Featured

- Get link

- X

- Other Apps

Supplemental Medicare Plans 2020

A Medicare Supplement insurance policy is a type of supplemental insurance policy that is sold by private insurance companies. Because of this Plans C and F will no longer be available to people who are new to Medicare on or after January 1 2020.

What Is Medicare Supplement Insurance Updated For 2020

What Is Medicare Supplement Insurance Updated For 2020

Find a Medicare plan You can shop here for drug plans Part D and Medicare Advantage Plans.

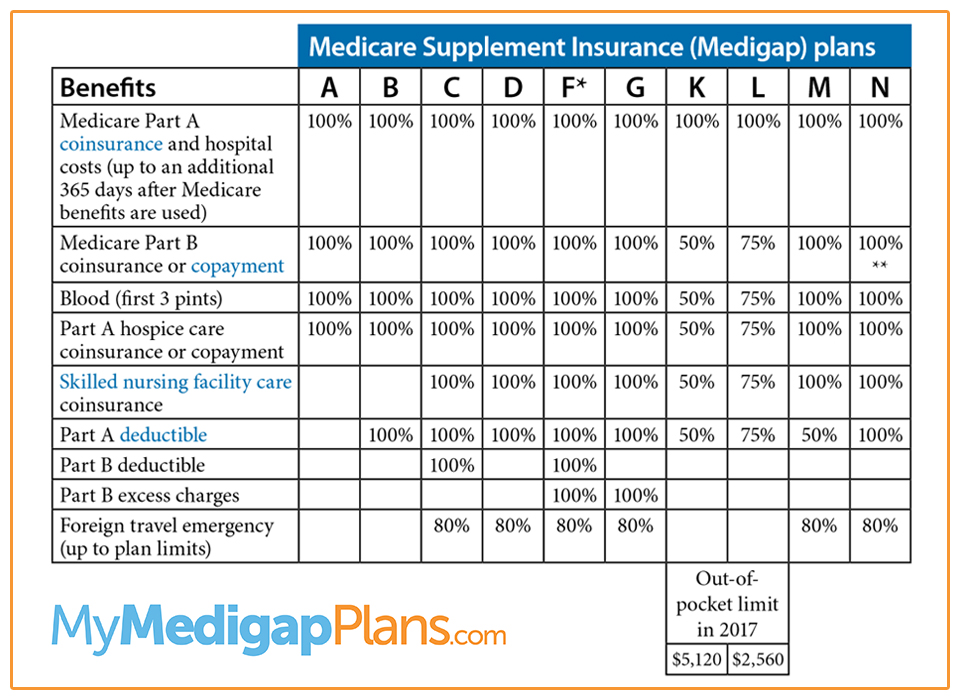

Supplemental medicare plans 2020. Effective January 1 2020 plan options C F and High Deductible Plan F will only be available for purchase by applicants first eligible for Medicare prior to 2020. Medigap policies are standardized and in most states are named by letters Plans A-N. No new subscribers can sign up for it.

Medigap Plan F Benefits Costs 2020 Medicare Supplement Insurance Medigap Plan F offers the most basic benefits of any Medigap plan. Starting January 1 2020 Medigap plans sold to people new to Medicare wont be allowed to cover the Part B deductible. Anyone who was eligible for Medicare prior to this date may still purchase a Plan C or F after this date.

Humana Medicare Supplement Insurance plans. 4 It is designed to cover some of the out-of-pocket expenses like copayments coinsurance and deductibles that Original Medicare does not cover. Because of this Plans C and F are not available to people new to Medicare starting on January 1 2020.

Medicare beneficiaries who are newly eligible for Medicare in 2020 have a range of choices when it comes to Medicare Supplement plans including Plan G High-deductible Plan G Plan D and Plan N. As of January 1 2020 Medigap plans sold to new people with Medicare arent allowed to cover the Part B deductible. See benefits of each plan.

Looking for Medigap policies. One of the most significant changes is to Plan F. 4 In order to be eligible for a Medical Supplement insurance policy you.

Medigap Plan G offers more benefits than any other Medigap plan available to beneficiaries who became eligible for Medicare after Jan. 1 factor for choosing a Medicare Supplement plan is. Learn more and find out if it could work for you.

Department of HHS logo A federal government website managed and paid for by the US. United American Insurance offers plans A B D G K L M and N to Medicare-eligible applicants and plans C and F for anyone who was Medicare-eligible prior to Jan. Looking for PACE plans.

Compare the benefits each plan helps pay for and choose a plan that covers what you need. The Medicare Supplements available in 2020 are a bit different from what they have been in past years. Decide which plan you want.

Medicare Supplement Plan F 2020 is now in a closed pool. As of January 1 2020 Medicare Supplement Plans C and F will no longer be available to newly eligible Medicare beneficiaries. In a June 2020 survey of Medicare Supplement enrollees across the country Health found that the No.

Any person currently owning a Plan. If you already have either of these two plans or the high deductible version. The top 12 carriers combined reported growth in Medicare Supplement lives of almost 15 in 2020 however seven of the 12 reported a decrease as shown below.

The 2020 overall Medicare Supplement market loss ratio of 724 was significantly lower than historical trends due to decreased utilization for non-Covid medical care. This basically means that only people who have Plan F right now can get it in 2020.

Medicare Supplement Plans Medigap Senior Healthcare Direct

Medicare Supplement Plans Medigap Senior Healthcare Direct

Medigap Plan M Medicare Supplement Plan M Medicarehaven Com

Medigap Plan M Medicare Supplement Plan M Medicarehaven Com

What Is A Medicare Supplement Medigap Plan Gomedigap

What Is A Medicare Supplement Medigap Plan Gomedigap

Medicare Supplement Plans In New Jersey 2021 What Do They Cover

Medicare Supplement Plans In New Jersey 2021 What Do They Cover

Best Medicare Supplement Plans Online Plan F G Changes

Best Medicare Supplement Plans Online Plan F G Changes

Will Medicare Supplement Plan F Plan C Go Away In 2020 Medicare Mindset Llc

Will Medicare Supplement Plan F Plan C Go Away In 2020 Medicare Mindset Llc

How Does High Deductible Medigap Plan F Work Medicaresupplement Com

How Does High Deductible Medigap Plan F Work Medicaresupplement Com

Medicare Supplement Plans Comparison Chart Compare Medicare Plans

Medicare Supplement Plans Comparison Chart Compare Medicare Plans

Complete Medicare Supplement Plans Comparsion Chart For 2021

Complete Medicare Supplement Plans Comparsion Chart For 2021

Why We No Longer Recommend Plan F Integrity Senior Solutions Inc

Why We No Longer Recommend Plan F Integrity Senior Solutions Inc

Medicare Plan G Review Medicare Nationwide

Medicare Plan G Review Medicare Nationwide

Ultimate Guide To Selling Medicare Supplements Senior Market Advisors

Ultimate Guide To Selling Medicare Supplements Senior Market Advisors

Medicare Supplemental Insurance In Pensacola Florida 2021 Best Medicare Supplement Medigap Plans Pensacola Florida

Best Medicare Supplement Plans And Reviews

Best Medicare Supplement Plans And Reviews

Comments

Post a Comment