Featured

- Get link

- X

- Other Apps

Private Catastrophic Health Insurance

In Maryland by Aetna Health Inc 151 Farmington Avenue Hartford CT 06156. In Utah and Wyoming by Aetna Health of Utah Inc.

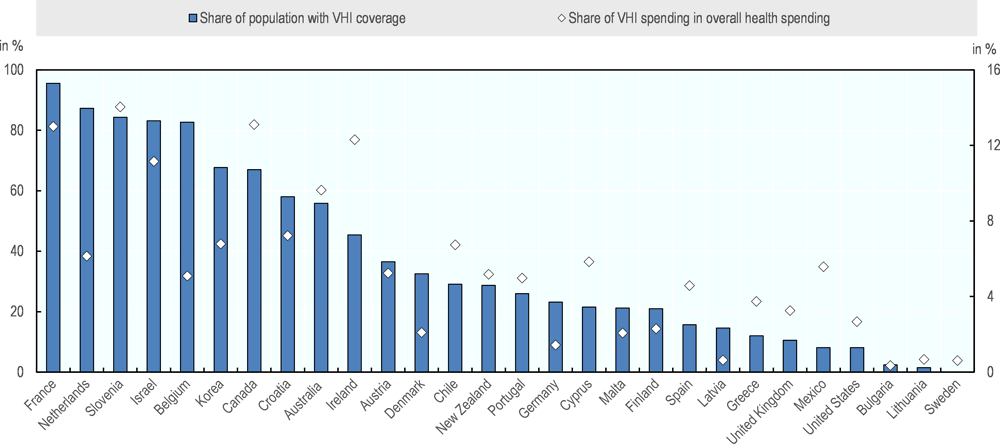

Affordability And Financial Protection Insights From Europe Health For Everyone Social Inequalities In Health And Health Systems Oecd Ilibrary

Affordability And Financial Protection Insights From Europe Health For Everyone Social Inequalities In Health And Health Systems Oecd Ilibrary

DMO dental benefits and dental insurance plans are underwritten by Aetna Dental Inc Aetna Dental of California Inc Aetna Health Inc.

Private catastrophic health insurance. Catastrophic health insurance is a low-premium comprehensive health plan for young adults and people who cant afford other health insurance plans and are facing hardships. According to eHealth Insurance the average cost of an individual plan purchased on your. Once you meet your deductible our Blue Cross Value catastrophic plans pay 100 percent for most services.

Catastrophic PPO Health insurance is designed to cover the costs of unforeseen medical emergencies or rather this plan kicks in and pays when something bad happens from what I like to refer to as the outside in As an example one of my clients was stung by a bee and went into anaphylactic shock. Overall most Americans are enrolled in a private health insurance plan according to the US. As of 2020 the.

Catastrophic health coverage is available to people under 30 who are looking for minimal coverage. Catastrophic health insurance plans have low monthly premiums and very high deductibles. Moreover we find that poor people present a greater tendency to incur catastrophic OOP expenditures for hospital health care in private providers.

Only the following people are eligible. Catastrophic health insurance is a type of medical coverage under the Affordable Care Act. For example if you get into a medical emergency and your medical.

This study uses 1-year data from 2013 and households with cancer patients as the unit of research rather than individual household m. And Aetna Life Insurance Company. This study examines the effects of private health insurance PHI on the incidence of catastrophic health expenditures CHE for households with a patient with cancer.

These plans offer the same coverage as an Affordable Care Act. Catastrophic health plans typically come with low monthly premiums and a high deductible. Who can buy a Catastrophic plan.

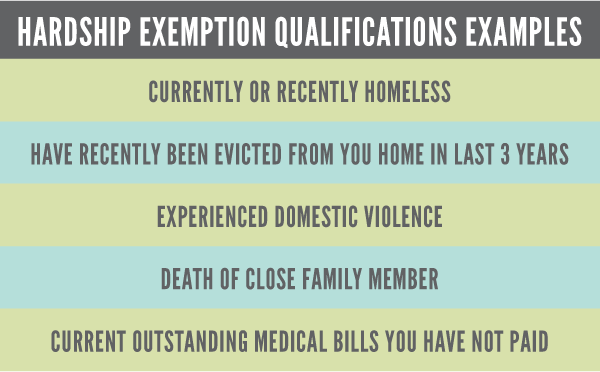

Combined social and private health insurance versus catastrophic out of pocket payments for private hospital care in Greece springermedizinde Skip to main content. Catastrophic health insurance is an inexpensive coverage option designed to protect you from major medical expenses. Hardship exemptions are given to those who cannot afford health insurance or face another obstacle to getting coverage like homelessness.

Drawing evidence from Greece a country with huge fiscal problems that has suffered the consequences of the economic crisis more than any other could be a starting point for policymakers to consider the perspective of SHI-PHI co-operation against OOP. Catastrophic health insurance is a type of health plan that offers coverage in times of emergencies as well as coverage for preventive care. In exchange for a low premium youll have a high deductible and pay most of your medical costs out of pocket until you reach it.

There have actually been objections that the modifications will certainly trigger several individuals to drop their private health insurance causing an additional problem on the public healthcare facility system and a rise in costs for those who stick with the private system. Many types of catastrophic health insurance also cover a certain number of visits to your primary physician as well as preventive care like flu shots and annual checkups or screenings. These plans have low monthly premiums but very high deductibles.

They may be an affordable way to protect yourself from worst-case scenarios like getting seriously sick or injured. Catastrophic health insurance is a type of medical coverage open to people under 30 and adults of any age who have a government-approved general hardship exemption. But you pay most routine medical expenses yourself.

You pay for any emergency medical care you receive until you meet your deductible and most preventive care is covered at 100. Andor Aetna Life Insurance Company. Catastrophic plans have low monthly payments but a high deductible.

A deductible is the amount you pay for health care services before your insurance starts to pay. You are only eligible if you are under the age of 30 or if you qualify for a hardship exemption. Dental PPO and dental indemnity insurance plans are underwritten andor administered by Aetna Life Insurance.

Private health insurance purchased on your own not through an employer is significantly more expensive. Catastrophic health insurance plans are designed for people who are under 30 or who meet hardship requirements. Employer-based coverage continues to be the most common followed by 19 of Americans with Medicaid and 17 with Medicare.

This is a type of high-deductible health plan for people under 30 or those who qualify for a hardship exemption Catastrophic plans are designed to protect you in a worst-case scenario. The rest may have coverage through a public or government program like Medicaid or Medicare. A catastrophic health insurance plan is a private plan that comes with a low monthly premium and high deductible.

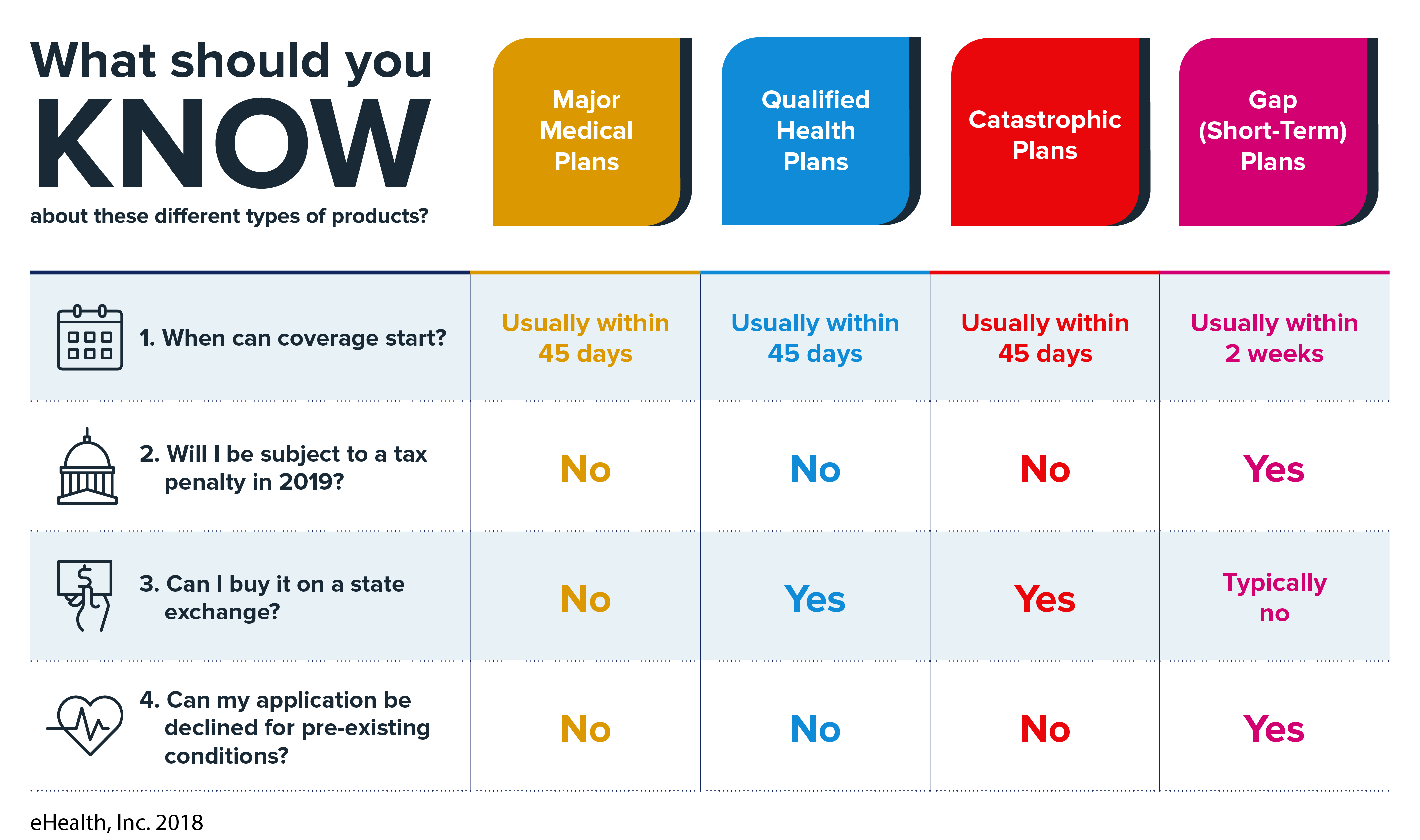

Different Types Of Health Insurance Plans

Different Types Of Health Insurance Plans

Pdf Private Health Insurance Implications For Developing Countries

Pdf Private Health Insurance Implications For Developing Countries

Skilled Tips We All Need To Know About Medical Insurance

Skilled Tips We All Need To Know About Medical Insurance

Pdf Catastrophic Spending On Health Care In Brazil Private Health Insurance Does Not Seem To Be The Solution Semantic Scholar

Pdf Catastrophic Spending On Health Care In Brazil Private Health Insurance Does Not Seem To Be The Solution Semantic Scholar

What Is Catastrophic Health Insurance And Do I Qualify

What Is Catastrophic Health Insurance And Do I Qualify

/how-does-health-insurance-work-f7aa9125e51f4f6698b38789ff3929c3.png) How Does Health Insurance Work

How Does Health Insurance Work

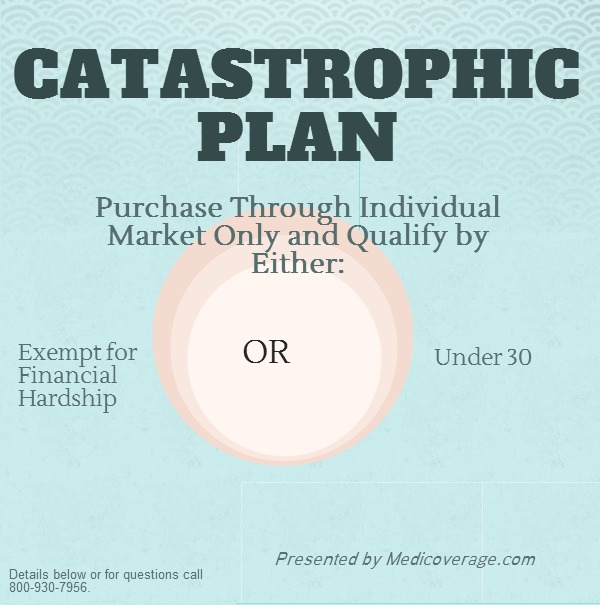

Catastrophic Plans Healthcare Exchange Medicoverage Com

Catastrophic Plans Healthcare Exchange Medicoverage Com

Metallic Health Plan Levels Under Obamacare

Metallic Health Plan Levels Under Obamacare

What Is Catastrophic Health Insurance My Private Health Insurance

What Is Catastrophic Health Insurance My Private Health Insurance

Catastrophic Health Insurance Definitions Plan Costs

Catastrophic Health Insurance Definitions Plan Costs

Comments

Post a Comment