Featured

Medicare Full Coverage Plans

Medicare Supplement Insurance plans also called Medigap help provide for gaps in coverage from Medicare Parts A and B and can potentially save you money. For Medicare beneficiaries including those in a Medicare Advantage plan the Center for Medicare Medicaid Services CMS will cover the full cost of the vaccine.

West Virginia Medicare Supplemental Insurance Plans Rates

If you have questions about your current insurance the best source of information is your benefits administrator insurer or plan provider.

Medicare full coverage plans. This deductible is 203 in 2021. Its important to understand how your current coverage works with Medicare. Each main plan type has more than one subtype.

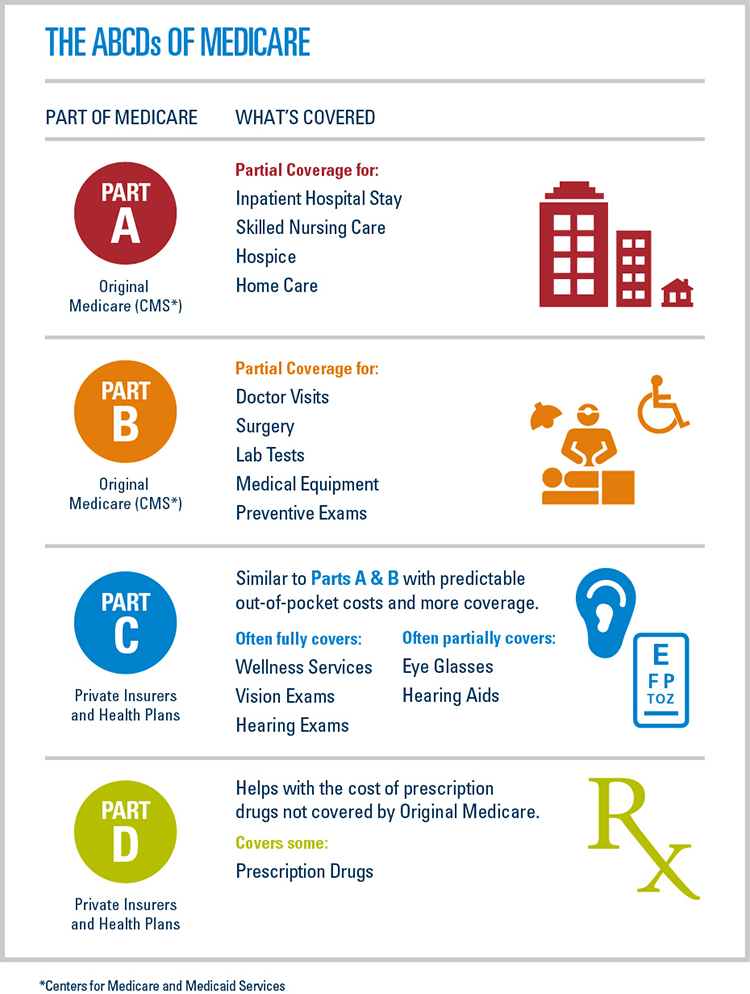

Some Medicare beneficiaries may pay more or less per month for their Part B coverage. Most plans include Medicare prescription drug coverage Part D. And Aetna Life Insurance Company.

The monthly premium cost can vary depending on the type of coverage but the premium cost is offset by lower annual out-of-pocket costs for healthcare services. Many Medicare Advantage plans also choose to offer prescription drug coverage as well as coverage for routine dental vision and hearing benefits to compete for your business. In most states there are 8 plans.

Days 6190 require a co-payment of 335 per day as of 2018. Others have four tiers three tiers or two tiers. For the popular Plan G monthly premiums range from 90 to.

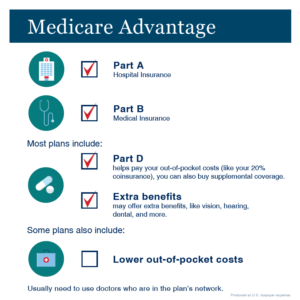

You may hear your medical service provider refer to Medicare Advantage plans as a Part C plan. In other words one pays the full cost for drugs subject to a deductible until the designated. These plans are offered by private insurance companies and include the same coverage as Original Medicares Parts A and B as well as other benefits.

While Medicare primarily covers people aged 65. Legal entities In Idaho health benefits and health insurance plans are offered andor underwritten by Aetna Health of Utah Inc. The first 60 days would be paid by Medicare in full except one copay also and more commonly referred to as a deductible at the beginning of the 60 days of 1340 as of 2018.

Beneficiaries are responsible for paying this deductible at the doctors office once per year. There are 2 main ways to get your Medicare coverage Original Medicare Part A and Part B or a Medicare Advantage Plan Part C. 2021 Part B premiums The standard monthly premium for Medicare Part B is 14850 per month in 2021.

In addition to your Part B premium you may have to pay a monthly premium for the Medicare Advantage Plan. Different types of Medicare Advantage Plans are. Health Maintenance Organization HMO Preferred Provider Organization PPO Private Fee-for-Service PFFS plans.

Special Needs Plans SNP HMO Point-of-Service HMOPOS plans. Some people need to get additional coverage like Medicare drug coverage or Medicare Supplement. Medicare Advantage plans are required by law to provideat minimumthe same coverage benefits and rights provided by Original Medicare Part A and Part B with the exception of hospice care.

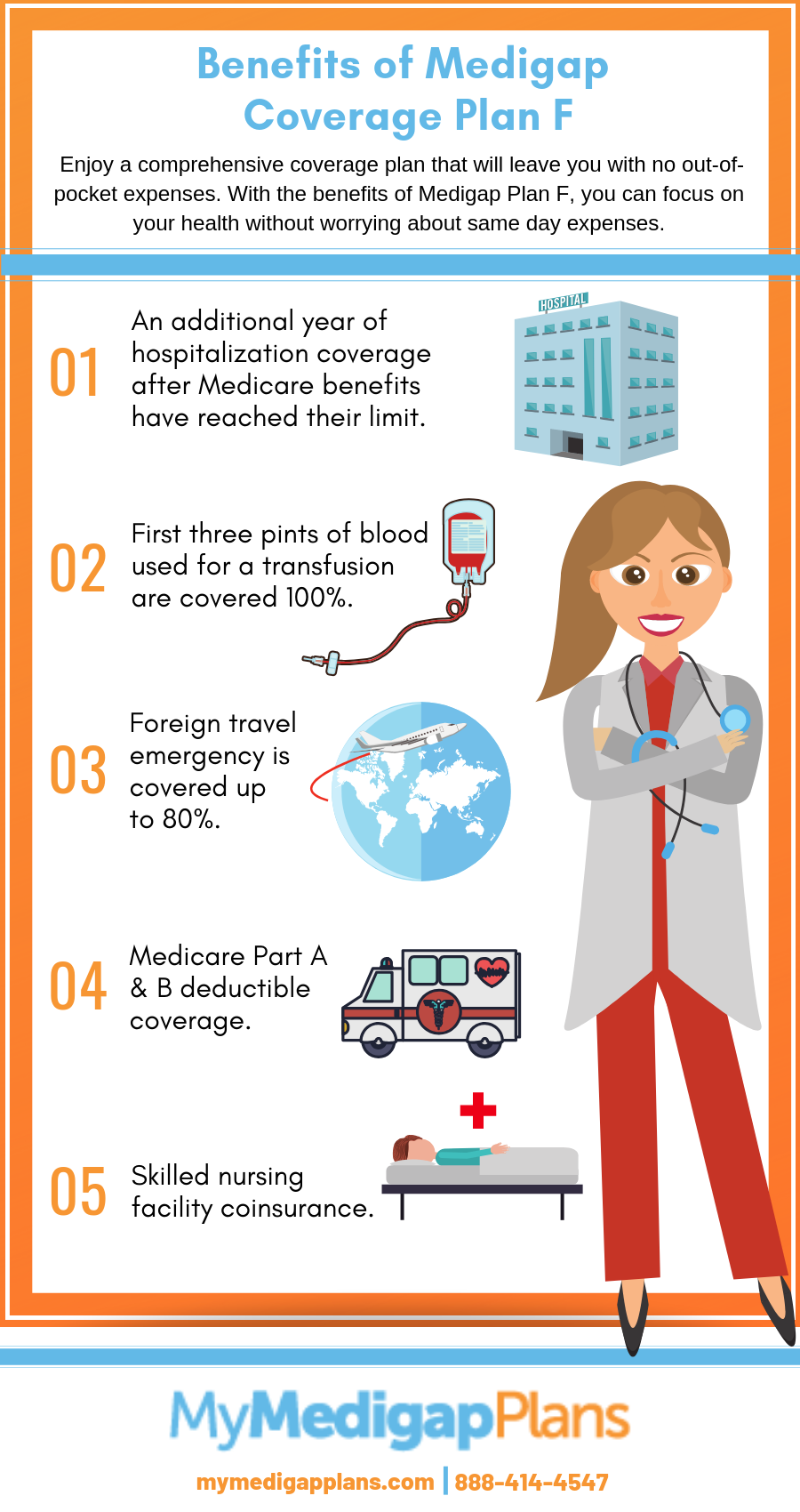

Medicare Advantage plans are alternatives to Original Medicare. Medigap policies either fully or partially cover certain cost-sharing aspects of basic Medicare such as copays or deductibles. The full cost of the drug determines how much a beneficiary must pay when the plan has a deductible.

Medicare Part B Deductible. Original Medicare does not cover birth control although Medicare Part D and Medicare Advantage plans offer coverage depending on certain conditions. Once you have paid this amount you have 100 full coverage.

This search will use the five-tier subtype. See what UnitedHealthcare can do for you. The Childrens Health Insurance Program CHIP Coverage under a parents plan.

There are quite a few differences between Original Medicare and Medicare Advantage plans. Medical Savings Account MSA plans. Medicare Part A or Part C but Part B coverage by itself doesnt qualify Most Medicaid coverage except for limited coverage plans.

The beneficiary is also allocated lifetime reserve days that can be used after 90 days. Types of Medicare health plans. It often takes folks a few doctor visits to reach the 203.

Medicare Part B covers medical insurance benefits and includes monthly premiums an annual deductible coinsurance and other potential costs. When you first enroll in Medicare and during certain times of the year you can choose how you get your Medicare coverage. Explore employer individual family Medicare-Medicaid health insurance plans from UnitedHealthcare.

I have employer coverage. Any job-based plan including retiree plans and COBRA coverage. It will show you whether a drug is covered or not covered but the tier information may not be the same as it is for your specific plan.

The maximum length of stay that Medicare Part A covers in a hospital admitted inpatient stay or series of stays is typically 90 days. This plan provides the same coverage as Plan F with one exception. The Medicare Part B deductible.

It helps pay some health care costs Medicare Parts A and B dont pay for such as copayments coinsurance and deductibles. Medicare Supplement Plan G is currently the most popular plan available. Some subtypes have five tiers of coverage.

When you enroll with a Medicare Advantage Plan you pay 2 premiums each month a premium for your. I have employer coverage.

Are You Taking Full Advantage Of Your Medicare Plan Social Security Matterssocial Security Matters

Are You Taking Full Advantage Of Your Medicare Plan Social Security Matterssocial Security Matters

Compare Medicare Supplement Plans Cigna

Compare Medicare Supplement Plans Cigna

.png) Learn About The Parts Of Medicare Aetna Medicare

Learn About The Parts Of Medicare Aetna Medicare

5 Steps To Consider While Comparing Medicare Insurance Plans

5 Steps To Consider While Comparing Medicare Insurance Plans

What Are The Parts Of Medicare The Abcd S Explained

What Are The Parts Of Medicare The Abcd S Explained

Complete Medicare Supplement Plans Comparsion Chart For 2021

Complete Medicare Supplement Plans Comparsion Chart For 2021

Learn About Medicare Blue Shield Medicare

Learn About Medicare Blue Shield Medicare

What Medicare Covers What Does Medicare Cover Bluecrossmn

What Medicare Covers What Does Medicare Cover Bluecrossmn

Medicare Advantage Vs Medicare Supplement Senior Healthcare Direct

Medicare Advantage Vs Medicare Supplement Senior Healthcare Direct

Medicare Plan G Review Medicare Nationwide

Medicare Plan G Review Medicare Nationwide

Comments

Post a Comment