Featured

Maximum Income To Qualify For Health Care Subsidy

How your income compares to the Federal Poverty Level. And although there is normally an income cap of 400 of the poverty level discussed in more detail below that does not apply in 2021 or 2022.

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Was ineligible for subsidies in 2021 if their income exceeded 51040.

Maximum income to qualify for health care subsidy. Thats about 47000 for an individual and 97000 for a family of four. Reducing the monthly cost of health insurance for the eligible individual. You qualify for subsidies if pay more than 85 of your household income toward health insurance.

Adjusted Gross Income AGI Your total or gross income for the tax year minus certain adjustments youre allowed to take. Use the chart below to see if youre eligible for Health First Colorado or CHP. The tax credits will be reconciled when you file your federal income taxes so try to be as accurate as possible.

2019 exemptions. To qualify for a subsidy your household income must be between 100 and 400 of the FPL. You can enroll in Marketplace health coverage through August 15.

2021 Key Subsidy Information. How to save on your monthly. Significant mid-year changes in income should be reported to Connect for Health Colorados customer service department.

Exemptions in 2018. The approved subsidy amount will provide a direct and immediate offset. Still need 2021 health coverage.

2 Start an S-Corp or LLC. For 2021 those making between 12760-51040 as an individual or 26200-104800 as a family of 4 qualify. Health care.

Minimum and maximum income for ObamaCare cost assistance are based on the Federal Poverty Level for the previous year. The catch is that these new subsidies end in two years not long after the midterm election. How much health insurance costs where you live.

Browse all topics Featured. Adjustments include deductions for conventional IRA contributions student loan interest and more. If you meet these criteria youll be eligible for a subsidy on a sliding scale based on your income.

Premiums will drop on average about 50 per person per month or 85 per policy per month. But you must also not have access to Medicaid or qualified employer-based health coverage. If you already enrolled in an ACA plan and got a subsidy you can change your plan and get the added savings.

By contrast the lower-level plans the basic ACA subsidies cover have a typical deductible of about 6900. Contribute the maximum 19500 to your 401k to reduce your. If your familys monthly gross income is above the levels in step 2 then go to step 3 below and use your familys estimated income.

Subsidies are available to individuals and families with income between 100 to 400 of the FPL chart below. You can qualify for a subsidy if you make up to four times the Federal Poverty Level. For income-based subsidy eligibility a household must have an income of at least 100 of the federal poverty level 139 percent of the federal poverty level in states that have expanded Medicaid.

The average healthcare subsidy per person is around 5000 depending on the same variables. You must make your best estimate so you qualify for the right amount of savings. The penalty for not having coverage in 2018.

Before the American Rescue Plan was enacted a single individual in the continental US. How To Take Advantage Of Health Care Subsidies 1 Maximize contribution to pre-tax retirement accounts. But for 2021 and 2022 this limit does not apply.

The richest of households sizes 1-6 that still qualify for ACA must pay 4788 13307 a year in healthcare premiums. A single person earning about 51520 or a family of four with a household income of. If youre an individual who makes about 29000 or less or a family of four that makes about 60000.

Can I get a subsidy. For 2022 coverage see our page on the maximum income for ObamaCare for 2021 - 2022. Starting a business is a way to reduce your taxable income by deducting all business related.

Marketplace savings are based on your expected household income for the year you want coverage not last years income. If you qualify you or a lawful representative must complete an application form and submit it to your long-term care home. The price tag for all the new health insurance subsidies is an estimated 34 billion.

Premium subsidies are normally available if your projected household income an ACA-specific calculation doesnt exceed 400 of the prior years poverty level. Select an article Income levels. Whose income to include in your estimate.

In general you may be eligible for tax credits to lower your premium if you are single and your annual 2020 income is between 12490 to 49960 or if your household income is between 21330 to 85320 for a family of three the lower income limits are higher in states that expanded Medicaid. In other words the maximum healthcare subsidy per person is about 7000 depending on plan household size and household income. Whats covered by the subsidy If you qualify you could get a subsidy of up to 189131 a month to help you pay for basic long-term care accommodation.

What is the maximum income to qualify for affordable care act. The main factor is your income. You will be asked about your current monthly income and then about your yearly income.

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

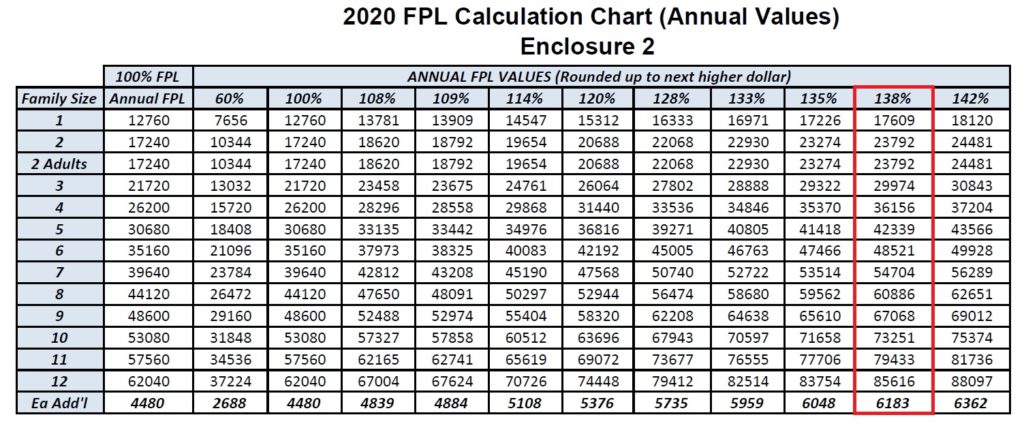

Medi Cal Income Levels For 2020

Medi Cal Income Levels For 2020

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

How The Affordable Care Act Is About To Become More Expensive Mygovcost Government Cost Calculator

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

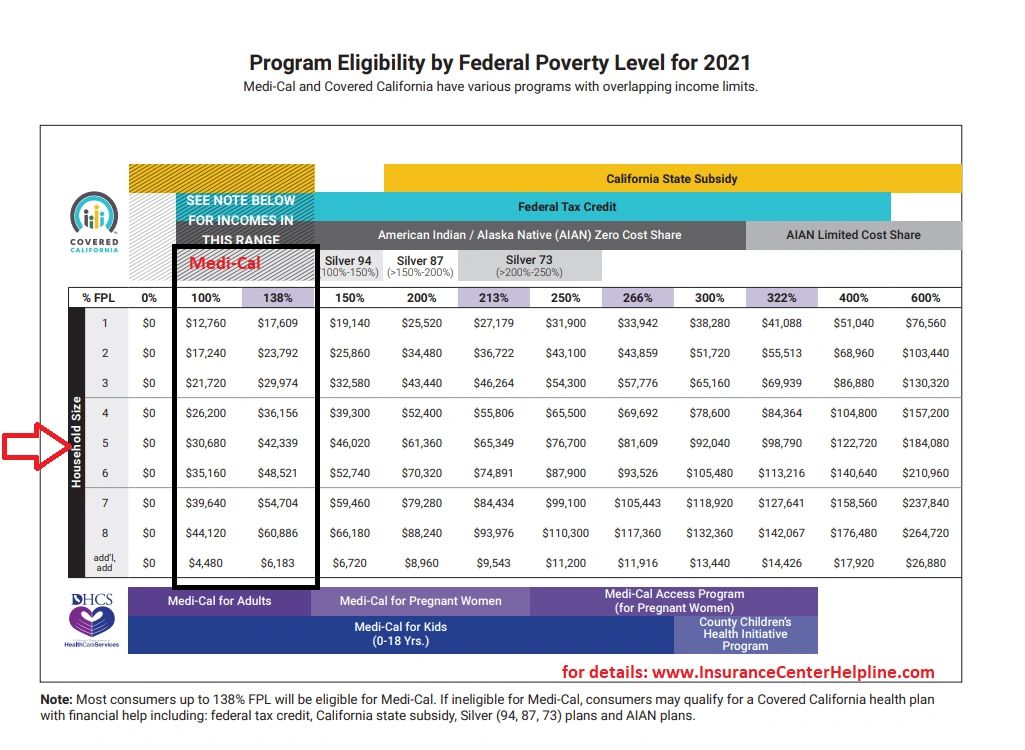

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Income Based Costs Nevada Health Link Official Website Nevada Health Link

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

2020 2021 Federal Poverty Levels Fpl For Affordable Care Act Aca Florida Health Agency

2020 2021 Federal Poverty Levels Fpl For Affordable Care Act Aca Florida Health Agency

Obamacare Income Limits 2018 Income Calculations Obamacare Quotes

Obamacare Income Limits 2018 Income Calculations Obamacare Quotes

What Is The Maximum Income For Obamacare Subsidies In Year 2021

What Is The Maximum Income For Obamacare Subsidies In Year 2021

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

Comments

Post a Comment