Featured

Blue Cross Blue Shield Out Of Pocket Maximum

The information includes both in- and out-of-network claims if applicable. Out-of-Pocket Maximum The most you pay for covered health care services during your plans calendar year.

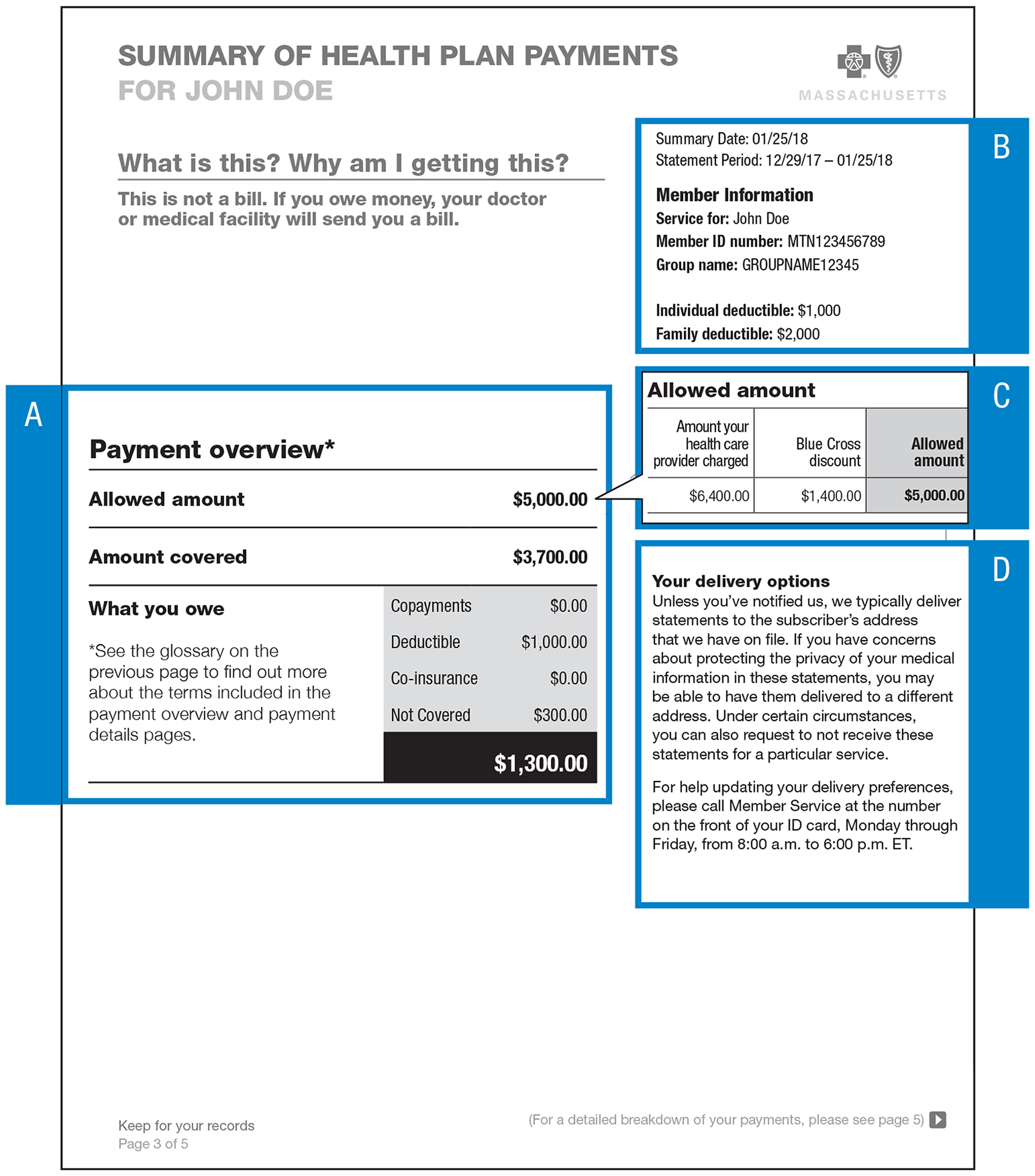

Summary Of Health Plan Payments Myblue

Summary Of Health Plan Payments Myblue

If you are a current BCBSMT member you can see what your plans OOPM is within Blue.

Blue cross blue shield out of pocket maximum. If your plan covers more than one person you may have a family out-of-pocket max and individual out-of-pocket maximums. Whenever the next plan year begins your coinsurance and deductible reset. When youve paid 5000 out of your pocket toward your medical costs your plan covers 100 of your costs until your plan year renews.

Member pays copayscoinsurance toward out-of-pocket maximum. The out-of-pocket maximum is the most you could pay for covered medical services andor prescriptions each year. Once you reach your out-of-pocket max your plan pays 100 percent of the allowed amount for covered services.

Member pays toward deductible. The out-of-pocket maximum does not include your monthly premiums. For 2015 the highest OOPM a plan can have is 6600 for individuals and 13200 for families.

If you selected a bronze plan your OOPM will be closer to 6000 and if you purchased a gold or platinum plan your OOPM. It typically includes your deductible coinsurance and copays but this can vary by plan. All of your covered expenses go toward this maximum.

Out-of-pocket maximum of 5000. The out-of-pocket maximum also called OOPM is the most you will have to pay out of your own pocket for expenses under your health insurance plan during the year. Maximum out-of-pocket MOOP expenses for specific individual members or the entire family.

When the amount of coinsurance youve paid reaches 6000 the plan covers 100 until your plan year renews. Calendar Year Out-of-Pocket Maximum 6850 per Member 13700 per Family 9850 per Member 19700 per Family Maximum Lifetime Benefits Maximum Blue Shield Payment Services by Preferred Participating and Other Providers 4 Services by Non-Preferred and Non-Participating Providers Lifetime Benefit Maximum No maximum. Health plan pays 100 of all medical expenses moving forward.

If you go out of your network for services those expenses may not count toward your OOPM so you could have to pay more. Deductibles Coinsurance and Out-of-pocket maximum. 3 The standard deductible and out-of-pocket maximum for this plan are 6 shown.

An out-of-pocket maximum is the annual limit on the amount of money that you would have to pay for health care services not including monthly premiums. The OOPM is different for every type of plan. The out-of-pocket maximum is what you pay during a policy period before your health insurance plan begins paying 100 percent of your covered medical expenses.

When the deductible coinsurance and copays for one person reach the individual maximum your plan then pays. You must pay 4000 toward your medical costs before your plan begins to cover costs. After that your plan covers 80 of the costs and you pay the other 20.

After the maximum is reached all covered health services are paid in full by the health plan for the rest of that plan year. If you are a current BCBSOK member you can see what your plans OOPM is within Blue Access for Members. When one covered family member Self Plus One and Self and Family contracts reaches the Self Only maximum during the calendar year that members claims will no longer be subject to associated member cost-share amounts for the remainder of the year.

The government can change this each year and the maximum OOP cannot go over this amount. All remaining family members will be required to meet the balance of the catastrophic protection out-of-pocket. Your health plan has a.

Once you reach the maximum your health care plan pays 100 toward covered services and you dont pay anything. The out-of-pocket maximum also called OOPM is the most you will have to pay out of your own pocket for expenses under your health insurance plan during the year. To view the report members can follow these easy steps.

Out-of-pocket maximum of 6000. You are once again responsible for the 4000 deductible and 30 coinsurance for that year. The reports available in both PDF and Excel formats can be quickly and easily downloaded or printed.

A plan is good for 1 year. After you pay the 4000 deductible your plan covers 75 of the costs and you pay the other 25. You must pay the first 5000 of your medical costs.

You must pay all the costs up to the deductible amount You must pay all the costs up to the deductible amount before this plan begins to pay for covered services you use. Know your out-of-pocket maximum All plans have them.

Oop Out Of Pocket Maximum Deductible Co Pay Participating Providers

Oop Out Of Pocket Maximum Deductible Co Pay Participating Providers

Out Of Pocket Maximums Copayments Coinsurance Bcbs Of Wny

Out Of Pocket Maximums Copayments Coinsurance Bcbs Of Wny

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

What Is An Out Of Pocket Maximum Blue Cross And Blue Shield Of Texas

What Is An Out Of Pocket Maximum Blue Cross And Blue Shield Of Texas

Summary Of Health Plan Payments Myblue

Summary Of Health Plan Payments Myblue

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

Medical Insurance 90 70 Ppo Kent State University

Medical Insurance 90 70 Ppo Kent State University

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Understanding Deductibles Out Of Pocket Maximums Health Insurance

What Is An Out Of Pocket Maximum Bluecrossmn

What Is An Out Of Pocket Maximum Bluecrossmn

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Out Of Pocket Maximums Copayments Coinsurance Bcbs Of Wny

Out Of Pocket Maximums Copayments Coinsurance Bcbs Of Wny

Comments

Post a Comment