Featured

- Get link

- X

- Other Apps

Medicare Supplement Plan N Versus Plan G

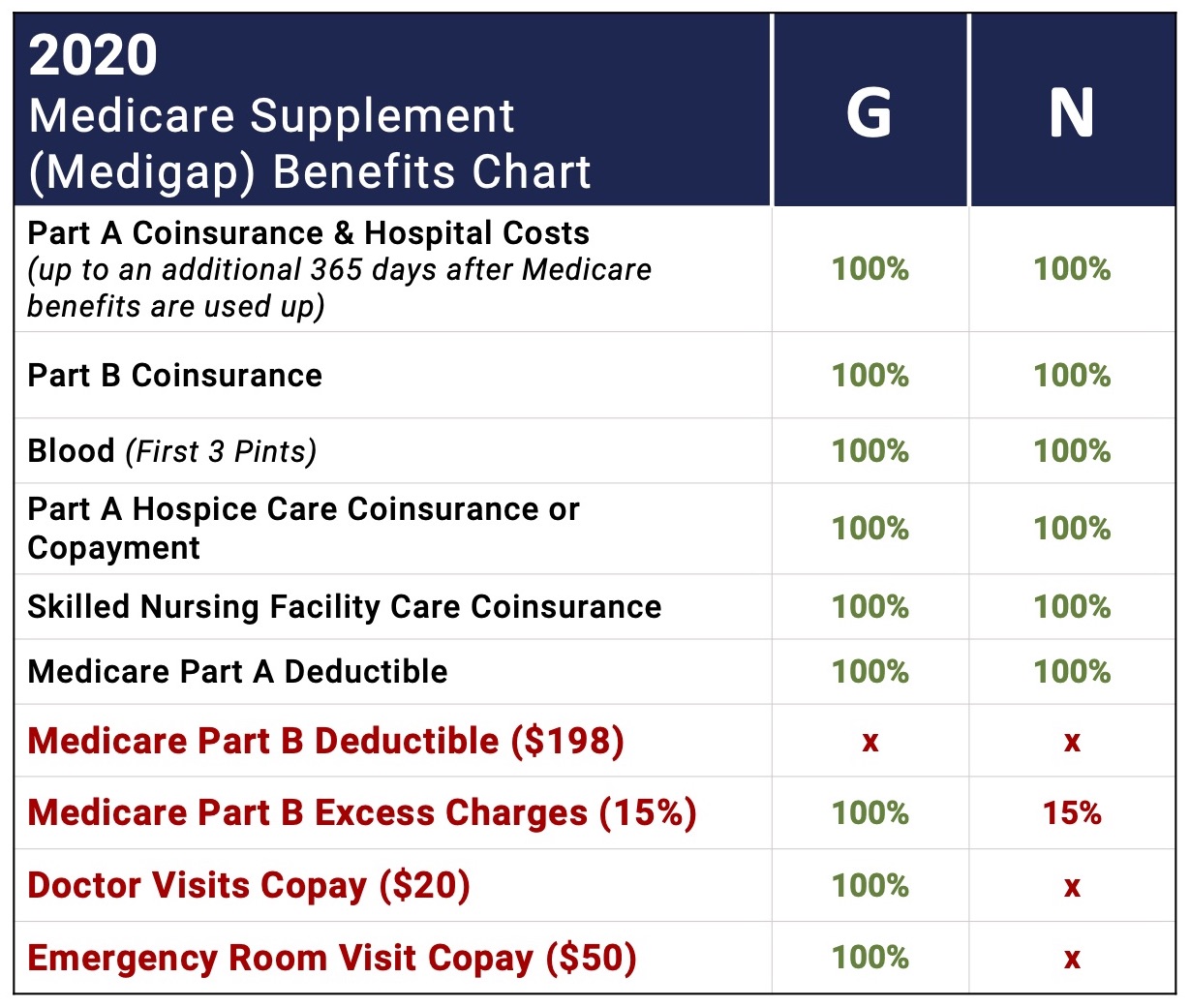

When you compare Plan G vs Plan N youll see that Plan G comes with more coverage. Also it covers the Medicare Part A deductible at 50 versus 100.

Medicare Supplement Plan N Medicare Plan N Medigap Plan N

Medicare Supplement Plan N Medicare Plan N Medigap Plan N

Medicare Supplement Plan F Plan G and Plan N Explained Plan N F and G are all under Medicare Supplement Plans or Medigap Plans.

Medicare supplement plan n versus plan g. Plan G is available to individuals who want comprehensive coverage and became newly eligible to Medicare after. Plan premium can vary widely depending on where you live and your health status if you dont have Guarantee Issue rights. Which is Better Medicare Supplement Plan G vs Plan N.

In the last five years premium. Medicare Supplement Plan N vs Plan G 2021 Plan D Watch later. Plan N offers the same coverage as Plan G in that it also does not cover the Medicare Part B deductible like Plan F does.

The next most comprehensive plan is Plan G which covers nearly as much with the Part B deductible being the only difference. However it differs from Plan G by not covering Medicare Part B excess charges. As mentioned above you can incur Part B excess charges when your health care provider does not accept Medicare assignment.

Medicare supplement Plan G is one of the two most comprehensive Medicare Advantage supplement plans also referred to as Medigap policies available. Visits and you also pay your own excess charges. In plain English if you go with Plan N.

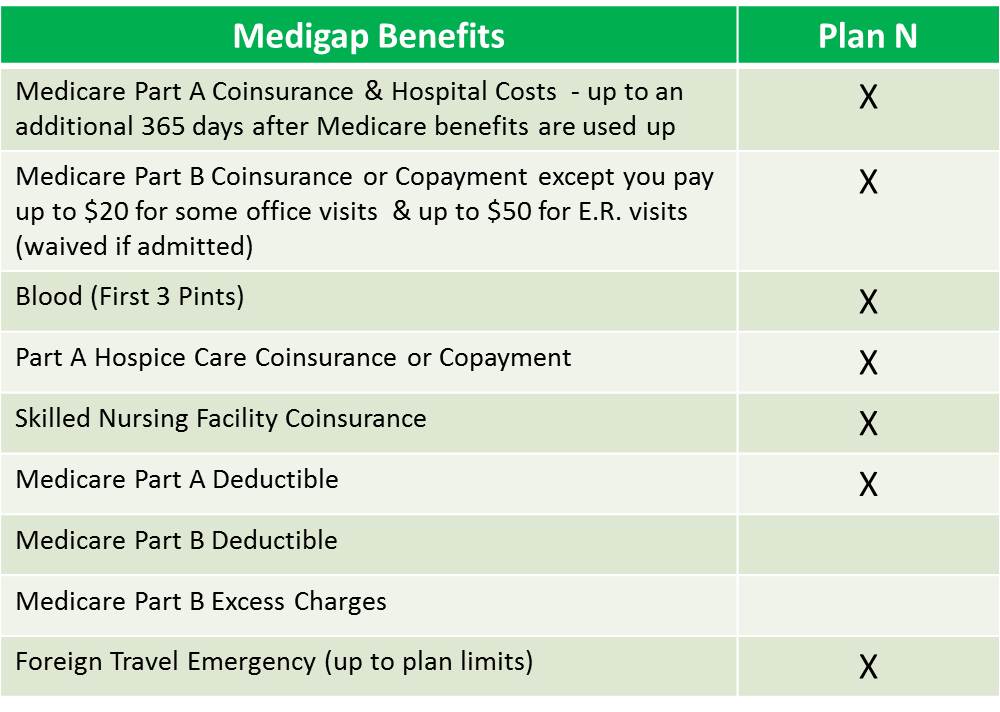

The two plans look similar in benefits covered except for plan N has an asterisk next to it. Medigap Plan G offers all of the same benefits as Plan F except for the Part B deductible. Plan N covers seven of the nine basic Medigap benefits excluding coverage for the Medicare Part B deductible 203 per year in 2021 and Medicare Part B excess charges.

The asterisk eventually leads you to info that explains the difference. You have to weigh the benefits of higher premiums and richer benefits against lower premiums and more potential out-of-pocket costs both for today and in the. Finally Plan N is probably the third most popular plan because it operates similar to Plan G except that you pay copays for doctor and ER.

Plan G will offer a high deductible option beginning January 1 2020. It covers nearly 100 of the benefits offered through Medicare Advantage Plans and meets new regulations for Medigap policies. Watch video to learn more.

However Plan N will come with a lower monthly premium. Among the factors that affect your monthly premium rates is the pricing method that your carrier uses. In most states Plan G generally runs about 20-25 more per month than Plan N More about Plan G prices.

Medigap Plan N is the third-most popular Medicare Supplement Insurance plan. Medicare Supplement Plan G. In exchange for a lower monthly premium you agree to pay small copays when visiting the doctor or hospital.

In most states Plan G costs somewhere in the neighborhood of about 20 to 25 more a month than Plan N. Medicare Supplement Plan N. Medicare Supplement Plan N Rate Increase History.

Depending upon the condition of your health it might be a better idea to sign up for Plan N even though there is a copay and may be 15 in excess charges associated with it. Medigap Plan N covers the same benefits as Plan F except the Part B deductible and Part B excess charges. If you read the fine print you will learn that Plan N pays 100 of the Part B coinsurance except for a copayment of up to 20 for some office visits and up to a 50 copayment for emergency room visits that dont result in inpatient admission.

Medicare Supplement Plan N vs Plan G 2021 Plan D - YouTube.

Medicare Plan N Vs Plan G Which Is Better Freemedsuppquotes

Medicare Plan N Vs Plan G Which Is Better Freemedsuppquotes

Medigap Plan G Vs Plan N Medicare Hero

Medigap Plan G Vs Plan N Medicare Hero

Transamerica Medicare Supplement Plans For Baby Boomers

Transamerica Medicare Supplement Plans For Baby Boomers

Medicare Supplement Plan N Is It Right For You

Medicare Supplement Plan N Is It Right For You

The Best Medicare Supplement Plan F Vs Plan G Vs Plan N Askmedicaremike Com

The Best Medicare Supplement Plan F Vs Plan G Vs Plan N Askmedicaremike Com

Which Is Better Plan F Plan G Plan N Medicare Supplement Youtube

Which Is Better Plan F Plan G Plan N Medicare Supplement Youtube

Medicare Supplement Plan N Medicare Plan N Medigap Plan N

Medicare Supplement Plan N Medicare Plan N Medigap Plan N

Medigap Plan N A Stable Choice

Medigap Plan N A Stable Choice

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Medicare Supplement Plan G Vs Plan N What Is The Difference Gomedigap

Medicare Supplement Plan G Vs Plan N What Is The Difference Gomedigap

Medigap Plan N Medicare Supplement Plan N 65medicare Org

Medigap Plan N Medicare Supplement Plan N 65medicare Org

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide

Medigap Planners Medigap Plan G Or Medigap Plan N Compare Rates And Benefits Medigap Planners

Medigap Planners Medigap Plan G Or Medigap Plan N Compare Rates And Benefits Medigap Planners

Comments

Post a Comment