Featured

Print Form 8962

Your social security number. Fillable Printable Form 8962 What is a Form 8962.

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png) Form 8962 Premium Tax Credit Definition

Form 8962 Premium Tax Credit Definition

Click on column heading to sort the list.

Print form 8962. The form will not be included with the e-filed return and should not be mailed with a paper-filed return. If you havent made one yet you can through Google or Facebook. Once completed you can sign your fillable form or send for signing.

Send the following to the IRS address or fax number given in your IRS letter. Email to a Friend. Name shown on your return.

All forms are printable and downloadable. Access your tax forms on Credit Karma Tax. You can delete Form 8962 and then it will repopulate from the information your entered from your 1095-A.

While in your return click on Tax Tools Tools in the black bar at the side of your screen. EFile your Federal tax return now eFiling is easier faster and safer than filling out paper tax forms. Go to wwwirsgovForm8962 for instructions and the latest information.

After the form is fully gone media Completed. Click on the product number in each row to viewdownload. It only has two pages as you can see from the Form 8962 printable template.

Form 8962 amount of Excess advance premium tax credit repayment is not flowing to Schedule 2 line 2 3 and thus on Form 1040 also. Easily find the app in the Play Market and install it for e-signing your printable tax form 8962. 16 In the Pages box type the page number of Form 8962 followed by a comma and the next page number.

Name shown on your return. Although filing Form 8962 is required of taxpayers receiving APTC. You fail to provide information of your form 1095A from the market place health insurance.

In this video I show how to fill out the 8962. And click on Form 8962 Premium Tax Credit. Go to wwwirsgovForm8962 for instructions and the latest information.

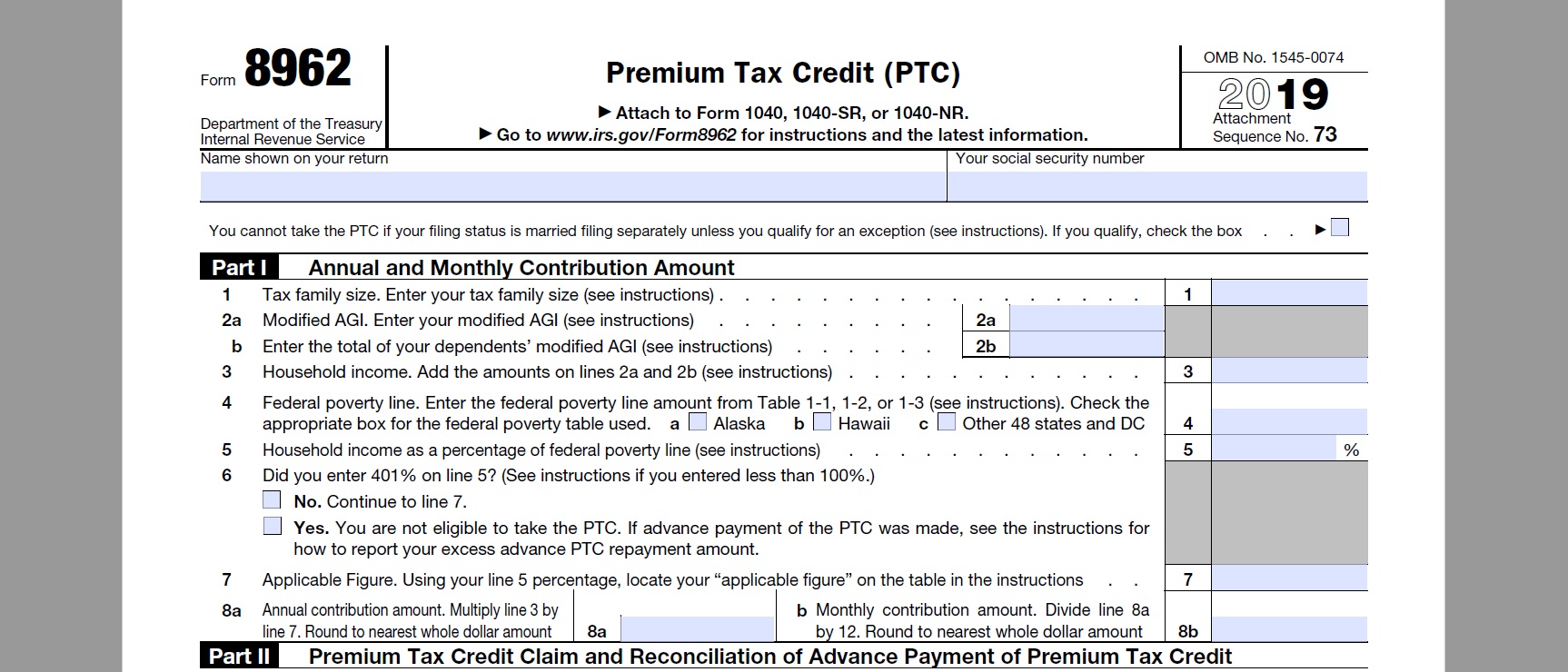

The first page of the blank Form 8962 seems quite obvious to file though there are some tricks. Mark as New. Form 8962 Department of the Treasury Internal Revenue Service Premium Tax Credit PTC Attach to Form 1040 1040-SR or 1040-NR.

You will need to to. The IRS may also ask for a signed copy of the second page of your tax return and a copy of the 1095-A. If you received a letter from the IRS requesting Form 8962.

Log in to your signNow account. 15 Note the page number of the form and then click on the Print icon. Enter a term in the Find Box.

In order to add an electronic signature to a irs form 8962 printable follow the step-by-step instructions below. Form 8962 Department of the Treasury Internal Revenue Service Premium Tax Credit PTC Attach to Form 1040 1040-SR or 1040-NR. Place an electronic digital unique in your Form Instructions 8962 by using Sign Device.

Fill Online Printable Fillable Blank Form 8962 Premium Tax Credit Form Use Fill to complete blank online IRS pdf forms for free. Deliver the particular prepared document by way of electronic mail or facsimile art print it out or perhaps reduce the gadget. Print your forms and mail the requested forms to the IRS.

Even its official instruction has 20 pages and besides that the most important reminders are printed on the form itself. Form 8962 is known as an Internal Revenue Service form that used for figuring the amount of your premium tax credit which abbreviates as PTC and reconcile it with any advance payments of the premium tax credit you know which is also called APTC. When youre done and return to the Deductions Credits screen select File top left of screen and choose Print.

The 8962 Form is one of the simplest. Your social security number. You can print other Federal tax forms here.

Here you can get. On the print pop up screen select your Federal Tax Return and the All forms worksheets button then select Continue. Select a category column heading in the drop down.

Recent IRS guidance relative to this provision instructs taxpayers who have an amount on line 29 of Form 8962 to not include Form 8962 with their return. Actual 8962 Form and previous years Printable File in PDF and DOC Requirements and Instructions Taxpayers who dont file and reconcile their 2019 advance credit score funds will not be eligible for advance payments of the premium tax credit sooner or later. If you want to delete an individual form please follow these instructions.

Open the downloaded PDF and navigate to your Form 8962 to print it. You can download or print current or past-year PDFs of Form 8962 directly from TaxFormFinder. Drake20 will continue to produce Form 8962 for review purposes only.

You may be able to enter information on forms before saving or printing. The Form 8962 is 2 pages and you want to print both pages Select Print.

Premium Tax Credit Form 8962 And Instructions

Premium Tax Credit Form 8962 And Instructions

Printable Tax Form 8962 Fill Out And Sign Printable Pdf Template Signnow

Printable Tax Form 8962 Fill Out And Sign Printable Pdf Template Signnow

Aca Affordable Care Act Information Vita Resources For Volunteers

Aca Affordable Care Act Information Vita Resources For Volunteers

Https Www Irs Gov Pub Irs Prior F8962 2015 Pdf

Irs 2019 Health Insurance Subsidy Tax Credit Reconciliation

Irs 2019 Health Insurance Subsidy Tax Credit Reconciliation

How To Fill Out Irs Form 8962 Accounts Confidant

How To Fill Out Irs Form 8962 Accounts Confidant

How To Fill Out Irs Form 8962 Correctly

How To Fill Out Irs Form 8962 Correctly

8962 Form 2021 Irs Forms Zrivo

8962 Form 2021 Irs Forms Zrivo

Irs Form 8962 Free Download Create Edit Fill Print Wondershare Pdfelement

Irs Form 8962 Free Download Create Edit Fill Print Wondershare Pdfelement

Aca Affordable Care Act Information Vita Resources For Volunteers

Aca Affordable Care Act Information Vita Resources For Volunteers

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

How To Fill Out Form 8962 Step By Step Premium Tax Credit Ptc Sample Example Completed Youtube

How To Fill Out Form 8962 Step By Step Premium Tax Credit Ptc Sample Example Completed Youtube

Form 8962 Edit Fill Sign Online Handypdf

Form 8962 Edit Fill Sign Online Handypdf

Https Www Irs Gov Pub Irs Prior F8962 2014 Pdf

Comments

Post a Comment