Featured

Irs Fax Number For 8962

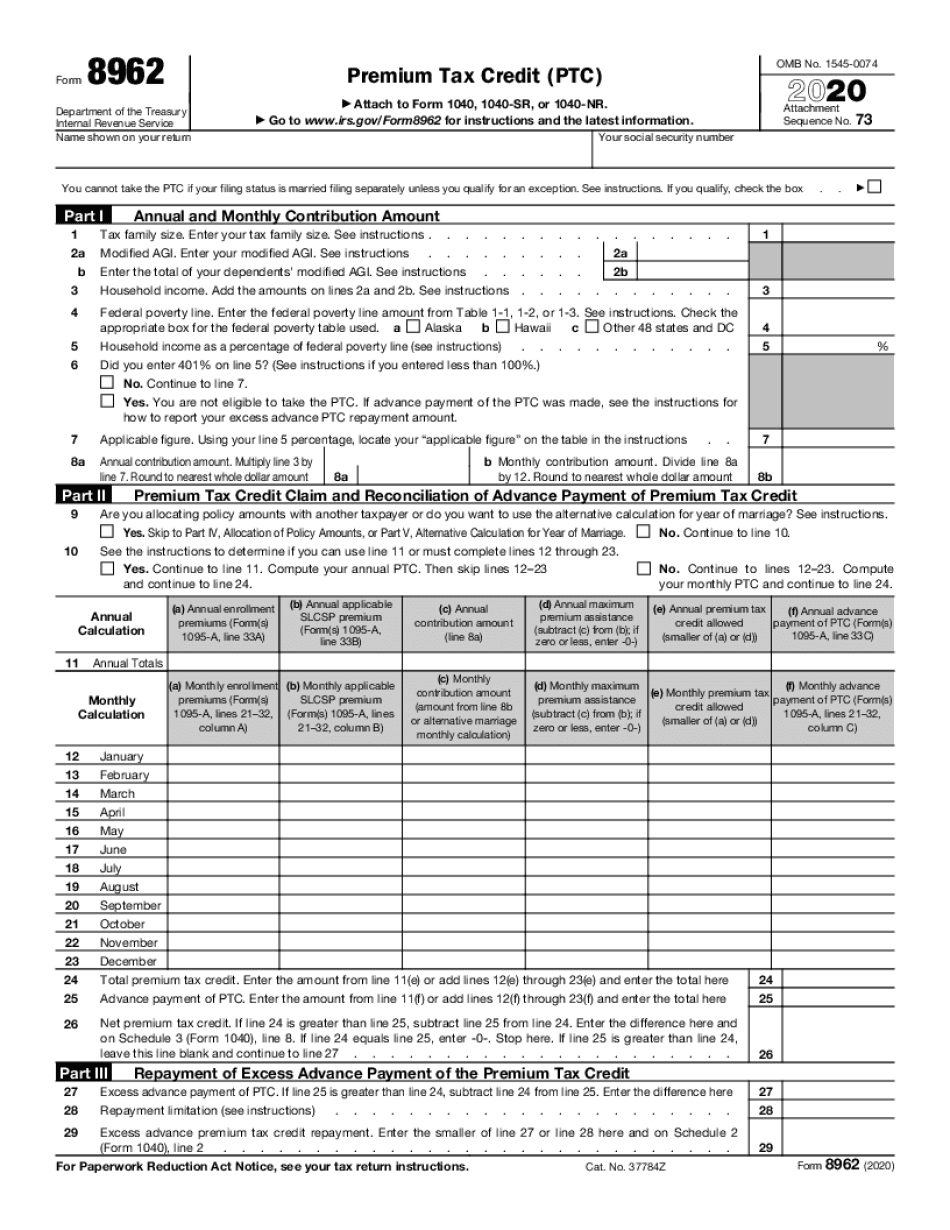

Organizing your documents and carefully going through the forms ensures you receive the returns you need and deserve. Usually they also would like us to fill out Form 8962 along with the submission of Form 1095-A.

8962 Form 1040 Premium Tax Credit Subsidy 12 C Letter Late Notice

8962 Form 1040 Premium Tax Credit Subsidy 12 C Letter Late Notice

Ensure that the details you fill in Irs Fax Number For 8962 is updated and accurate.

Irs fax number for 8962. When you fax fax with the letter you received and whatever the documents the IRS requested in the notice. For the latest updates on coronavirus tax relief related to this page check IRSgovcoronavirus. 17 Send the following to the IRS address or FAX number given in your IRS letter.

All my clients have had the fax 855-309-9361 associated with their letter so that is. You cannot email or fax form 8962 About Form 8962 Internal Revenue Service to the IRS. You can file Form 1040 including Form 8962 electronically but the IRS will NOT accept the form emailed or faxed.

Tips on how to complete the Irs fax number for form 8962 form on the web. What is the fax number to IRS to send form 8962 and 1095-A form. It must be attached to Form 1040 even if you are not otherwise required to file Form 1040 except to report the information on Form 8962.

Finally select Preview Print Copy and then print the form. 10 In the Form Selection window select Specific Forms and then check the box for Form 8962. Fill out every fillable area.

Form 8962 Premium Tax Credit A copy of your Form 1095-A Health Insurance Marketplace Statement. If the IRS will accept your submission via Fax. A newly computed page 2 of your tax return with your original signatures showing the transferred amount from Form 8962 if applicable.

Instructions for Form 8962 Premium Tax Credit PTC 2015 Form 8962. The IRS fax number for 8962 form is 1-855-204-5020. Premium Tax Credit 2016 Inst 8962.

After I print the 8962 I fax it with the 1095A and Page 2 3 of the IRS letter the one that has the blanks for Taxpayer name number number of pages etc I use that as the Fax Cover page. While the fax number is available only on the letter sent to you by the IRS you may not be able to get the document to go through. That inquiry will have a direct contact faxaddress for the area assigned your return to work on specifically and will speed up processing significantly.

A completed Form 8962. To begin the document utilize the Fill Sign Online button or tick the preview image of the document. Instructions for Form 8962 Premium Tax Credit PTC 2016 Form 8962.

A copy of your Form 1095-A. Add the date to the record with the Date tool. The IRS is not processing manually submitted forms at this time.

Enter your official identification and. 11 Send the following to the IRS address or FAX number given in your IRS letter. What is the fax number to send form 8962 Since you have already filed your tax return you may wish to wait for an inquiry regarding those forms.

1-855-309-9361 is the fax number on the IRS letters requesting form 8962 and 1095-A to be sent to. Filling out Form 8962 and finding an example of Form 8962 filled out can feel stressful. Verify with the notice you received.

Reconcile it with any advance payments of the premium tax credit APTC. Turn on the Wizard mode in the top toolbar to have extra pieces of advice. Figure the amount of your premium tax credit PTC.

The IRS mailing address or fax number will appear on the letter 12C. You need to get it from your 12c letter or by calling the IRS. The chart below is provided for your reference.

The fax number should be on the upper right hand side corner. Fax IRS form 8962 Upload your IRS form to WiseFax and select pages that you wish to fax Select United States as recipients country and enter IRS fax number Sign in and make a one time purchase of fax tokens if required Click the Send button to confirm your fax. The advanced tools of the editor will direct you through the editable PDF template.

Form 8962 Premium Tax Credit A copy of your Form 1095-A Health Insurance Marketplace Statement A copy of the IRS letter that you received. What to send to the IRS. Use Form 8962 to.

Were reviewing the tax provisions of the American Rescue Plan Act of 2021 signed into law on March 11 2021. Premium Tax Credit 2015 Inst 8962. You have to send your 8962 1095-A to a specific department - its not something you want to crowd source.

Where to send requested forms. Instructions for Form 8962 Premium Tax Credit PTC 2017 Form 8962.

How To Fill Out Irs Form 8962 Correctly

How To Fill Out Irs Form 8962 Correctly

How To Send Irs Form By Fax Fax Plus Help Center

How To Send Irs Form By Fax Fax Plus Help Center

Irs Fax Number For 8962 Fill Out And Sign Printable Pdf Template Signnow

Irs Fax Number For 8962 Fill Out And Sign Printable Pdf Template Signnow

Premium Tax Credit Form 8962 And Instructions

Premium Tax Credit Form 8962 And Instructions

Aca Affordable Care Act Information Vita Resources For Volunteers

Aca Affordable Care Act Information Vita Resources For Volunteers

Irs Fax Number For 8962 Fill Online Printable Fillable Blank Pdffiller

Irs Fax Number For 8962 Fill Online Printable Fillable Blank Pdffiller

Irs Form 8962 Instructions Fill Online Printable Fillable Blank Form 8962 Printable Com

Irs Form 8962 Instructions Fill Online Printable Fillable Blank Form 8962 Printable Com

How To Fill Out Irs Form 8962 Accounts Confidant

How To Fill Out Irs Form 8962 Accounts Confidant

Beautiful Form 8962 Fax Number Models Form Ideas

Beautiful Form 8962 Fax Number Models Form Ideas

What Individuals Need To Know About The Affordable Care Act For 2016

Http Www Healthreformbeyondthebasics Org Wp Content Uploads 2016 03 Premium Tax Credit Tips And Tricks Pdf

Aca Affordable Care Act Information Vita Resources For Volunteers

Aca Affordable Care Act Information Vita Resources For Volunteers

Aca Affordable Care Act Information Vita Resources For Volunteers

Aca Affordable Care Act Information Vita Resources For Volunteers

Form 8962 Fax Number Lovely Student Information Worksheet Irs Best Free Word Searches Models Form Ideas

Form 8962 Fax Number Lovely Student Information Worksheet Irs Best Free Word Searches Models Form Ideas

Comments

Post a Comment