Featured

- Get link

- X

- Other Apps

Medicare Supplement Insurance Plan F Rates

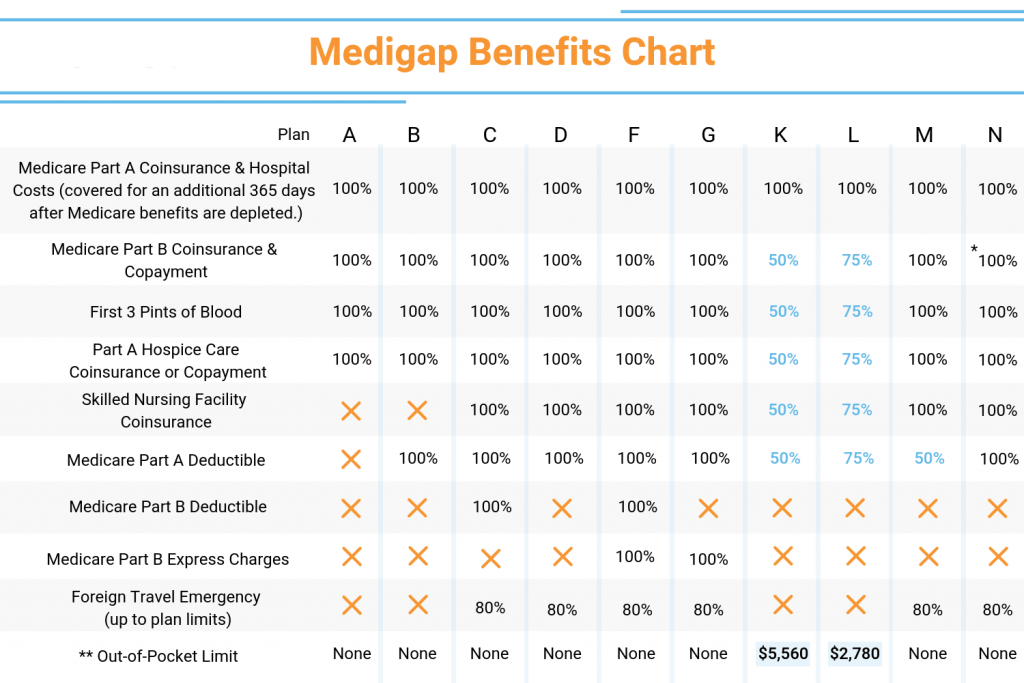

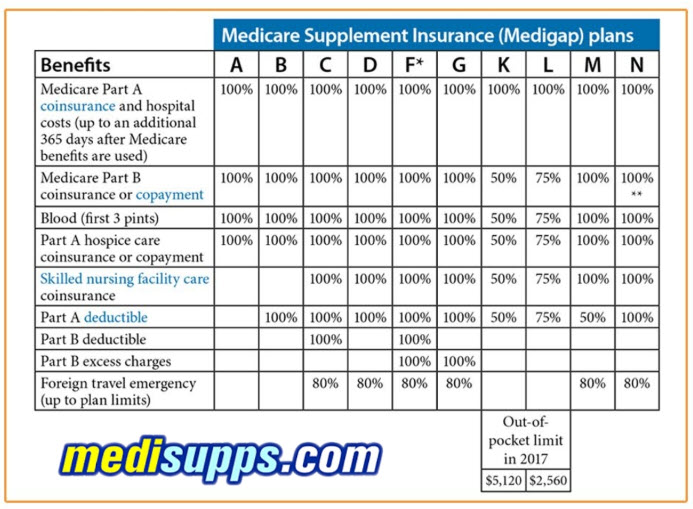

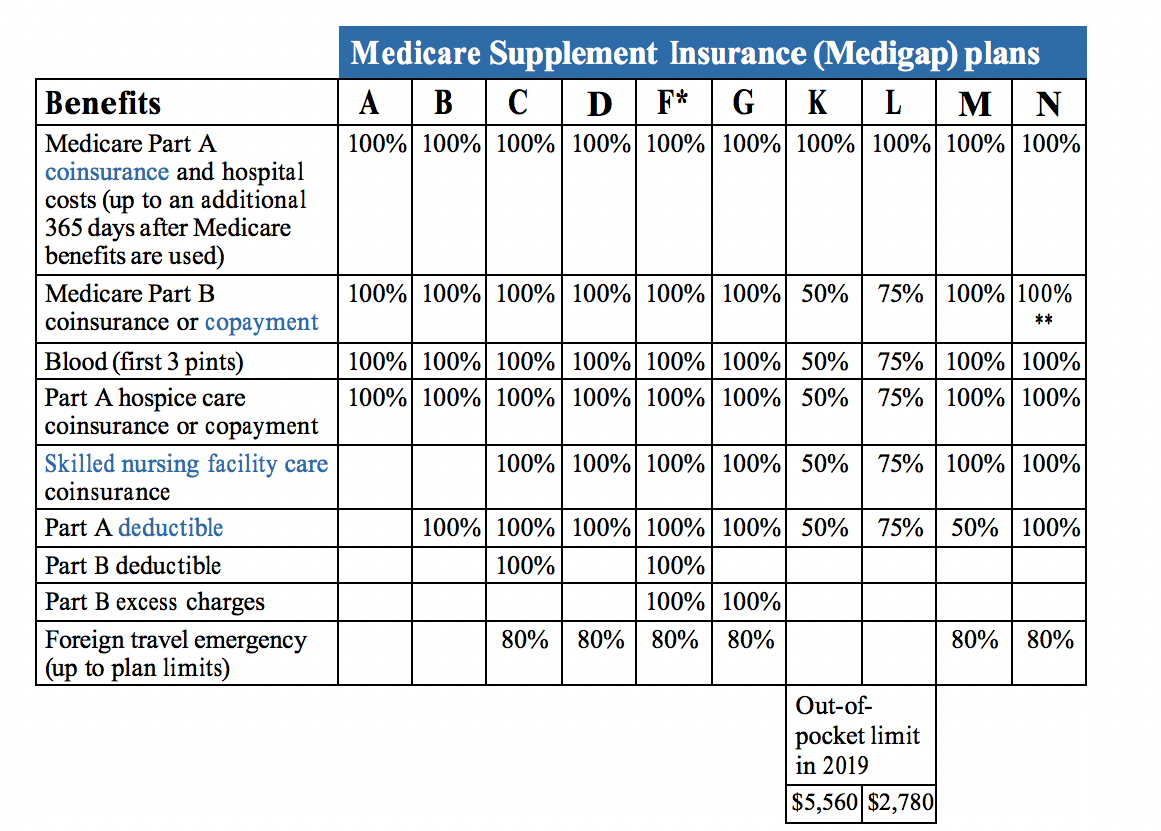

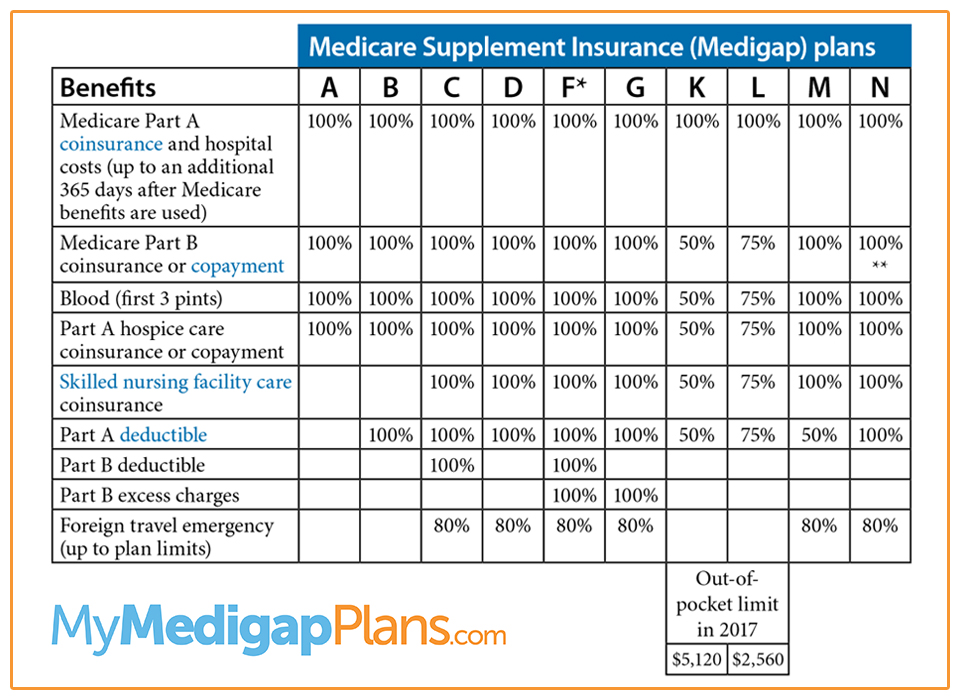

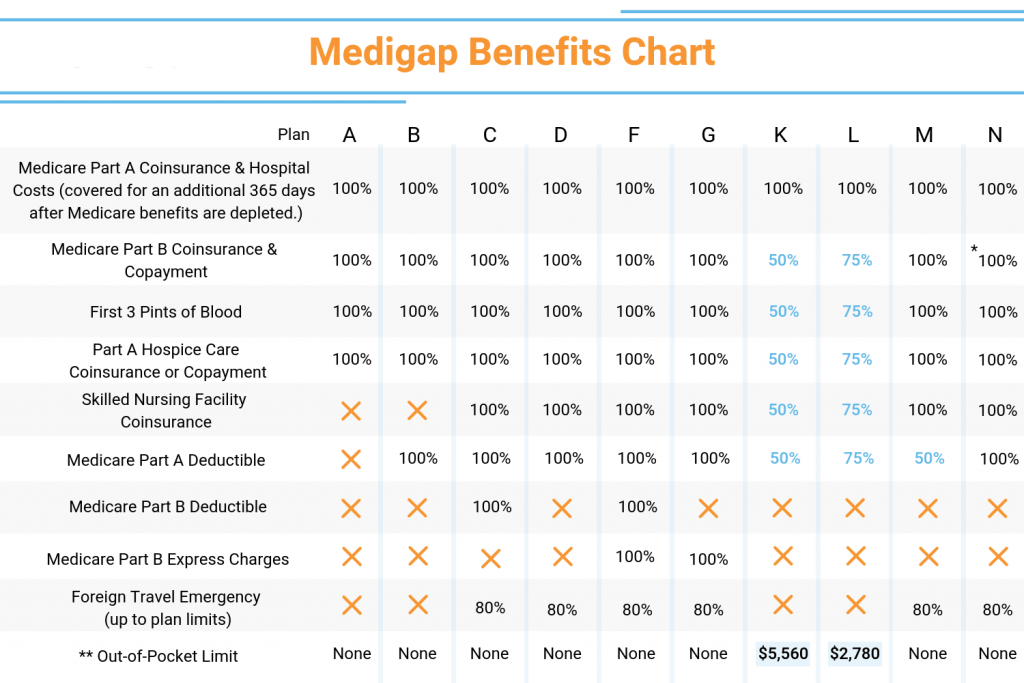

Your options if Medicare Supplement Plan F rates increase beyond your budget. So for example every Medicare Supplement Plan F sold in your state has the same basic benefits no matter where you buy it.

Medicare Supplemental Insurance True Cost Of Healthcare

Medicare Supplemental Insurance True Cost Of Healthcare

Medicare Supplement insurance plan F 2020.

Medicare supplement insurance plan f rates. With Plan F you need to pay just 20 of the healthcare expenses when out of the country. 12 Zeilen The average premium for Medicare Supplement Insurance Plan F in 2018 was 16914 per. With Plan F one will be covered with all supplemental expenses.

This chart lists covered benefits. The Difference Between Plan F Extra and Medicare Advantage Ancillary Benefits. It is just the list of benefits gained from Plan G and then Medicare Part B added onto it.

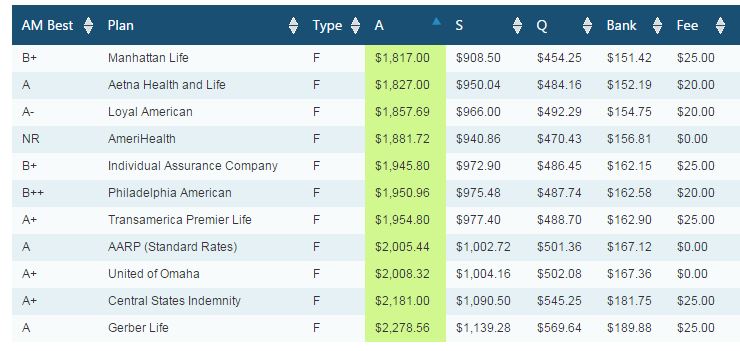

The average cost of Innovative Plan F is around 130-230 per month. Regular Plan F will offer higher monthly premiums but will begin to pay toward out-of-pocket costs right away. Those with high medical expenses can really benefit from comprehensive.

Medical underwriting could affect your Medigap plan rates. Doing a comparison of Aetna Medicare Supplement Plan F rates will help you find the most affordable rates. Beginning January 1 2020 Medigap plans that cover the Part B deductible arent available to newly eligible beneficiaries.

Youll both need to sign up for Aetna Medicare Supplement Plan G Plan F or your preferred plan to enjoy benefits. Get Quotes in Minutes from Mutual of Omaha Cigna Aetna BCBS AARP United Healthcare and more. There are 10 plan types available including Medicare Supplement Plan F.

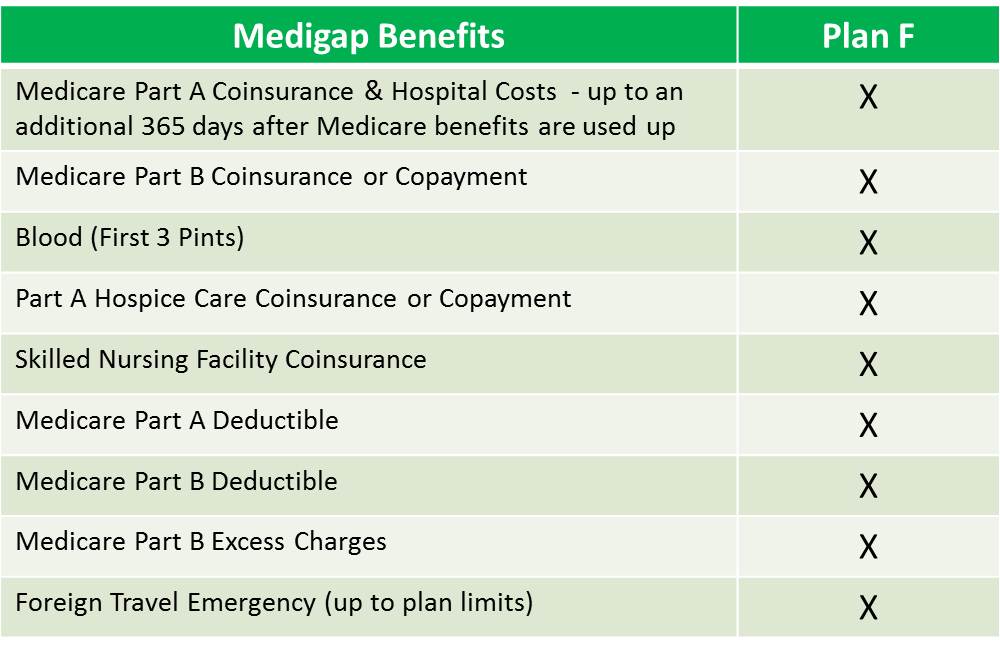

With HD Plan F your benefits will not begin until a predetermined deductible has been reached. 12 Zeilen Plans F and G also offer a high-deductible plan in some states. The benefits marked as Yes are 100 covered by Medicare Supplement Plan F.

The best time to enroll is during your Medicare Supplement. The Monthly Premiums for May 1 2021 are contained in the body of the Table. Plan F options have always been the most expensive Medigap plan with the most coverage.

PLAN G HIGH DEDUCTIBLE ALBANY BUFFALO LONG ISLAND. Medicare Supplement Insurance Rate Plan G. It should be noted that Original Medicare does not offer coverage for these costs.

Learn more about how Medicare Supplement Insurance rates are determined and request free online policy quotes so that you can find the right Medigap plan. Medicare Supplement Insurance plans also called Medigap are sold by private insurance companies so their rates will vary based on your location the type of plan you buy and several other factors. Each plan is standardized across each letter type.

It facilitates enrollees by paying certain out-of-pocket expenses that are not covered under their original policy. High Deductible Plan F Medicare Supplement Insurance. High Deductible Plan F is popular as the premiums are usually very low when compared to most other supplements sold today.

Medicare Supplement Plan F covers a wide range of Medicare costs. New Medicare beneficiaries will not be able to enroll in a Plan C or a Plan F. View the Lowest Rates for Medicare Supplement Plan f in 2019 Easily Online.

The following Table Plan G shows the Regions across the Top Row the first three digits of the Zip Code across the Second Row and the insurers names down the first Column. Therefore Plan F is a full-coverage plan though some people would not prefer to enroll for Part B. Plan F is unique in that it is the only Medicare supplement sold today that offers a variation with a deductible.

As the risk pool ages it stands to reason that claims will increase causing Plan F premiums to increase. Medicare Supplement Plan F covers up to 80 of the health care expenses incurred abroad. Company also offers Plans A F HDF K and N with dental and vision benefits for an additional monthly cost of 1325.

The rates on this chart are monthly electronic funds transfer EFT rates in most cases. For Supplements they offer Plan A Plan F High Deductible Plan F Plan G Plan N in most states. Like with the federal Medicare program you will not be covered by your spouses Supplemental plan or vice-versa.

Plan F is often compared with Plan G and Plan N. High-Deductible Plan F on the other hand offers lower monthly premiums but requires you to pay an annual deductible set at 2370 for 2021 before it will pay toward out-of-pocket costs. In Medigap Plan F Rates For 2021 one will have to incur 185 a year for deductibles.

Medicare supplement Insurance often referred to as Medigap is a form of additional health insurance coverage for enrollees who are already covered under the basic Medicare plan. If you apply for a Medicare Supplement Insurance plan after your six-month Medigap Open Enrollment Period OEP you may be subject to medical underwriting. Innovative Plan F is equal in comparison.

If you are a Medicare beneficiary who already has one of these plans you will be able to keep your current policy. Medigap Plan F Rates For 2021. In 2021 prices are expected to change though it wont guarantee the Plan F.

Your Medigap Open Enrollment Period starts as soon as you are at least 65 years old and enrolled in Medicare Part B. The real concern is that Medicare supplement Plan F rates will increase faster than they normally would if new insured were buying the plan. Since each state has variations on the plans available check with a broker to view options.

Medicare Supplement Plans Comparison Chart 2021 What S New

Medicare Supplement Plans Comparison Chart 2021 What S New

Comparing Medigap Plans Senior65

Comparing Medigap Plans Senior65

Best Medicare Supplement Plan F Rates Benefits Medigap Plan F Comparison

Best Medicare Supplement Plan F Rates Benefits Medigap Plan F Comparison

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Supplement Plans San Diego Compare Plans

Medicare Supplement Plans San Diego Compare Plans

Medicare Supplement Plan F 7 Essential Facts You Must Know Clear Medicare Solutions

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Best Medicare Supplement Plans Online Plan F G Changes

Best Medicare Supplement Plans Online Plan F G Changes

Illinois Medicare Supplement Plans

Illinois Medicare Supplement Plans

Medigap Plan F Medicare Supplement Plan F 65medicare Org

Medigap Plan F Medicare Supplement Plan F 65medicare Org

What Is The Average Cost Of Medicare Supplement Insurance In Decatur Il

What Is The Average Cost Of Medicare Supplement Insurance In Decatur Il

Cost Of Supplemental Health Insurance For Seniors

Cost Of Supplemental Health Insurance For Seniors

Cheapest Nj Medicare Supplement Plan F

Cheapest Nj Medicare Supplement Plan F

Comments

Post a Comment