Featured

- Get link

- X

- Other Apps

Blue Cross Blue Shield Deductible Out Of Pocket

Heres how the costs might break down. The OOPM is different for every type of plan.

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

Once you reach your out-of-pocket max your plan pays 100 percent of the allowed amount for covered services.

Blue cross blue shield deductible out of pocket. When the amount of coinsurance youve paid reaches 6000 the plan covers 100 until your plan year renews. You must pay the first 5000 of your medical costs. Not 6000 as the third bullet point says.

The X-ray costs 200. Because you pay some of your deductible with each visit or service it helps to hold down the cost of your premiums. About your deductible.

Member pays copayscoinsurance toward out-of-pocket maximum. The out-of-pocket limit includes deductible coinsurance and copayment amounts for medical and pharmacy services. Your plan covers 80 which is 160.

After you pay the 4000 deductible your plan covers 75 of the costs and you pay the other 25. Advertentie Compare 50 Global Health Insurance Plans for Expats living abroad. Our Member Online Services tools make it easy for them to get much of the health coverage information they need when they need it.

Out-of-pocket maximum of 5000. Deductible and Maximum Out-of-pocket Information are Now Available Online Horizon Blue Cross Blue Shield of New Jersey is improving the way we provide our members with access to their information. After you pay the 4000 deductible your health plan covers 70 of the costs and you pay the other 30.

The out-of-pocket maximum also called OOPM is the most you will have to pay out of your own pocket for expenses under your health insurance plan during the year. If your plan covers more than one person you may have a family out-of-pocket max and individual out-of-pocket maximums. Get a Free Quote.

Its often the amount you pay for your health costs before your plan benefits start to pay. The OOPM is different for every type of plan. But with a little know-how on your part and a bit of help from us youll find the true value they can offer.

Else with the current example you would be paying 5000 towards the deductible plus 6000 coinsurance for a total of 11000 out-of-pocket instead of the maximum of 6000. You pay out of pocket for your medical services until youve paid your deductible in full. Since the 5000 deductible applies towards the 6000 out-of-pocket maximum you are responsible for at most 1000 of coinsurance then.

After that your plan covers 80 of the costs and you pay the other 20. You must pay 4000 toward your covered medical costs before your health plan begins to cover costs. Advertentie Compare 50 Global Health Insurance Plans for Expats living abroad.

Deductibles Coinsurance and Out-of-pocket maximum. You must pay 4000 toward your medical costs before your plan begins to cover costs. The out-of-pocket maximum is the amount each covered person must pay in a calendar year before your insurance covers at 100.

Your health Insurance plan may. If you are a current BCBSTX member you can see what your plans OOPM is within Blue Access for Members. Your out-of-pocket cost or coinsurance is 40.

This amount may or may not include deductible amounts copay amounts or out-of-network amounts. The out-of-pocket maximum also called OOPM is the most you will have to pay out of your own pocket for expenses under your health insurance plan during the year. If you are a current BCBSIL member you can see what your plans OOPM is within Blue Access for Members.

Out-of-pocket maximum of 6000. You can contact us directly to verify what is included in your plans out-of-pocket maximum. Your health plan has a.

A deductible plan means youll be required to pay a specific amount of out-of-pocket cost the deductible before your insurance comes in to pay some of your claim. Member pays toward deductible. What you pay toward your plans deductible coinsurance and copays are all applied to your out-of-pocket max.

Out-of-pocket maximum of 5000. Get a Free Quote. When our members need to know how much money has been applied to their deductibles and out-of-pocket.

The out-of-pocket maximum is the amount you have to pay for eligible costs under your health care plan during a certain period of time. Remember that your health plan includes certain services at no cost to you before you meet your deductible. Once youve paid your deductible your health plan will begin to pay for its share of covered services.

A deductible is another portion of your out-of-pocket costs.

Http Www Bluecrossma Com Municipal Pdf New Bedford Deductible Fact Sheet Pdf

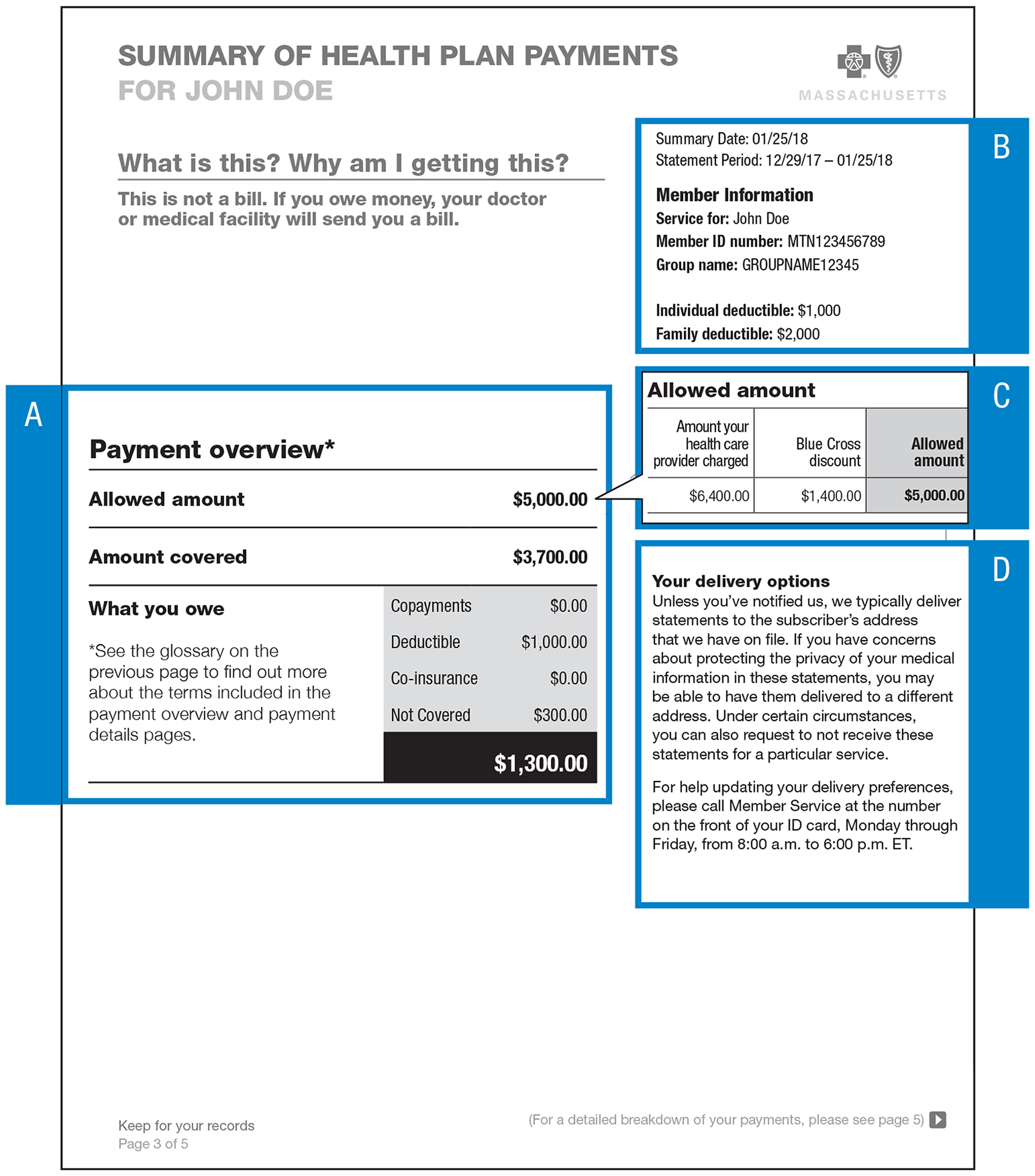

Summary Of Health Plan Payments Myblue

Summary Of Health Plan Payments Myblue

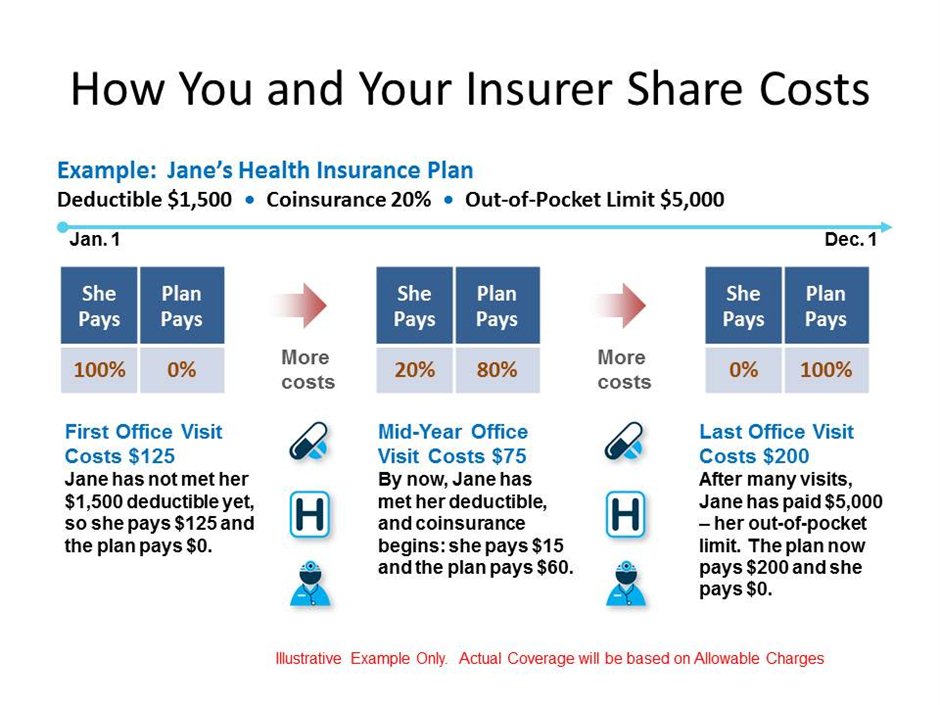

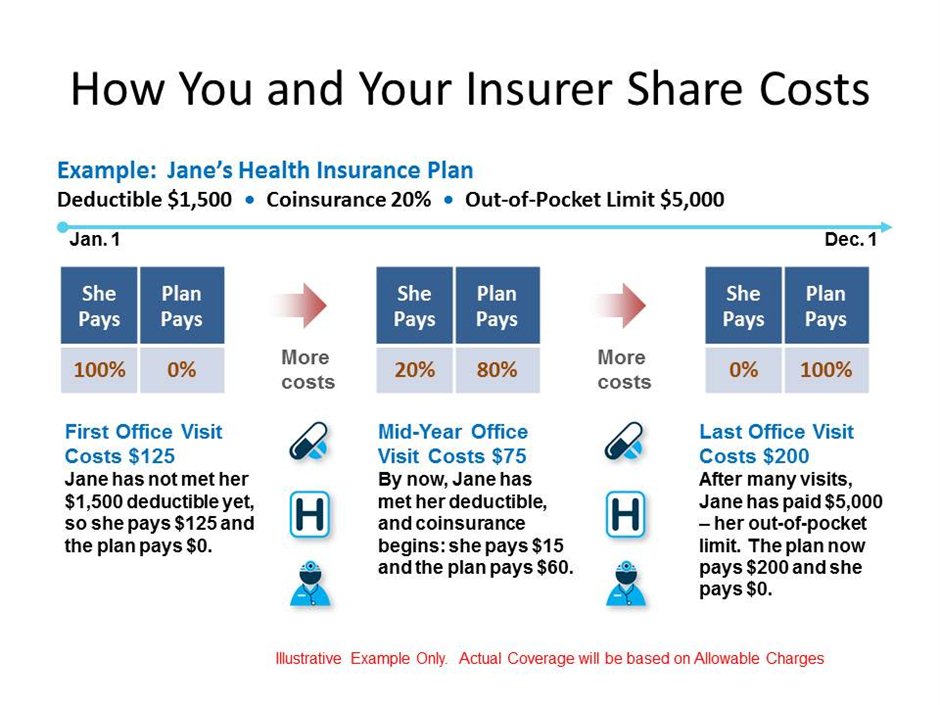

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Understanding Deductibles Out Of Pocket Maximums Health Insurance

What Is An Out Of Pocket Maximum Bluecrossmn

What Is An Out Of Pocket Maximum Bluecrossmn

Explanation Of Benefits And Claims Letters Healthselect Of Texas Blue Cross And Blue Shield Of Texas

Explanation Of Benefits And Claims Letters Healthselect Of Texas Blue Cross And Blue Shield Of Texas

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Understanding Deductibles Out Of Pocket Maximums Health Insurance

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

What Is A Summary Of Benefits And Coverage And How Should I Use It Goodrx

What Is A Summary Of Benefits And Coverage And How Should I Use It Goodrx

Out Of Pocket Maximums Copayments Coinsurance Bcbs Of Wny

Out Of Pocket Maximums Copayments Coinsurance Bcbs Of Wny

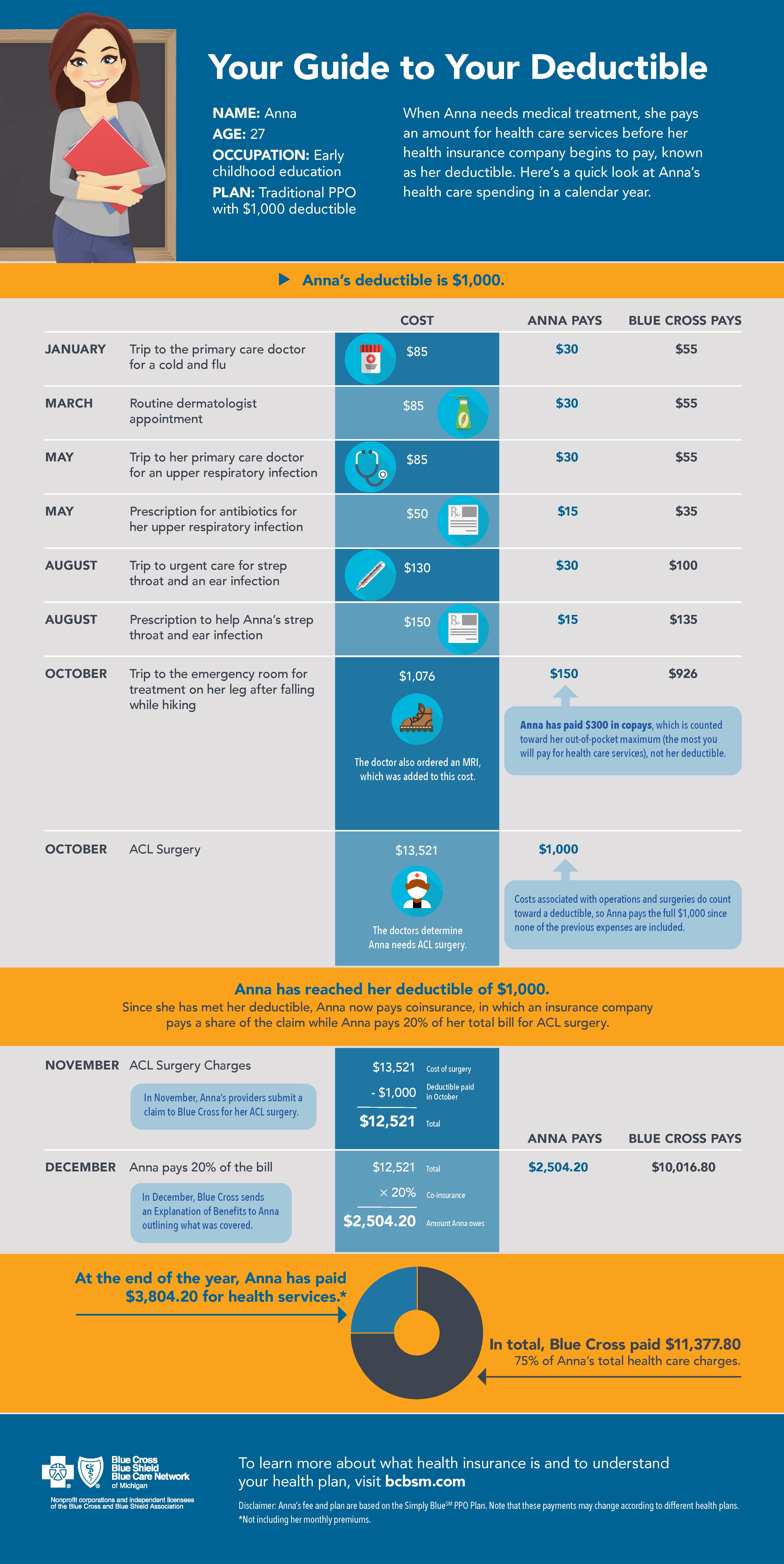

A Guide To Understanding Your Deductible Mibluesperspectives

A Guide To Understanding Your Deductible Mibluesperspectives

Oop Out Of Pocket Maximum Deductible Co Pay Participating Providers

Oop Out Of Pocket Maximum Deductible Co Pay Participating Providers

Summary Of Health Plan Payments Myblue

Summary Of Health Plan Payments Myblue

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Oklahoma

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Oklahoma

Comments

Post a Comment