Featured

Can I Keep My Health Insurance Instead Of Medicare

An amount of money to purchase health insurance you do NOT have health insurance based on current employment If you have one of these types of insurance you should find that situation in the fact sheet. You do need to apply for Medicare and most likely will be able to continue your Medicaid coverage as whats called a dual eligible beneficiary who qualifies for both programs.

For example suppose youre enrolled in Medicare Part A and Part B and youre still covered through an employer or your spouses employer.

Can i keep my health insurance instead of medicare. With Medicare there are no networks. Dont forget to bookmark can i keep my. In this case Medicare pays.

But once your Medicare Part A coverage starts youll no longer be eligible for any premium tax credits or other cost savings you may be getting for your Marketplace plan. This means that Medicare is the primary payer for. He would however get to keep any funds in an existing HSA and use them to pay health charges not covered by Medicare.

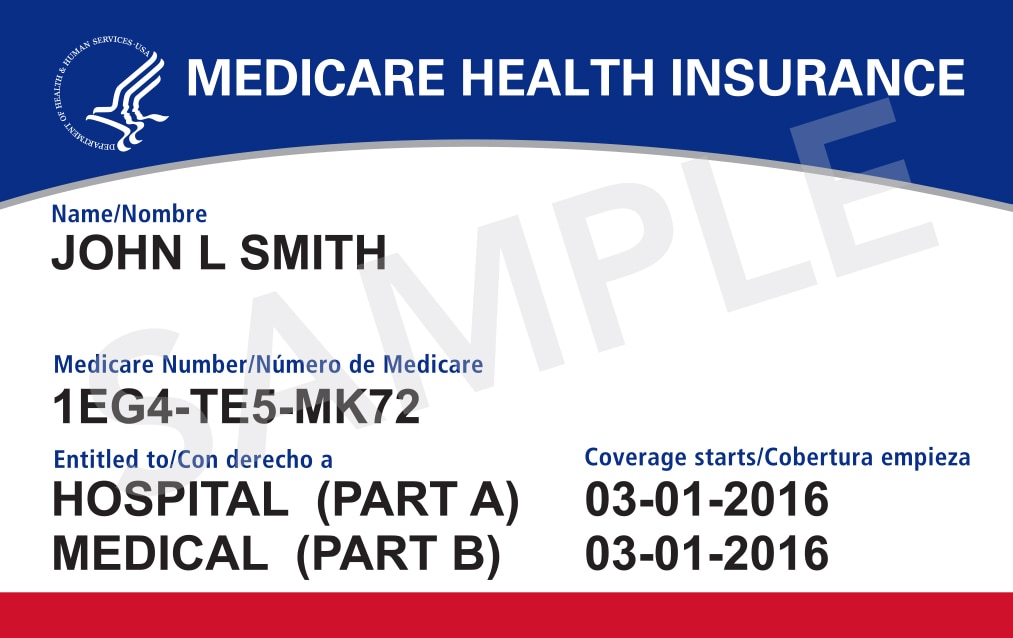

Should I keep my ACA Health plan instead of Medicare. Can you choose employer benefits instead of Medicare. Medicare is a government-funded health insurance option available to Americans ages 65 and over and those with certain disabilities.

His question indicates to me that he is leaning toward signing up for the. Download this image for free in High-Definition resolution the choice download button below. Group Insurance Plan Negatives.

Medicare Advantage is the term used to describe the various private health plan choices available to Medicare beneficiaries. You can enroll in a Medicare Advantage plan to get your Medicare benefits. Group plans can be very convenient but there are still some more factors to consider.

That might be a cost-conscious way to increase your. If you have private health insurance along with your Medicare coverage the insurers generally do coordination of benefits to decide which insurer pays first. If you like you can keep your Marketplace plan too.

In situations where there are two insurances one is deemed the primary payer and pays the claims first. There is a monthly premium for Part D coverage. However you may be eligible to receive premium-free Medicare Part A hospital insurance as explained above.

Using Medicare With Other Insurances. If you have a ACA Health Plan aka Marketplace or Obamacare and you are turning 65 years old you can. Keeping employer coverage and enrolling in Medicare.

If you are happy with your original Medicare coverage but want prescription drug coverage and help with your out-of-pocket Medicare costs you can add Part D and Medigap policies to your plan. Before your employer insurance. Most people pay a monthly premium for Medicare Part B medical insurance.

In most cases you can elect to not use your Medicare coverage and just keep using your FEHB plan. Find out how to end your Marketplace plan without penalty. However you may end up with more coverage than you need and you may have to pay a premium for both your employer-sponsored plan and Medicare Part B along with Medicare Part A if you dont receive premium-free Part A.

You should enroll in Part A and Part B when you turn 65. But once you apply for Medicare you might not be able to buy certain private health insurance alternatives. If you have both the employer-sponsored plan will coordinate benefits with Medicare.

The first is that group plans have networks and those networks will restrict which doctors you can go to. An alternative form of receiving the coverage provided with Parts A B is Medicare Part C commonly referred to as Medicare Advantage There are. The other becomes known as the secondary payer and only applies if there are expenses not covered by the primary policy.

If he has either filed for his Social Security or has enough work experience to qualify for benefits he can get premium-free Part A hospital insurance from Medicare. In this case you can choose private health insurance or Medicare. You may want to apply for Medicare Part A if you want when you are first eligible and apply for Medicare Part B later when you lose your employer coverage.

If you have a Marketplace plan you can keep it until your Medicare coverage starts. You may be able to keep your employer health plan and enroll in Medicare. Medicare is an optional plan meaning you dont have to have either Part A.

So youd have to pay full price for the. You can also have both Medicare and private insurance to help cover your health care expenses. Medicare Advantage is another story but Medicare with a Medigap plan will give you more.

You may be able to buy private health insurance instead of Medicare if you are younger than 65 and qualify for Medicare due to disability or end-stage renal disease ESRD. We can do that for you. Most Federal employees do not need to enroll in the Medicare drug program since all Federal Employees Health Benefits Program plans will have prescription drug benefits that are at least equal to the standard Medicare.

If you do not find the exact resolution you are looking for then go for a native or higher resolution. Can i keep my health insurance instead of medicare is important information accompanied by photo and HD pictures sourced from all websites in the world.

Medicare Everything You Want To Know But Are Afraid To Ask Northern Trust

Medicare Everything You Want To Know But Are Afraid To Ask Northern Trust

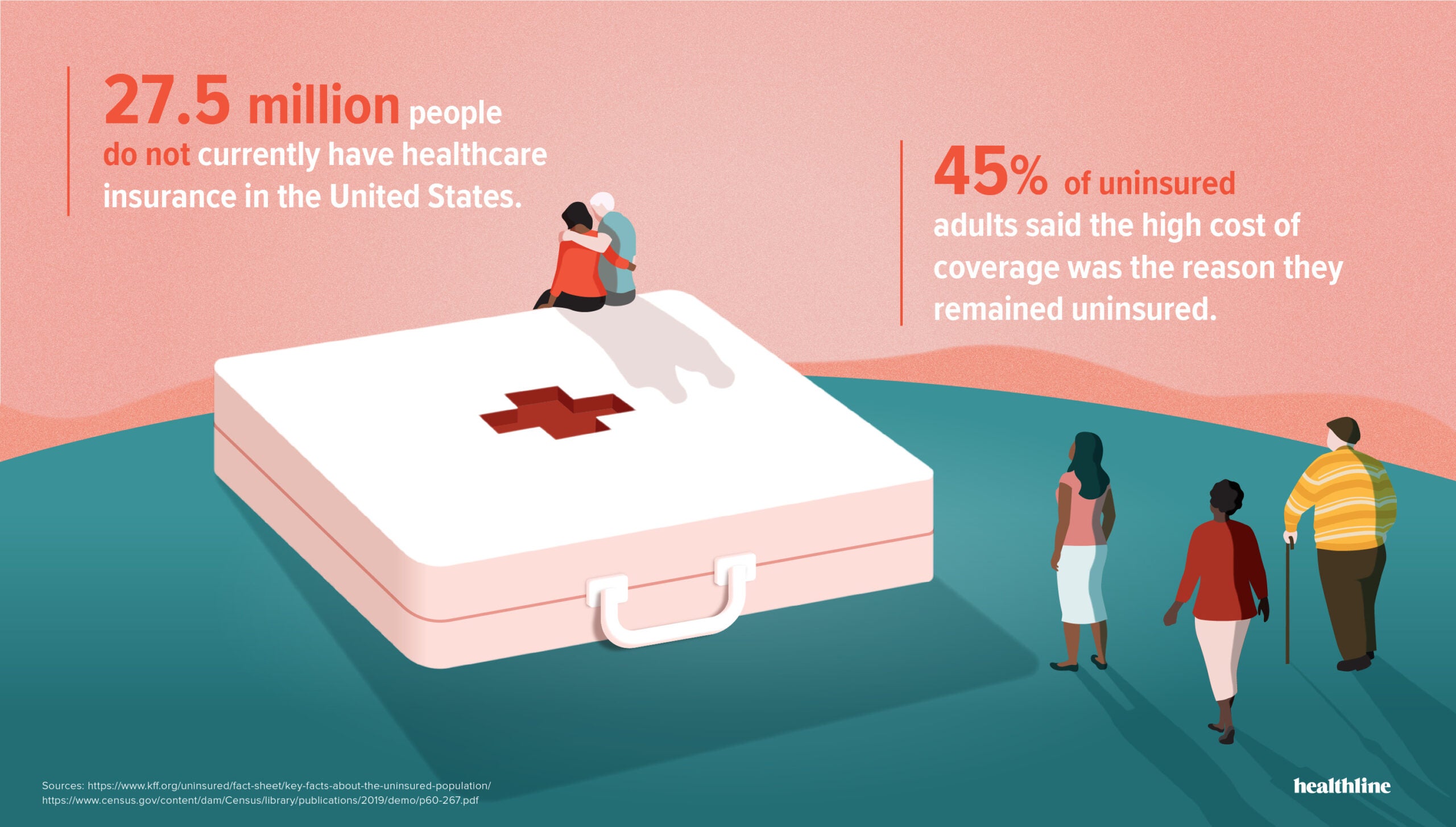

Medicare For All What Is It And How Will It Work

Medicare For All What Is It And How Will It Work

Choosing Between Original Medicare Or Medicare Advantage

Choosing Between Original Medicare Or Medicare Advantage

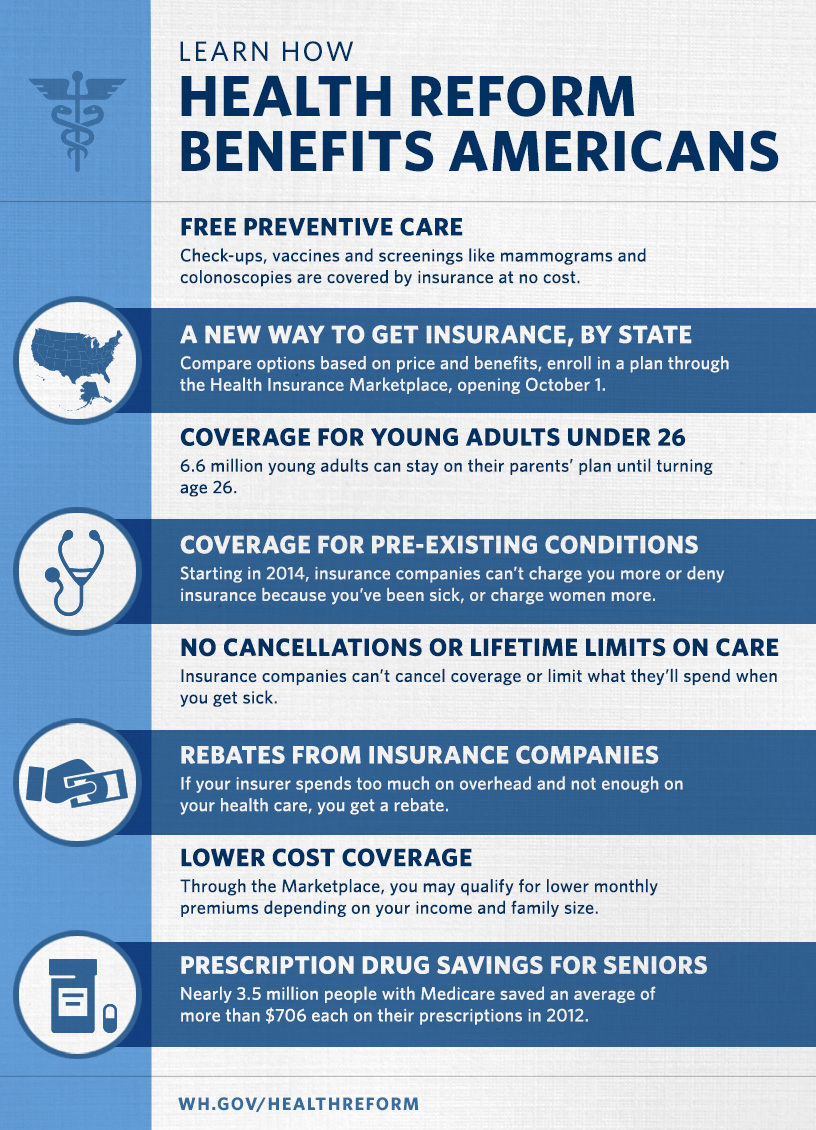

Can I Keep My Health Care Plan Under Obamacare

Can I Keep My Health Care Plan Under Obamacare

Can You Have Private Insurance And Medicare

Can You Have Private Insurance And Medicare

Can I Use Private Insurance Instead Of Medicare Updated For 2021 Aginginplace Org

Can I Use Private Insurance Instead Of Medicare Updated For 2021 Aginginplace Org

Medicare And Employer Coverage Boomer Benefits

Medicare And Employer Coverage Boomer Benefits

My Employer Health Insurance Is Unaffordable Should I Get Medicare Pbs Newshour

My Employer Health Insurance Is Unaffordable Should I Get Medicare Pbs Newshour

Can I Use Private Insurance Instead Of Medicare Updated For 2021 Aginginplace Org

Can I Use Private Insurance Instead Of Medicare Updated For 2021 Aginginplace Org

Can I Use Private Insurance Instead Of Medicare Updated For 2021 Aginginplace Org

Can I Use Private Insurance Instead Of Medicare Updated For 2021 Aginginplace Org

What Are The Parts Of Medicare The Abcd S Explained

What Are The Parts Of Medicare The Abcd S Explained

Medicare For All Would Abolish Private Insurance There S No Precedent In American History The New York Times

Medicare For All Would Abolish Private Insurance There S No Precedent In American History The New York Times

Understanding Medicare Part A Part B Part C And Part D

Understanding Medicare Part A Part B Part C And Part D

Comments

Post a Comment