Featured

- Get link

- X

- Other Apps

Health Insurance For Chronic Conditions

High deductible health care plans often have lower monthly premium costs. Dont forget to check that the insurance company has your doctor in their network and covers the.

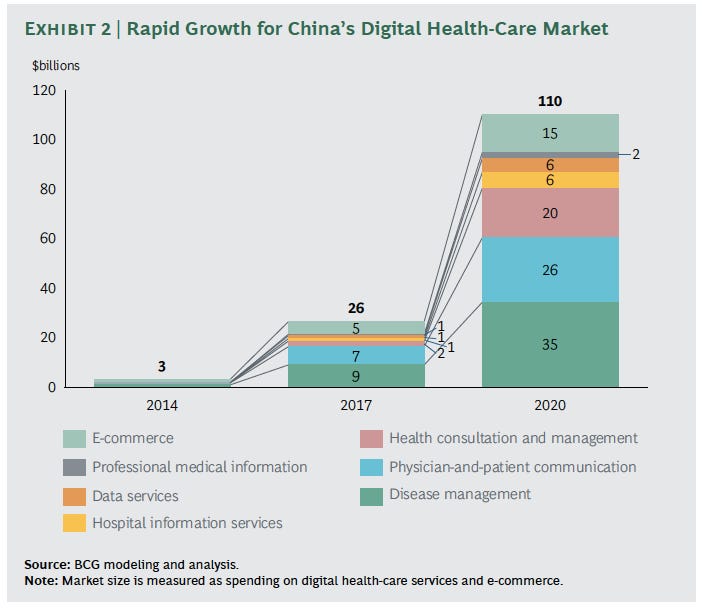

Insurers Are Bleeding 2 4 Trillion In Claims Or Why Insurers Need Digital Health By Jonah Cacioppe Ramblings Medium

Insurers Are Bleeding 2 4 Trillion In Claims Or Why Insurers Need Digital Health By Jonah Cacioppe Ramblings Medium

It mainly focuses on paying off for the treatment that comes under acute medical conditions and includes curable diseases and illnesses.

Health insurance for chronic conditions. Under the Affordable Care Act all health plans sold on the Health Insurance Marketplace on the Individual market or through employers have a list of essential benefits including chronic condition management they must cover. Just wondering if anyone has any recommendations for private health insurance in the UK that will cover chronic conditions. Bronze Plan for Chronic Conditions You may be wondering if a bronze plan will provide adequate coverage for managing your chronic condition.

How can Health Insurance Help Pay For Treatment Costs of My Chronic Condition. It is vital to note that all insurance companies have their own definition of pre-existing and chronic conditions and the clients need to be prudent when reviewing the documentationFor example some insurance covers short-term treatment for unexpected acute aggravations of the chronic disease necessary to stabilize the condition if no other limits exclusions or policy conditions. Health Insurance and Chronic Conditions.

Chronic Cover helps your employees live with a wide range of long-term conditions such as diabetes heart problems or muscle bone and joint issues with fewer worries. Private medical insurance - chronic conditions. Are given coverage under this type of health insurance.

However in the event that you do develop a chronic medical condition you need to know that your policy will be able to provide you with the protection you need. Common ways in which a global health insurance policy will provide coverage for a Chronic Medical Condition include. Coverage of Acute Phases Only.

Chronic conditions need ongoing and regular treatment to help you manage them rather than short term treatment to cure them. Private medical insurance can be a great way to give yourself peace of mind in the event that you find yourself needing medical attention and you dont want to receive your treatment on the NHS. These conditions include asthma heart disease diabetes and more.

The main reason that people choose to sign up to a health insurance policy is the fact that by receiving your treatment. For people who are in good health this is usually the most affordable type of life insurance policy. These include Exclusion Moratorium Coverage with Loading or Medical History Disregarded.

Essential care coverage from insurance providers covers any trips to the doctor. For people with manageable chronic health conditions this can be a very affordable option. As mentioned above a Chronic Condition is a condition which currently.

However if you have a chronic health condition and you have a high deductible you will have to pay your health care expenses out of pocket until you reach your deductible and your insurance takes over. If you have a chronic condition plans with affordable copays andor lower deductibles can help you save money in the long run. With fast access to out-patient consultations diagnostics and therapies plus wellbeing support through their mental health benefits it can enable them to manage their condition with more confidence.

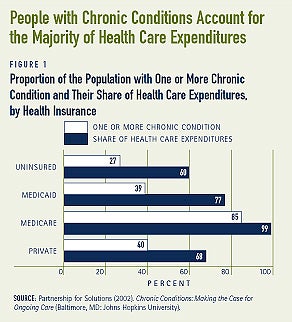

When it comes to offering coverage for chronic conditions you need to understand the point of view of insurance companies as they take various risk factors into consideration while providing the coverage for the same. One essential benefit is management for a chronic condition such as asthma or diabetes. Chronic conditions are those which can be managed but have no known cure and will persist over time.

Many expatriate medical insurance plans will cover chronic conditions. There are a number of ways which insurance providers may deal with a pre-existing chronic condition. Term insurance policies are for a specific time period typically between 10 and 30 years.

Premium - 330 monthly Deductible - 6750 Out-of-Pocket Max - 7500. Covering chronic conditions Many policies exclude chronic conditions but some let you pay extra to cover them. Diabetes asthma or heart disease.

Most plans will help pay for. Most plans will help pay for. Health insurance or Private Medical Insurance is a term used for an insurance coverage that covers medical and surgical expenses of a person and saves them from any financial risk.

Getting routine lab tests can be a necessity for monitoring some chronic conditions. Acute conditions are short term occurrences where symptoms of the chronic ailment are displayed. What Qualifies as Chronic Condition According to the Health Insurance Companies.

If your health care plan has a high deductible. Examples of chronic conditions include. Insurance plans cover an.

In this regard life-threatening conditions like heart disease cancer kidney failure etc. Lets look at an example and assume the following for the bronze plan. The most common way for a pre-existing condition to be handled under an international health insurance plan is to exclude the treatment of that condition and all related.

![]() Health Insurance Basics For People With Chronic Conditions Amber Specialty Pharmacy

Health Insurance Basics For People With Chronic Conditions Amber Specialty Pharmacy

Infographic Most Common Health Insurance Exclusions

Infographic Most Common Health Insurance Exclusions

Health Insurance For Chronic Diseases Medlife Blog Health And Wellness Tips

Health Insurance For Chronic Diseases Medlife Blog Health And Wellness Tips

Chronic Disease And The Rise Of Health Coach Jobs

Chronic Disease And The Rise Of Health Coach Jobs

Disease Management Programs Improving Health While Reducing Costs Health Policy Institute Georgetown University

Disease Management Programs Improving Health While Reducing Costs Health Policy Institute Georgetown University

How To Choose Health Insurance For Chronic Conditions Alliance Health

How To Choose Health Insurance For Chronic Conditions Alliance Health

5 Health Insurance Facts To Know If You Have A Chronic Disease

5 Health Insurance Facts To Know If You Have A Chronic Disease

Veta Health Blog Chronic Conditions Increase Healthcare Spending

Top 10 Most Expensive Chronic Diseases For Healthcare Payers

Top 10 Most Expensive Chronic Diseases For Healthcare Payers

Choosing A Health Insurance Plan For Chronic Conditions Thinkhealth

Choosing A Health Insurance Plan For Chronic Conditions Thinkhealth

High Deductible Health Insurance And Chronic Disease New Rule Aims To Lower Treatment Costs Ehealth

High Deductible Health Insurance And Chronic Disease New Rule Aims To Lower Treatment Costs Ehealth

Does Health Insurance Cover Chronic Conditions

Does Health Insurance Cover Chronic Conditions

High Deductible Health Insurance And Chronic Disease New Rule Aims To Lower Treatment Costs Ehealth

High Deductible Health Insurance And Chronic Disease New Rule Aims To Lower Treatment Costs Ehealth

Comments

Post a Comment