Featured

- Get link

- X

- Other Apps

California Health Insurance Laws Employers

New Employee Registry NER. This is also called employee coverage.

The Rules For California Small Business Health Insurance

The Rules For California Small Business Health Insurance

Most people in California get group health insurance through a job.

California health insurance laws employers. We can help you investigate whether this option might work for you with part-time and full-time employees. Californias new individual health insurance mandate 2019 Ch. A small employer is defined as a business with 2 to 50 full-time employees.

In most cases group insurance is better than individual insurance. Thus an insured plan that permits spouses to enroll must also extend an offer of coverage to registered domestic partners. 1 2020 or pay a state tax penalty.

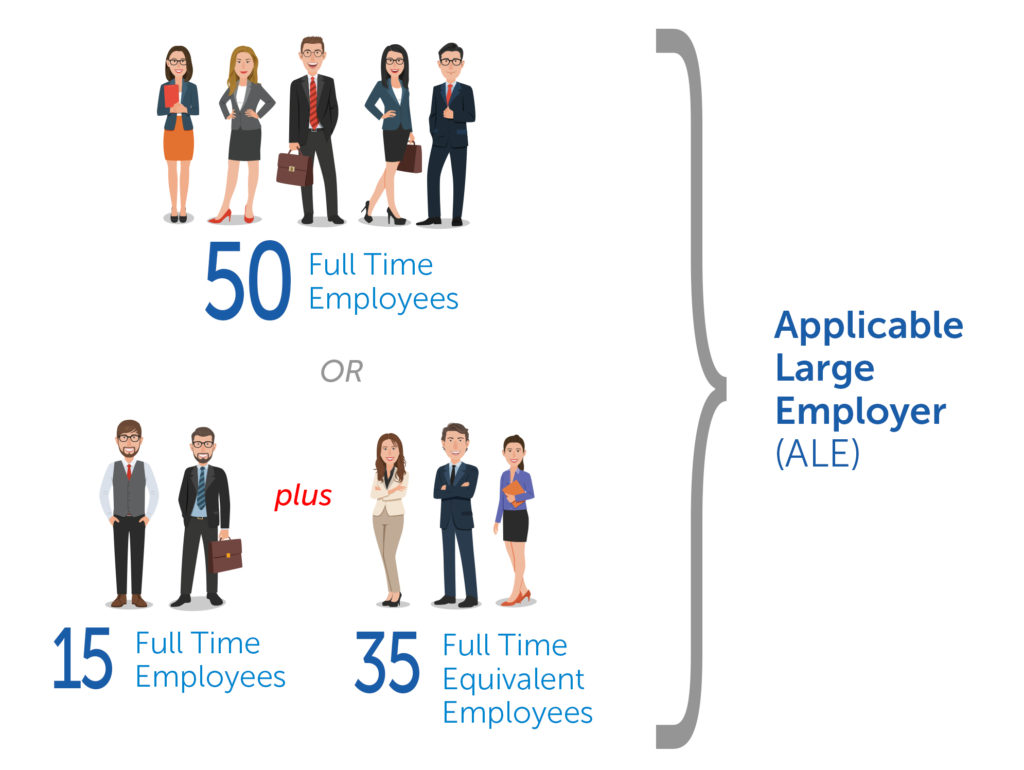

Employers can require that employees contribute toward their insurance coverage but they cant require. This means that we add up the of full time employees 30 hours per week PLUS The equivalent of part-time employees. Employers have 90 days from the date of the notice it receives from Covered California to request an appeal.

As under current law employees are not eligible unless they have worked for the employer for more than 12 months and have at least 1250 hours of service with the employer during the 12-month period prior to the start of the leave. The California Insurance Equality Act the Act requires an employer that sponsors a fully-insured health plan that provides coverage to the spouses of employees to offer equal coverage to registered domestic partners. Employer appeals will be handled by.

The law speaks of full time equivalents. Insurance companies agents and brokers are required to comply with these insurance laws. Under California law AB1672 small employers are guaranteed group coverage should they choose to purchase it regardless of the employees health status.

Under a new state law California employers with five or more employees will be required to continue to maintain and pay for health coverage under a group health plan for an eligible female employee who takes Pregnancy Disability Leave PDL up to. Are California employers required to provide health insurance. 38 SB 78 requires state residents to maintain minimum essential coverage MEC for themselves and their dependents starting on Jan.

Eligible employees can take leave within one year of the childs birth or placement for adoption or foster care. Under the current ACA law theres dividing line based on the size of your company. All employers are required by law to report all newly hired or rehired employees to the NER within 20 days of their start-of.

If an employer provides health insurance Californias insurance laws require policies to cover certain benefits mandated benefits and give employees the right to continue group coverage in certain circumstances if. Individuals who do not obtain health insurance for themselves and their dependents will be subject to a penalty unless they qualify for an exemption. California health insurance companies require that an employer contribute at least 50 percent of the employee only monthly cost or premium So for example if the monthly cost for one employee not including dependents is 300 then the employer must pay at least 150.

Laws and Regulations Welcome to the California Department of Insurance CDI Laws and Regulations page. There is currently no state law requiring employers to offer group healthcare insurance to their employees but most employers do provide this benefit. First a note on how to calculate your size.

California Healthcare Mandate The State of California adopted a new state individual health care mandate that requires individuals to maintain health insurance beginning January 1 2020. This insurance must pay for at least 60 of covered services. California employer requirements for health insurance.

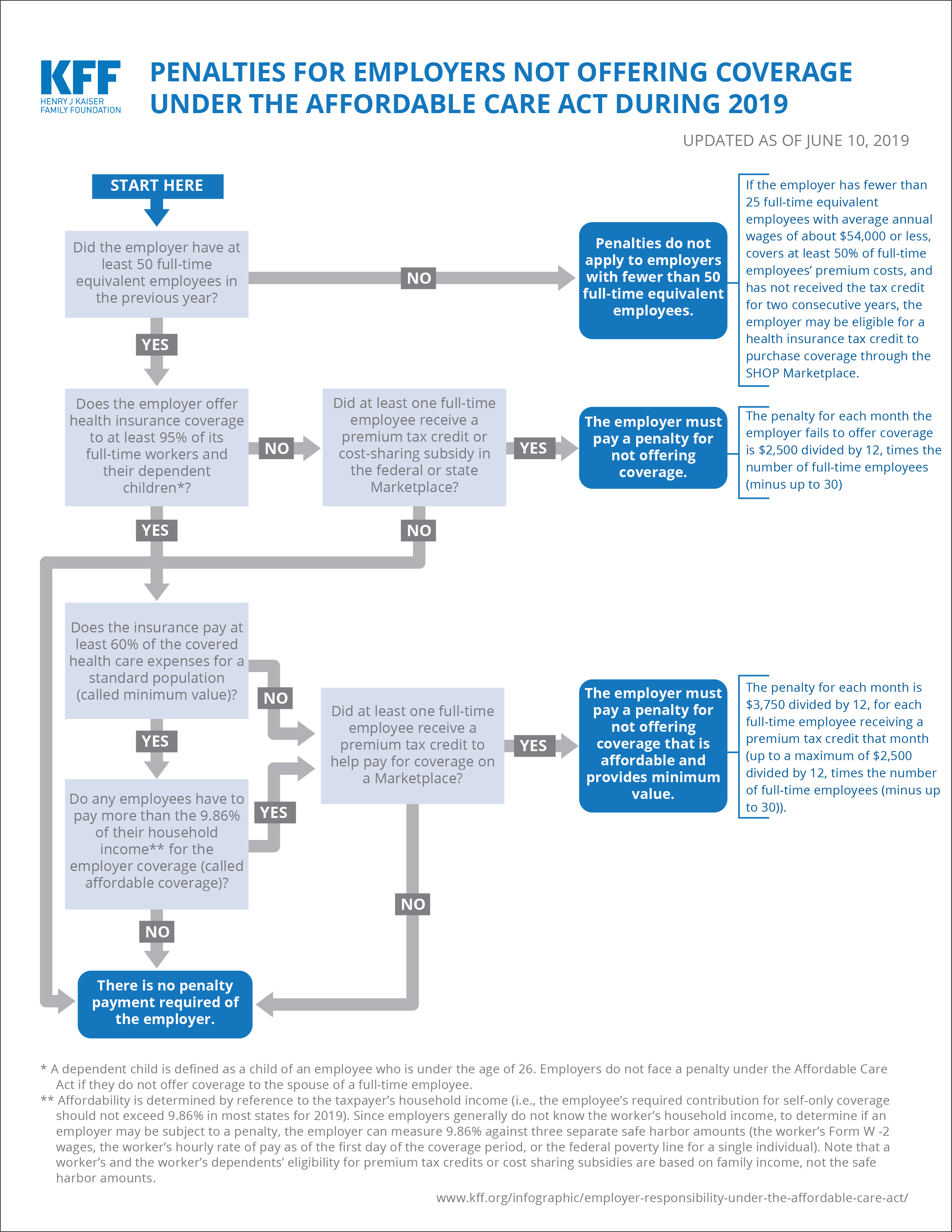

It gives you more benefits at a lower cost. In 2016 a small employer will be defined as a business with 2 to 50 full-time employees. An employer may appeal an employer notice if it asserts that it offers affordable minimum essential coverage to employees or that its employee is enrolled in employer coverage and therefore ineligible for premium tax credits.

The ACA employer mandate requires large employers to provide a specified percentage of their full-time equivalent employees and those employees families with minimum essential healthcare insurance. The new QSEHRA from Employers A recent law created the new QSEHRA Qualified Small Employer HRA which allows eligible employer to pay towards an employees individualfamily health plan and deduct it. Employers with 100 employees buy large-group policies and those with fewer than 100 buy small-group policies.

There is currently no state law obliging employers to offer group health insurance to employees but most employers provide this benefit. This page contains links to state of California insurance statutes and regulations as well as all other California statutes and regulations.

California Individual Health Coverage Mandate Includes Employer Reporting Mercer

California Individual Health Coverage Mandate Includes Employer Reporting Mercer

Individual Health Insurance Plans Quotes California Hfc

Individual Health Insurance Plans Quotes California Hfc

![]() California Labor Laws 2021 Guide To California Employment Law

California Labor Laws 2021 Guide To California Employment Law

Does A Company Have To Offer Health Insurance To Employees In California

Does A Company Have To Offer Health Insurance To Employees In California

How Much Should A Business Pay For Employee Health Insurance My Calchoice

How Much Should A Business Pay For Employee Health Insurance My Calchoice

Employer Responsibility Under The Affordable Care Act Kff

Employer Responsibility Under The Affordable Care Act Kff

New Law Allows Small Employers To Pay Premiums For Individual Policies California Employee Benefits Arrow Benefits Group Complex Questions Straight Answers

New Law Allows Small Employers To Pay Premiums For Individual Policies California Employee Benefits Arrow Benefits Group Complex Questions Straight Answers

Https Www Calpers Ca Gov Docs Circular Letters 2013 600 051 13 Attach1 Pdf

National Health Reform Requirements And California Employers Uc Berkeley Labor Center

National Health Reform Requirements And California Employers Uc Berkeley Labor Center

Extent Of Health Coverage Gains From California Gig Worker Law Uncertain Fiercehealthcare

Extent Of Health Coverage Gains From California Gig Worker Law Uncertain Fiercehealthcare

Https Www Chcf Org Wp Content Uploads 2017 12 Pdf Himuregulatoryoversight Pdf

Watch Out For California S New Laws Affecting Employer Health Coverage Benefitspro

Watch Out For California S New Laws Affecting Employer Health Coverage Benefitspro

Health Insurance In California Disability Rights Legal Center

Health Insurance In California Disability Rights Legal Center

Comments

Post a Comment