Featured

- Get link

- X

- Other Apps

What Is The Difference In Ppo And Hmo Insurance

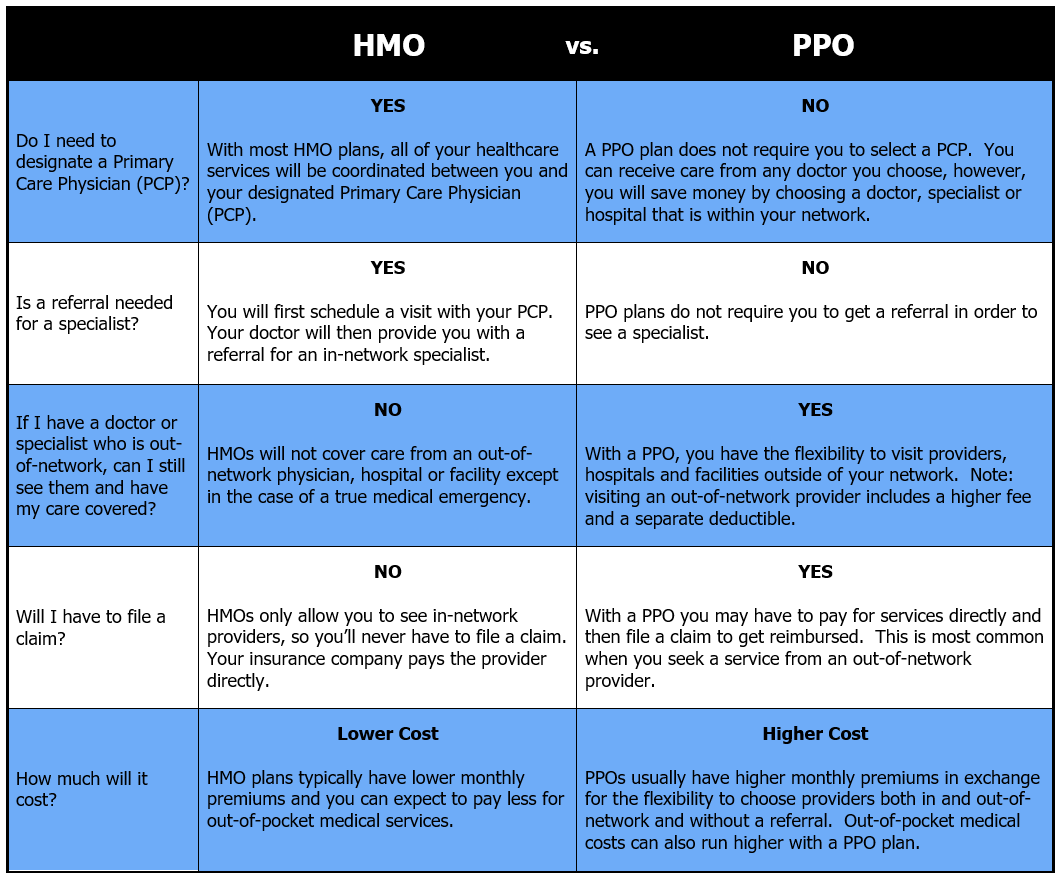

You dont need a referral from a primary care physician to see most specialists and you can visit providers not contracted by the insurance company. 5 Zeilen PPOs differ from HMOs in that PPO plans will usually provide some coverage for these types of.

Hmo Vs Ppo What S The Difference

Hmo Vs Ppo What S The Difference

7 Differences Between an HMO vs.

What is the difference in ppo and hmo insurance. What an HMO offers HMOs work with specific doctors and hospitals to be part of its network of medical providers. With an EPO you typically dont need a referral to see a specialist which makes it more flexible than an HMO. HMOs offer lower premiums and out-of-pocket costs.

HMO plans Have Lower Premiums and Out-of-Pocket Costs with Less Flexibility. Yes actually PPO and HMO insurance plans are types of Medicare Advantage Plans Part C. Below is a breakdown of some notable differences between HMO vs.

HMOs have lower premiums and out-of-pocket expenses but less flexibility. The biggest difference in the HMO vs. Lets take a look at some of the most common differences between these two types of health insurance plans.

An exclusive provider organization EPO plan is situated between an HMO and PPO in terms of flexibility and costs. HMOs offered by employers often have lower cost-sharing requirements ie lower deductibles copays and out-of-pocket maximums than PPO options offered by the same employer although HMOs sold in the individual insurance market often have out-of-pocket costs that are just as high as the available PPOs. A PPO insurance plan gives greater choices.

HMO or Health Maintenance Organization and PPO Preferred Provider Organization health insurance plans can appear to be very similar when you are shopping for a new health plan. PPO universe is how an enrollee in one of these plans chooses and sees their doctors hospitals and other providers. The cost of health insurance is an important differentiator.

The coverage for out-of-network services The big difference between HMO and PPO for many individuals and families is the primary care doctor. The cost of HMO plans is less but PPO plans offer greater flexibility and have larger networks compared to HMO plans. That can also lead to big differences in how much the coverage will cost.

HMO vs PPO Insurance Plans. Eligibility of Preferred Provider Organization PPO and Health Maintenance Organization HMO Like Original Medicare to enroll in PPO or HMO you must be. Deciphering health insurance can feel like a complicated task.

However like an HMO there are no out-of. Thus the difference between HMO and PPO plans include network size ability to see specialists costs and out-of-network coverage. If the alphabet soup of health insurance jargon still has you scratching your head take heart.

What is PPO insurance. However there are several aspects in which. With an HMO you will have a primary care doctor whom you and your family go through for most medical services.

The most popular types of health insurance plans are HMOs and PPOs that are offered through employers and available for individual purchase. Here is a quick rundown of these two popular health insurance options and the difference between an HMO and PPO. PPO and HMO comparison chart There are a lot of similarities between Medicare Advantage PPO and HMO plans such as the costs of premiums deductibles and other plan fees.

But the major differences between the two plans. The differences besides acronyms are distinct. 5 Zeilen HMO vs.

An HMO is a Health Maintenance Organization while PPO stands for Preferred Provider Organization.

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between An Hmo Vs Ppo Xcelhr

Hmo Vs Ppo Comparison 5 Differences With Video Diffen

Hmo Vs Ppo Comparison 5 Differences With Video Diffen

Hmo Vs Ppo Health Insurance Plans Selecting The Right Plan For Your Needs San Diego Financial Literacy Center

What Is The Difference Of Hmo And Ppo Health Insurance Hmo Vs Ppo Youtube

What Is The Difference Of Hmo And Ppo Health Insurance Hmo Vs Ppo Youtube

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

How Do Commerical Ppo Vs Hmo Insurance Plans Work Dr Wenjay Sung Podiatrist

How Do Commerical Ppo Vs Hmo Insurance Plans Work Dr Wenjay Sung Podiatrist

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

What Is An Hmo About Hmo Health Insurance Medical Mutual

What Is An Hmo About Hmo Health Insurance Medical Mutual

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Difference Between Hmo And Ppo Difference Between

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Comments

Post a Comment