Featured

Different Insurance Options

If youre looking for Affordable Care Act ACA plans in New York or Massachusetts visit Healthcaregov or call 1-844-joinUHC to learn about plans available near you. A managed care plan where services are covered only if you use doctors.

Understanding The Different Types Of Health Insurance Plans Alliance Health

Understanding The Different Types Of Health Insurance Plans Alliance Health

Due to the growth of population between 2010-2020 it was nearly increased to one billion people.

Different insurance options. 7 Different Insurance Career Options Insurer American National Group Exploring Options Including Possible Sale -Reuters Aon Willis Towers Watson to Sell WTW Assets to Gallagher for 357 Billion. For example According to consulting firm EY labor demographics are about to drastically shift. Where boomers favored face-to-face interaction millennials want a different experience.

Variable Universal Life Insurance. Find affordable reliable coverage options in your area at UnitedHealthcare Exchange plans or call 1-800-806-0451 TTY 711. How Demographics Impact Healthcare Delivery.

Final Expense Life Insurance. Technology will change how talent acquisition takes place and it will even alter commercial lines and how insurance is purchased. You have choices when you shop forhealth insurance.

Above all else established members of the insurance industry should position themselves as mentors. A type of health insurance plan that usually limits coverage to care from doctors. Exclusive Provider Organization EPO.

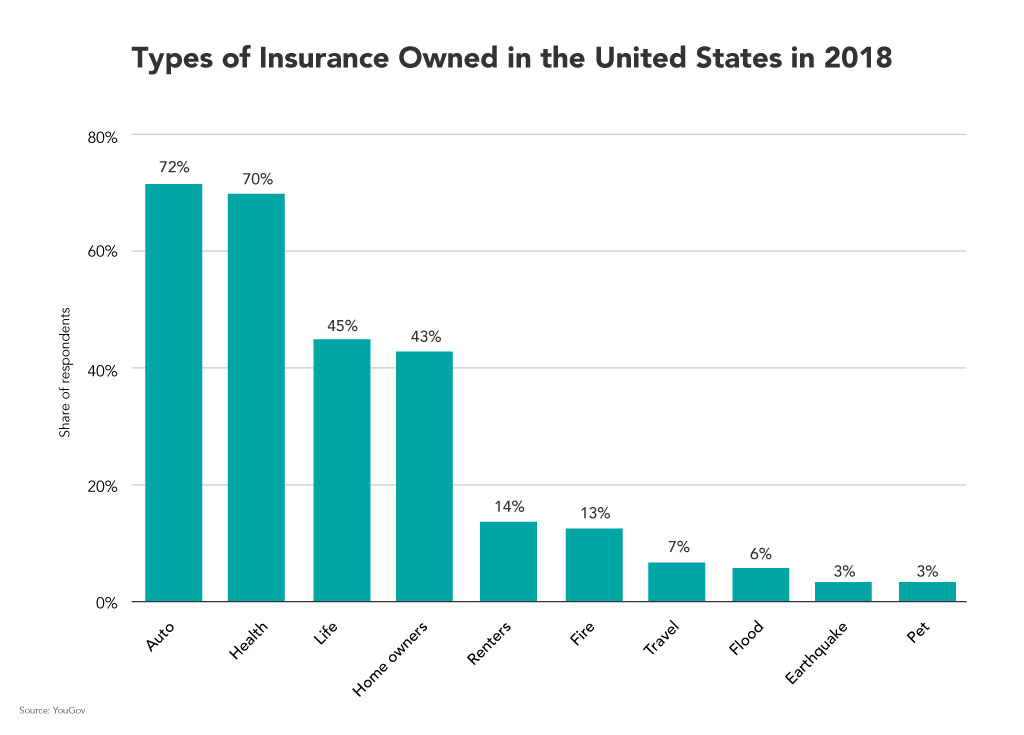

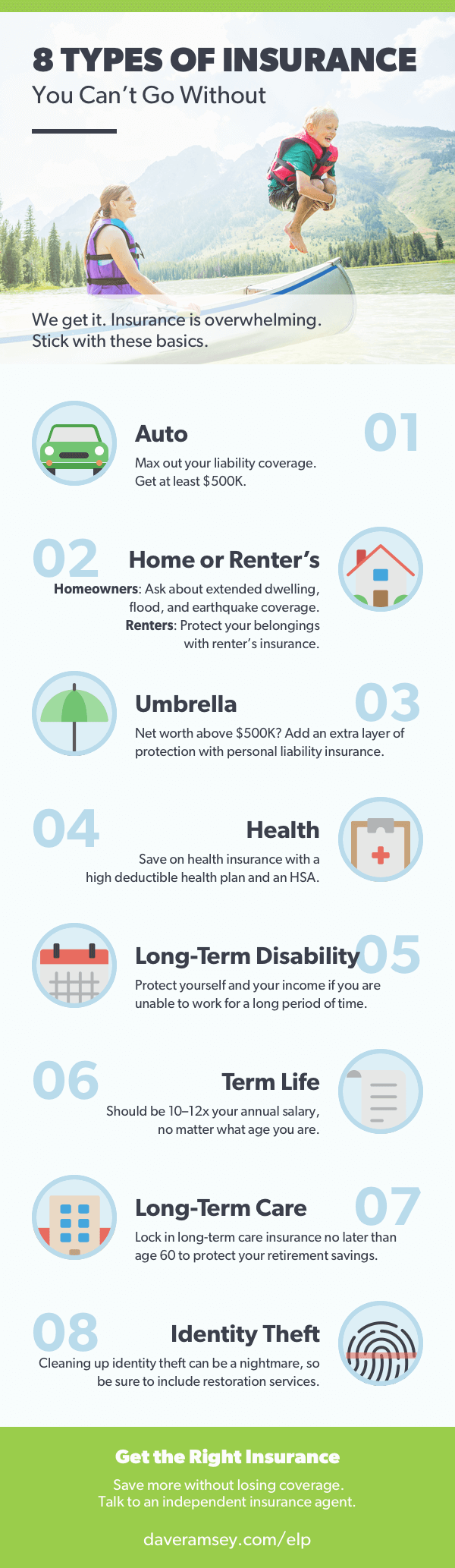

Most experts agree that life health long-term disability and auto insurance are the four types of insurance you must have. Permanent life insurance differs in that it lasts your entire lifetime. Health-care system and the people in its care.

Changes in population size age race and ethnicity affect the health-care resources needed the cost of care. As our country gets bigger older and more diverse the ever-evolving composition of the population will have profound effects on the US. 11 Different Types of Life Insurance Policies Available Today Include.

Let us help you get covered. There are two primary categories of life insurance. While the population grows there will always be changes in the healthcare industry.

If youre buying from your statesMarketplaceor from an insurance broker youll choose fromhealth plansorganized by the level of benefits. Health Maintenance Organization HMO. Always check with your employer first for available coverage.

While the basic liability collision and comprehensive insurance options remain the same across a spectrum of cars insurance companies offer coverage options that greatly vary in price and conditions based on the type of vehicle you own among a myriad of other factors. No Medical Exam Life Insurance. 6 rows Government-sponsored health insurance coverage Medicare Medicaid etc Other types of health.

6 rows You may be familiar with term and whole life insurance but there are several other options. Some examples of plan types youll find in the Marketplace. How do different insurance options impact different demographics.

Term life insurance has a set timeframe usually 10 to 30 years making it a more affordable option. Key Man Life Insurance.

What Is Term Life Insurance Ramseysolutions Com

What Is Term Life Insurance Ramseysolutions Com

Different Types Of Health Insurance Plans

Different Types Of Health Insurance Plans

Types Of Health Insurance Plans Health Insurance Plans Compare Health Insurance Types Of Health Insurance

Types Of Health Insurance Plans Health Insurance Plans Compare Health Insurance Types Of Health Insurance

5 Different Types Of Insurance Policies Coverage You Need Mint

5 Different Types Of Insurance Policies Coverage You Need Mint

Using Health Insurance Agent When Getting New Health Plans

Using Health Insurance Agent When Getting New Health Plans

8 Types Of Insurance You Can T Go Without Ramseysolutions Com

8 Types Of Insurance You Can T Go Without Ramseysolutions Com

Different Types Of Health Insurance Plans

Different Types Of Health Insurance Plans

Individual Health Insurance Plans Quotes California Hfc

Individual Health Insurance Plans Quotes California Hfc

Individual Health Plans Vs Medicare

Individual Health Plans Vs Medicare

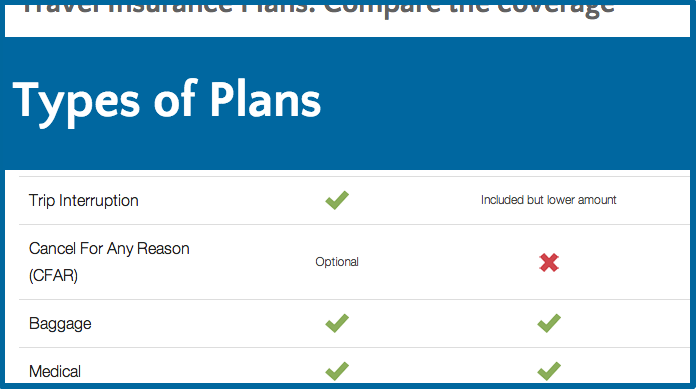

Types Of Travel Insurance Plans Explained Travel Insurance Review

Types Of Travel Insurance Plans Explained Travel Insurance Review

5 Different Types Of Insurance Policies Coverage You Need Mint

5 Different Types Of Insurance Policies Coverage You Need Mint

How To Choose Your Own Health Insurance Plan

How To Choose Your Own Health Insurance Plan

A Comparison Of Health Insurance Options For Different Age Bracketsaegon Life Blog Read All About Insurance Investing

A Comparison Of Health Insurance Options For Different Age Bracketsaegon Life Blog Read All About Insurance Investing

Comments

Post a Comment