Featured

- Get link

- X

- Other Apps

What Is Commercial Prescription Drug Insurance

It includes both brand-name and generic prescription medications approved by the US. Depending on the chosen program you can partially or completely protect yourself from unforeseen expenses.

Understanding Commercial Prescription Drug Insurance Ipa

Understanding Commercial Prescription Drug Insurance Ipa

Prescription drug insurance is similar to medical insurance.

What is commercial prescription drug insurance. Commercial prescription drug insurance covers a portion of the cost of medications prescribed by a doctor and filled by a pharmacy. Commercial prescription drug insurance is a policy that is designed to cover part of the cost of medications prescribed by a doctor and which are filled by a pharmacy. Depending on the tier of your prescription drug you may owe a copay for your medication or you may pay coinsurance after meeting your deductible.

Depending on the chosen program you can partially or completely protect yourself from unforeseen expenses. Most commercial health insurance plans include commercial prescription drug insurance as a policy segment. A health insurance plan that an individual purchases through their employer from private insurers for instance would be a form of commercial health insurance.

Food and Drug Administration FDA. The drug must not appear on the excluded drug list. Must cover at least two drugs from specific prescription drug categories.

Also known as private health insurance commercial health insurance is any type of health insurance that is not offered and managed by a government entity. Prescription insurance pays a portion of your physician prescribed medications while the non-covered proportion is normally referred to as a copay. The reimbursement percentage will vary depending on the chosen policy.

Copay coupons typically will only work if you have commercial insurance so most of these will NOT work if you are uninsured have Medicare part D or have Medicaid. The Drug Pricing tool can help you compare prices for specific drugs at pharmacies near you. Must cover 95 of the cost of covered medications together with Original Medicare after you pay 6550 in out-of-pocket costs for the year leaving you to pay just 5 of your drug costs when you reach that catastrophic coverage level.

Most commercial health insurance plans including those for prescription drug insurance work the same way. Medications are listed by common categories or classes and placed in tiers that represent the cost you pay out-of-pocket. What is commercial prescription drug insurance is a tool to reduce your risks.

What is Prescription Insurance. That means that even Americans who are enrolled in a plan with prescription drug coverage may incur substantial out-of-pocket costs. Commercial prescription drug insurance plans are provided by for-profit or non-profit organizations to pay some or most of the costs of medications prescribed by a doctor.

Pharmacy benefits and services from Aetna can help individuals and families make the best choices for their health and budget. And if the accident insurance event occurs the insurance company will bear all or all of the costs in full or in part. If you have commercial drug insurance you may be able to lower your prescription drug cost through a copay coupon this is also referred to as a copay assistance program.

The percentage usually ranges between 70 and 100 until you reach the yearly maximum. You or your employer pay a premium and then you pay a copay or a deductible or coinsurance when you fill a prescription. Learn more about the coverage and benefits offered by Aetnas pharmacy plans including prescription drug home delivery and condition support programs.

And these costs can be from 100 to several. But as drug prices rise many insurance companies have put more restrictions on what they will and will not cover. Commercial prescription drug insurance is a tool to reduce your risks.

And if the accident insurance event occurs the insurance company will bear all or all of the costs in full or in part. Most commercial health insurance plans already include commercial prescription drug insurance as part of the policy. Prescription drug coverage is a significant part of a comprehensive health insurance plan.

Commercial health insurance is health insurance provided and administered by non-governmental entities. Be covered by a provincial health insurance with prescription drugs. The drug must be prescribed by a physician.

In most private prescription plans participants pay a monthly premium a co-pay for services and have an annual deductible. The PDL is a list of the most commonly prescribed medications. And these costs can be from 100 to several tens or even hundreds of thousands of dollars.

Companies that sell this type of insurance are for-profit corporations and offer their insurance services through group insurance plans as well as individual or personal plans. It can cover medical expenses and disability income for the insured. When an individual signs up they should already have an idea of what their plan.

What Is Commercial Prescription Drug Insurance. If you are insured through a large employer group plan prescription drug coverage may be a separately-administered plan or integrated with your medical insurance. Cant have a deductible of more than 445 in 2021.

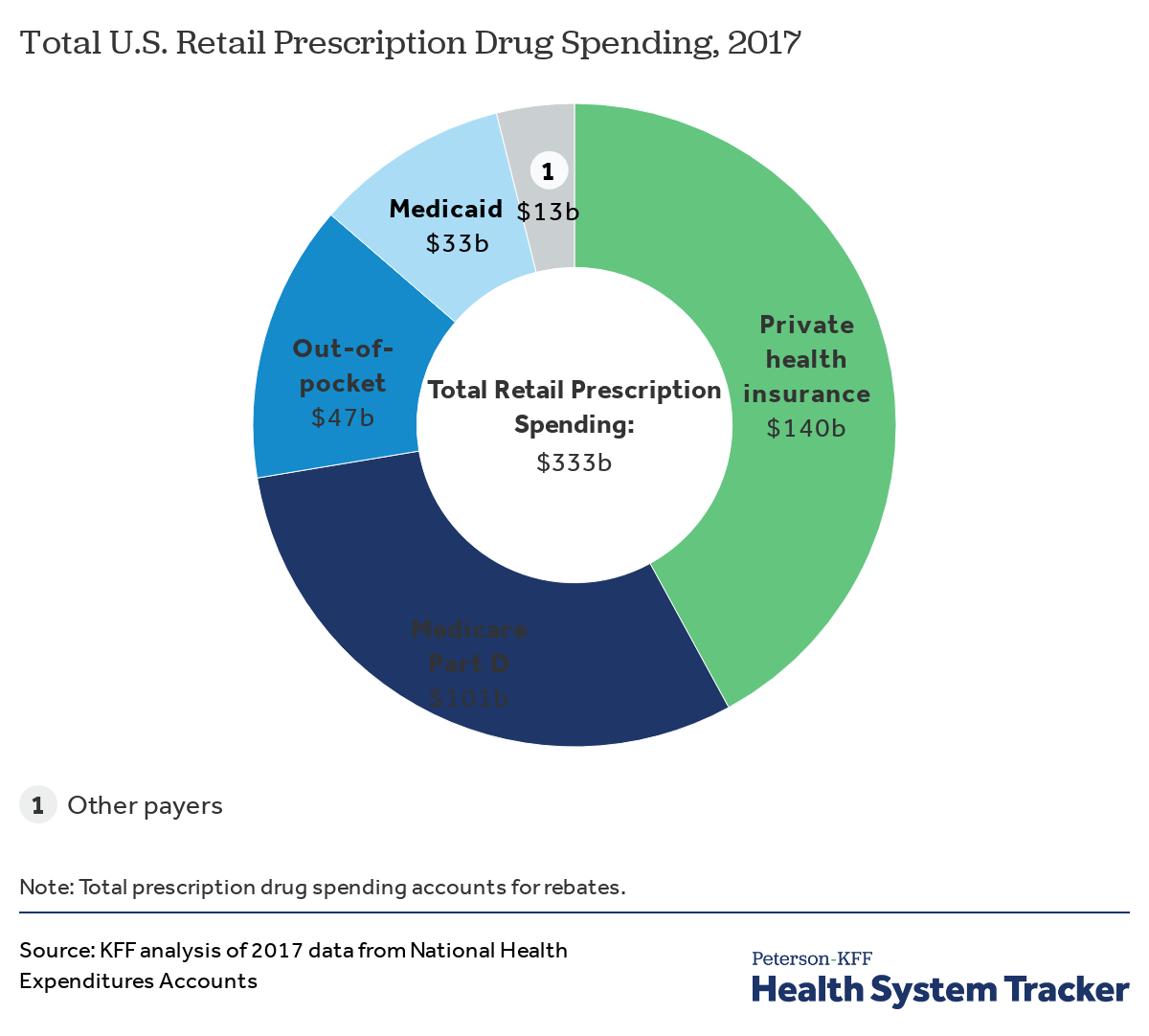

How Does Prescription Drug Spending And Use Compare Across Large Employer Plans Medicare Part D And Medicaid Peterson Kff Health System Tracker

How Does Prescription Drug Spending And Use Compare Across Large Employer Plans Medicare Part D And Medicaid Peterson Kff Health System Tracker

Pricing And Payment For Medicaid Prescription Drugs Kff

Pricing And Payment For Medicaid Prescription Drugs Kff

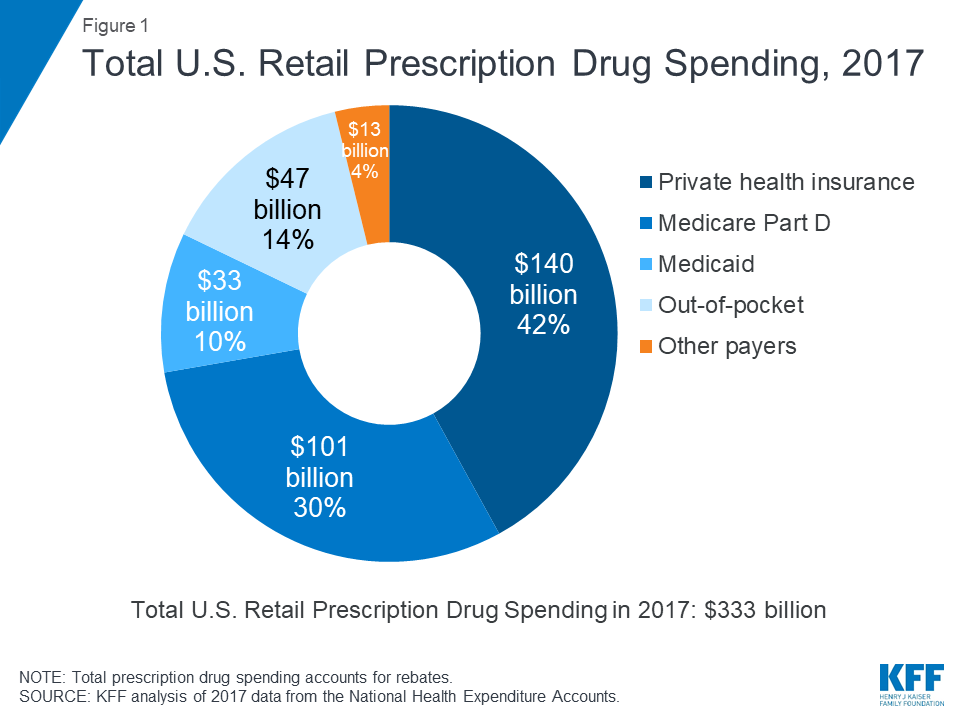

How Does Prescription Drug Spending And Use Compare Across Large Employer Plans Medicare Part D And Medicaid Kff

How Does Prescription Drug Spending And Use Compare Across Large Employer Plans Medicare Part D And Medicaid Kff

Impact Of Deductibles In Health Plans

Impact Of Deductibles In Health Plans

Understanding Commercial Prescription Drug Insurance Ipa

Understanding Commercial Prescription Drug Insurance Ipa

Getting The Most Out Of Commercial Drug Insurance The Diabetes Prescription

Getting The Most Out Of Commercial Drug Insurance The Diabetes Prescription

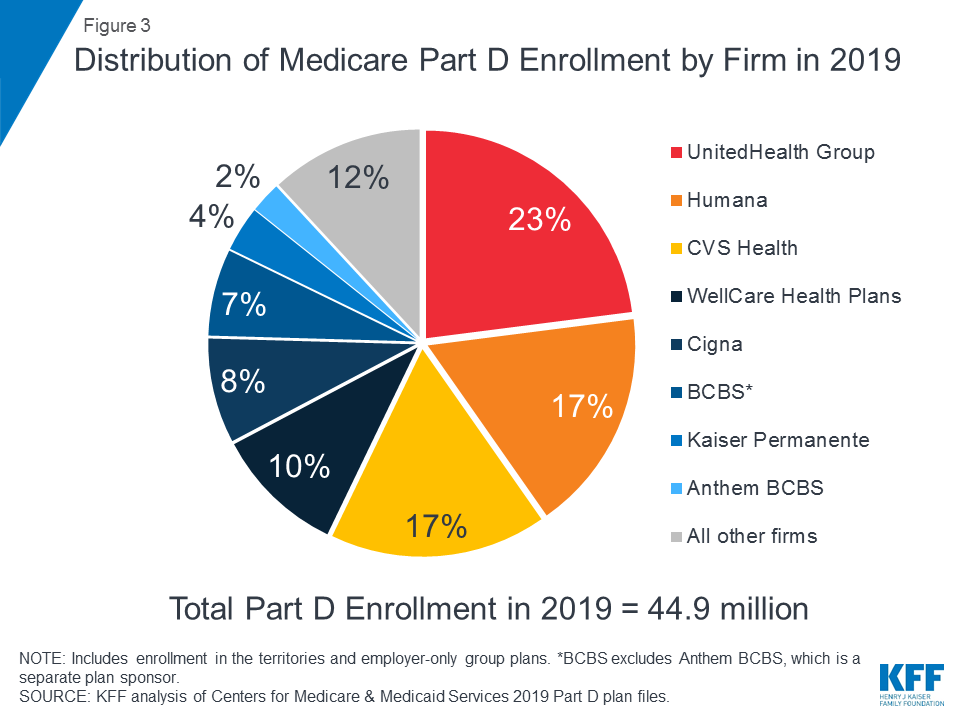

10 Things To Know About Medicare Part D Coverage And Costs In 2019 Kff

10 Things To Know About Medicare Part D Coverage And Costs In 2019 Kff

![]() How Does Prescription Drug Spending And Use Compare Across Large Employer Plans Medicare Part D And Medicaid Peterson Kff Health System Tracker

How Does Prescription Drug Spending And Use Compare Across Large Employer Plans Medicare Part D And Medicaid Peterson Kff Health System Tracker

Will Your Insurance Pay For Your Prescription Drugs Here S How To Find Out Diatribe

Will Your Insurance Pay For Your Prescription Drugs Here S How To Find Out Diatribe

Prescription Drug Coverage Cvs Health

Prescription Drug Coverage Cvs Health

Understanding Commercial Prescription Drug Insurance Ipa

Understanding Commercial Prescription Drug Insurance Ipa

Payer 101 Three Things Every Healthcare Market Researcher Should Know Access Insights

Payer 101 Three Things Every Healthcare Market Researcher Should Know Access Insights

Understanding Commercial Prescription Drug Insurance Ipa

Understanding Commercial Prescription Drug Insurance Ipa

Comments

Post a Comment