Featured

Difference Between Hmo And Ppo Plans

These two types of plans have unique features benefits and limitations that are attractive to different people. PPO Health Insurance Plans.

All health care plans arent the same.

Difference between hmo and ppo plans. All these plans use a network of physicians hospitals and other health care professionals to give you the highest quality care. It looks like your browser is out of date. The differences besides acronyms are distinct.

One kind might work better for you than another. An HMO is a Health Maintenance Organization while PPO stands for Preferred Provider Organization. While HMO and PPO plans are the 2 most common plans especially when it comes to employer-provided health insurance there are other plan types you should know about including EPO and POS plans.

Learn the difference between an HMO and a PPO plan why your choice of doctors is important and see if your doctor is in our network. Lets update your browser so you can enjoy a faster more secure site experience. PPO stands for preferred provider organization.

Out-of-network care is allowed in emergency cases only. HMOs focus on prevention and wellness rather than specialized care. PPO plans provide more flexibility when picking a doctor or.

5 Patients in with an HMO must always first see their primary care physician PCP. The difference between them is the way you interact with those networks. PPO - Which ones for you.

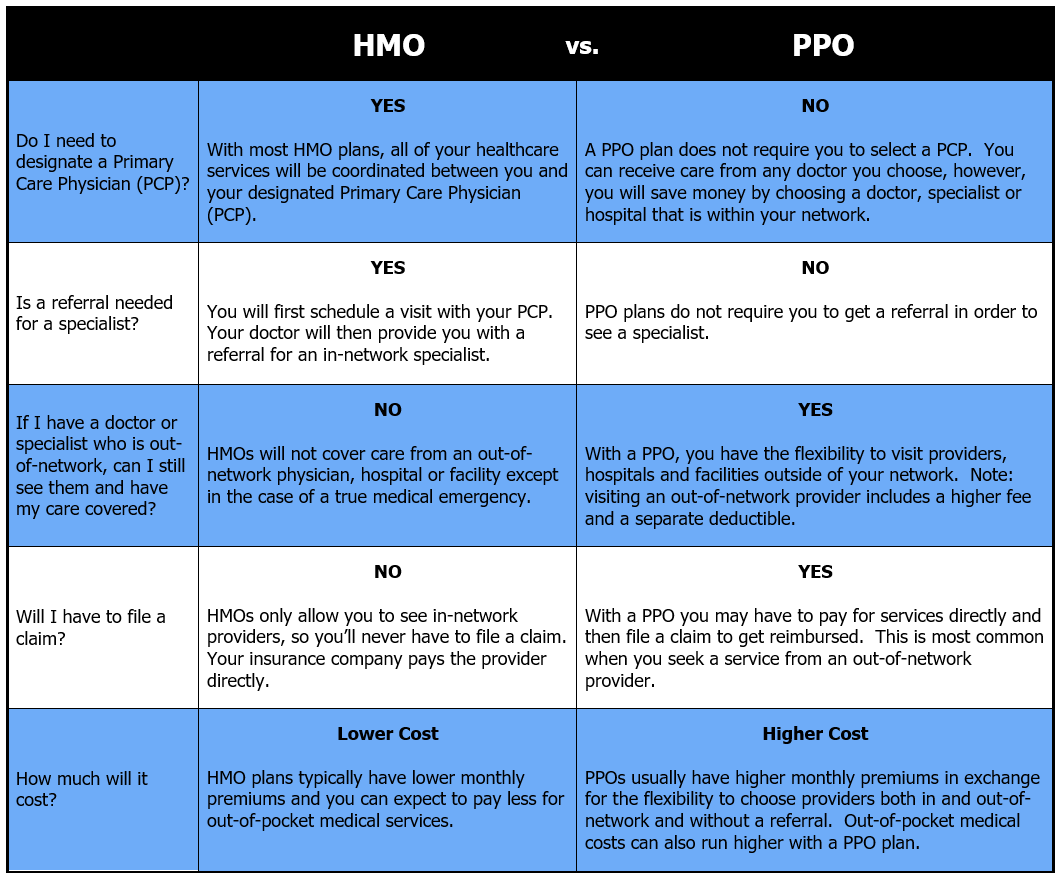

If your PCP cant treat the problem they will refer you to an in-network specialist. PPO and HMO comparison chart There are a lot of similarities between Medicare Advantage PPO and HMO plans such as the costs of premiums deductibles and other plan fees. The biggest differences between an HMO and a PPO plan are.

But the major differences between the two plans. With a PPO plan you can see a specialist without a referral. HMO stands for health maintenance organization.

Itll depend on how often you visit the doctor where you go to get your care and how much you can pay for it. In most cases if you belong to an HMO you must use in-network care meaning care from those health care facilities or doctors that are in the HMOs network. In summary here are the key differences between a dental HMO and PPO these are general and you should always check the details of any plan before you buy or enroll.

2 But they tend to have lower monthly premiums than plans that offer similar benefits but come with fewer network restrictions. Click on the image below to make it bigger. Take a look at this infographic to see the differences.

In order to understand the difference between DHMO and PPO dental insurance lets take a closer look at how each plan. 5 rows Compare Plans Select plan to compare Select 2 or more plans to compare Compare plans. Preferred Provider Organization PPO While both Medicare HMO and PPO typically have more similarities than differences the main contrast comes down to premiums or higher costs in When choosing a Medicare plan that is best for you or your loved ones you may want to consult a plan representative to better understand the advantages of each plan.

At a high level DHMO plans are designed to help keep your dental costs lower. 5 rows PPO Health Insurance Plans. PPO dental insurance plans on the other hand offer a balance between low-cost care and dentist choice.

An exclusive provider organization EPO plan is situated between an HMO and PPO in terms of flexibility and costs. HMOs require primary care provider PCP referrals and wont pay for care received out-of-network except in emergencies. So this type of health insurance is a good fit for people looking to maintain their health because for all intents and purposes theyre already healthy.

Referrals and Primary Care Physicians PCPs In HMOs you will likely have to choose a PCP.

Hmo Vs Ppo Selecting The Right Plan For Your Employees Clarity Benefit Solutions

Hmo Vs Ppo Selecting The Right Plan For Your Employees Clarity Benefit Solutions

Difference Between Hmo And Ppo Difference Between

Comparing Costs And Rates Of Hmo To Ppo Plans In California

Comparing Costs And Rates Of Hmo To Ppo Plans In California

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between An Hmo Vs Ppo Xcelhr

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

How Do Commerical Ppo Vs Hmo Insurance Plans Work Dr Wenjay Sung Podiatrist

How Do Commerical Ppo Vs Hmo Insurance Plans Work Dr Wenjay Sung Podiatrist

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Hmo Vs Ppo What S The Difference

Hmo Vs Ppo What S The Difference

Hmo Vs Ppo Comparison 5 Differences With Video Diffen

Hmo Vs Ppo Comparison 5 Differences With Video Diffen

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

Hmo Vs Ppo Health Insurance Plans Selecting The Right Plan For Your Needs San Diego Financial Literacy Center

Comments

Post a Comment