Featured

Anthem Blue Cross Plan F

Anthem Blue Cross 21555 Oxnard Street Woodland Hills California 91367 This Combined Evidence of Coverage and Disclosure Evidence of Coverage Form is a summary of the important terms of your health plan. This policy does not apply to any newly covered enrollee who had the option to continue with.

Anthem Medicare Supplement Plans Boomer Benefits

Anthem Medicare Supplement Plans Boomer Benefits

This plan covers all the benefits offered by traditional Medigap Plan F with the exact same network of doctors but now includes new vision and hearing benefits.

Anthem blue cross plan f. Plan F offers the broadest coverage and is one of the most popular Medicare supplement plans. And in most states you can also get special offers or enroll in programs to help keep you healthy and save you money. Innovative F represents a new risk pool.

Anthem Blue Cross and Blue Shield Group Retiree Plan F 2017 Medicare Part A - Hospital Services - Per Benefit Period A benefit period begins on the day you are admitted as an inpatient in a hospital and ends after you have been out of the hospital and have not received skilled care in any other facility for 60 days in a row. Innovative F is eligible for the 20 per month new to Medicare discount. Innovative F is a Plan F Supplement with added benefits.

Anthem Blue Cross Plan F. A newly covered enrollee to Anthem Blue Cross whose prior coverage was terminated when their health benefit plan was withdrawn from the market. Anthem Medicare Supplement Rates.

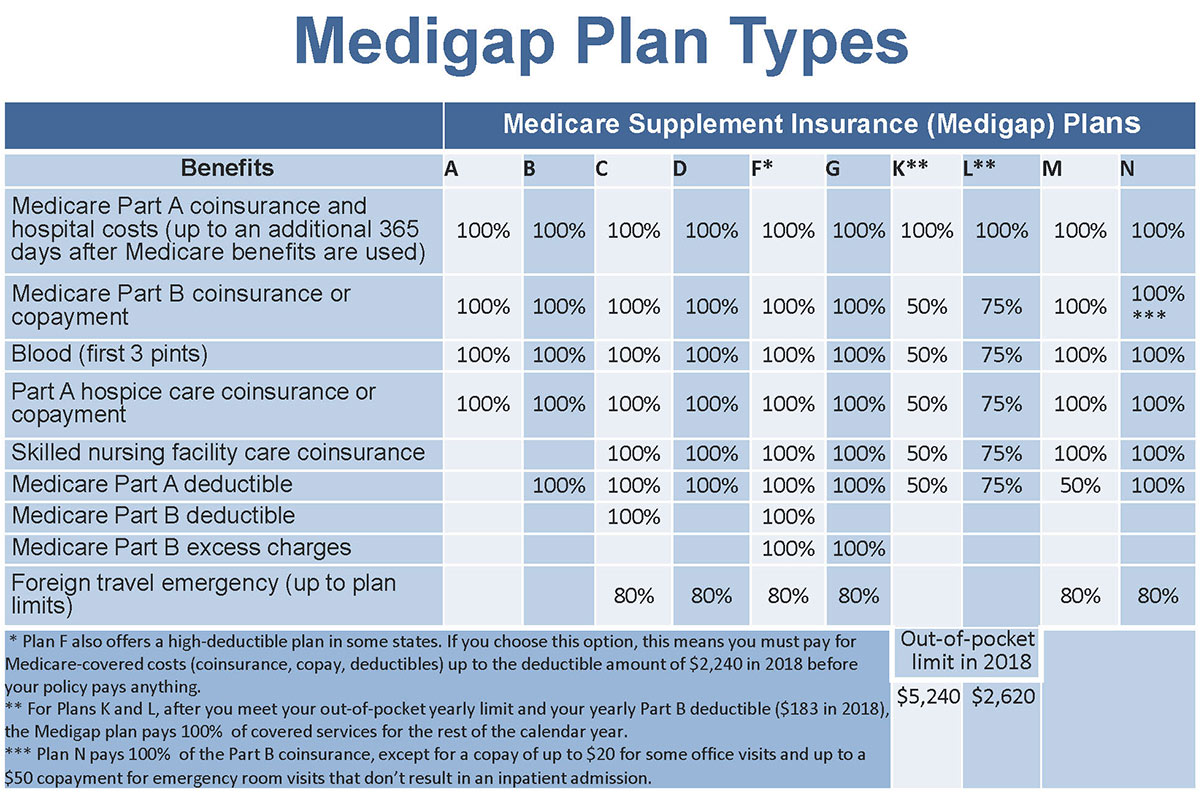

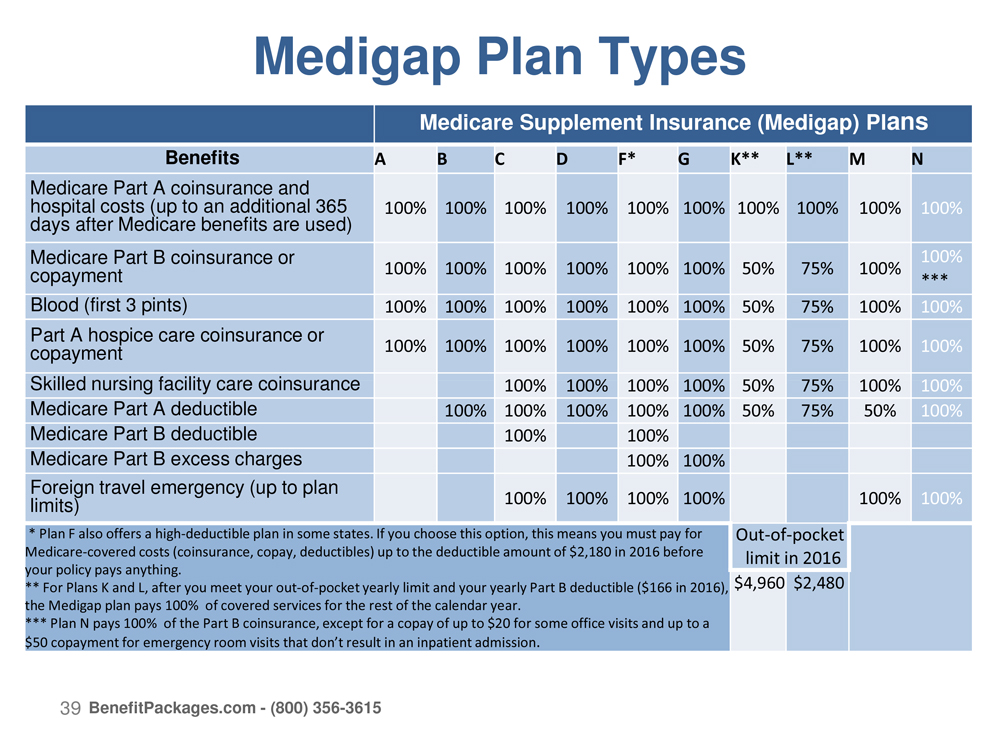

A high deductible version of Plan F is also offered. HMO products underwritten by HMO Colorado. The Part A and B deductible Part A coinsurance and hospital costs up to an additional 365 days Part A hospice care coinsurance or copayment Part B excess charges and foreign travel emergency services.

Anthem Blue Cross California has released a new Plan F Medicare Supplement called Innovative F. Anthem Blue Cross of Californias Senior Secure Plan provides benefits for medically necessary plus Senior Secure also provides coverage for the routine services that are not covered by original Medicare. Anthem Blue Cross Innovative F has slightly less coverage in the vision and hearing department but has Silver Sneakers and a surprising hearing aid coverage every year.

Rocky Mountain Hospital and Medical Service Inc. Enrollment in Anthem Blue Cross and Blue Shield depends on contract renewal. Plan F covers all gaps in deductibles for Medicare coinsurance and copays you normally would pay out of pocket.

Although Anthem Blue Cross does not offer Plan F to all seniors or in all states see above where offered the plan covers the following. Blue Shields F Extra also has a fine vision coverage and Silver Sneakers but only limits you to one company to choose from when it comes to Hearing Benefits. Notably the plan covers your Part B excess charges.

Anthem Blue Cross Plan F provides the highest amount of coverage that you may buy from a supplemental insurance policy. The industry calls this a first-dollar coverage which means you wont have to get your wallets out for Medicare Part A and Medicare Part B services. The health plan contract must be consulted to determine the exact terms and conditions of coverage.

Medicare Plan F is the most comprehensive of the 10 standardized supplements sold by Anthem Blue Cross. Moreover Plan F is the only Anthem Blue Cross Medigap plan that pays Part B deductible of 198 in 2020. Anthem Blue Cross and Blue Shield is the trade name of.

There are two more options in California for an Innovative F plan. And the Innovative F rates are quite a bit lower then the original Anthem F plan state wide. Identical to the original Plan F except the new Innovative F includes vision and hearing benefits at no additional cost.

Plan F Anthem Medicare Supplement. These optional plans issued by private insurance companies help pay for some of the out-of-pocket costs that Original Medicare Part A and Part B doesnt cover. Foreign Travel Emergency.

When you sign up for a Medicare Supplement plan with Anthem Blue Cross and Blue Shield youll have access to some great extras. High-deductible plan F Plan F also has a high deductible option. While monthly premiums for this option may be lower you must pay a deductible before Plan F begins paying for benefits.

Switched to an Anthem Blue Cross plan by their employer. Anthem Blue Cross and Blue Shield is a DSNP plan with a Medicare contract and a contract with the state Medicaid program. Plan F covers all of the following.

A F G and N. Anthem Blue Cross Senior Secure includes all of that plus Medicare Part D prescription drug coverage for no additional cost. This is why Anthem Medicare Plan F tends to be one of the most popular choices among our Medicare supplement customers.

Anthem Blue Cross has a new Medicare Supplement called the Innovative Plan F. The Anthem Blue Cross Medicare Supplement plans consist of plans. All other plans do not.

It also covers physician services speech and physical therapy durable medical equipment diagnostic tests supplemental Medicare coverage for skilled nursing facility care. You could join our popular fitness program SilverSneakers. Original Medicare is essentially a national health care program for people age 65 or older or for individuals under age 65 with certain disabilities and or with ESRD end-stage renal disease.

Blue Cross Medicare Supplement Plan F includes supplemental Medicare coverage for medical services covered in Part B including outpatient and medical services in or out of the hospital. Anthem Blue Cross Medigap Plan F high deductible Plan F and Plan G pay Medicare Part B Excess Charges. The most noteworthy addition to Innovative F is a 750 hearing aid coverage.

Plan F has long been the most popular Medigap plan. Part B excess charges. Close to 34 percent of all Medicare beneficiaries are enrolled in a Medicare supplement insurance Medigap plan.

Innovative F Medigap is a Medicare Supplement plan offered by Anthem Blue Cross in California and Nevada.

High Deductible F Plan For Medicare Coverage

High Deductible F Plan For Medicare Coverage

Anthem Medicare Plan F Indiana Health Agents

Anthem Medicare Plan F Indiana Health Agents

Blue Cross Blue Shield Plan F Bcbs Plan F Hea

Blue Cross Blue Shield Plan F Bcbs Plan F Hea

Anthem Blue Cross Medicare Supplement Senior Healthcare Direct

Anthem Blue Cross Medicare Supplement Senior Healthcare Direct

Anthem Blue Cross And Blue Shield Group Retiree Plan F Cbia

Anthem Blue Cross And Blue Shield Group Retiree Plan F Cbia

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Blue Cross Bcbs Medicare Supplement Review Plans Pricing

Blue Cross Bcbs Medicare Supplement Review Plans Pricing

Ca Medicare Learn About Anthem Blue Cross Medicare Plans For Seniors

Ca Medicare Learn About Anthem Blue Cross Medicare Plans For Seniors

Anthem Medicare Supplement Plans Boomer Benefits

Anthem Medicare Supplement Plans Boomer Benefits

Anthem Medicare Supplement Plans Boomer Benefits

Anthem Medicare Supplement Plans Boomer Benefits

Medicare Supplements For Mature Members Of Blue Cross Benefitpackages Com

Medicare Supplements For Mature Members Of Blue Cross Benefitpackages Com

Release Anthem Blue Cross And Blue Shield In Missouri Introduces New Medicare Supplement Plan F To Help Consumers Control Health Care Costs Clayton Times

Release Anthem Blue Cross And Blue Shield In Missouri Introduces New Medicare Supplement Plan F To Help Consumers Control Health Care Costs Clayton Times

Blue Cross Blue Shield Medicare Supplement Insurance Reviews

Blue Cross Blue Shield Medicare Supplement Insurance Reviews

Comments

Post a Comment