Featured

- Get link

- X

- Other Apps

Medicareblue Supplement Plan F

What is Medicare Supplement Plan F. Determining your 2021 premiums.

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

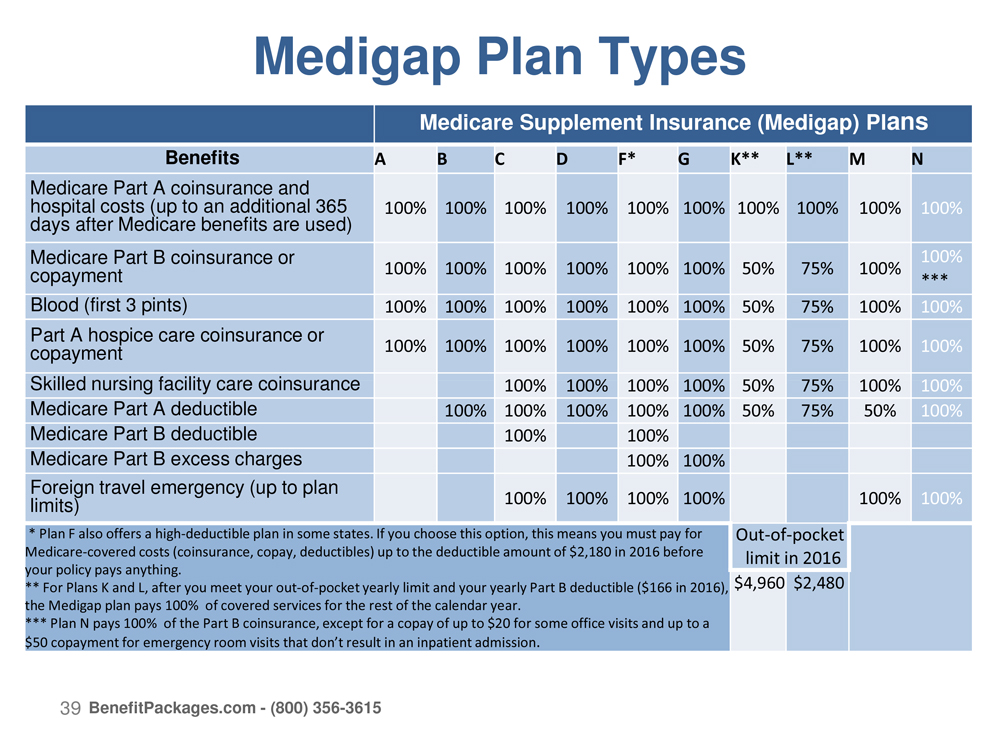

Part A coinsurance and hospital costs for an extra 365 days beyond what Medicare covers.

Medicareblue supplement plan f. MedicareBlue Supplement Plan F Plan F is available only to those who are eligible for Medicare prior to Jan. Each company was ranked based on the quality and ease of use of its website price transparency whether prices were based on age and the types of plan. For a complete listing please contact 1-800-MEDICARE 1-800-633-4227 TTY users should call 1-877-486-2048 24 hours a day7 days a week or consult wwwmedicaregov.

Youll pay a fixed amount each month and youll pay nothing for services covered by Original Medicare when you go to any doctor or hospital that accepts Original Medicare. All but 352 a day. Skilled Nursing Facility Coinsurance.

As long as you see. Medigap Plan F may cover. 1-888-563-3307 or TTY 711.

1 2021 your MedicareBlue Supplement benefits will automatically adjust to match the Medicare covered deductibles and cost-sharing amounts. 2019 AON Inc. In addition to covering your out-of-pocket costs Plan F travels well.

Hospital Part A Deductible. Medicare Supplement Plan F is the most comprehensive private insurance policy available to go with Medicare Part A and Part B. About 25 percent of people who have original Medicare are.

Out-of-pocket expenses for this deductible are expenses that would ordinarily be paid by the policy. Plan F is the most inclusive Medigap plan. Coinsurance - A percentage for example 10 you pay for your care after you meet your deductible.

Pays the Part A deductible for you. AON is the leading global provider of risk management services. Your Medicare Supplement plan costs include.

For example anyone who turns 65 has a qualifying disability or terminal illness and enrolls in Medicare in 2021 can not purchase Plan F. It covers everything that Plan C covers and also covers excess charges associated with Medicare Part B. This includes the Medicare deductibles for Part A and Part B but does not include the plans separate foreign travel emergency deductible.

Plans E H I and J are no longer sold. You will not be allowed to purchase Plan F if you are new to Medicare on or after January 1 2020. A Medicare Supplement high-deductible Plan G may now be available in some states.

Learn more about the changes to Medicare supplement Plan F on BlueSM. Plan F has a high-deductible version. It pays the out-of-pocket costs associated with Parts A and B including deductibles and the 20 coinsurance after the Part B deductible and more.

2021 Blue Cross Medicare Supplement Plan F. Medigap Plan F is retiring for new-to-Medicare enrollees. Just pay your premiums and the plan pays the rest of your Medicare-covered services including Part B excess costs.

BCBS Medicare Supplement Plan F. This is our most comprehensive Medicare supplement plan. Benefits from the High Deductible Plan F will not begin until out-of-pocket expenses are 2300.

Medicare supplement insurance can help pay for healthcare costs that original Medicare doesnt cover. Only those that serviced 40 or more states were considered. The Innovative Plan F is Plan F with extra benefits.

Hospitalization medical expenses blood and hospice care. This is not a complete listing of plans available in your service area. Plan F Available only to those eligible for Medicare prior to Jan.

Who can keep Medicare Supplement Plan F. If you were eligible for Medicare before January 1 2020 and bought a Medicare Supplement Plan F youll likely be able to keep your plan. Medicare Plan F also known as Medicare Supplement Plan F or Medigap Plan F is no longer available for people new to Medicare as of January 1 2020.

1408 Part A Deductible 0. Age Plan D Plan F High Deductible Plan F Plan N Male Female Male Female Male Female Male Female Age 64 Under 21130 18680 22220. Even if you didnt purchase a Medicare Supplement Plan F.

91st day and after while using 60 lifetime reserve days All but 704 a day. Medicare Supplement Plan F benefits As mentioned Medicare Supplement Plan F offers the broadest coverage of all of the standardized Medigap plan offerings Plans A-N. Recent Medigap Plan F changes wont impact all Medicare beneficiaries.

Plan Pays You Pay Hospitalization 1 S emiprivate room and board general nursing and miscellaneous services and supplies First 60 days. 91st day and after. Plans A D F High Deductible F and N Individual Part D PDP plans are also available Some plans cover your deductibles and coinsurance for Medicare parts A and B.

Copay - A flat dollar amount for example 10 you pay each time you receive care. To find the top Medicare Supplement carriers we reviewed all companies in the Medigap Find a Plan database that offered Plan F and High-Deductible Plan F. The plan premiums shown in the enclosed 2020 Outline.

1 2020 Plan F is our most comprehensive benefit package. But qualifying members may enjoy the newer all-inclusive updated plan. Medicare Supplement Options Wellmark Blue Cross and Blue Shield MedicareBlue SupplementSM Plans 1 Wellmark offers.

Covers stay in a skilled nursing facility. Deductible - The amount you pay before Florida Blue begins to pay its share of the cost. This is a hassle-free plan.

Medicare Supplement Plan F Is It Still Available

Medicare Supplement Plan F Is It Still Available

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Supplements For Mature Members Of Blue Cross Benefitpackages Com

Medicare Supplements For Mature Members Of Blue Cross Benefitpackages Com

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Five Things To Know About Medicare Supplement Plan F Wellmark Blue

Five Things To Know About Medicare Supplement Plan F Wellmark Blue

Blue Cross Blue Shield Plan F Bcbs Plan F Hea

Blue Cross Blue Shield Plan F Bcbs Plan F Hea

Medicare Supplement Plans 2021 The 3 Best Plans

Medicare Supplement Plans 2021 The 3 Best Plans

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Five Things To Know About Medicare Supplement Plan F Wellmark Blue

Five Things To Know About Medicare Supplement Plan F Wellmark Blue

Comments

Post a Comment