Featured

Does Insurance Cover Er Visits

Most plans will cover all ER fees when youre treated for a true emergency. In rare instances the urgent care that you visit may not accept your type of insurance.

Emergency Room Visit Coverage In Visitors Insurance For Fixed Coverage Plans

Emergency Room Visit Coverage In Visitors Insurance For Fixed Coverage Plans

The typical insurance plan requires notification within 48 hours as there are not a lot of situations where you would need more time.

/cdn.vox-cdn.com/uploads/chorus_asset/file/10086753/LS_Vox_Health_036.JPG)

Does insurance cover er visits. This is insurance that specifically covers dental work. The deductible and out-of-pocket costs on your plan and any copay that applies to ER visits 6 note that some policies will waive the copay if you end up being admitted to the hospital via the ER and the charges will instead apply to your deductiblethese are the sort of things youll want to understand ahead of time so call your insurance company and ask questions if youre unsure how. My girlfriend visited the ER a month or two ago and recently received a bill in the mail for 12k.

For example if someone goes to the hospital because of chest pain and is simply diagnosed with heartburn the visit would still have to be covered by her health insurance plan because the pain could have been a symptom of a heart attack. It all depends on what kind of insurance is under discussion. During this time some insurers like United Healthcare are waiving cost-sharing for COVID-19 treatment as well.

Lincoln Health Network of. Patients are generally still responsible for a co-payment or deductible just like when you go to your primary care doctor. It typically costs you in addition to health.

Insurers cannot charge you more for going to an out-of-network hospital or health care provider. Does insurance cover an emergency room visit. At Vera Health we understand you want a health insurance plan that covers ER visits so the short-term health insurance plans we offer provide benefits for emergency room care to help alleviate some of the worries an ER visit can cause.

Under the Affordable Care Act health insurance companies are required to cover ER services in or out of network if you have an emergency medical condition According to HealthCaregov an emergency medical condition is an illness injury symptom or condition so serious that a reasonable person would seek care right away to avoid severe harm. You keep your prescription drug coverage and. Anthem isnt the only health insurance company trying to discourage costly emergency room care.

If diagnosed with COVID-19 your insurer will likely cover related office and urgent care visits observation stays inpatient rehab inpatient hospital stays and ER visits. A change in emergency coverage announced by Anthem Blue Cross Blue Shield earlier this year means fewer visits to the emergency room are covered. If you need emergency care you should go to the nearest emergency room and feel confident that your insurance will cover it.

Your Doctors Clinics Hospitals and Prescriptions Are Covered Under COBRA When you elect insurance continuation of your former employers group health plan you get all of the same benefits you had previously. She called the hospital billing and they said her insurance doesnt cover ER visits. Check all your ER bills and insurance reports.

Emergency room visits can be expensive time-consuming and stressful. When making the call on whether to go to the emergency room the prudent layperson standard may not be much help. Obamacare requires all plans to cover emergency services.

Health emergencies happen from time to time so why not protect your wallet. That is because the entire PPO system has set up discounts for doctors in their network. Unfortunately some health insurance plans might not cover an emergency room visit while you are on vacation or a business trip.

In most cases your insurance should cover at least a portion of urgent care visits. Dental Insurance for Cleanings and Fillings. An ER visit a 12000 bill and a health insurer that wouldnt pay A new insurance policy expects patients to diagnose themselves.

But you may have to submit them yourself to your insurance company. You must patronize their doctors to qualify for said discounts. To avoid issues its best to call ahead and.

By Sarah Kliff Jan 29 2018 800am EST. Many insurers charge a higher copay for ER visits compared with urgent care or walk-in. First and foremost you will need to notify your insurance company within a pre-determined amount of time of your visit to the ER or youll be out of luck.

Does insurance cover the cost of dental fillings. Medicare Part B usually covers emergency room ER visits unless a doctor admits a person to the hospital for a certain length of time. Most insurance companies sell a separate dental insurance policy or dental policy.

A study published in the JAMA Network Open contends.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/58464995/LS_Vox_Health_013.0.jpeg) An Er Visit A 12 000 Bill And A Health Insurer That Wouldn T Pay Vox

An Er Visit A 12 000 Bill And A Health Insurer That Wouldn T Pay Vox

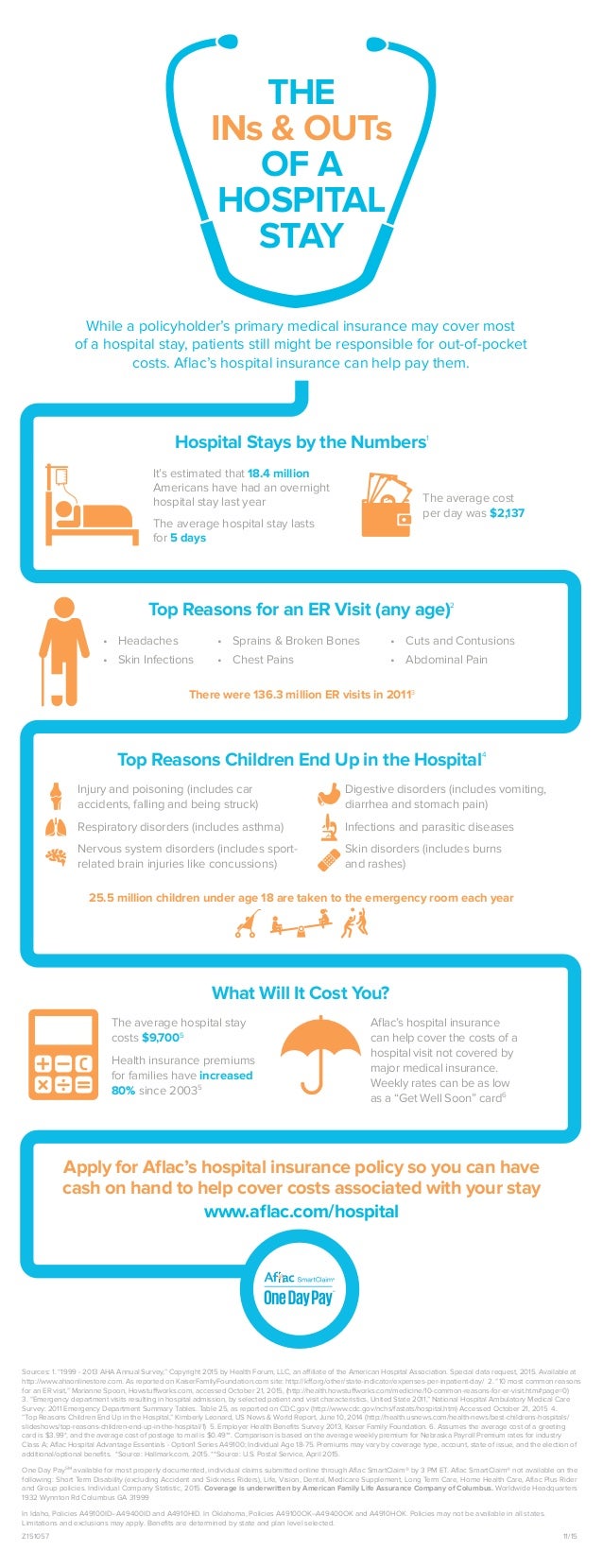

The Ins Outs Of A Hospital Stay

The Ins Outs Of A Hospital Stay

Did You Know Your Health Insurance Covers Er Visits Kindhealth

Did You Know Your Health Insurance Covers Er Visits Kindhealth

Study Most Medicaid Patients Visit The Er For Urgent Not Routine Care The Washington Post

Study Most Medicaid Patients Visit The Er For Urgent Not Routine Care The Washington Post

Medicare Part A And Er Visits Coverage And Costs

Medicare Part A And Er Visits Coverage And Costs

Health Insurance Helps Pay For Emergency Room Visits Stride Blog

Health Insurance Helps Pay For Emergency Room Visits Stride Blog

/cdn.vox-cdn.com/uploads/chorus_asset/file/10098111/mo_er_member_letter_2017__1_.jpg) An Er Visit A 12 000 Bill And A Health Insurer That Wouldn T Pay Vox

An Er Visit A 12 000 Bill And A Health Insurer That Wouldn T Pay Vox

Will My Homeowners Insurance Cover My Er Visits For Tripping

Will My Homeowners Insurance Cover My Er Visits For Tripping

What To Do If Your Insurance Refuses To Cover Your Emergency Room Visit Wfmynews2 Com

What To Do If Your Insurance Refuses To Cover Your Emergency Room Visit Wfmynews2 Com

How Much Does An Urgent Care Visit Cost Ehealth

How Much Does An Urgent Care Visit Cost Ehealth

/cdn.vox-cdn.com/uploads/chorus_asset/file/10086753/LS_Vox_Health_036.JPG)

Does Short Term Health Insurance Cover Er Care Coverage Corner

Does Short Term Health Insurance Cover Er Care Coverage Corner

/average-cost-of-an-er-visit-059cd1b1df38413f94f3ba420c8c24b5.png)

Comments

Post a Comment