Featured

Medi Cal Monthly Income Limits 2020

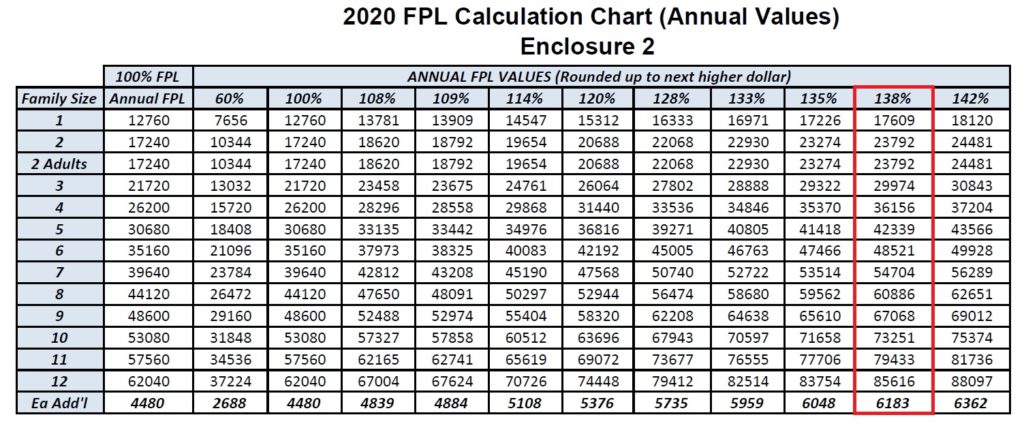

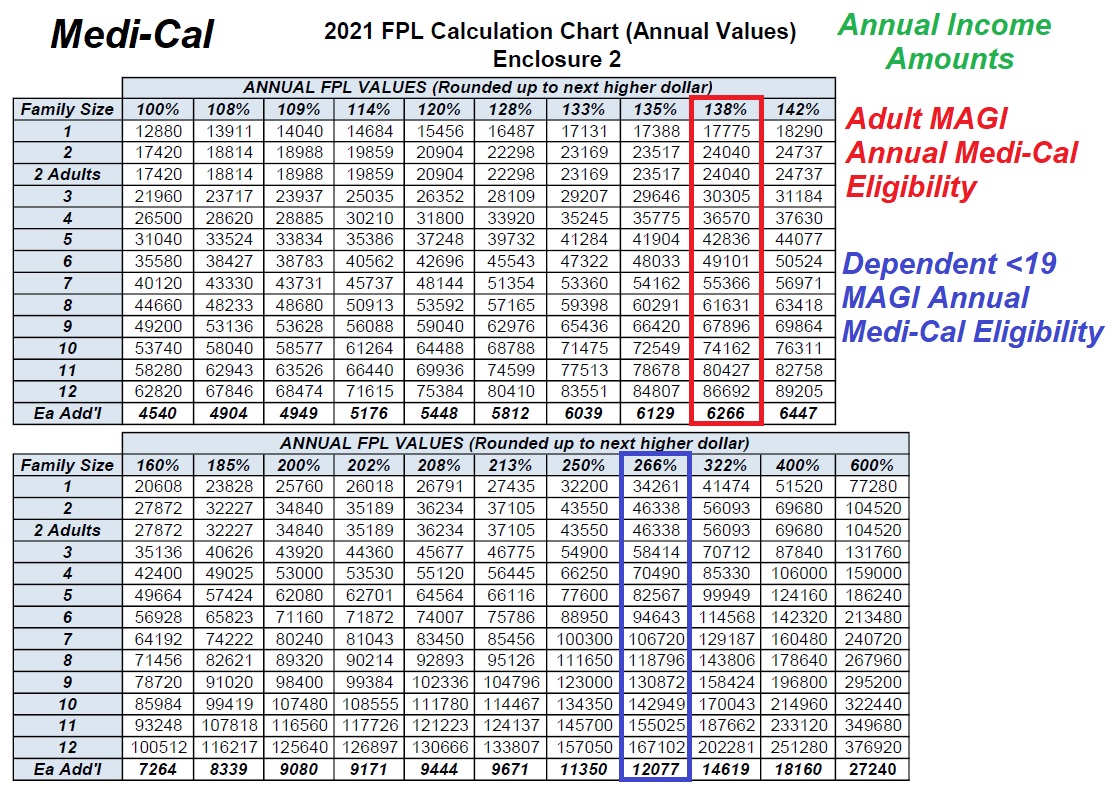

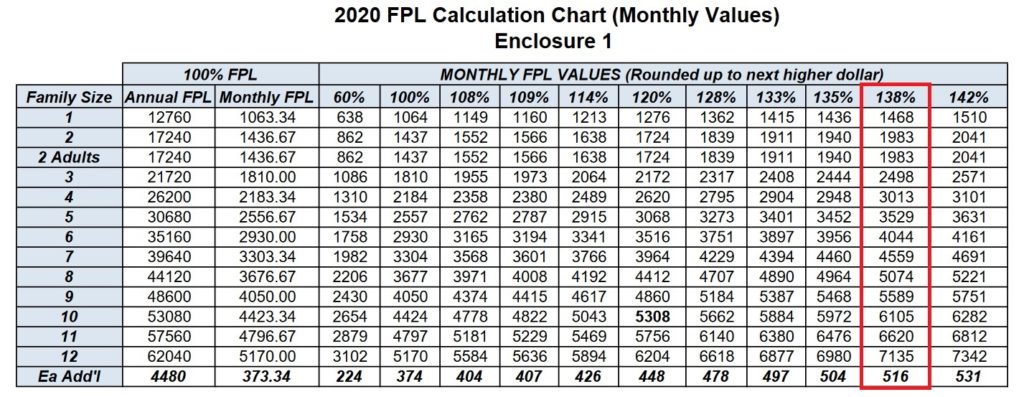

Medi-Cal for Adults up to 138 FPL Medi-Cal for Children up to 266 FPL Medi-Cal for Pregnant Women up to 213 FPL MCAP over 213322 FPL CCHIP over 266322 FPL The shaded columns display 2020 FPL values according to the Department of Health Care Services see annual values on page 5. CalFresh Income Limits 2021 Most households must have a total gross monthly income less than or equal to 200 of the federal poverty level to be potentially eligible for CalFresh.

Medi Cal Income Levels For 2020

Medi Cal Income Levels For 2020

Age 65 or older Spouses income and resources if live together at home.

Medi cal monthly income limits 2020. If income exceeds income limit and the indicator is yes the individual or family may be able to be eligible for Medicaid if they can meet a deductible. Have countable income less than 250 of the Federal Poverty Level 2683 per month for individuals and 3629 for couples. For example if you have an individual monthly income of 1300 Medi-Cal subtracts 600 for a SOC of 700.

What is interesting is that these 2020 FPL income levels are higher than what Covered California posted in their program eligibility income chart at the start of the 2020 open enrollment period. M edi-Cal 2020 Monthly Income Amounts What has not change is the upper income limit of 400 percent for the federal Advance Premium Tax Credits. Countable income below established limits.

Keep in mind that these are countable income limits which is your gross income minus certain deductions. The IRS uses the federal poverty levels for determining the subsidy when people file their taxes. Income numbers are based on your annual or yearly earnings.

Why ending the senior penalty is important Due to the Affordable Care Act most adults in California can qualify for full Medi-Cal with incomes up to 138 of the poverty level 1436month for an individual. The Medi-Cal income limits shown below. December 1 2020 the new California law raises the monthly income limit for the Aged Blind and Disabled Federal PovertyT Levhis meleans pr mogroream applicants and beneficiarieswill beeligible f freeor Medi-Cal.

Your gross income can be much higher than your countable income. Those with income below these limits may qualify for Modified Adjusted Gross Income MAGI Medi-Cal. Medi-Cal disregards property for individuals whose eligibility is determined using.

Be eligible fforree Medi-Cal. T Your Medi-Cal benefwiiltl snot changeright now. The new income limit was supposed to go into effect as of August 1 2020 but has been delayed to December 1 2020.

2 1437 SSI Limits 1 - 2000. 2020 Medi-Cal Aged Disabled Federal Poverty Level Program Single Person 1482 per month Married Couple 2004 per month When your countable income is greater than the Medi-Cal income limits Medi-Cal will give you a monthly Share of Cost. Beginning August 1 2020 the limit for the Aged Blind Disabled Medi-Cal Program will increase to 138 percent FPL.

Medi-Cal Eligibility SSI and other categorically-related recipients are automatically eligible. 12 rows State of California. Currently the SSISSP couples rate is the lower amount.

The countable income in this program for a couple cannot be lower than the SSISSP level for a disabled couple. Medi-Cal income limits for persons age 65 and older will increase from 100 Federal Poverty Level FPL to 138 FPL making more seniors eligible for Medical. 109 FPL MAGI Medi-Cal.

2 - 3000 YES. This means you must pay at least 700 in covered medical expenses andor health care premiums in a given month before Medi-Cal covers any of your health care costs for that month. Covered California Programs Medi-Cal Programs Percentage of income paid for premiums based on household FPL Based on second-lowest-cost Silver plan Household FPL Percentage Percent of Income 0-150 FPL 0 household income 150-200 FPL 0-2 household income.

It is still at 49960 while the Medi-Cal chart based on the federal poverty level is 51040. Also deductions are expenses that are subtracted from the households monthly gross income to arrive at the net monthly income. This brings the couples income limit to 2081 month 1481 month for the applicant spouse and 600 month as a maintenance.

The 100 column display 2020 FPL values as published by the Department of Health and Human Services. The limit is 1436 per month gross for a household of 1 and the limits increase as the household size increases. Effective January 1 2021 through December 31.

Medi cal eligibility log in Verified Just Now. To see if you qualify based on income look at the chart below. Others whose income would make them ineligible for public benefits may also qualify as medically needy if their income and resources are within the Medi-Cal limits current resource limit is 2000 for a single individual.

100 of Poverty Level 1 1 064. These income limits go up every April. What happens nex.

Covered California listed the single adult Medi-Cal annual income level 138 of FPL at 17237 and for a two-adult household at 23226. New Medi-Cal Income Levels Higher Than Covered California. Associated with eligibility ranges for Medi-Cal programs.

People with higher incomes may qualify for other Medi-Cal programs possibly with a Share of CostChildren under 21.

Medi Cal Income Levels For 2020

Medi Cal Income Levels For 2020

Medi Cal Income Levels For 2020

Medi Cal Income Levels For 2020

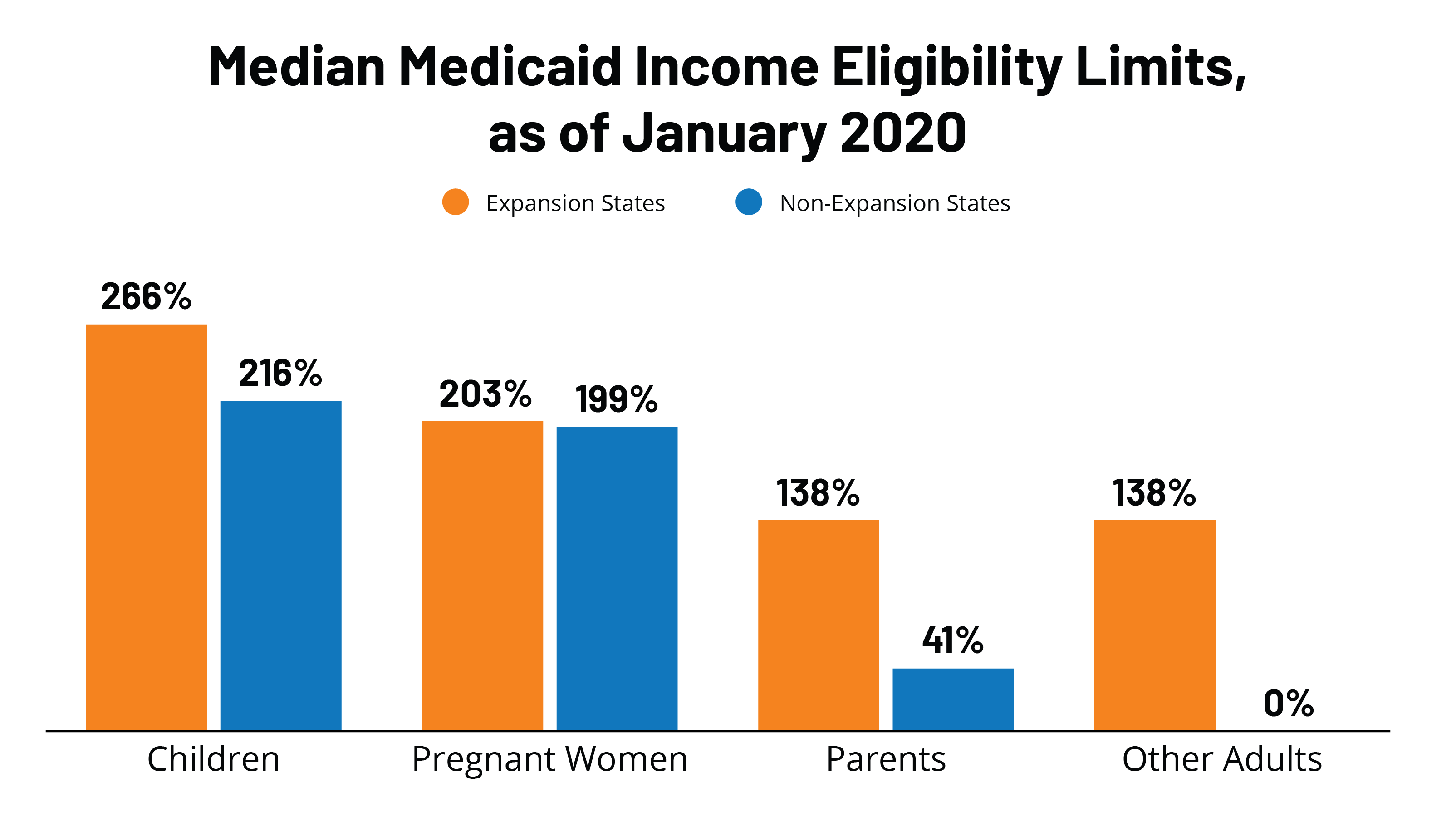

Medicaid And Chip Eligibility Enrollment And Cost Sharing Policies As Of January 2020 Findings From A 50 State Survey Kff

Medicaid And Chip Eligibility Enrollment And Cost Sharing Policies As Of January 2020 Findings From A 50 State Survey Kff

Medi Cal Income Levels For 2020

Medi Cal Income Levels For 2020

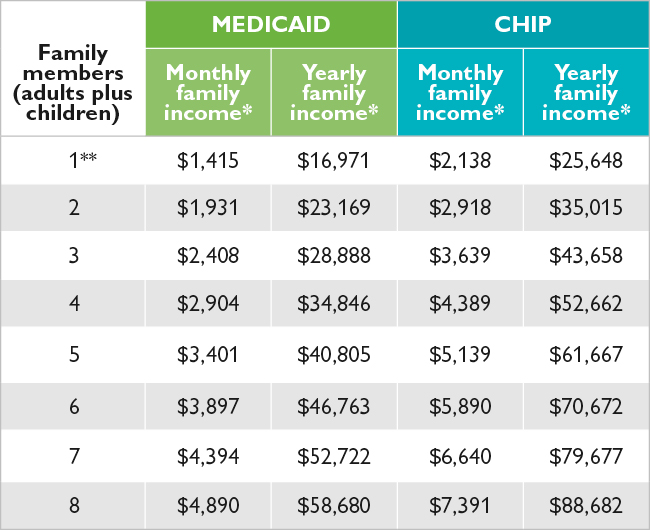

Do I Qualify Texas Children S Health Plan

Do I Qualify Texas Children S Health Plan

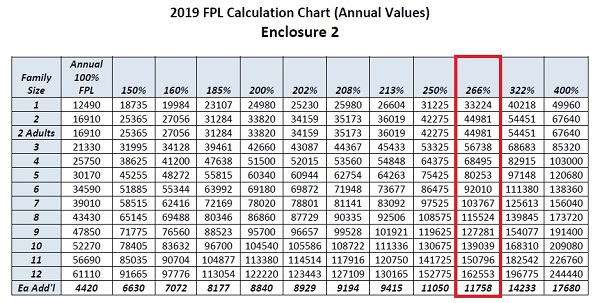

2019 Medi Cal Program Income Levels For Families And Individuals

2019 Medi Cal Program Income Levels For Families And Individuals

How To Enroll In Medicaid Maryland Health Connection

How To Enroll In Medicaid Maryland Health Connection

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

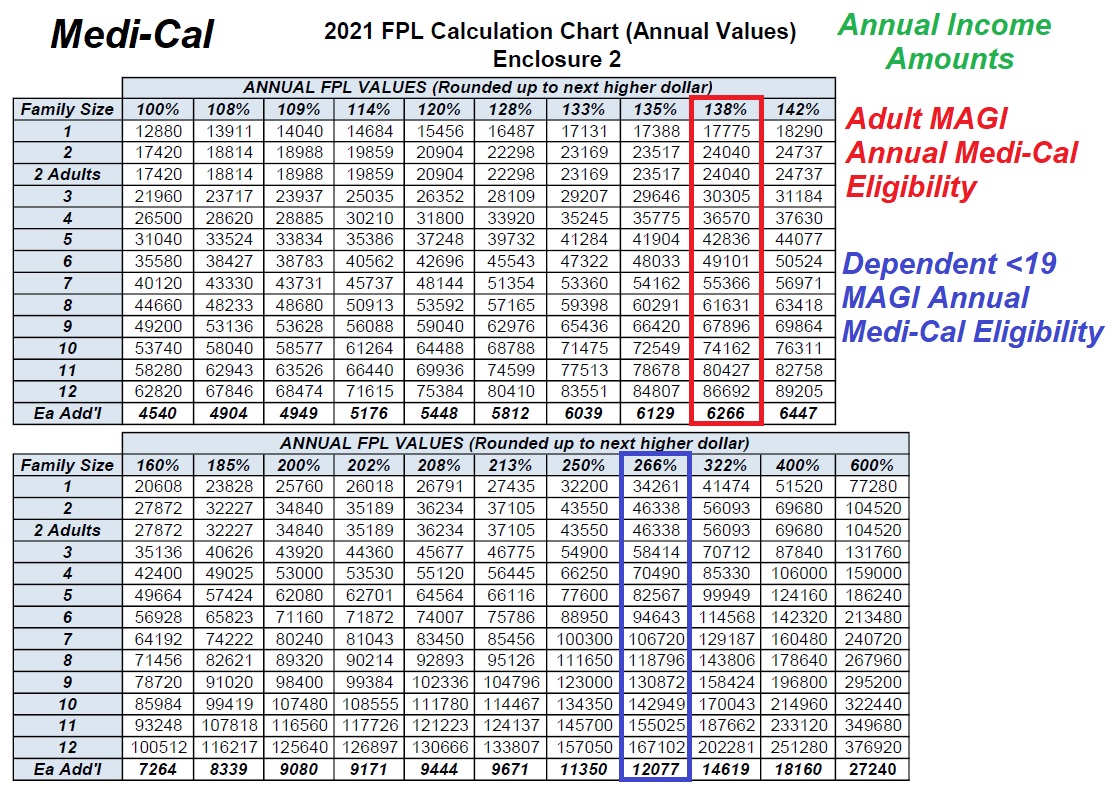

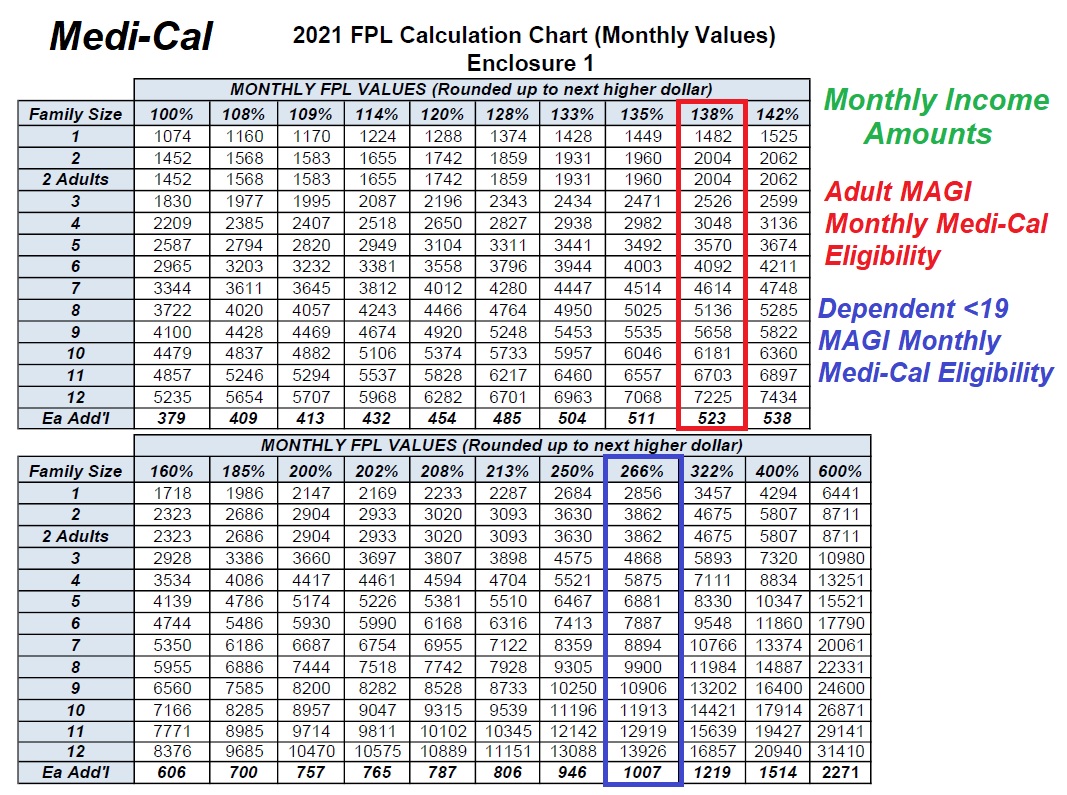

2021 Medi Cal Income Amounts Modest Increase Fpl

2021 Medi Cal Income Amounts Modest Increase Fpl

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

2021 Medi Cal Income Amounts Modest Increase Fpl

2021 Medi Cal Income Amounts Modest Increase Fpl

Covered California Income Tables Imk

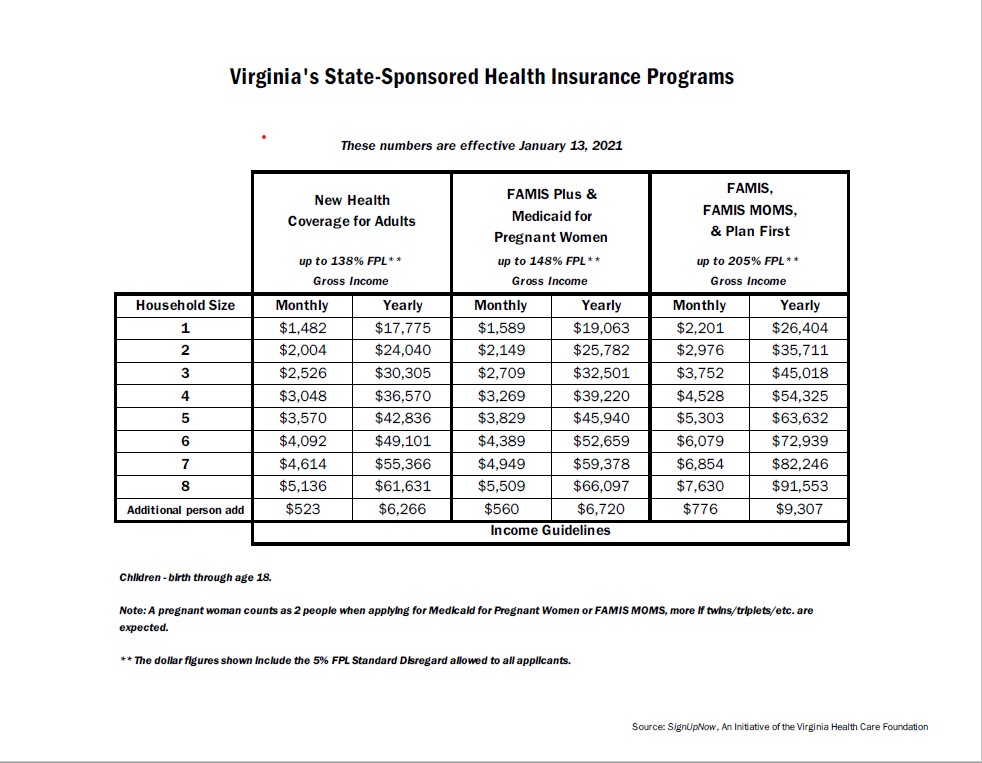

Virginia Health Care Foundation Income Guidelines

Virginia Health Care Foundation Income Guidelines

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Comments

Post a Comment