Featured

- Get link

- X

- Other Apps

Epo Plan Vs Ppo

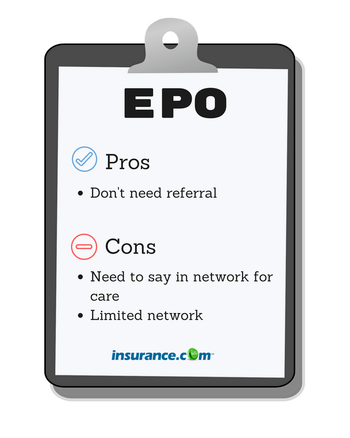

Plans that dont require a PCP including most EPOs and PPO plans use preauthorization as a mechanism to reach the same goal. You can also see specialists without a referral.

Epo Vs Ppo Difference And Comparison Diffen

Epo Vs Ppo Difference And Comparison Diffen

Similar to an EPO a PPO network is made up of those doctors and facilities that have negotiated lower rates on the services they perform.

Epo plan vs ppo. Costs are kept low because providers charge a fee that has been negotiated with your EPO plan ahead of time. PPO but it could be more helpful to talk about it in terms of HSA vs. PPOs preferred provider organizations are usually more expensive.

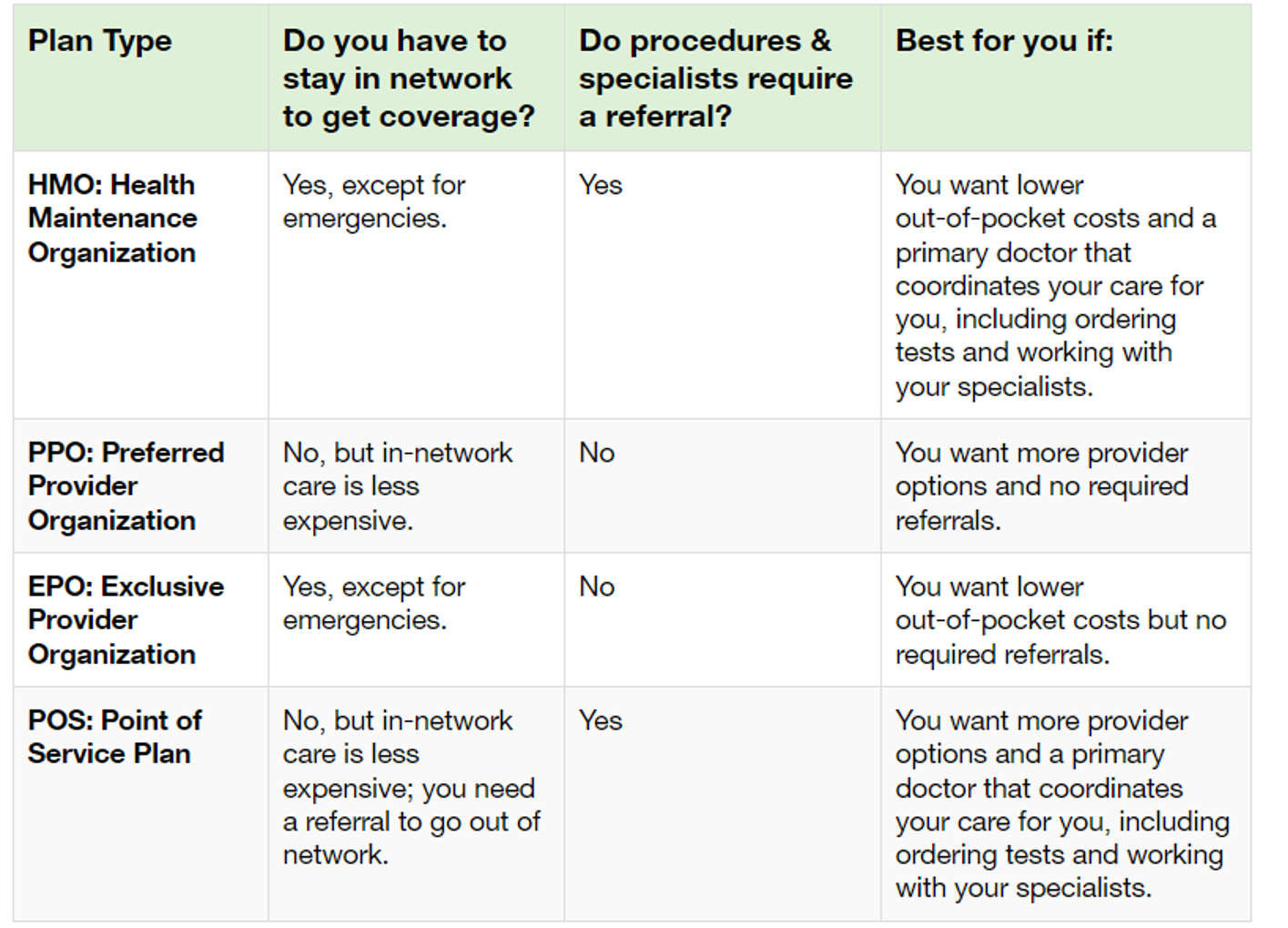

The more a plan pays for out-of-network care the higher your monthly payments will be. EPO plans are similar to HMO plans in that members are required to visit a provider within the plans network. EPO stands for exclusive provider organization and doesnt cover any out-of-network care.

An EPO or exclusive provider organization is a bit like a hybrid of an HMO and a PPO. 2017 Important Change - Anthem Blue Cross changing PPO to EPO. Let us see the two plans closely.

Selecting the Right Plan for Your Needs Anna Helhoski NerdWallet December 17 2014. The one exception is emergencies which are often covered even if they are out of your network. PPOs cover care provided both inside and outside the plans provider network.

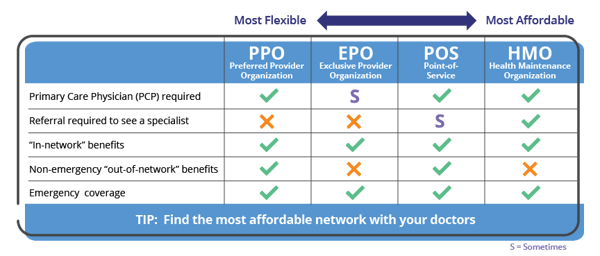

PPO or Preferred Provider Organization health plans are generally more flexible than EPO Exclusive Provider Organization plans and have higher premiums. A POS plan is another hybrid between an HMO plan and a PPO plan. EPO and PPO are essentially two different types of healthcare insurances.

What Is an HMO. This comparison explains how. In-network versus out-of-network care.

EPOS exclusive provider organizations combine features. Many Anthem PPO members have received notification that their PPO plan is turning into an EPO. EPO plans are similar to PPO plans in that members do not have to see their PCP to see a specialist.

The main difference between the plans isnt the network syle though. The question of which plan to choose is often framed as HDHP vs. You will pay the full cost of items such as prescription drugs and office visits until the plans deductible amount is met.

However if you choose to get care out of your plans network your medical care may not be covered. Like a PPO you do not need a referral to get care from a specialist. After all people dont go for an HDHP because of their undying love for high deductibles.

EPO - you can not see out of network providers and do not need a referral to see a specialist. Plans differ as to what types of services must be preauthorized but almost universally require that non-emergency hospital admissions and surgeries be pre-authorized. Because the lower premiums could result in lower annual medical costs out of pocket.

Whats The Difference Between EPO and PPO Networks. POS stands for Point of Service. 5 For some however an HMO health maintenance organization or PPO preferred provider organization might be a better fit.

EPOs generally offer a little more flexibility than an HMO and are generally a bit less pricey than a PPO. NerdWallet December 17 2014 restricted to what the insurance company is willing to pay them says Stacey Weinstein a full-service independent insurance broker with KGK Agency. A Blue Dental EPO plan only covers services from in-network PPO dentists.

They do it for two main reasons. EPO health plans are often more affordable than PPO plans if you choose a doctor or specialist in your local network. For most services youll have to meet a higher deductible before the HSA Plan pays its share of the cost of services than you would in the EPO or PPO Plans.

The health plan only pays for care thats medically necessary. PPO health plans have access to those negotiated rates. EPO stands for Exclusive provider organizations while PPOs are Preferred provider organizations.

Difference between EPO and PPO Both EPO and PPO have different features and it is necessary to keep in mind various factors such as cost options as well as your own needs before finally choosing a plan. In exchange you will likely get a larger network and the ability to see a provider outside that network. PPO - you can see providers in or out of network and do not need a referral to see a specialist.

EPOs only cover care provided by the provider network. This is especially important since the network size is already an issue. You must identify your own needs before going with a plan.

A health plans network is the set of healthcare providers eg hospitals doctors and specialists with whom the insurance company has contractual agreements in any given plan. This reduces costs so your monthly payments will be lower.

Looking For Ppo Health Plans In Texas For 2018 Good Luck

Looking For Ppo Health Plans In Texas For 2018 Good Luck

What S The Difference Between Hmo Ppo Pos And Epo Insurance Justworks

What S The Difference Between Hmo Ppo Pos And Epo Insurance Justworks

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Ppo Epo Hmo Which Is The Best Safe Policies Insurance

Ppo Epo Hmo Which Is The Best Safe Policies Insurance

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

Individual And Family Health Plans Wilson Consulting Group

Individual And Family Health Plans Wilson Consulting Group

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Epo Health Insurance Plan What You Need To Know My Calchoice

Epo Health Insurance Plan What You Need To Know My Calchoice

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between An Hmo Vs Ppo Xcelhr

Hmo Vs Ppo Which Plan Is Best For You

Hmo Vs Ppo Which Plan Is Best For You

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

Hmo Ppo Or Epo I Just Don T Know

Hmo Ppo Or Epo I Just Don T Know

Comments

Post a Comment