Featured

- Get link

- X

- Other Apps

Update Income Covered California

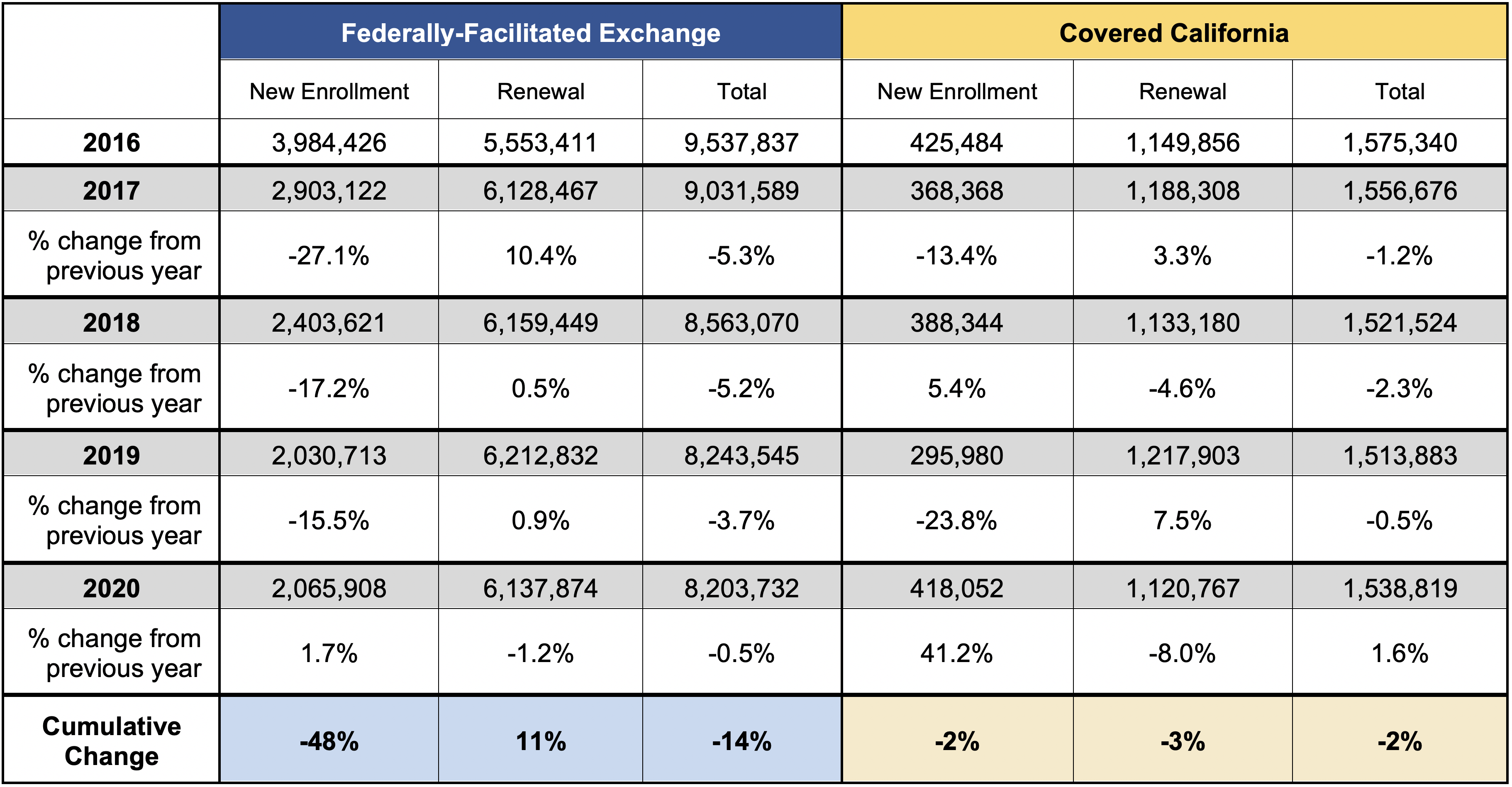

Covered California said that on average exchange enrollees who plan to renew for 2021 can save 73 on premiums by switching to the least expensive plan in the same tier of coverage. Changes in household income size and where you live can all have an impact on your monthly premium and how much financial help you can receive.

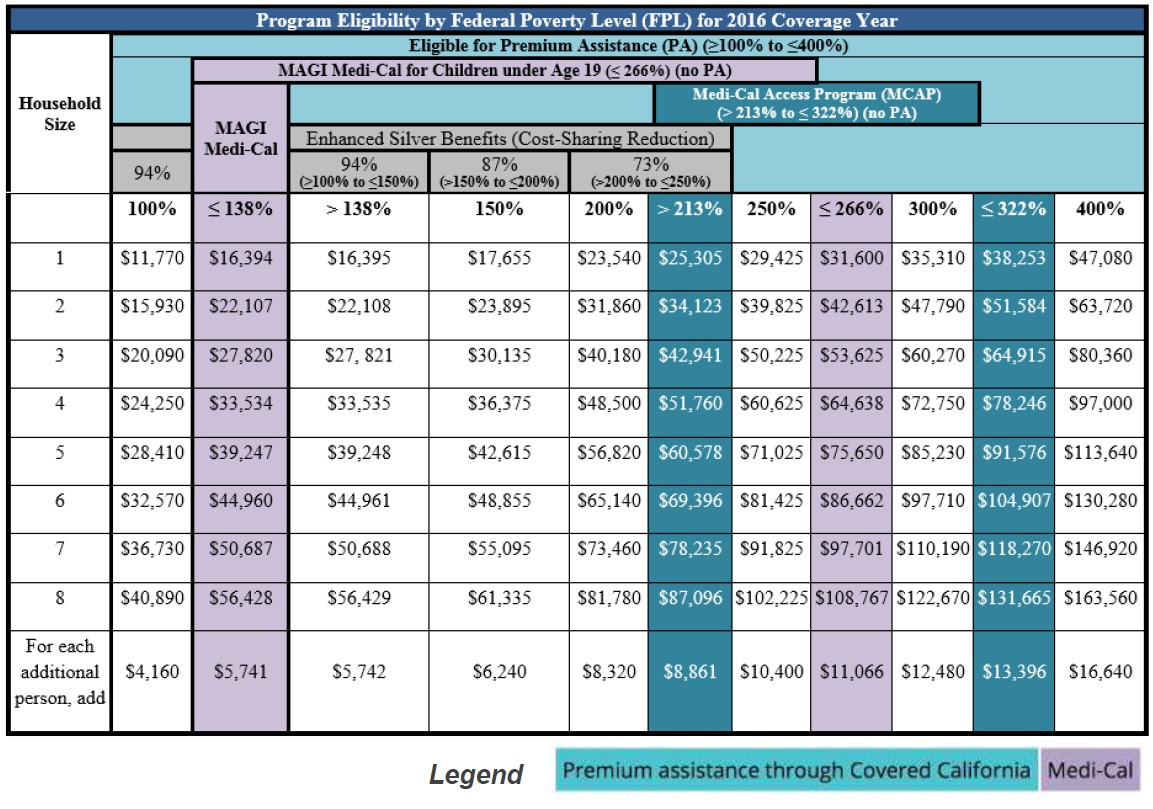

Https Hbex Coveredca Com Toolkit Webinars Briefings Downloads Fpl Webinar Slides Final Pdf

Medi-Cal Eligibility and Covered California - Frequently Asked Questions.

Update income covered california. Back to Medi-Cal Eligibility. Alternatively if you used an insurance agency you can call them for assistance in updating. Below you will find the most frequently asked questions for current and potential Medi-Cal coverage recipients.

Report changes keep plan up-to-date If you experience a change to your income or household like a pay raise a new household member or a dependent getting other coverage you must update your Marketplace application. It is important to report income changes to Covered California that impact the amount of premium assistance or tax credits that you receive. However if your income increases you may receive too much premium assistance and may be required to repay.

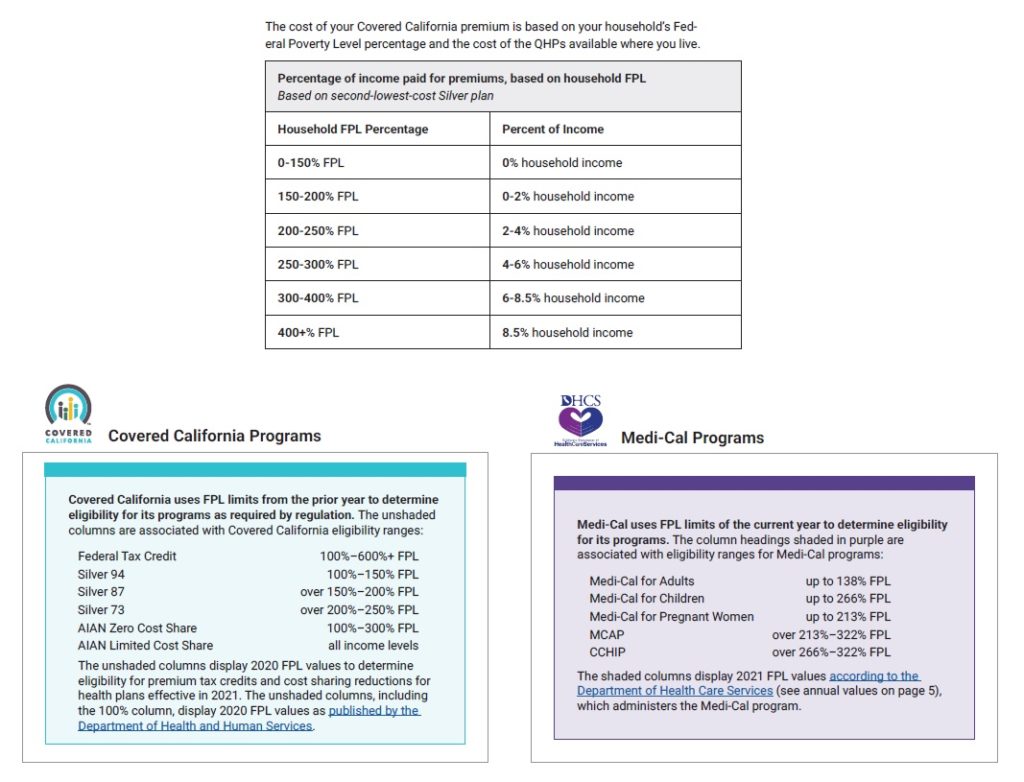

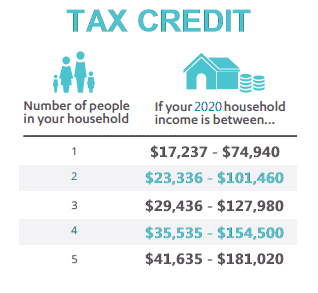

0rglilhggmxvwhgurvvqfrph 0 ruprvwshrsoh 0zlooehwkhgmxvwhgurvvqfrph wkdwlvrqrxuihghudowduhwxuq 6lqfhrxduhsuhglfwlqjlqfrphiruwkhixwxuh lwlv. In order to qualify for federal tax credits or a subsidy in California you must make between 0-600 of the FPL. 2020 Individual Product Prices for all Health Insurance Companies.

Dont forget to update your account. If your income decreases you may qualify to receive a higher amount of premium assistance and reduce your out-of-pocket expenses even more. Taxes or they need help with tax attestation they may contact their Covered California Certified Enroller.

Improving Access Affordability and Accountability. First call or visit your local county Medi-Cal office to report your change s Then if you or any member of your household is eligible for a Covered CA plan call Covered CA to confirm andor update your plan selection. 2019 Covered California Data.

You can assist them via. Can anyone get Covered California. December 2019 Tax News Update on the new Minimum Essential Coverage Individual Mandate The Franchise Tax Board and Covered California are working together to administer the new Minimum Essential Coverage Individual Mandate Senate Bill 78 Ch.

Covered California Holding Health Plans Accountable for Quality and Delivery System Reform. To report changes call Covered California at 800 300-1506 or log in to your online account. Covered Californias First Five Years.

If you do not find an answer to your question please contact your local county office from our County Listings page or email us at. It is your responsibility to report this change to Covered California. 2019 otherwise known as the health care mandate which takes effect January 1 2020.

Are you a Covered California member. Please contact Covered Californias Ombudsman Darryl Lewis at 916 228-8327 darryllewiscoveredcagov. If you make 601 of the FPL you will be ineligible for any subsidies.

Consequently it is important to report the income change. Update your health plan. When you enroll on.

Log in or Create an Account to Get Covered. The 2021 rates are subject to final review by the Department of Managed Health Care and the Department of Insurance but significant changes are unlikely. In order to be eligible for assistance through Covered California you must meet an income requirement.

You can also find a Licensed Insurance Agent Certified Enrollment Counselor or county eligibility worker who can provide free assistance in your area. Get help over the phone 800 787-6921. Add any foreign income Social Security benefits and interest that are tax-exempt.

Reporting Income OCTOBER 2016 WWWCONSUMERSUNIONORG How to Report Your Income When You Apply for Financial Help from Covered California for 2017. If your income is verified as eligible for premium assistance and then later you become Medi-Cal eligible you do not have to repay the premium assistance you received as long as you report the income change within 30 days. You can start by using your adjusted gross income AGI from your most recent federal income tax return located on line 8b on the Form 1040.

Certified Enrollment Counselors. Some changes will qualify you for a Special Enrollment Period allowing you to change your plan. 10 million in subsidies for a relatively small group of Californians who earn between 0 and 138 percent of the federal poverty level up to about 17000 a year for individuals yet must obtain.

This way you can be switched to the appropriate program. Then add or subtract any income changes you expect in the next year. Heres some additional information relating to the IRS.

Keep in mind that Tax deductions can lower your income level and. Covered Californias answer is Generally no.

Covered California Updates Income Reporting Former Foster Youth

Covered California Updates Income Reporting Former Foster Youth

When Do Medi Cal And Covered California Implement The New Fpl Chart Each Year Health For California Insurance Center

When Do Medi Cal And Covered California Implement The New Fpl Chart Each Year Health For California Insurance Center

Covered California Income Tables Imk

Covered California Income Tables Imk

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

How To Get The Most 2018 Covered California Tax Credit

How To Get The Most 2018 Covered California Tax Credit

Covered California Q A Covered California Archives

Covered California Q A Covered California Archives

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Revised Covered California And Medi Cal Income Table For 2021 Arp

Reporting Changes Yourself Health For California Insurance Center

Reporting Changes Yourself Health For California Insurance Center

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

2021 Covered California Renewal And Open Enrollment Changes

2021 Covered California Renewal And Open Enrollment Changes

Https Hbex Coveredca Com Toolkit Renewal Toolkit Downloads 2016 Income Guidelines Pdf

Updated Countable Sources Of Income Covered California 2020

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Comments

Post a Comment