Featured

- Get link

- X

- Other Apps

Income Requirements For Health Insurance Subsidy

Including the right people in your household. 9 Zeilen Income Limits for 2021 ACA Tax Credit Subsidies on healthcaregov Based on eligibility.

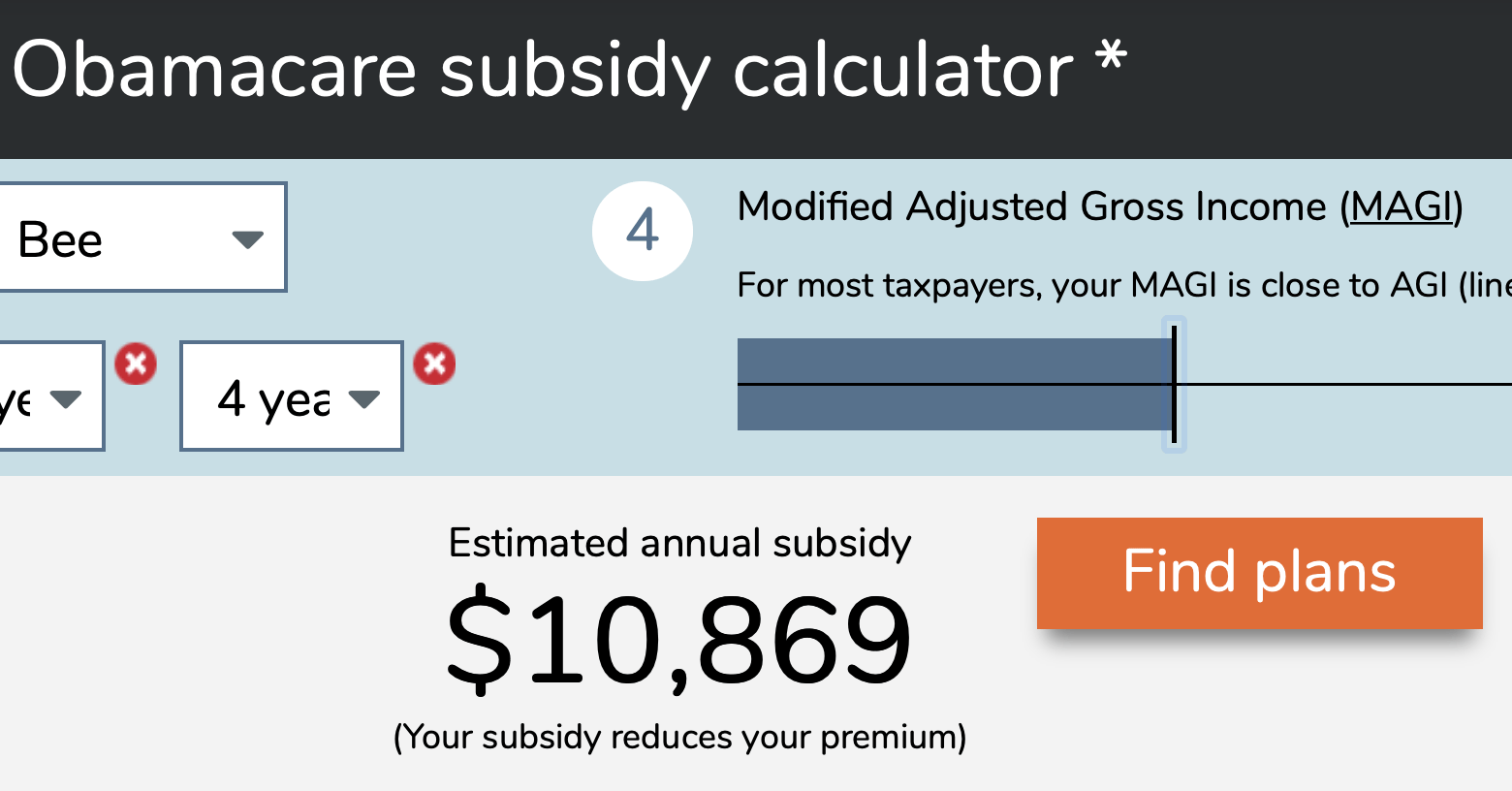

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

By contrast the lower-level plans the basic ACA subsidies cover have a typical deductible of about 6900.

Income requirements for health insurance subsidy. If you earn anywhere from 100 to 199 percent of the federal poverty level your maximum payback is 300 for an individual and 600 for a family. To use the chart. The majority of the states have expanded Medicaid.

2021 estimated household income must be above the 100 Minimum Income Amount Shown on the chart below in order to be eligible for a subsidy. If the 2021 estimated household income is less than the 100 minimum income there is no subsidy available. When their net premium is reduced from 12000 to 3140 thats nearly 9000 in subsidy from the state of California.

Can I get a subsidy. If you make 601 of the FPL you will be ineligible for any subsidies. If youre an individual who makes about 29000 or less or.

You qualify for subsidies if pay more than 85 of your household income toward health insurance. That said it is technically MAGI and not AGI but they are very similar figures. For a married couple with 70000 AGI their California state income tax is about 1400.

The income cutoffs are tied to the Federal Poverty Level and are adjusted each year. 2021 Subsidies are based on the 2020 Federal Poverty Level Guidelines. In order to be eligible for assistance through Covered California you must meet an income requirement.

Thats about 47000 for an individual and 97000 for a family of four. The 2017 figures are in the chart below. Count yourself your spouse if youre married plus everyone youll claim as a tax dependent including those who dont need coverage.

20 Zeilen You will be asked about your current monthly income and then about your yearly income. To qualify for a subsidy your modified adjusted gross income must be less than 400 of the federal poverty level. The minimum income for an individual is 12760.

In some states that will qualify you for Medicaid in others just marketplace coverage. If you earned more than you estimated and you got a subsidy for your health insurance you may have to pay back some of the subsidy. This tool provides a quick view of income levels that qualify for savings.

The 9000 health insurance subsidy from the state is over six times the California state income tax they pay. If you already enrolled in an ACA plan and got a subsidy you. In order to qualify for federal tax credits or a subsidy in California you must make between 0-600 of the FPL.

A single person earning about 51520 or a family of four with a household income of. Learn more about who to include in your household. Premiums will drop on average about 50 per person per month or 85 per policy per month.

The main factor is your income. How your income compares to the Federal Poverty Level. Prior to 2021 the rule was that households earning between 100 and 400 of the federal poverty level could qualify for the premium tax credit health insurance subsidy the lower threshold is 139 of the poverty level if youre in a state that has expanded Medicaid as Medicaid coverage is available below that level.

To qualify for a subsidy your household income must be between 100 and 400 of the FPL. You can qualify for a subsidy if you make up to four times the Federal Poverty Level. If you meet these criteria youll be eligible for a subsidy on a sliding scale based on your income.

The maximum amount of payback is tied to your actual income. For 2018 coverage thats 48240 for singles or 64960 for a couple. You may be eligible for a subsidy to help you afford health insurance in 2017 if your total household income falls within certain limits.

Under the ACA people with incomes between 100 percent and 400 percent of the federal poverty level from 12760 to 51040 for one person or 26200 to 104800 for a family of four were. How much health insurance costs where you live. But you must also not have access to Medicaid or qualified employer-based health coverage.

Subsidy Calculator Are You Eligible For A Subsidy Ehealth

Subsidy Calculator Are You Eligible For A Subsidy Ehealth

2015 Aca Obamacare Income Qualification Chart My Money Blog

2015 Aca Obamacare Income Qualification Chart My Money Blog

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

How The Affordable Care Act Is About To Become More Expensive Mygovcost Government Cost Calculator

Obamacare Subsidies Made Easy Healthtn Com

Obamacare Subsidies Made Easy Healthtn Com

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

Obamacare Health Insurance Income Requirements Il Health Insurance

Obamacare Health Insurance Income Requirements Il Health Insurance

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

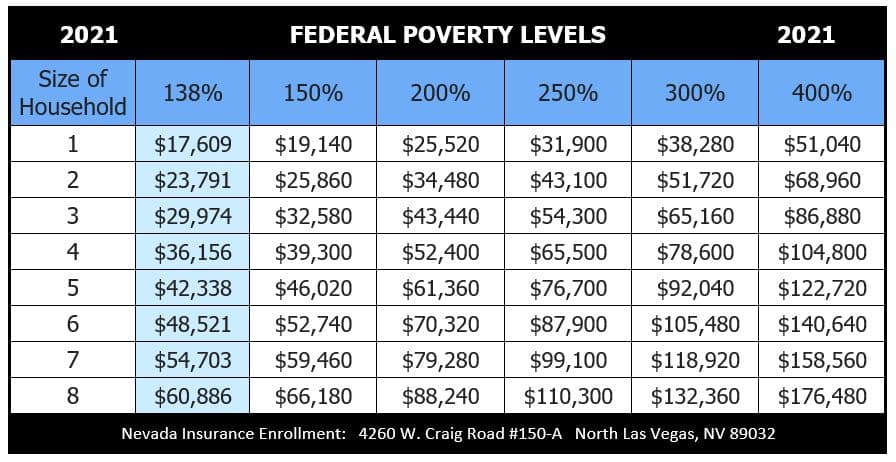

2021 Health Insurance Federal Poverty Level Chart

2021 Health Insurance Federal Poverty Level Chart

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

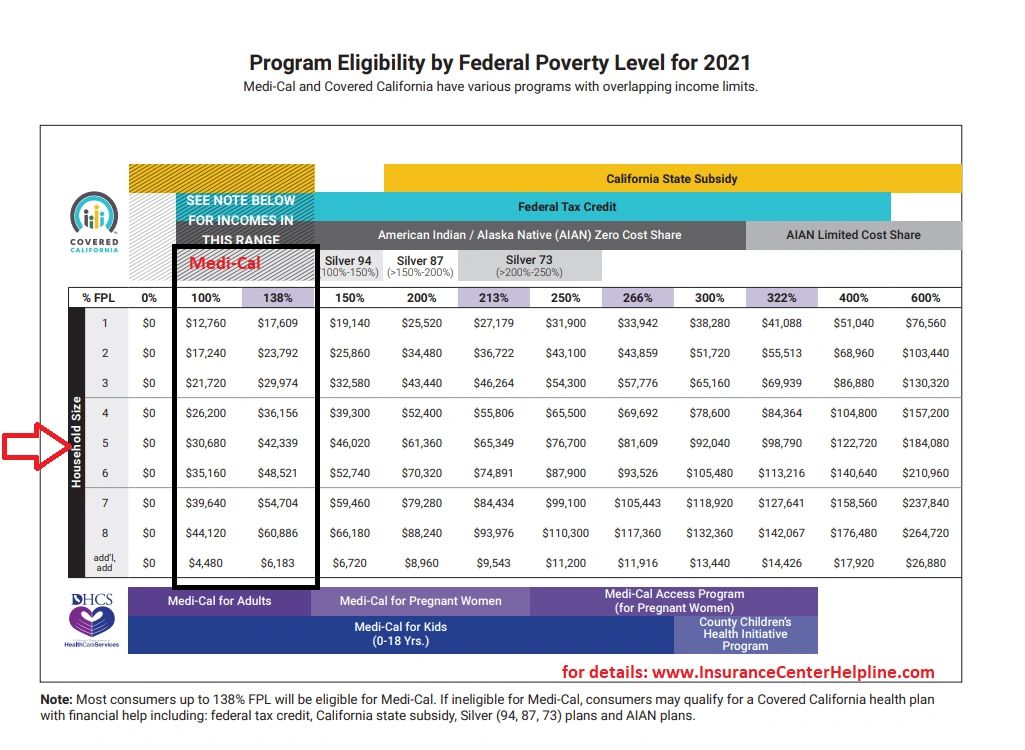

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

What Is The Maximum Income For Obamacare Subsidies In Year 2021

What Is The Maximum Income For Obamacare Subsidies In Year 2021

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Comments

Post a Comment