Featured

Plan F Coverage

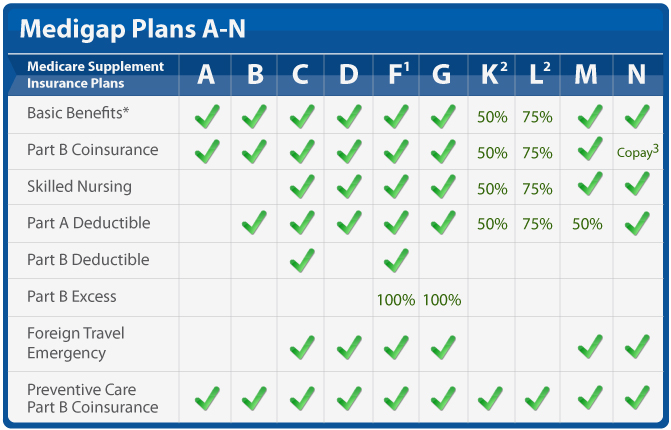

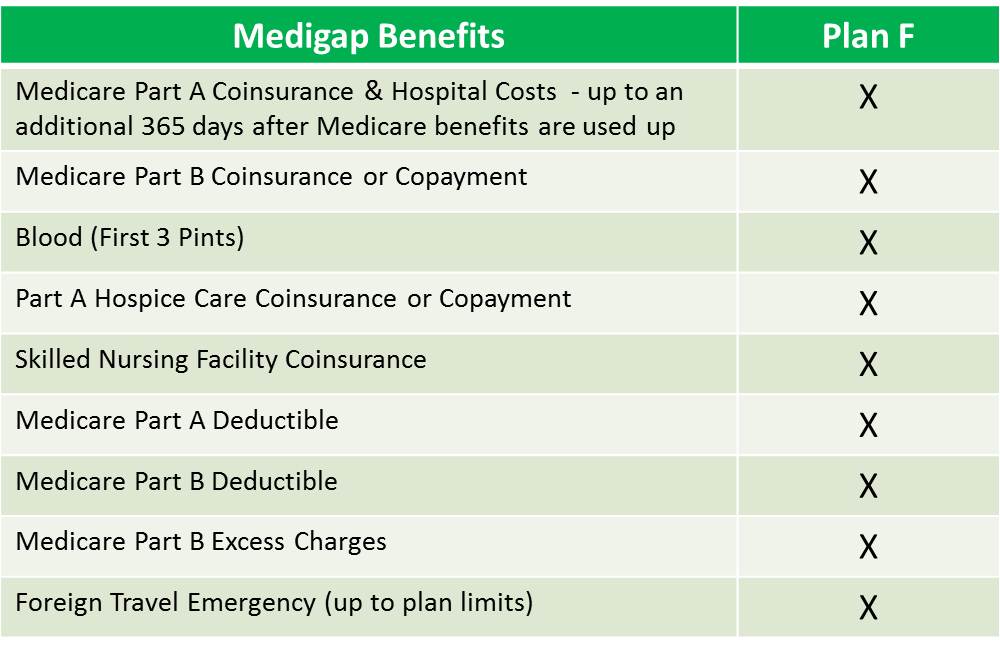

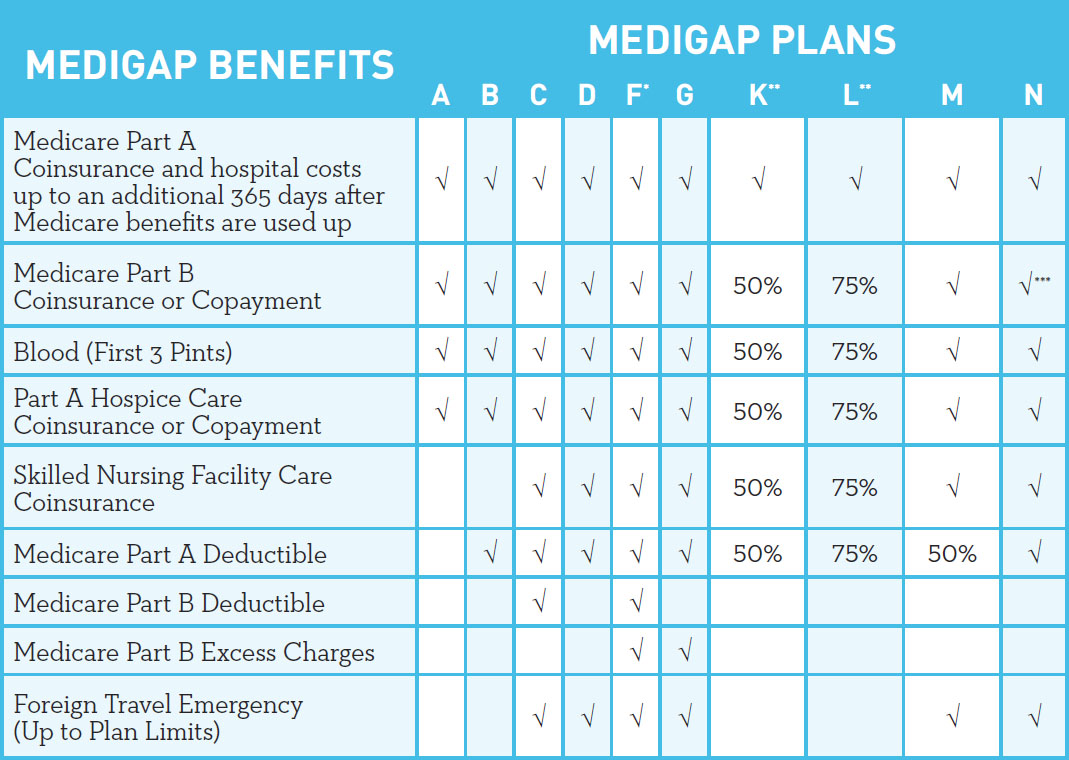

Medigap Plan F leaves enrollees with minimal out-of-pocket expenses by covering the remainder of hospital and doctor costs after Original Medicare Part A and Part B has paid its portion. Review the chart below for all the details of Plan F coverage or explore other Medicare Supplement plans.

Medicare Supplement Plan F Medigap Plan F Freemedsuppquotes

Medicare Supplement Plan F Medigap Plan F Freemedsuppquotes

Plans E H I and J are no longer sold.

Plan f coverage. The difference between what your doctor will charge and what Medicare pays. Benefit Plans A B F G and N are Offered Plan F also has an option called a high deductible Plan F. Like many other Medigap policies Plan F also covers Part B copayments and the deductible.

Medicare Supplement Medigap Plan F Covered Benefits The following is. Supplemental Insurance The Benefit. Plan F is only available if you first became eligible for Medicare before January 1 2020 which means your 65th birthday occurred before January 1 2020.

It covers all of the 20 that Medicare Part B normally leaves for you to pay. Private insurers may offer a high deductible version of Plan F which means that a person must reach. Plan F is still an option if you were eligible for Medicare before that date whether based on age 65 years or older or qualifying disability regardless of age.

Outline of Medicare Supplement Coverage. If you have been shopping for a Medicare Supplement also known as Medigap insurance plan you may already know that Medicare Supplement Plan F may cover a lot of your Medicare Part A and Part B out-of-pocket costs. You will never pay the.

In some states both plans offer a high deductible version. Plan F covers Medicare Part B approved services at the doctors office such as. Plan C is the other.

Medigap Plan F is the most comprehensive Medigap plan covering 100 of your cost-sharing. Plan Fs coverage is similar to that of Plan J including the coverage of the Part B deductible. Medicare covers only within the USA.

All the gaps for Medicare Part A and Part B. Your assets are protected. This means that regardless of where you live or which insurance company you purchase from youll get the exact same basic benefits for a Plan F sold anywhere in your state note that there is also a high-deductible version of Plan F discussed below.

Plan F has two. If you choose Plan F youll essentially only pay your monthly premium and have no out-of-pocket costs for your covered medical expenses. Part A coinsurance and hospital costs for an extra 365 days beyond what Medicare covers Part A hospice care copayment or coinsurance costs.

That means you could see a doctor with little to no money out of your own pocket. Medicare Supplement Plan F may eventually leave the market starting in 2020 but not for everyone. Of the ten Medicare Supplement plans Medicare Supplement Plan F offers the most comprehensive coverage which is why many people prefer it.

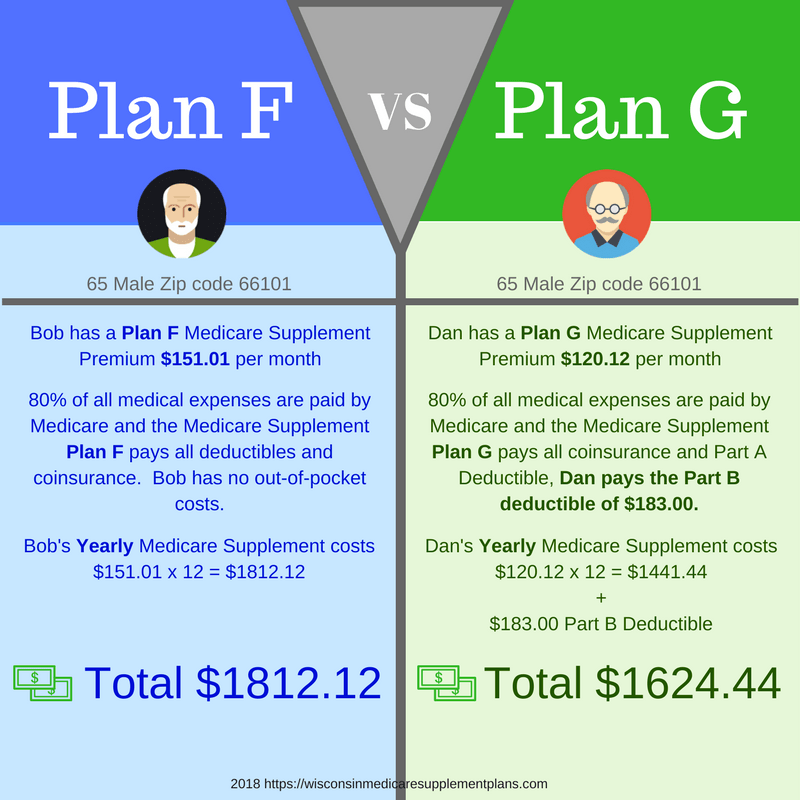

Medicare Part B coinsurance and copayment Medicare approved doctors office fees Part B deductible Medicare Part B excess charges Other Medicare-approved expenses associated with Part B coverage. Medigap plans F and G offer similar coverage. Or you qualified for Medicare due to a disability before January 1 2020.

As mentioned Medicare Supplement Plan F offers the broadest coverage of all of the standardized Medigap plan offerings Plans A-N. In addition Plan F provides coverage for skilled nursing facility care Medicare Part A and B deductibles and international travel medical emergency help. All medical expenses while traveling outside the US up to 50000.

Supplement Plan F is a high-coverage plan which pays for a lot of the out-of-pocket costs typically incurred by Medicare beneficiaries. Medicare Supplement Plan F Coverage is Comprehensive Plan F fully covers both your Part A hospital deductible and your Part B outpatient deductible. A person with such a plan.

Plan F is one of two Medicare Supplement plans that covers Part B excess charges what some doctors charge above what Medicare pays for a service. Plan F basic benefits like other Medigap plans are standardized in most states. Medigap Plan F may cover.

Medicare Plan F covers all Part B excess charges. What benefits are covered under Medicare Supplement Plan F. Benefits from high deductible Plan F will not begin until out-of-pocket expenses exceed 2180.

Plans F and G also offer a high-deductible plan in some states. Dental care vision care including eyeglasses hearing aids long-term care private nursing. With this option you must pay for Medicare-covered costs coinsurance copayments and deductibles up to the deductible amount of 2340 in 2020 2370 in 2021 before your policy pays anything.

Like other Medicare supplement plans Plan F typically doesnt cover. Starting on January 1 2020 Plan F is not available to people newly enrolled in Medicare. However Plan G does not cover the Medicare Part B deductible.

This high deductible plan pays the same benefits as Plan F after one has paid a calendar year 2180 deductible. Plan F is for beneficiaries looking for full coverage for all out-of-pocket costs including. Because the plan also covers costs in excess of Medicare-approved amounts you may have no out-of-pocket costs for hospital and doctors office care with this plan.

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medigap Plan F Medicare Supplement Plan F 65medicare Org

Medigap Plan F Medicare Supplement Plan F 65medicare Org

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medigap Plan F What You Need To Know Ensurem

Medigap Plan F What You Need To Know Ensurem

Medigap Plan F Medicare Supplement Plan F 65medicare Org

Medigap Plan F Medicare Supplement Plan F 65medicare Org

Medicare Supplement Plan F Quote Senior Healthcare Direct

Medicare Supplement Plan F Quote Senior Healthcare Direct

What Does Plan F Cover Medicare Plan F Coverage

What Does Plan F Cover Medicare Plan F Coverage

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Supplement Plan F 7 Essential Facts You Must Know Clear Medicare Solutions

Medicare Supplement Plan F Wisconsin Medicare Plans

Medicare Supplement Plan F Wisconsin Medicare Plans

Comparing Medicare Supplement Plan F G Medicarehaven Com

Comparing Medicare Supplement Plan F G Medicarehaven Com

Medigap Plan F The Most Common And Comprehensive Plan

Comments

Post a Comment