Featured

Compare Medicare Drug Plans 2017

If you choose this option this means your must pay for Medicare-covered costs coinsurance copayments and deductibles up to the deductible amount of 2200 in 2017 before your policy pays anything. The least expensive drugs including generics are on the.

How To Compare Medicare Part D Drug Plan Costs

How To Compare Medicare Part D Drug Plan Costs

Trust us it looks a lot better than the old version so if youve never had luck using it before try it now.

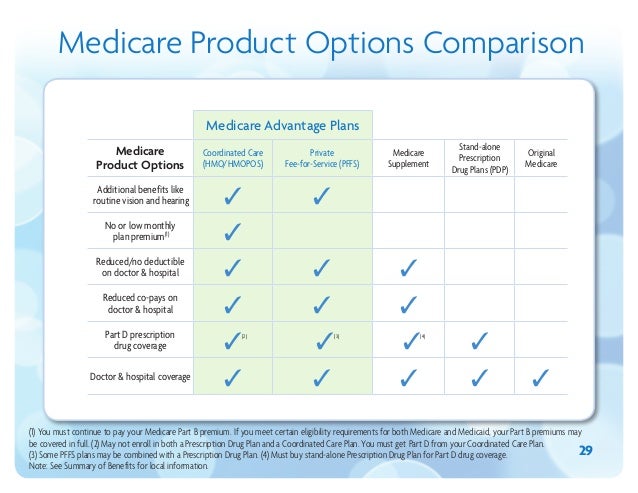

Compare medicare drug plans 2017. In 2019 Medicare revamped its Plan Finder tool making it easier for consumers to navigate and use. Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare Prescription Drug Plans. Find a Medicare plan You can shop here for drug plans Part D and Medicare Advantage Plans.

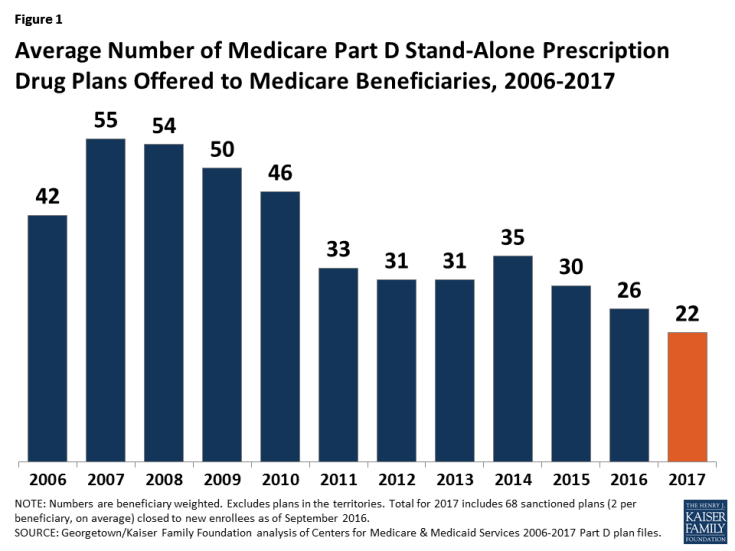

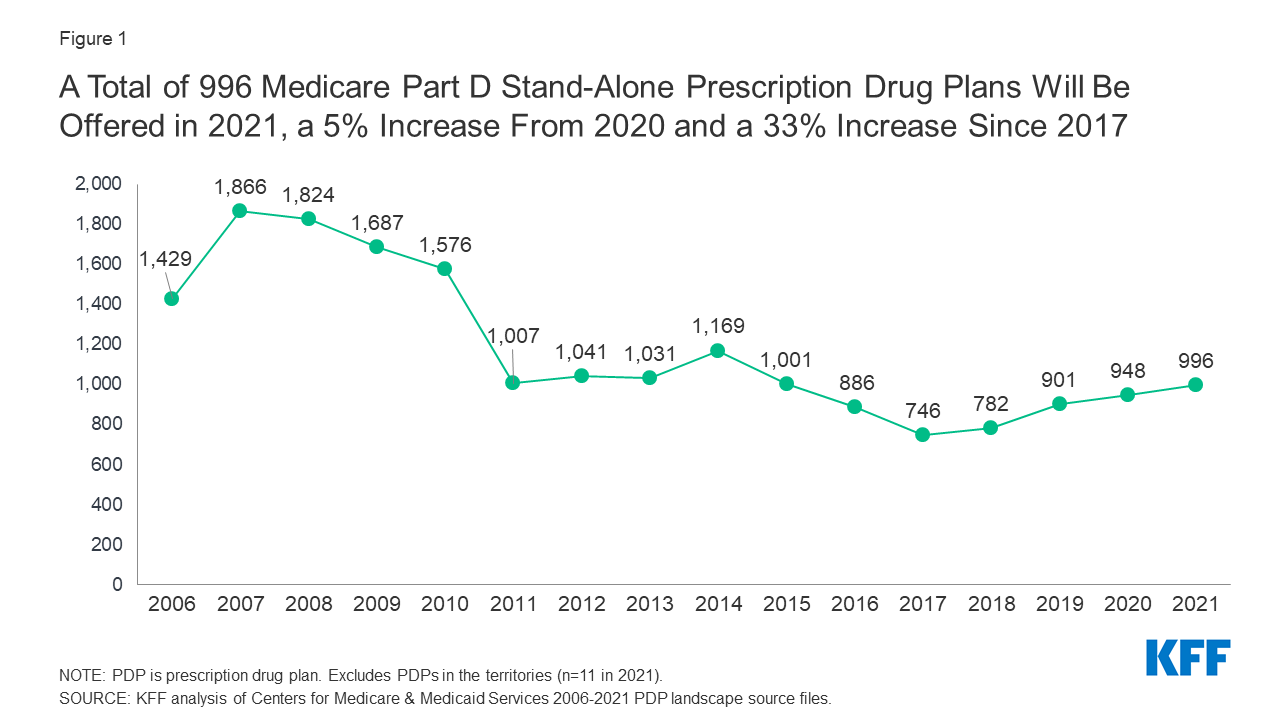

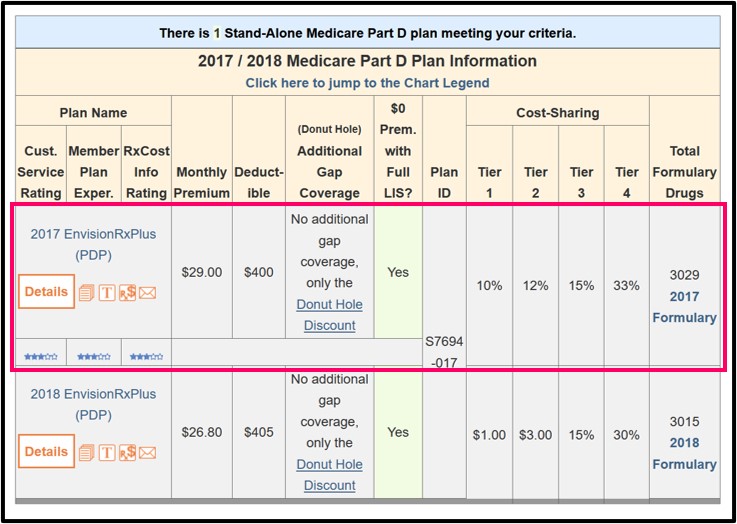

Standalone prescription drug plans have monthly premiums which vary between insurers. Will be increased by 40 to 400 in 2017. Providing detailed information on the Medicare Part D program for every state including selected Medicare Part D plan features and costs organized by State.

In 2017 Aetna sold its group life and disability businesses to The Hartford for 145 billion. The Part D prescription drug deductible was a maximum of 435 in 2020 and that increased to 445 for 2021. This is on top of the 13 percent jump in average.

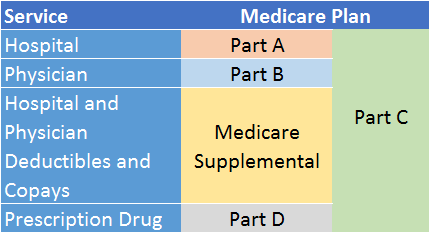

Both of these amounts must be factored in when comparing Medicare Part D plans. Part D adds prescription drug coverage to Medicare Part A and Part B some Medicare Cost Plans some Medicare Private-Fee-for-Service Plans and Medicare Medical Savings Account Plans. Will increase from 3310 in 2016 to 3700 in 2017.

For 2017 there are several ways to find the best Part D plan. Overview of what Medicare drug plans cover. Learn about the types of costs youll pay in a Medicare drug plan.

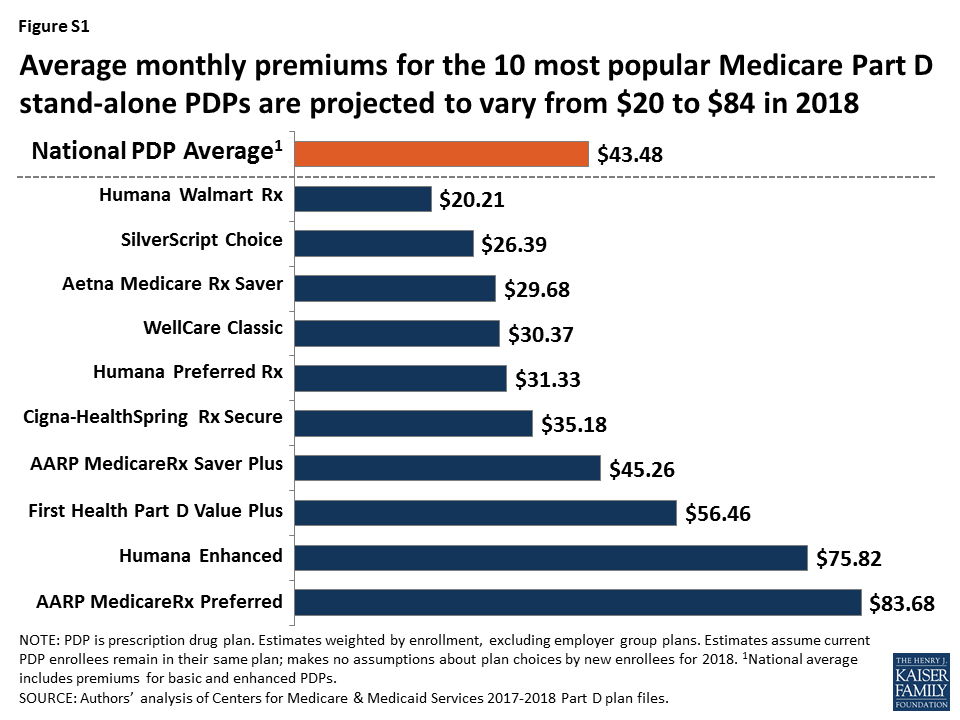

Multiply this by 12 months and just 3 drugs with a 20 variation and your part D plan can cost 720 more in co-pays. Part D premiums will be 9 percent higher in 2017 than in 2016 the Kaiser Family Foundation reported and will average more than 42 a month. Many times a Medicare Part D plans co-pays can vary by as much as 20 for a 30 day supply more if the drug is not on a plans formulary from one pharmacy to the next.

These plans are offered by insurance companies and other private companies approved by Medicare. Will increase from 4850 in 2016 to 4950 in 2017. Once youve met your deductible your Part D plan.

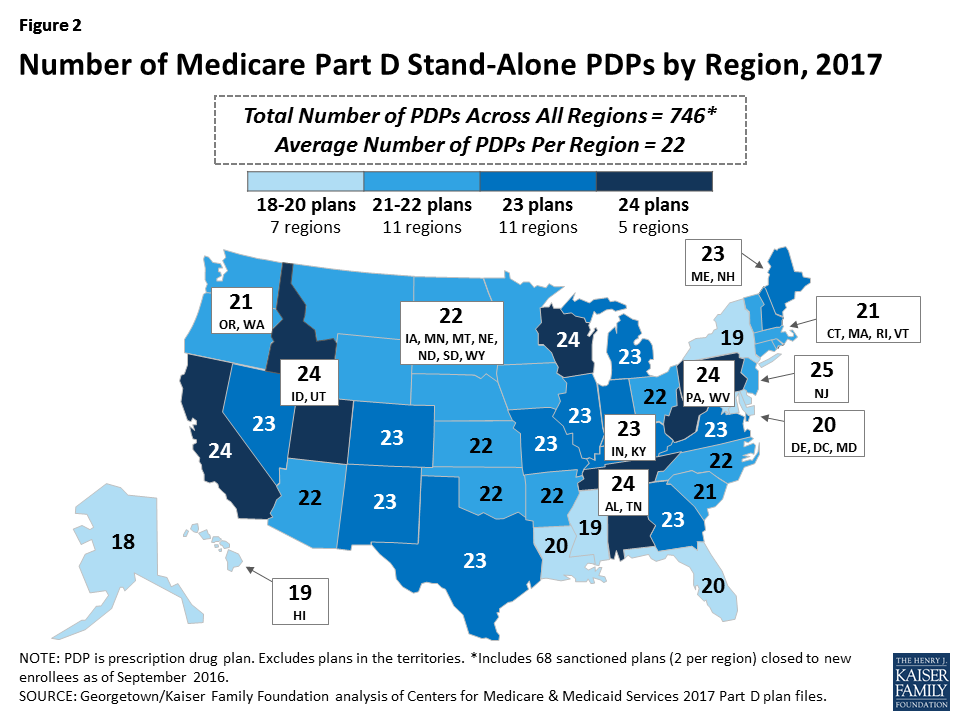

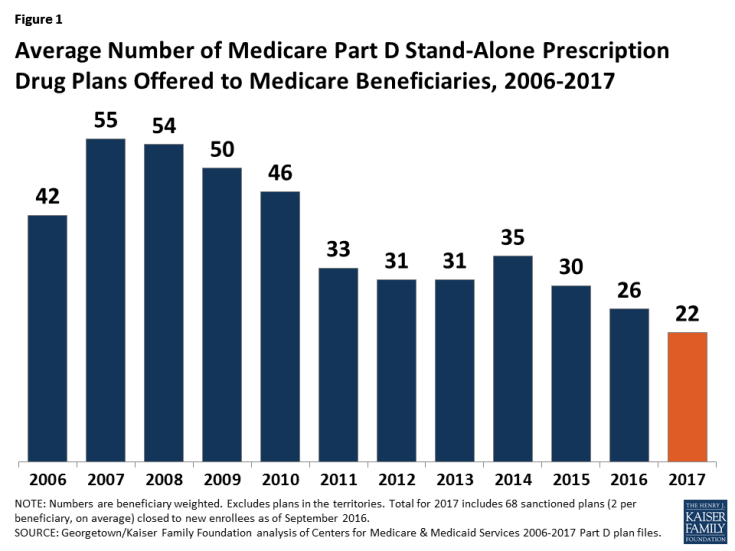

In todays episode we guide you on the best way to go about comparing medicare part d prescr. Average PDP premiums will continue to vary across states in 2017 from a low of 3127 in New Mexico to a high of 5095 in New Jersey. Get the right Medicare drug plan for you.

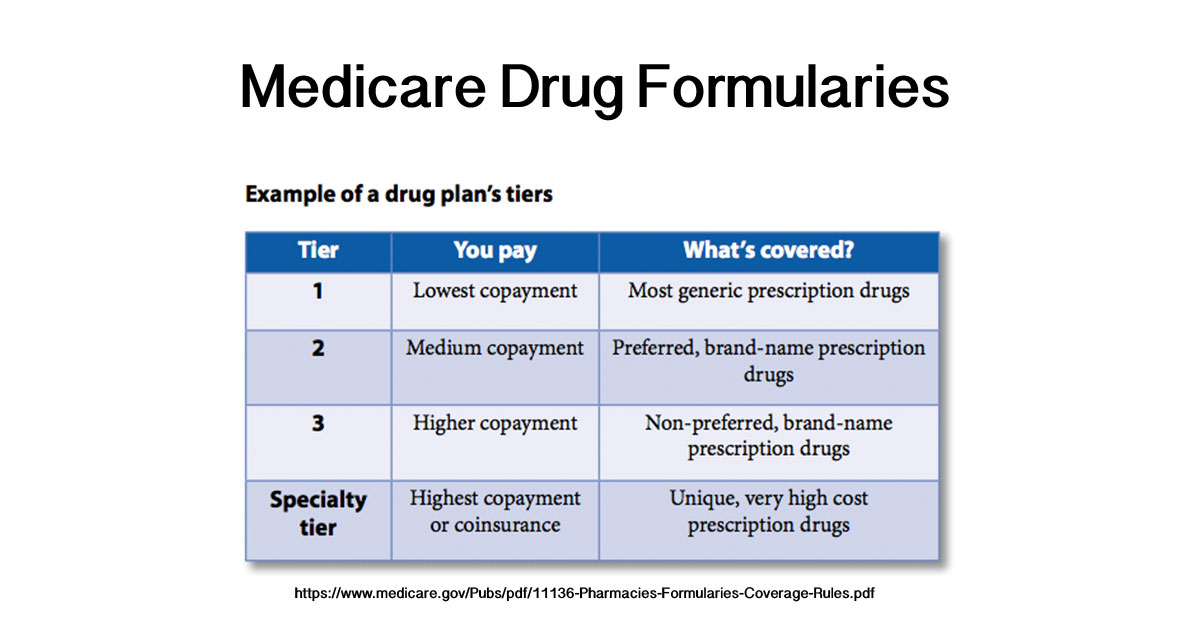

Learn about how Medicare Part D drug. How Part D works with other insurance. Learn about formularies tiers of coverage name brand and generic drug coverage.

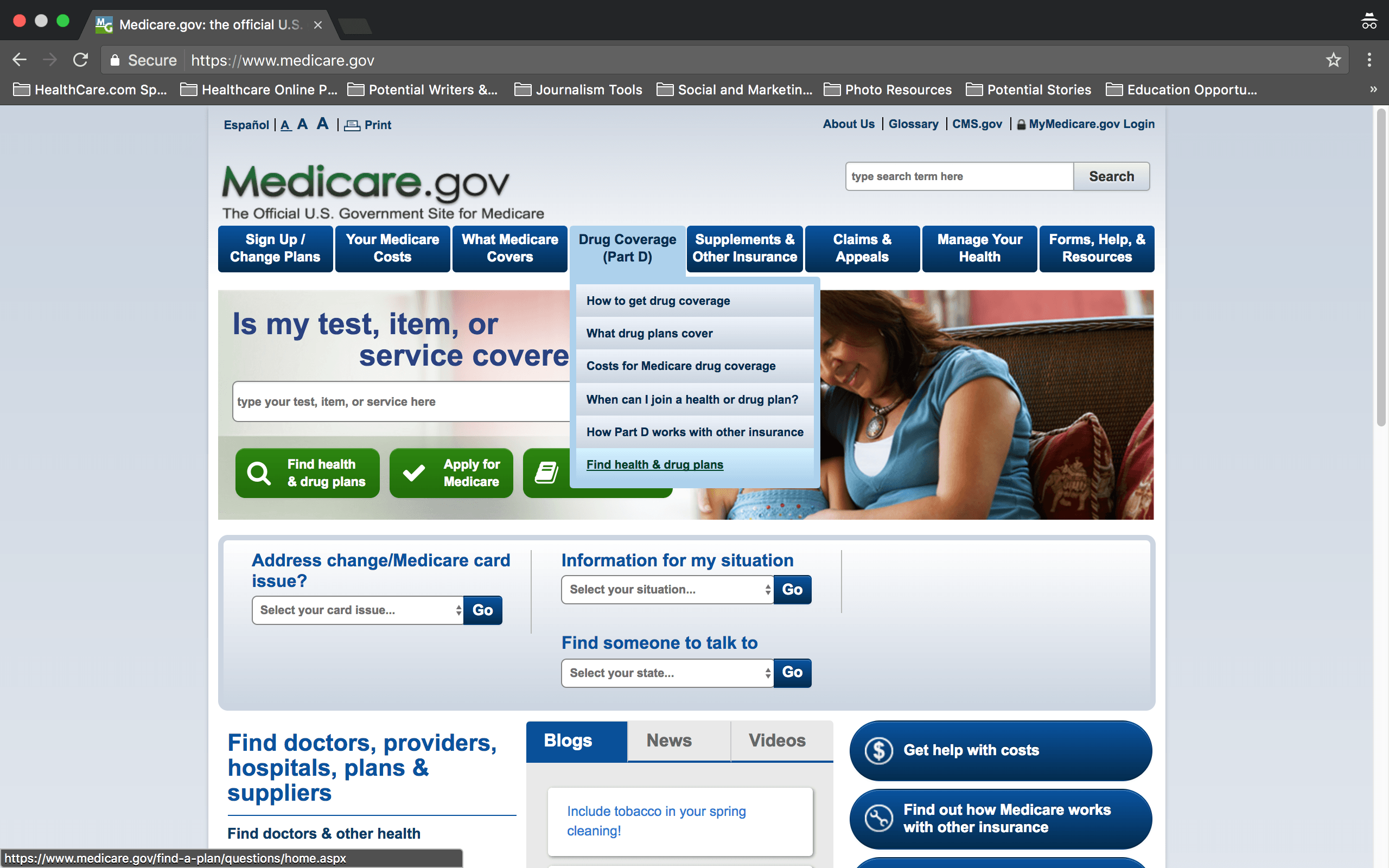

Your annual income can also impact how much youll pay above the standard monthly premium. According to an analysis from the Kaiser Family Foundation the average monthly drug plan premium for 2017 will increase 9 percent to about 42. Just go to Medicares Plan Finder Tool at wwwmedicaregovfind-a-plan and type in your zip code or your personal information the drugs you take and their dosages and select the pharmacies you use and youll get a cost comparison breakdown for each plan.

Aetna also responded to hurricane season with donations exceeding 470000 in Texas Louisiana and parts of the Caribbean. How do my Medicare prescription drug costs in 2021 compare with 2020. Some plans have deductibles well under these amounts or no deductible at all but no plans can have deductibles that exceed 445 in 2021.

If youre comfortable using a computer you can easily compare Medicares drug plans yourself online. You can compare your Medicare Part D drug plan costs on Medicares website. Each Part D plan has its own list of covered drugs which varies by plan type and carrier.

Compare features of all Medicare Part D plan available in your state with just one click. Begins once you reach your Medicare Part D plans initial coverage limit 3700 in 2017 and ends when you spend a total of 4950 in 2017. What Medicare Part D drug plans cover.

In order to maximize your coverage youll need to compare the medicines you take against the list of covered prescriptions on a plan that youre interested in. Aetna is acquired by CVS Health Corporation at the end of 2017. Plan F also offers a high-deductible plan in some states.

Prescription drug plans can have an annual deductible costing no more than 445 in 2021. The list is arranged in levels or tiers. The company also matched donations from associates that totalled more than 230000.

Top Medicare Supplement Insurance Medigap Plans Comparison Chart. Some plans may feature 0 deductibles. Sign-up for our free Medicare Part D Newsletter Use the Online Calculators FAQs or contact us through our.

But premiums vary widely from 17 to 72 a month. There are approximately 55 million Medicare beneficiaries and all are eligible for Part D prescription drug coverage. Costs for Medicare drug coverage.

Medicare projects Part D premiums will remain stable in 2017 2017 Part D prescription drug plan premiums are expected to average 34 per month. This represents a 150 per month increase over the average 2016 Part D premium.

Medicare Open Enrollment Review Compare Enroll Starts October

Medicare Open Enrollment Review Compare Enroll Starts October

Medigap Planners Prescription Drug Plans Medicare Part D Or Pdp Start With The Basics Medigap Planners

Medigap Planners Prescription Drug Plans Medicare Part D Or Pdp Start With The Basics Medigap Planners

Medicare Part D A First Look At Prescription Drug Plans In 2017 Findings 8935 Kff

Medicare Part D A First Look At Prescription Drug Plans In 2017 Findings 8935 Kff

What Are Medicare Drug Formularies

What Are Medicare Drug Formularies

Medicare Part D A First Look At Prescription Drug Plans In 2018 Kff

Medicare Part D A First Look At Prescription Drug Plans In 2018 Kff

An Overview Of The Medicare Part D Prescription Drug Benefit Kff

An Overview Of The Medicare Part D Prescription Drug Benefit Kff

An Explanation Of The 2017 Medicare Part D Coverage Gap Or Donut Hole

An Explanation Of The 2017 Medicare Part D Coverage Gap Or Donut Hole

Medicare Part D A First Look At Prescription Drug Plans In 2017 Findings 8935 Kff

Medicare Part D A First Look At Prescription Drug Plans In 2017 Findings 8935 Kff

Medicare Part D Prescription Drug Coverage Sensible Financial

Medicare Part D Prescription Drug Coverage Sensible Financial

How To Compare Prescription Drug Prices To Save Money On Medicare Part D Medicareguide Com

How To Compare Prescription Drug Prices To Save Money On Medicare Part D Medicareguide Com

It Can Pay To Pick A New Medicare Part D Drug Plan Here S How To Start Shopping Pbs Newshour

It Can Pay To Pick A New Medicare Part D Drug Plan Here S How To Start Shopping Pbs Newshour

It Can Pay To Pick A New Medicare Part D Drug Plan Here S How To Start Shopping Pbs Newshour

It Can Pay To Pick A New Medicare Part D Drug Plan Here S How To Start Shopping Pbs Newshour

How Will I Know If My Medicare Drug Plan S Drug Copayments Will Change Next Year

How Will I Know If My Medicare Drug Plan S Drug Copayments Will Change Next Year

Comments

Post a Comment