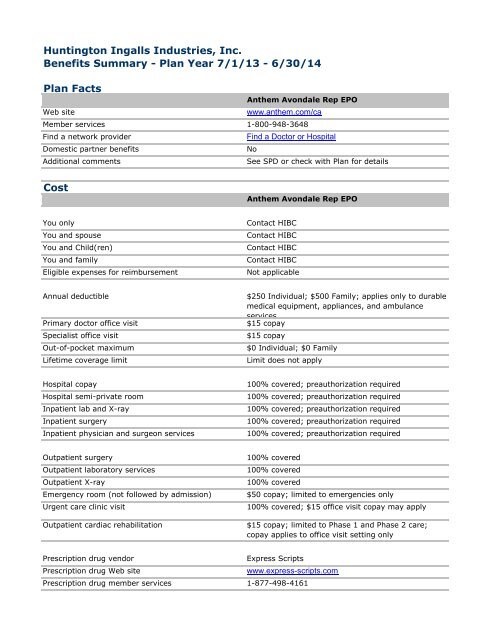

Anthem Blue Cross Avondale Represented Epo

Anthem Blue Cross Avondale Represented Epo

Anthem Health Insurance Makes Deals With Two Main Air Ambulance Companies To Cover Airlifts For Missouri Customers Metro Stltoday Com

Anthem Health Insurance Makes Deals With Two Main Air Ambulance Companies To Cover Airlifts For Missouri Customers Metro Stltoday Com

Doctors Ordered An Air Ambulance Flight Anthem Blue Cross Won T Pay Los Angeles Times

Doctors Ordered An Air Ambulance Flight Anthem Blue Cross Won T Pay Los Angeles Times

Https Providernews Anthem Com California Article Anthem Blue Cross Contracted Ambulance Providers Pdf

Https Providernews Anthem Com Georgia Article Anthem Georgia Contracted Air Ambulance Providers Pdf

Https Www Bluecrossnc Com Document Ambulance And Medical Transport Services

Comments

Post a Comment