Featured

- Get link

- X

- Other Apps

Catastrophic Health Insurance California

Catastrophic health insurance is a type of medical coverage under the Affordable Care Act. If approved these consumers will get an Exemption Certificate Number ECN and may buy a.

Best Cheap Health Insurance In California 2021 Valuepenguin

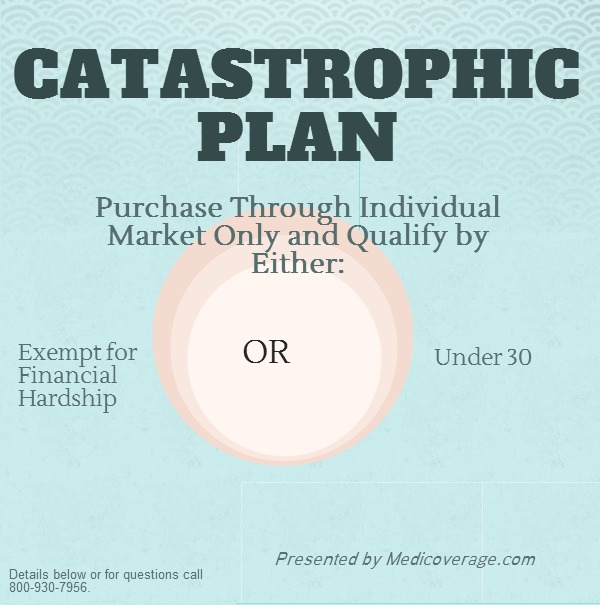

Catastrophic health insurance plans are designed for people who are under 30 or who meet hardship requirements.

Catastrophic health insurance california. The Covered California health insurance marketplace will offer a catastrophic health plan to California residents under-thirty years of age in 2014. Best Values for Catastrophic California Health Insurance. And if the accident insurance event occurs the insurance company will bear all or all of the costs in full or in part.

And boy are there many of those these days. Over half of bankruptcies are the result of unexpected health care expenses. But you pay most routine medical expenses yourself.

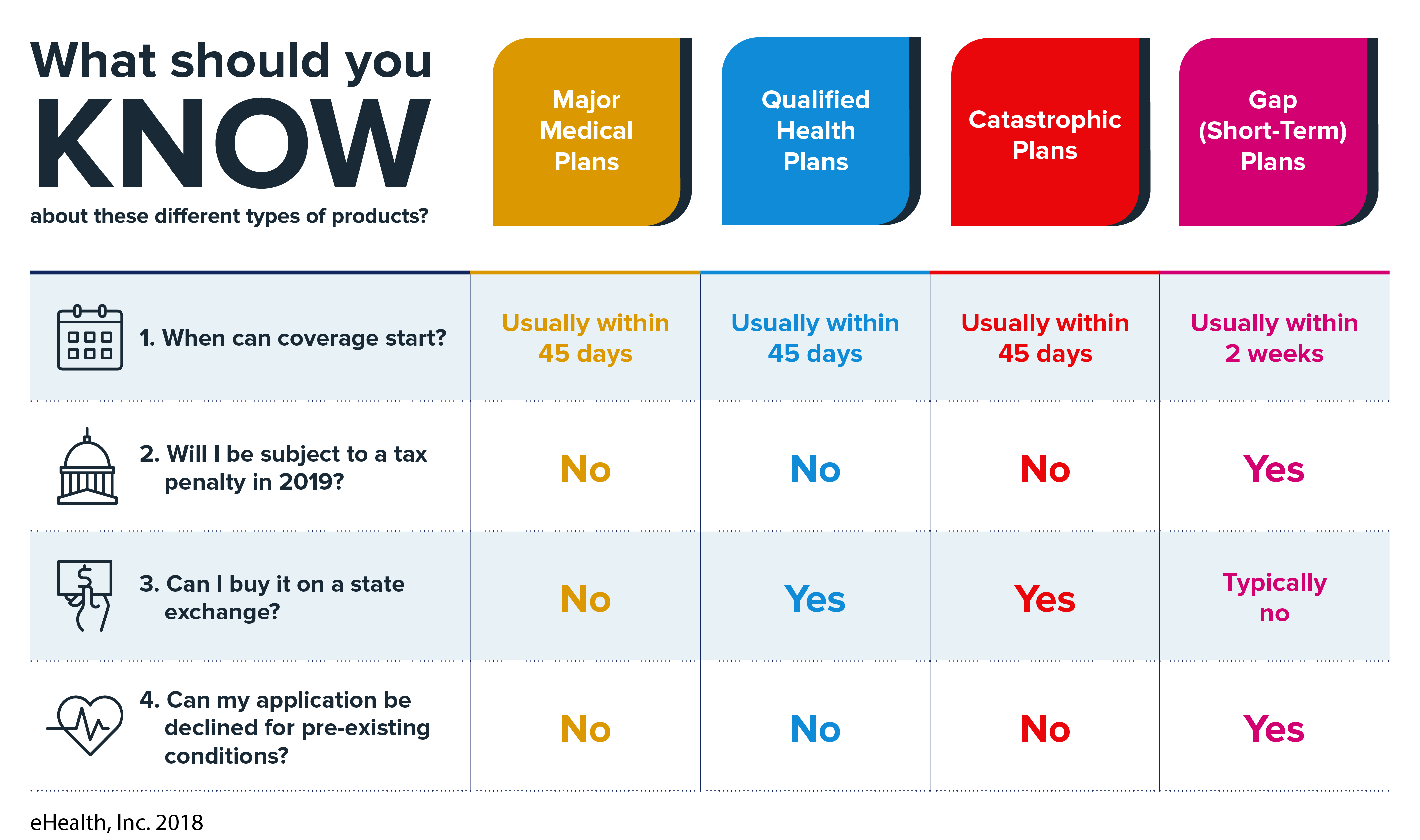

Short-term health insurance in California Short-term health insurance plans are not available for purchase in California. Catastrophic health insurance is a low-cost health care plan that covers very few medical expenses until you reach a high deductible. They may be an affordable way to protect yourself from worst-case scenarios like getting seriously sick or injured.

Who can buy a Catastrophic plan. This plan includes free preventative care. Consumers age 30 or older can buy catastrophic coverage if they apply for an affordability or general hardship exemption through Covered California and are approved.

Catastrophic health insurance plans have low monthly premiums and very high deductibles. People 30 or older however can qualify if theyre eligible for a hardship or affordability exemption. Again there is absolutely no cost to you for our services.

Catastrophic refers bare-bones health insurance coverage with the emphasis on affordability. Only the following people are eligible. Make sure to learn about the new health sharing plan approach to catastrophic health coverage with AlieraCare here.

Catastrophic health insurance is basically designed to cover the big medical bills that can wipe someone out financially. This is a type of high-deductible health plan for people under 30 or those who qualify for a hardship exemption. The California government understands however that money is tight.

Over half of bankruptcies are the result of unexpected health care expenses. Individuals younger than 30 years old are eligible which is the age cutoff for qualifying for a catastrophic health insurance. Currently catastrophic health insurance under the Affordable Care Act ACA has high deductibles equal to the average out-of-pocket cost under the.

This plan has a 8150 individual deductible and 16300 on a family basis. Depending on the chosen program you can partially or completely protect yourself from unforeseen expenses. You can run your Catastrophic Health Plan Quote here to view rates and plans side by side from the major carriersFree.

Catastrophic health insurance california is a tool to reduce your risks. If you qualify for premium assistance you may pay less for a Bronze Plan. See affordable health insurance plans.

The Covered California Cheap Health Insurance Option. CURRENT CATASTROPHIC PLANS FOR CALIFORNIA INDIVIDUAL HEALTH INSURANCE. If youre 30 or older and want to enroll in a Catastrophic plan you must claim a hardship exemption to qualify.

In 2018 Senate Bill 910 was passed by California lawmakers which effectively banned the sale and renewal of all temporary health policies starting January 1 2019. This plan also includes 3 free primary care office visits in-network only per person per year that are in-network only. This type of health policy is intended to cover young people and those going through difficult times.

First What Is Catastrophic Health Coverage. There was a time when a small percentage of the shoppers for California health insurance were looking for catastrophic or major medical coverage. And boy are there many of those these days.

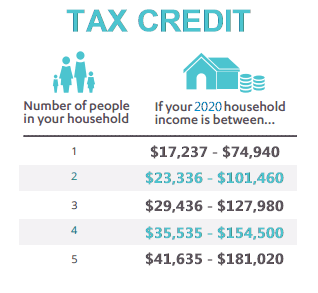

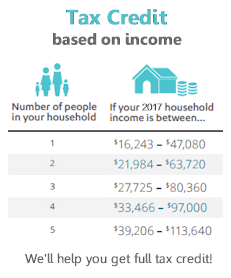

A family of four can earn in excess of 90000. Tax credits and federal subsidies are available on a sliding scale to help ease the burden for those who meet income guidelines. Catastrophic plans hardship exemptions.

These plans are only available to people under age 30 those who qualify for a hardship exemption or those who cannot afford any options from their employer or the healthcare marketplace. Our selection of family and individual health insurance plans offers you the perfect coverage. And these costs can be from 100 to several tens or even hundreds of thousands of dollars.

Learn more about Catastrophic plans. Low premiums are important to the young men and women who make up a disproportionate share of the Californias 7 million uninsured. Catastrophic health insurance is basically designed to cover the big medical bills that can wipe someone out financially.

These plans have low monthly premiums but very high deductibles. A Catastrophic health plan offers lower-priced coverage that mainly protects you from high medical costs if you get seriously hurt or injured. Keep in mind that preventative benefits and maternity are covered under all California health plans except for short term.

A catastrophic plan is the best option for those who qualify and are concerned about monthly premiums.

Metallic Plan Benefits Covered California Health For Ca

Metallic Plan Benefits Covered California Health For Ca

Individual Health Insurance Plans Quotes California Hfc

Individual Health Insurance Plans Quotes California Hfc

How To Get Cheap Health Insurance In 2021 Valuepenguin

Catastrophic Plans Healthcare Exchange Medicoverage Com

Catastrophic Plans Healthcare Exchange Medicoverage Com

.png) Immediate Health Insurance Coverage In California

Immediate Health Insurance Coverage In California

Catastrophic Health Insurance California California Health Insurance

Catastrophic Health Insurance California California Health Insurance

/Blue_Cross_Blue_Shield-c8b7f152cc8646f0bf5d1cd3efae9294.jpg) The 4 Best Catastrophic Health Insurance Of 2021

The 4 Best Catastrophic Health Insurance Of 2021

Get Emergency Health Insurance In California

Get Emergency Health Insurance In California

Catastrophic Health Insurance California At Healthinsurancequotescalifornia Net

Catastrophic Health Insurance Definitions Plan Costs

Catastrophic Health Insurance Definitions Plan Costs

Health Insurance California Visual Ly

Health Insurance California Visual Ly

Best Values For Catastrophic California Health Insurance

Best Values For Catastrophic California Health Insurance

The Catastrophic Plan Ca S Cheapest Health Plan Terpening Insurance

The Catastrophic Plan Ca S Cheapest Health Plan Terpening Insurance

Obamacare Health Plans In California Benefit Details

Obamacare Health Plans In California Benefit Details

Comments

Post a Comment