Featured

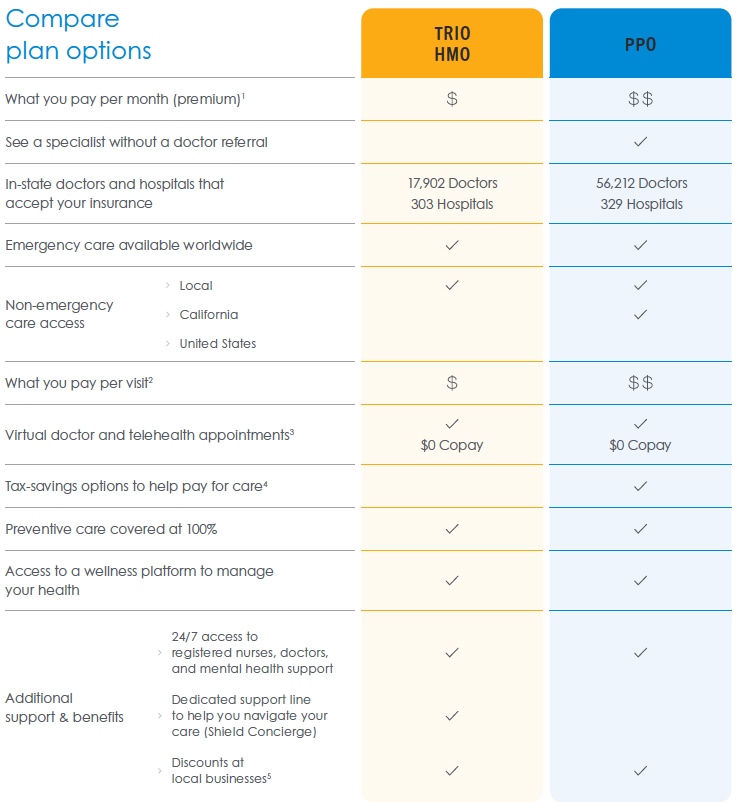

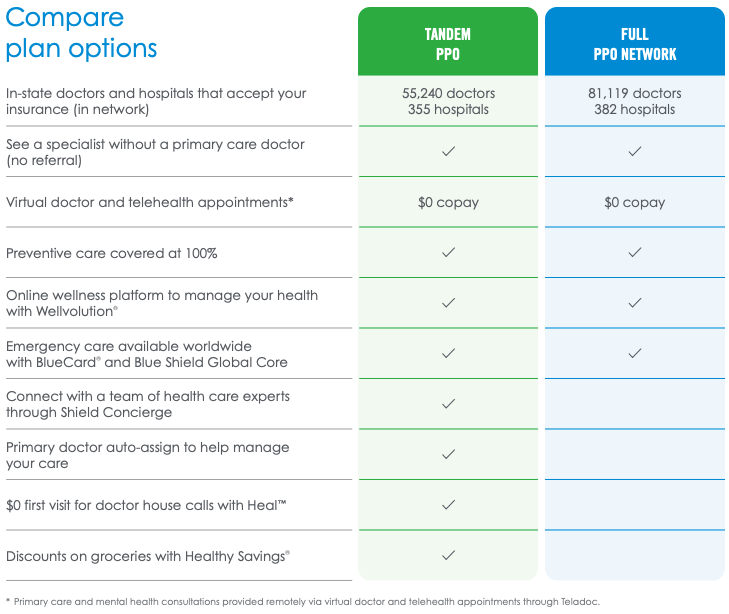

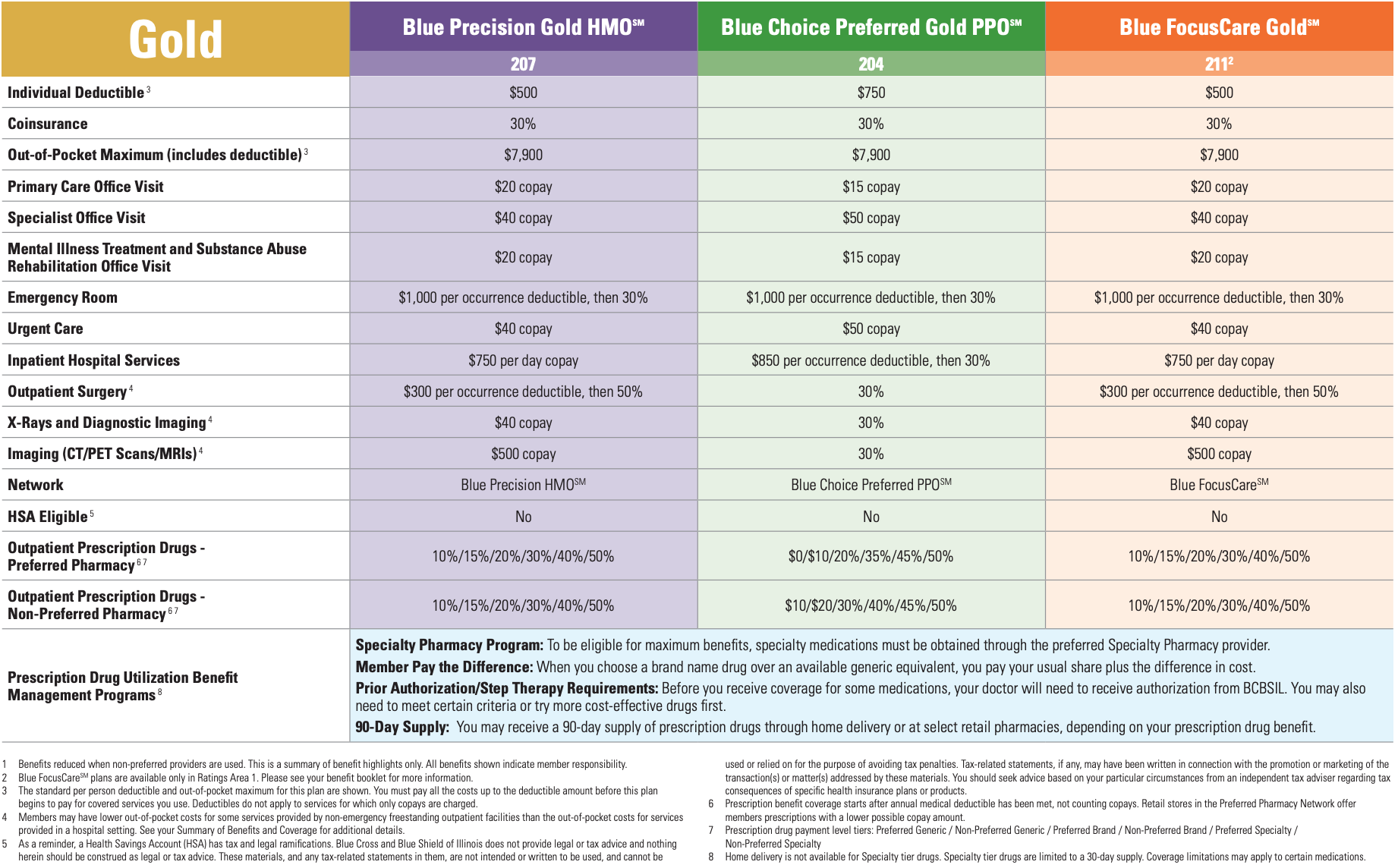

Compare Blue Shield Ppo Plans

There are 2 Blue PPO Bronze Plan Options. Blue Shield tends to focus more on PPO type plans.

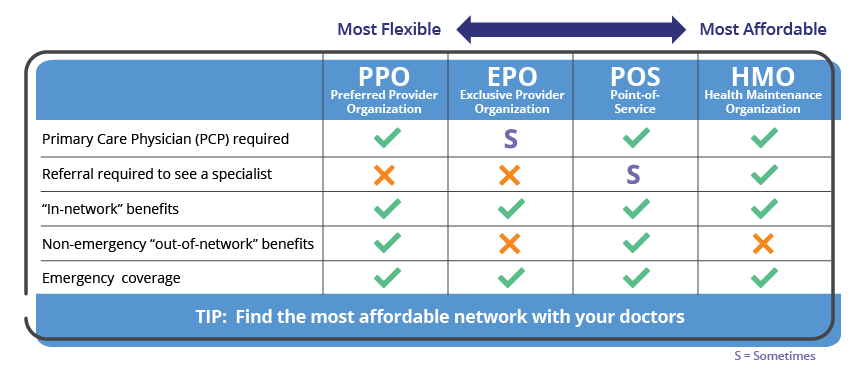

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

HealthEquity has agreed to follow Blue Cross privacy and security policies regarding the confidentiality and.

Compare blue shield ppo plans. Key Blue PPO Bronze plan features include. That really fluctuates by area so its important to put together a list of providershospitals you want access to. All health care plans arent the same.

Anthem Blue Cross and Blue Shield used to be the only PPO providers we date ourselves but they still dominate it. Choose this plan if you want health and prescription drug coverage with extra benefits for dental vision hearing and fitness all in one plan. Shield Spectrum SM PPO Plan 750 Value 750member.

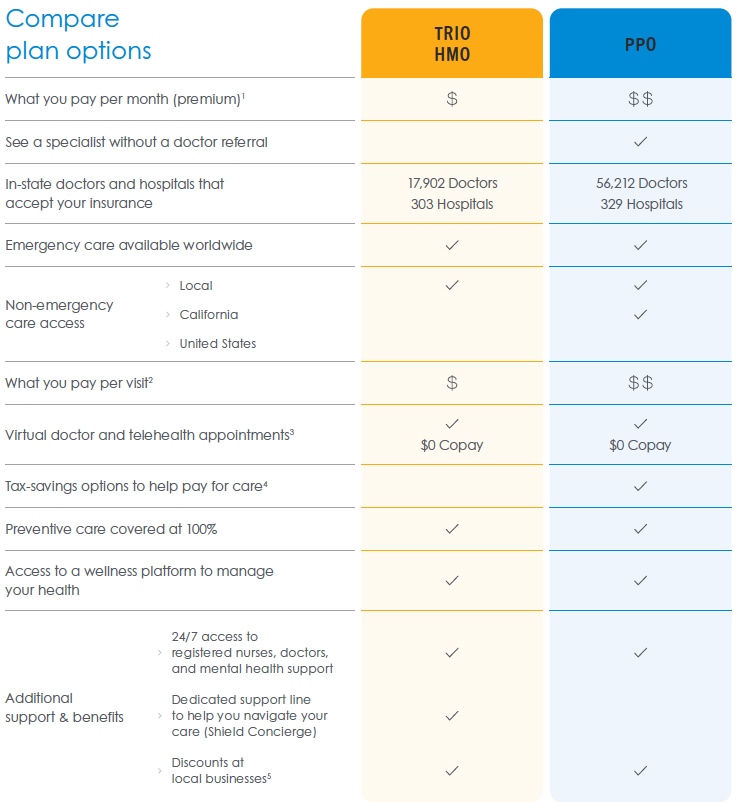

Primary care and behavioral health consultations provided remotely via virtual doctor and telehealth appointments available through Teladoc. The average out-of-pocket cost of all Trio HMO plans for 2021 is lower than the average out-of-pocket cost of all PPO plans. All 0 2575 2575 OON Tier 1 Only 50 50150 75225 75225 OON Tier 1 Only All.

One kind might work better for you than another. Blue Shield offers two packages to small businesses outside of Covered California for Small Business. This plan comparison tool shows the benefits used most often to compare two plans side by side.

This plan has a slightly higher deductible and out-of-pocket maximum but these increases are offset by a lower cost per paycheck and by using your HSA for your medical expenses. Check any two boxes to compare those two plans. PPO stands for Participating Provider Option.

Itll depend on how often you visit the doctor where you go to get your care and how much you can pay for it. The Blue Shield Off Exchange Package includes up to 43 plans including PPO HMO and HSA-HDHP options. Bronze Plan 005 5000 individual deductible and 80 coinsurance.

Blue Cross and Blue Shield companies. Blue Shield does not offer tax advice. These plans are available at each metal level.

Its a type of health plan that lets you choose where you go for care without a referral from a primary care physician or having to only use providers in your plans provider network. Forms policies benefit information medical guidelines and more. Before making a final decision please read the Plans Federal brochures Standard Option and Basic Option.

Blue Advantage PPO is a Medicare Part C Medicare Advantage plan. CareFirst BlueCross BlueShield offers several types of health plans. The IndividualFamily market has changed quite a bit since 2014.

You can offer plans from the Off Exchange Package or the Mirror Package but not both. Funds from your HSA account including the Blue Cross contributions can be used to pay for the charges. Employers will receive a copy of one of these fliers per plan in which.

MyBlue HealthSM plans are available only in Harris and Dallas Counties. 30 initial 3 visits. You are about to leave Blue Cross and Blue Shield of Alabamas website and enter a website operated by HealthEquity.

Please use these handy fliers to review a side-by-side comparison of withdrawn Simply Shield medical plans with suggested plans from the new ACA-compliant Blue Shield portfolio effective January 1 2014. HealthEquity is our business associate and is an independent company that provides account-based plan services to Blue Cross. Medicare Advantage Plan.

Please see the plans Benefit Book for more information. Learn about our mission and values history and leadership. Shield Spectrum SM PPO Plan 1500 Value 1500member.

15 initial 3 visits. This is a summary of the features of the Blue Cross and Blue Shield Service Benefit Plan. With PPO plans you may select any physicians and hospitals within the plans network as well as outside of the network.

For information or questions consult a financial or tax advisor. Blue Shield Platinum 90 PPO Blue Shield Silver 94 PPO Blue Shield Bronze 60 PPO Blue Shield Gold 80 PPO Blue Shield Silver 87 PPO Blue Shield Bronze 60 HDHP PPO Blue Shield Silver 70 PPO Blue Shield Silver 73 PPO Blue Shield Minimum Coverage PPO How do you choose the plan thats right for you. Were here to help simplify it for you.

It typically has higher monthly premiums and out-of-pocket costs like copays coinsurance and deductibles. Shield Spectrum SM PPO Plan 1000 Value 1000member. Under this plan the member is billed 100 of the charges until the deductible is met.

A PPO may be a good choice for you because. Blue Shield intends to continue to make it easy for you to understand your coverage options. Compare benefits from our standard portfolio plans.

PPO plans require you to meet an annual deductible before your plan coverage begins. Click on the image below to. Once you meet the deductible you share.

Shield Spectrum SM PPO Plan. Individual Plan Comparison Chart Participating Provider Coverage Shown1 2021 All plans from Blue Cross and Blue Shield of Texas BCBSTX a Division of Health Care Service Corporation provide. 4 You must be the contract holder or spouse 18 or older on an FEP Blue Focus plan to earn this reward.

Keep in mind that if your doctor or other provider is not part of the plans PPO network you may have to pay more for each visit. On the individualfamily market if youre looking for the broadest list of doctors youre probably looking at either Anthem Blue Cross or Blue Shield. Bronze Plan 006 HSA Compatible 6000 individual deductible and 100 coinsurance.

20 initial 3 visits. All Plan Features Essential Pediatric Adult 1 Pediatric Adult 2 Preventive Program 1 Program 2 Select Value Voluntary All Plan Features. Take a look at this infographic to see the differences.

Their pricing and network is then compared against Anthem Blue Cross the other dominant PPO carrier. More about our plans.

Blue Shield Of California Archives Claremont Insurance Services

Blue Shield Of California Archives Claremont Insurance Services

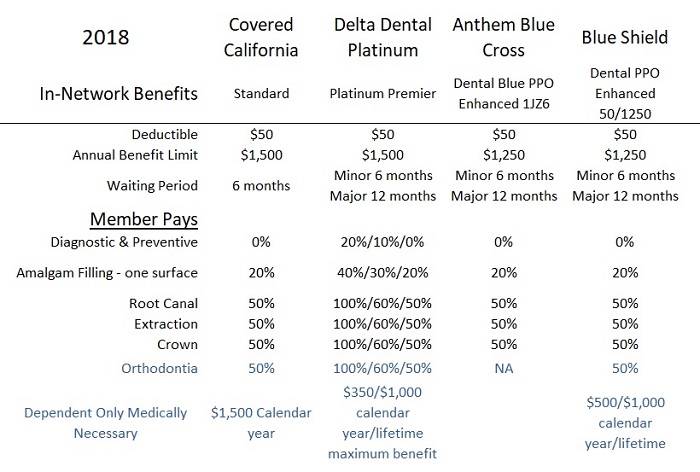

2018 Dental Ppo Insurance Review Rates And Plans

2018 Dental Ppo Insurance Review Rates And Plans

Blue Cross Blue Shield Of Illinois Medicare Supplement Rates Rating Walls

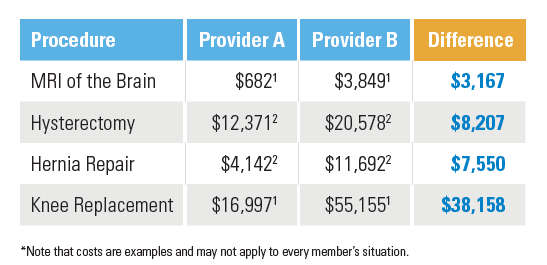

Compare Health Care Costs Quality With Provider Finder Blue Cross And Blue Shield Of Illinois

Compare Health Care Costs Quality With Provider Finder Blue Cross And Blue Shield Of Illinois

Health Insurance Company Comparison Oscar Vs Blue Cross Blue Shield Of Michigan

Health Insurance Company Comparison Oscar Vs Blue Cross Blue Shield Of Michigan

Blue Cross Blue Shield Amends Error Ridden 2018 Benefits Outline Michigan Radio

Ppo Trio 2021 Blue Shield California Individual Family

Family And Individual Health Insurance Plans Carefirst Bluecross Blueshield

Family And Individual Health Insurance Plans Carefirst Bluecross Blueshield

Ct Scan Cost Blue Cross Blue Shield Ppo Ct Scan Machine

Ct Scan Cost Blue Cross Blue Shield Ppo Ct Scan Machine

Ppo Blue Cross And Blue Shield Of Illinois

Ppo Blue Cross And Blue Shield Of Illinois

Medi Share Review Why We Switched From Blue Cross

Medi Share Review Why We Switched From Blue Cross

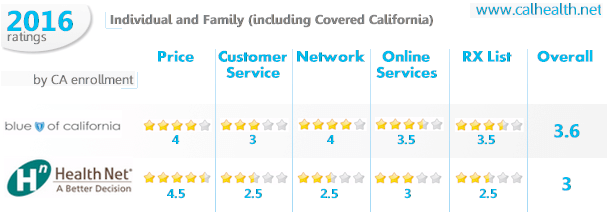

Health Net Versus Blue Shield Of California Comparison

Health Net Versus Blue Shield Of California Comparison

Blue Shield Of California Archives Claremont Insurance Services

Blue Shield Of California Archives Claremont Insurance Services

Comments

Post a Comment