Featured

- Get link

- X

- Other Apps

What Is A Surety Bond California

We offer same-day quoting and issue of vehicle title bonds. Through this bond the Surety is guaranteeing that the Principal will faithfully and honestly perform his or her legal obligations as a conservator.

Http Www Insurance Ca Gov 0250 Insurers 0300 Insurers 0200 Bulletins Bulletin Notices Commiss Opinion Upload Instructionsforexecutionofsuretybonds Certifateofauthorityorcertificateofexemption Pdf

A Surety Bond is a type of agreement that provides a financial guarantee to the party awarding a job to a company.

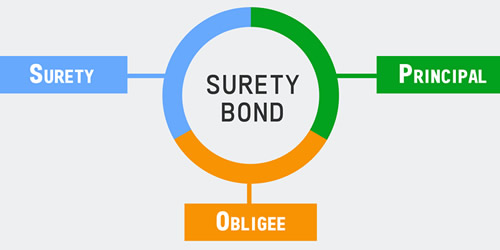

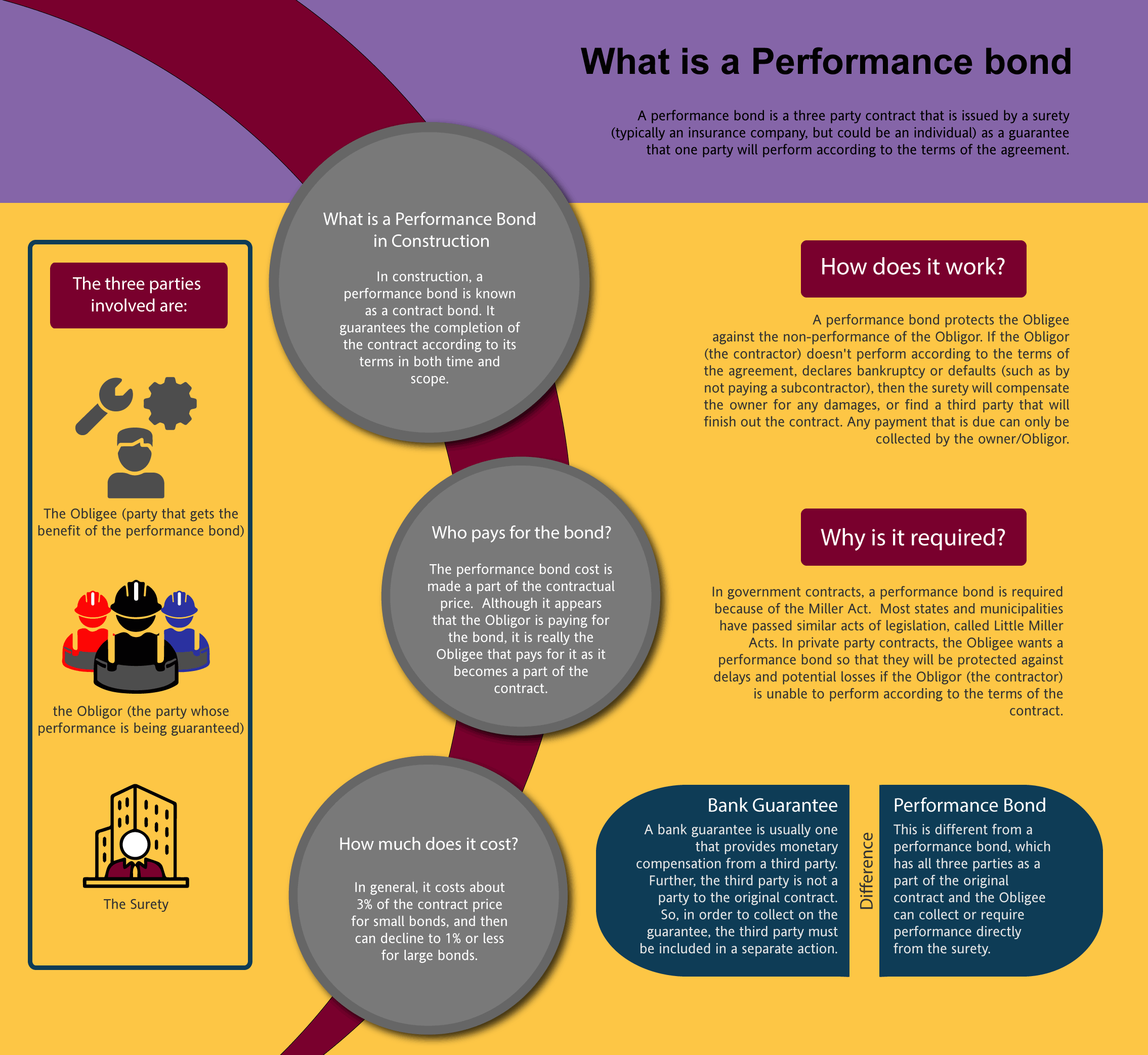

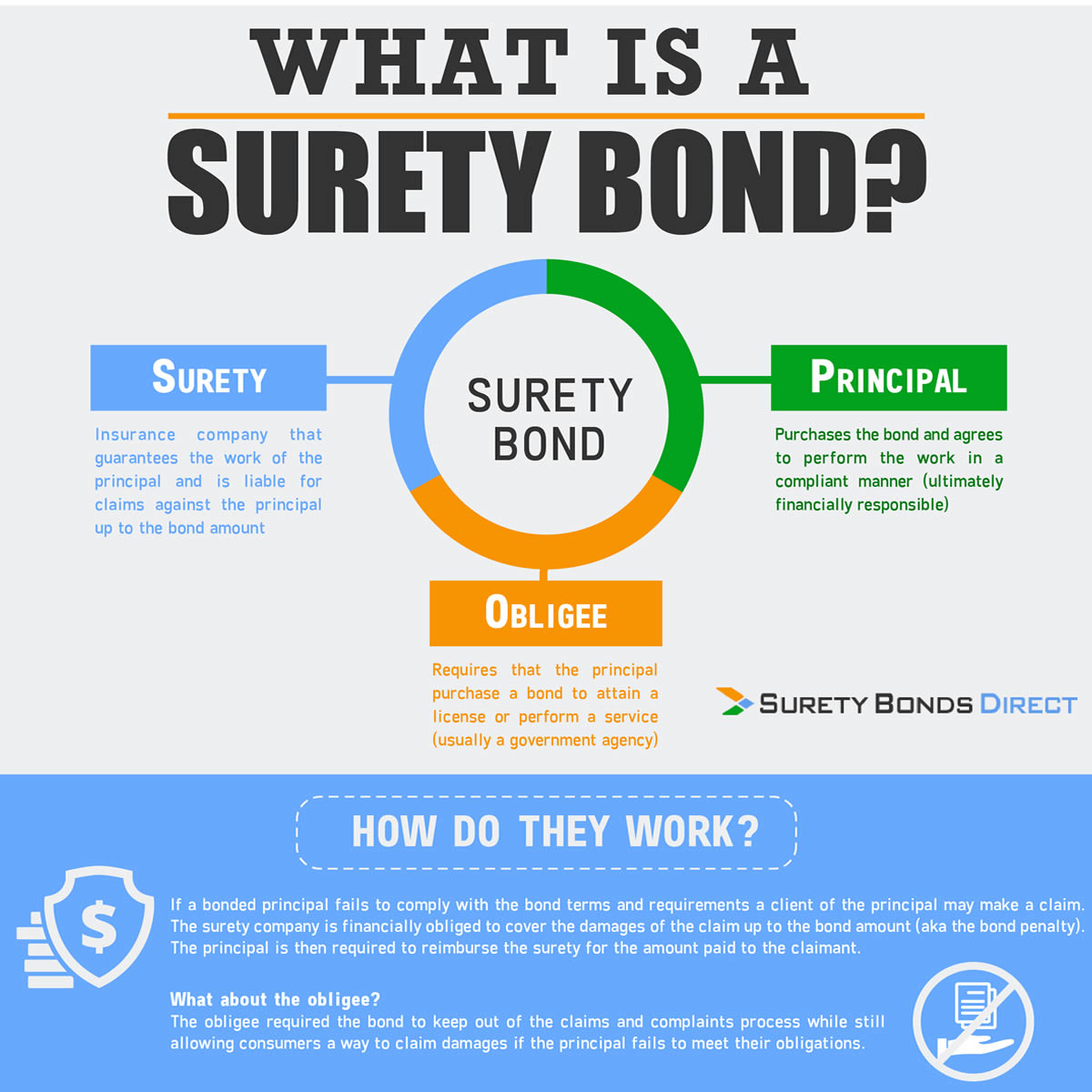

What is a surety bond california. If you need a bond for filing with the Secretary of State the bond form is listed on the Forms and Fees page with the corresponding descriptive title. A surety bond is a financial guarantee between 3 parties that ensures contractual completion and fulfillment of obligations by principals and obligees. Principal Surety and Obligee.

This applies to those who want to open a car dealership become freight brokers or mortgage brokers or open a medical marijuana dispensary to name a few. What is a Surety Bond. For bonds greater than 500000 the information required progresses.

For bonds under 500000 all that is usually required is a bond application plus a copy of the contract. Vehicle is nontransferable goldenrod. California surety bond leader Surety One Inc.

Owners of businesses in the state of California that require licensing will need to obtain license bonds. Various types of professions need to have a bond on file with the Secretary of State. California requires the amount of defective title bonds to be equal to the Kelley Blue Book appraisal amount.

Surety is a unique type of insurance because it involves a three-party agreement. The bond protects the customer by guaranteeing that the company or bond principal the person or entity that buys the bond will register the vehicle and pay all taxes and fees required by law. Required if you own a vehicle with insufficient proof of ownership in California.

Value of the vessel is 2000 or more. If someone comes forward later on and says that they are the owner of the vehicle and that you should not have been granted a bonded title they can make a. A Motor Vehicle Ownership Surety Bond REG 5057 form or a bond alternative must be submitted when the required supporting evidence of ownership is not available and at least one of the following conditions exist.

A defective title surety bond allows applicants to get a bonded title for a vehicle when there is insufficient evidence of ownership. The surety provides a financial guarantee to the obligee ie. Government that the principal business owner will fulfill their obligations.

If the Principal commits any act that is against the California Probate Code or the guidelines. The entity providing the guarantee on your companys behalf that you will finish the job as promised is referred to as the Surety. Learn more about the California bonded title process below.

However the Secretary of States office cannot advise you as to whether or not your business must have a bond. It also ensures that the registration service does not cause any loss to the people of California because of the operation of the registration service. With access to a broad range of surety markets our expert agents are ready to assist with all of your California title bond needs.

A surety bond is a promise by a surety or guarantor to pay one party the obligee a certain amount if a second party the principal fails to meet some obligation such as fulfilling the terms of a contract. Required if you operate as a freight broker or freight forwarder in South Dakota. The three parties in a surety agreement are.

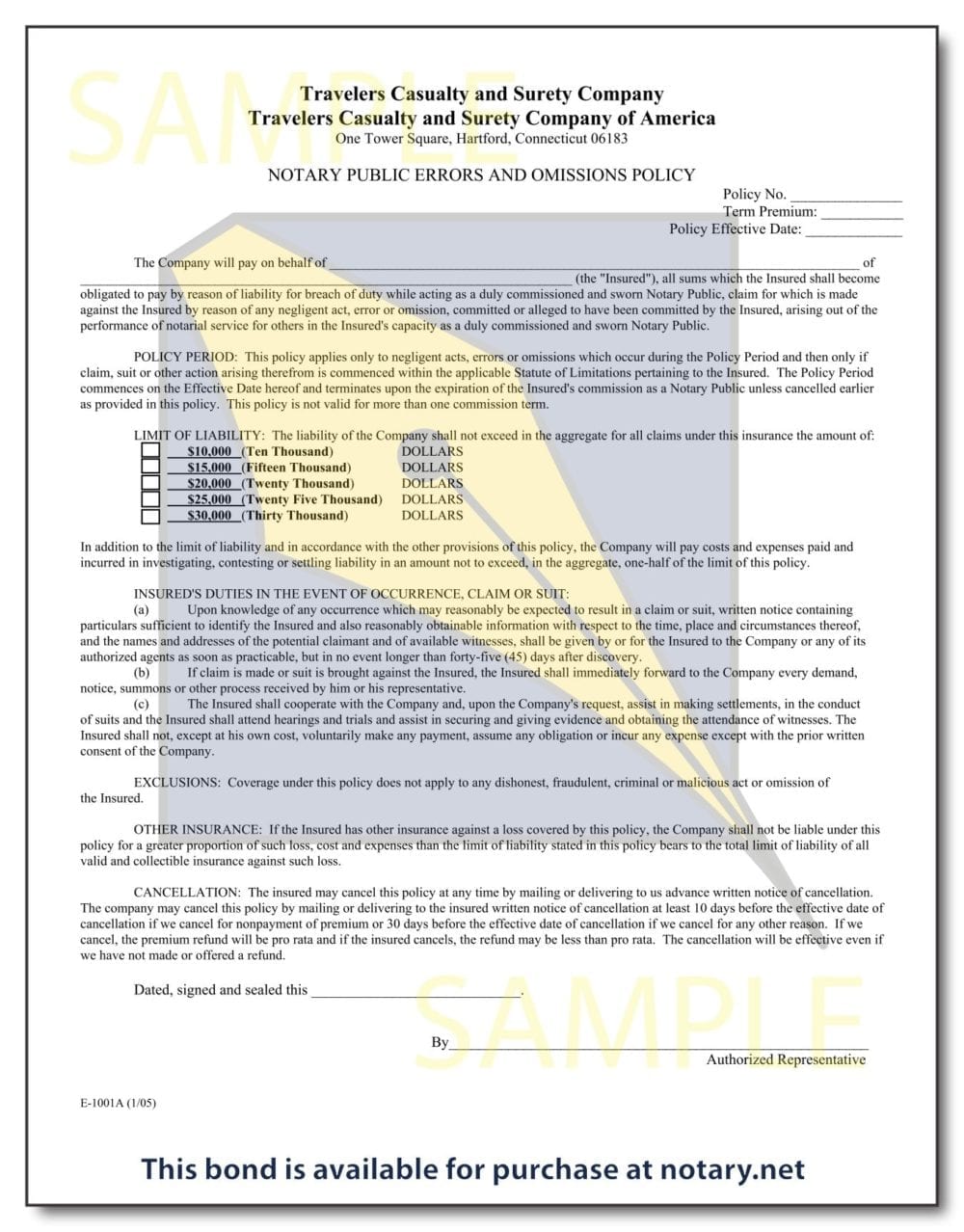

A surety bond is simply an agreement between three parties. A surety bond pronounced shur -ih-tee bond can be defined in its simplest form as a written agreement to guarantee compliance payment or performance of an act. The surety bond protects the obligee against losses resulting from the principals failure to meet the obligation.

Lance Surety Bonds underwrites all types of surety bonds in California. Questions about this surety bond. What is a Surety Bond.

Required for individuals who construct or alter any structure contracted for 500 or more. The requirements for getting a California surety performance bond are not that strict. ConstructionBondca What is a Surety Bond.

From financial statement information to personal financial statement to work-in-progress reports etc. Surety Bond Professionals is a family-owned and operated bonding agency with over 30 years of experience. The surety bond is there to protect any previous owners of the vehicle and the California DMV.

Value of the vehicle is 5000 or more. Is a specialist in the bonding needs of the motor vehicle industry.

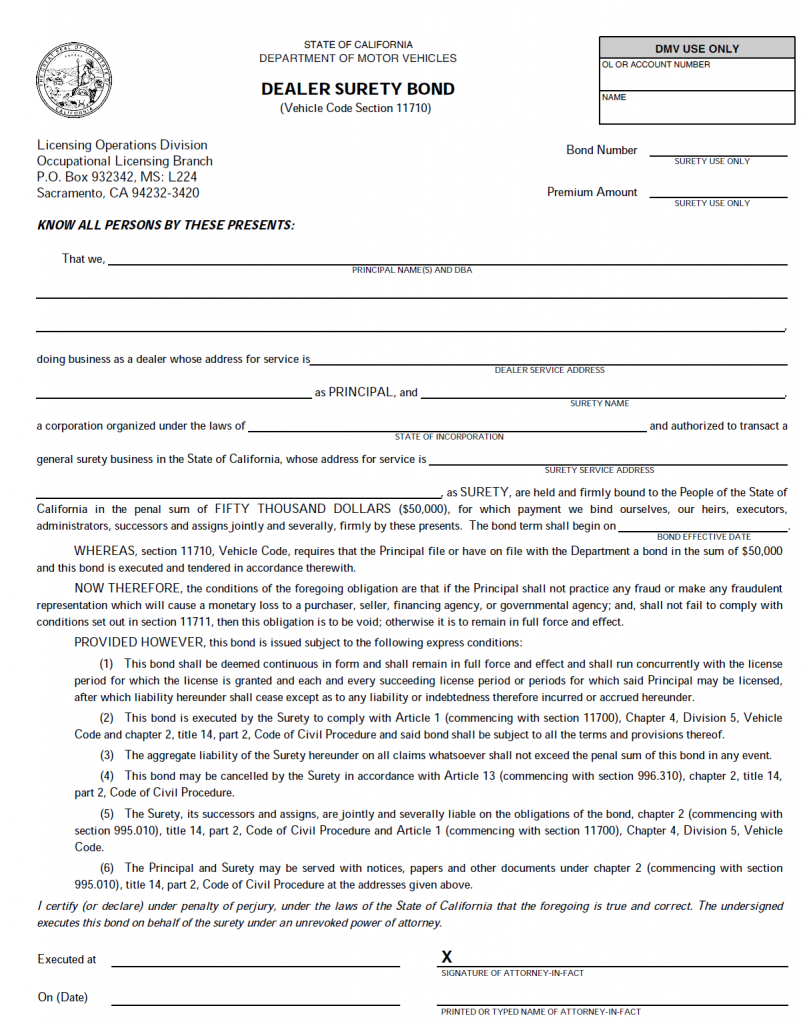

California Defective Title Motor Vehicle Surety Bond Motor Car Fifty States Bond

California Defective Title Motor Vehicle Surety Bond Motor Car Fifty States Bond

) View Document California Code Of Regulations

View Document California Code Of Regulations

10 000 California Insurance Broker Bond Bond Republic

10 000 California Insurance Broker Bond Bond Republic

Surety Bond Form Anatomy Explained Like Never Before

Surety Bond Form Anatomy Explained Like Never Before

California Motor Vehicle Ownership Bond Fast Approval

California Motor Vehicle Ownership Bond Fast Approval

What Is A Surety Bond Surety Bonds Explained

What Is A Surety Bond Surety Bonds Explained

California Performance Bonds Swiftbonds

California Performance Bonds Swiftbonds

What Is A Surety Bond Surety Bond California Answers Sarkhosh Insurance Agency

What Is A Surety Bond Surety Bond California Answers Sarkhosh Insurance Agency

California Notary Bond 15 000 Order Online Fast Shipping Notary Net

California Notary Bond 15 000 Order Online Fast Shipping Notary Net

What Is A Surety Bond Surety Bonds Explained

What Is A Surety Bond Surety Bonds Explained

What Is A Dealer Bond Rider Your Car Dealer Bond Llc

What Is A Dealer Bond Rider Your Car Dealer Bond Llc

Comments

Post a Comment