Featured

How To Verify Medical Insurance

Get a Copy of the Patients Insurance Card. An easier way to verify patient insurance coverage is online although it is not always free and some insurance companies do not have an online verification option.

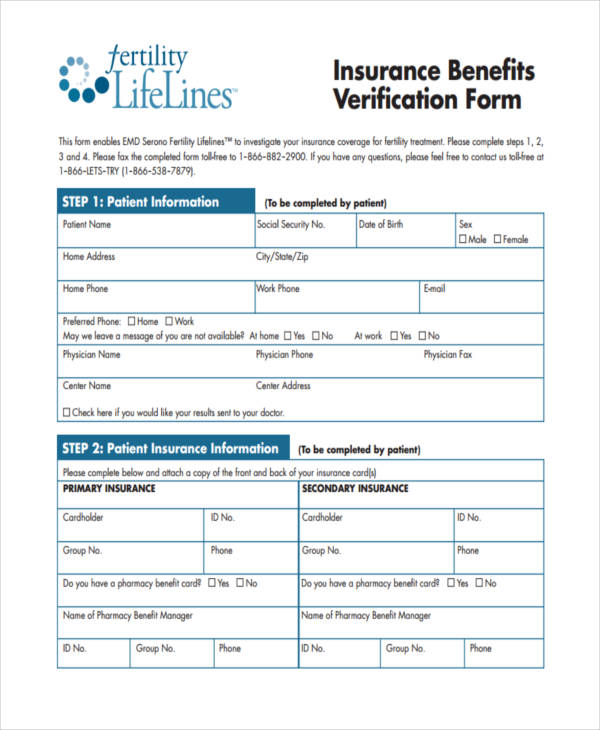

Free 23 Insurance Verification Forms In Pdf Ms Word

Free 23 Insurance Verification Forms In Pdf Ms Word

For example If your patient gets a new job he or she will have new benefits and that means youve got to complete a new eligibility check.

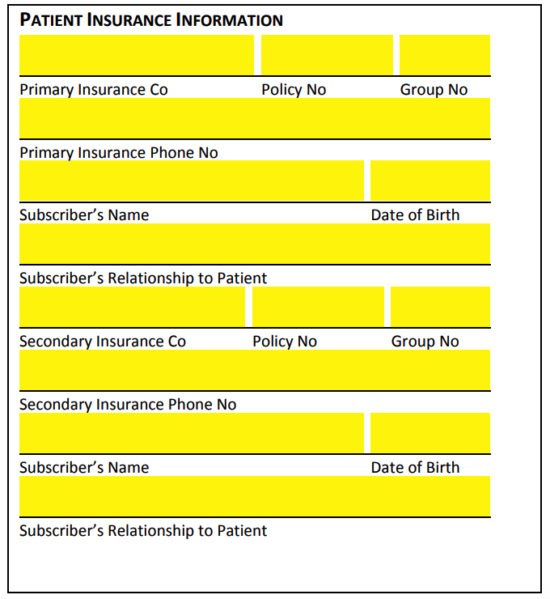

How to verify medical insurance. Upon arrival the clerk asks for the patients insurance card and then proceeds to contact the insurance carrier to verify eligibility and benefits. Contact information for the insurance company including phone number website and address for submitting claims. Another way to verify an insurance beneficiarys benefits is by visiting the office of the insurance company.

Most commercial payers also have websites that enrolled providers can use to verify benefits and eligibility. Enjoy pVerifys new Medicare Eligibility Summary Dashboard to make easy and informed actions based on a quick-glance overhead view of a patients Part A Part B Home Health Medicare Secondary Payer HMO Medicare Advantage Plan Hospice Dates and Deductible Remaining details. The card provides phone numbers for members and providers to call.

Depending on your office you may be able to verify patient insurance through an online clearinghouse such as Availity. If your primary insurer pays 300 and your secondary insurer pays 150 you will owe 50. This is a direct approach to verifying an information since the beneficiary will be able to negotiate and talk in front of an insurance representative.

Name of the primary insured. The process is complicated and goes through many different people at both the healthcare provider and the insurance provider. Real-Time Medicare Medicaid Private Health Plan Insurance Eligibility Verification is a fast and secure method to instantly retrieve patient insurance information from over 800 Health Insurance Payers from a single point of access.

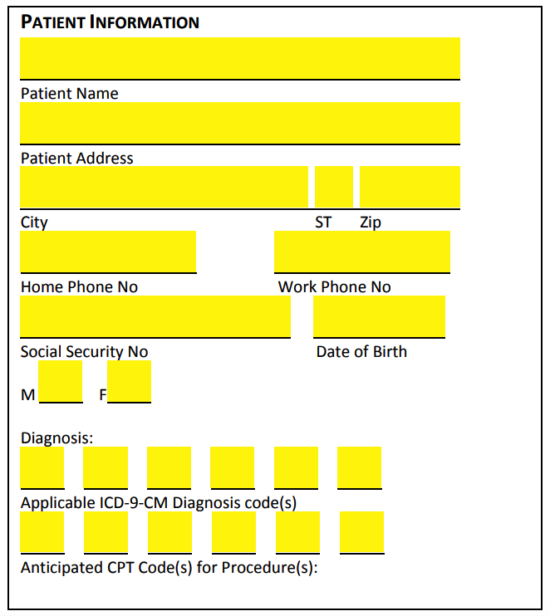

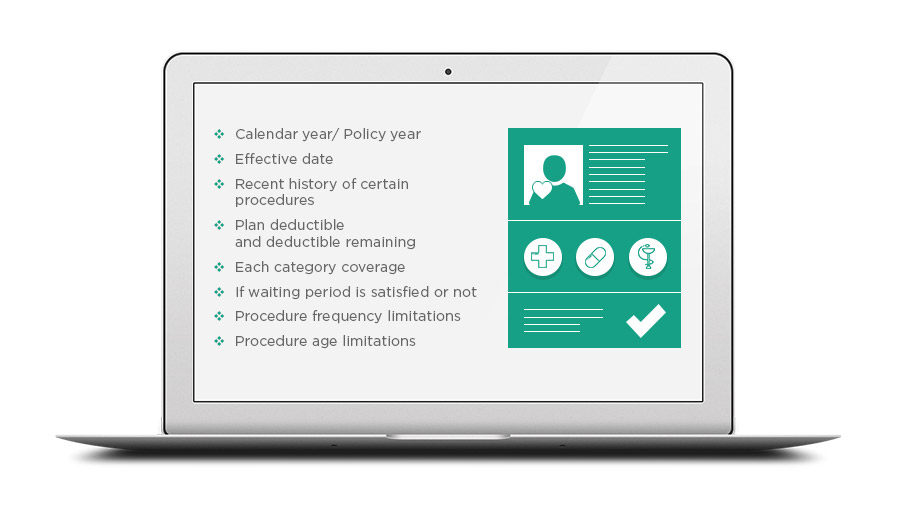

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. By calling the appropriate number you can get a summary of plan benefits. In order to confirm insurance eligibility your insurance information form should ask for.

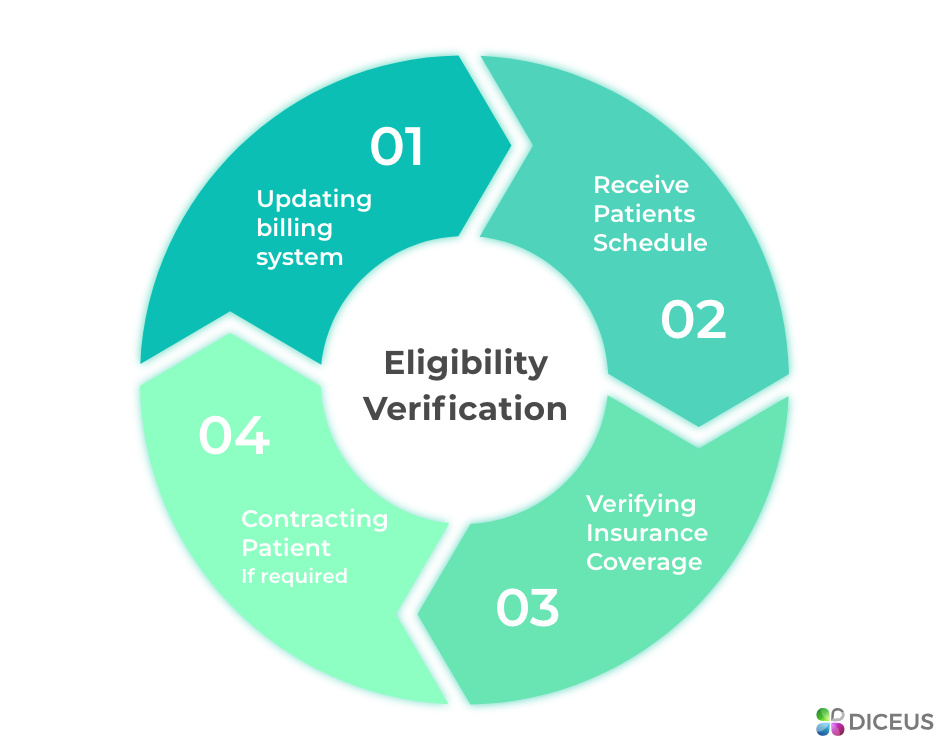

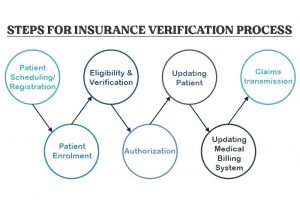

Steps In The Health Insurance Verification Process. Just look at the patients insurance card. When the clerk contacts the insurance carrier that is listed on the card he is informed that the patient no longer has.

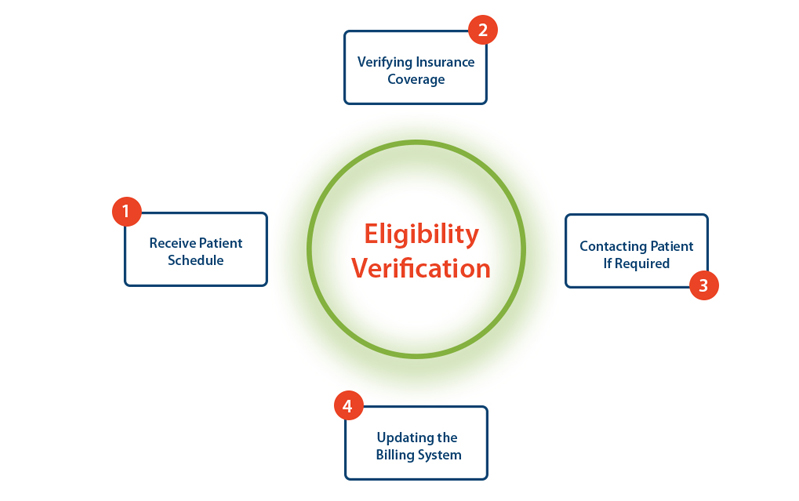

Collect the patients insurance information. Your front office staff also should re-verify the patient insurance when appropriate. Insurance Verification Process Simply put insurance verification is the process of contacting the insurance company to determine whether the patients healthcare benefits cover the required procedures.

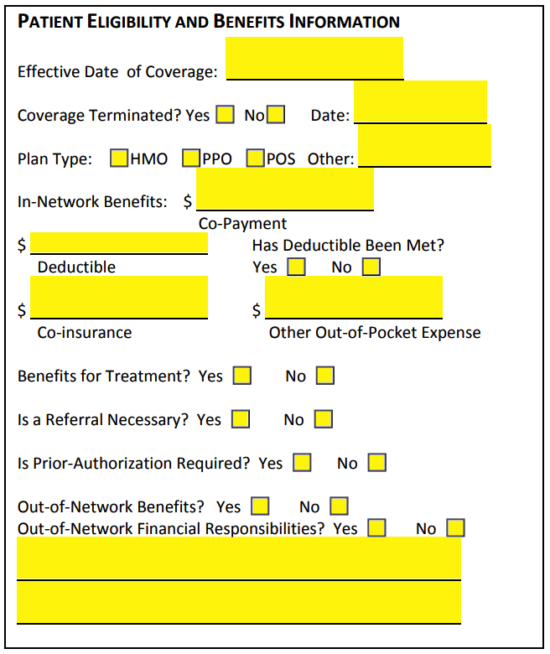

Begin the process of collecting insurance eligibility verification. The health insurance verification process is a series of steps that checks whether or not the patient admitted has the ability to make a reimbursable claim to their health insurance provider. If theres a remainder then that bill goes to the second insurer which pays what it owes.

Gather all the crucial benefits information. Also it is necessary to complete insurance verification before a. 5 Insurance Eligibility Verification Steps For Every Practice 1.

Contact the insurance company before the patients initial visit. Combine pVerifys Medicare Patient Verification. Social security number of primary insured.

Labeled with a green check or a red exclamation scan patients and make actionable decisions without toggling pages. Ask the right questions during insurance verification. Youll then be responsible for whats left over if anything.

Front office staff should. Patients name and date of birth. All Payer Batch Eligibility Verification is now available.

Insurance Re verification. Verifying patient insurance benefits can feel overwhelmingbut you can actually accomplish it all in three easy steps. Free Training 7 Steps to Land Doctor Clients.

So lets say you have a bill for 500 from a visit.

Eligibility Benefits Verification And Prior Authorization Services

Eligibility Benefits Verification And Prior Authorization Services

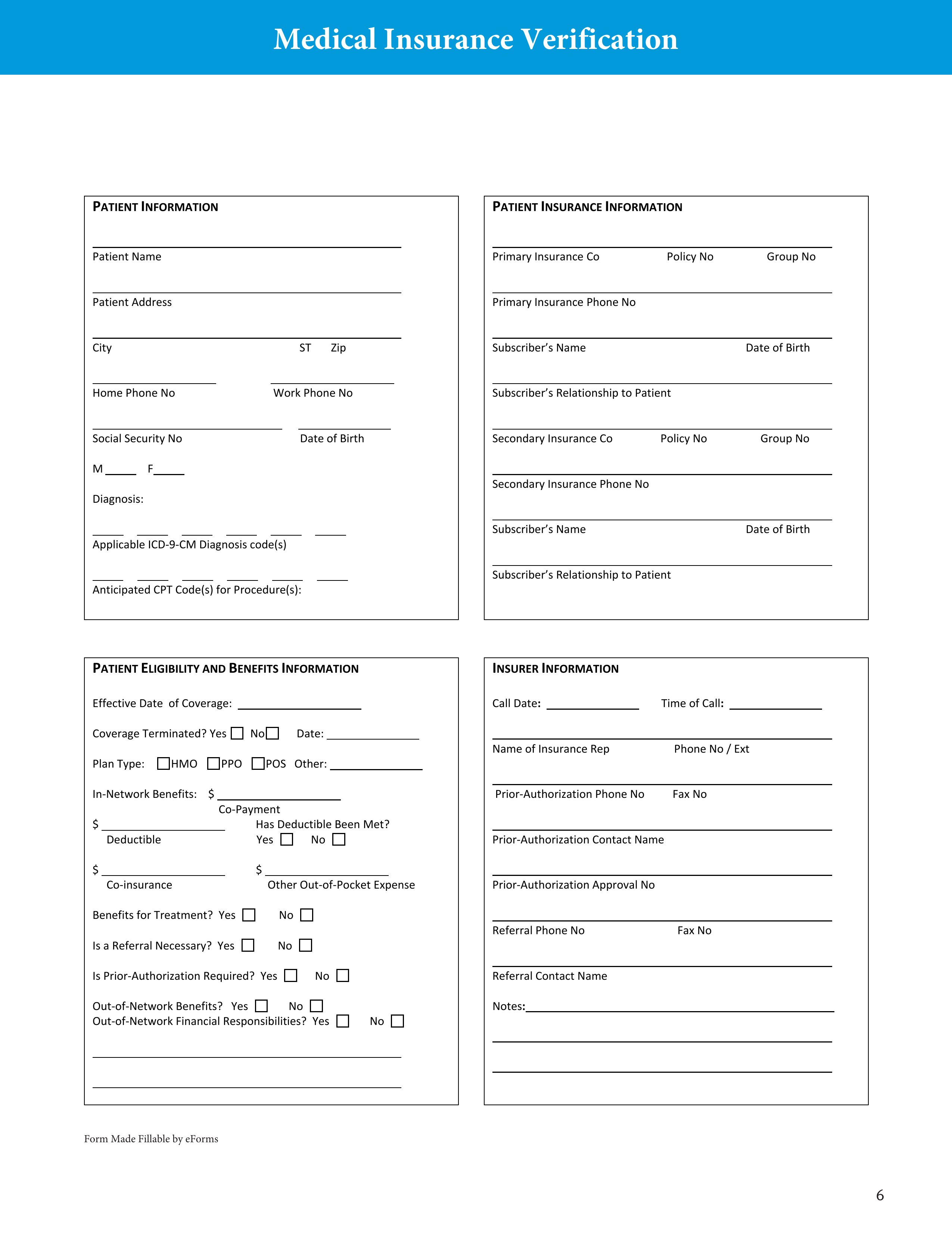

Free Medical Health Insurance Verification Form Pdf Eforms

Free Medical Health Insurance Verification Form Pdf Eforms

How To Verify Health Insurance 15 Steps With Pictures Wikihow

How To Verify Health Insurance 15 Steps With Pictures Wikihow

Medical Insurance Verification Software For Hospitals

Medical Insurance Verification Software For Hospitals

Free Medical Health Insurance Verification Form Pdf Eforms

Free Medical Health Insurance Verification Form Pdf Eforms

How To Verify Health Insurance 15 Steps With Pictures Wikihow

How To Verify Health Insurance 15 Steps With Pictures Wikihow

Free Medical Health Insurance Verification Form Pdf Eforms

Free Medical Health Insurance Verification Form Pdf Eforms

Insurance Verification Mms Group

Insurance Verification Mms Group

Understanding The Medical Billing Process In Detail Healthcare And Data Science

Understanding The Medical Billing Process In Detail Healthcare And Data Science

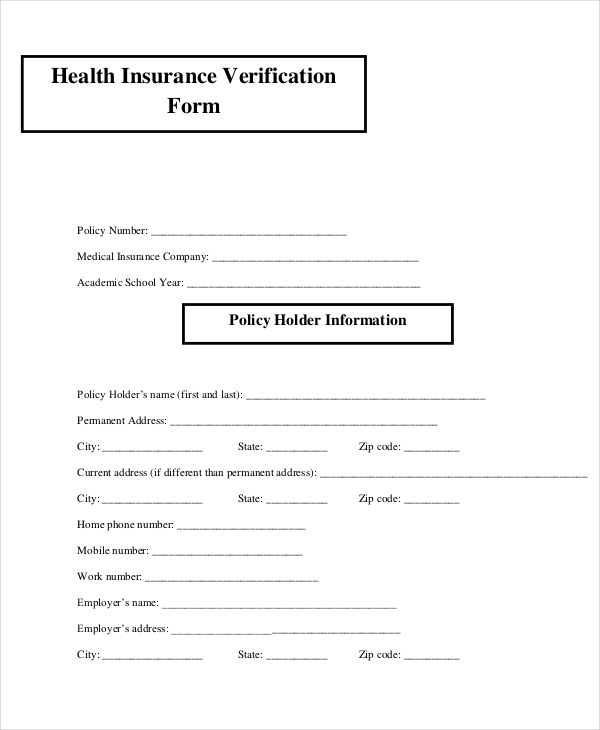

Free 23 Insurance Verification Forms In Pdf Ms Word

Free 23 Insurance Verification Forms In Pdf Ms Word

Free Medical Health Insurance Verification Form Pdf Eforms

Free Medical Health Insurance Verification Form Pdf Eforms

Insurance Verification Process In Dental Medical Billing Services Medical Billing Service Provider

Insurance Verification Process In Dental Medical Billing Services Medical Billing Service Provider

10 Key Features In Effective Insurance Verification Solutions Velvetech

10 Key Features In Effective Insurance Verification Solutions Velvetech

How To Verify Patient Insurance In Three Easy Steps Webpt

How To Verify Patient Insurance In Three Easy Steps Webpt

Comments

Post a Comment