Featured

What's The Difference Between An Hmo And A Ppo Insurance

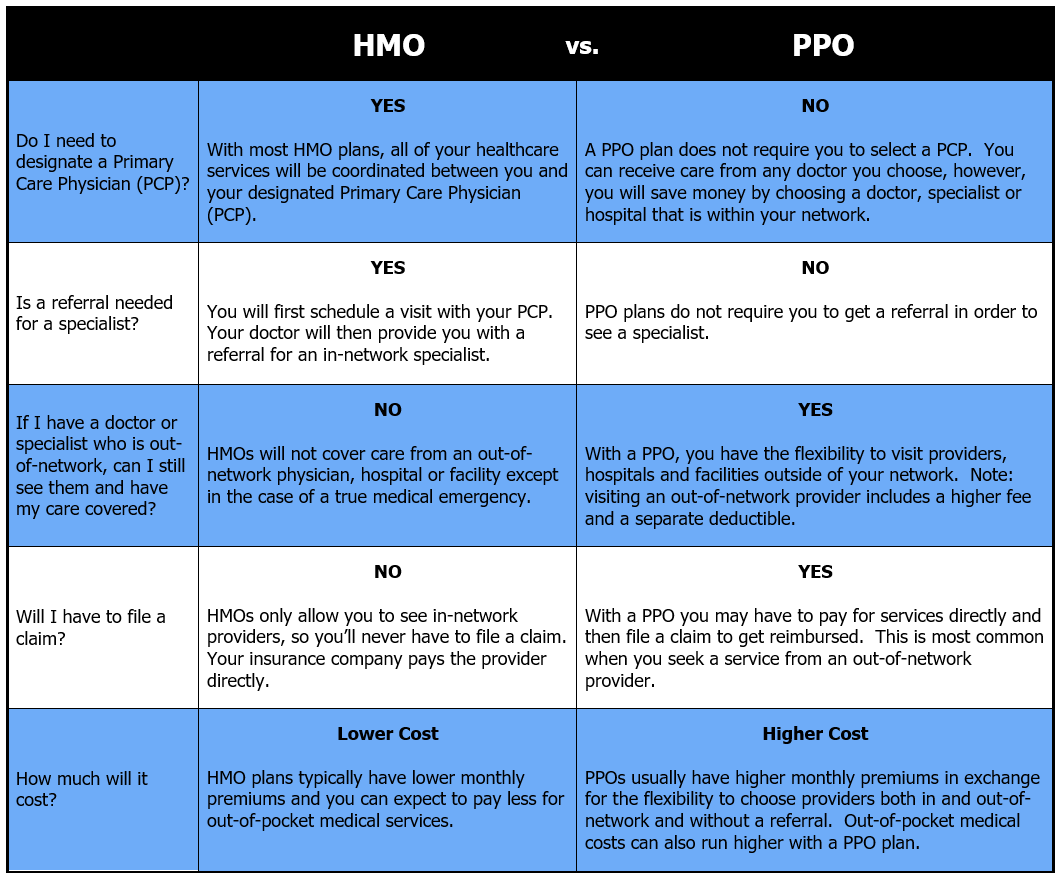

But the provider network for a HMO is less expansive. 7 Differences Between an HMO vs.

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between An Hmo Vs Ppo Xcelhr

If the alphabet soup of health insurance jargon still has you scratching your head take heart.

What's the difference between an hmo and a ppo insurance. However PPOs generally offer greater flexibility in seeing specialists have larger networks than HMOs and offer some out-of-network. These health care insurances help the employees with their medical bills. Good to know.

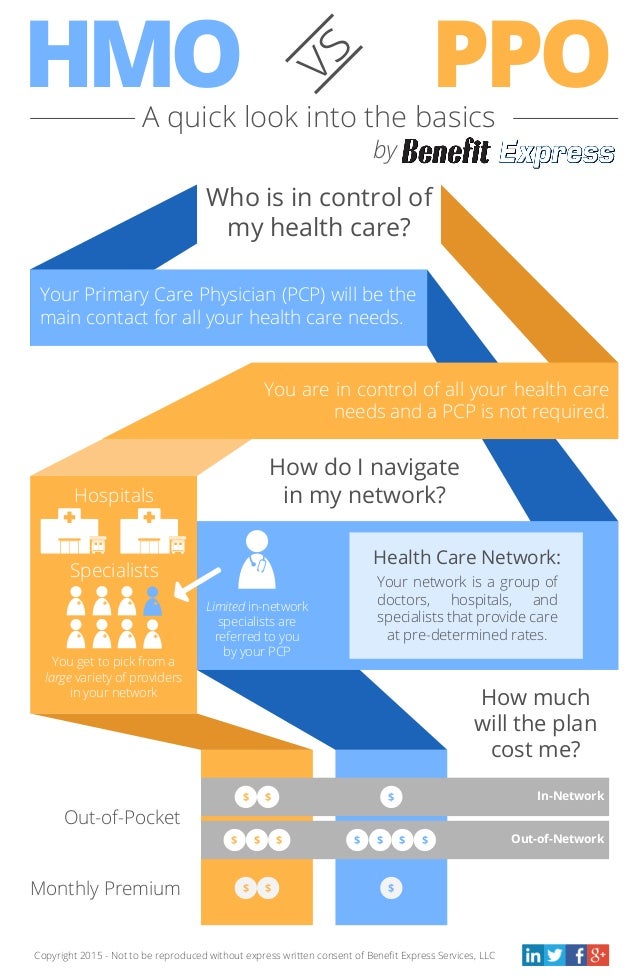

In 2018 the average PPO cost 3019 annually compared to an HMO which cost 2764 annually. But finding the right health care coverage should be a priority for everyone. Medicare HMO and PPO typically have more similarities than differences Many times people dont realize the importance of health care until they fall ill.

And which one is best. A person who has taken a HMO. Yes Im a 28yoF millennial who just cant comprehend 0 comments.

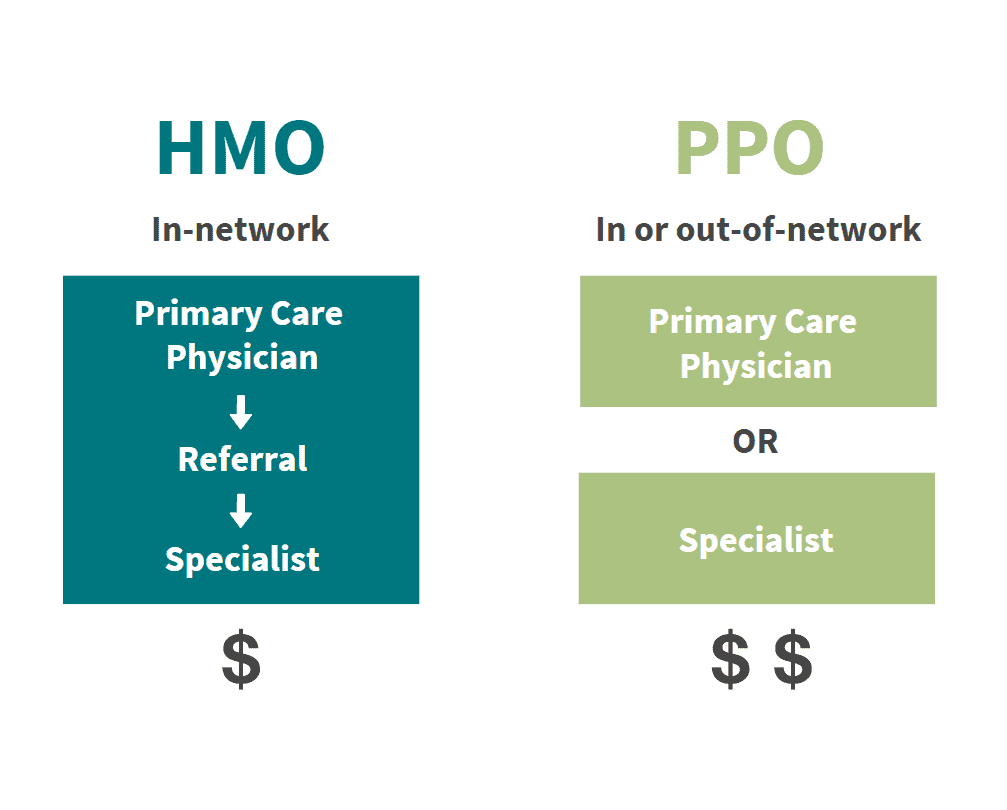

5 Patients in with an HMO must always first see their primary care physician PCP. Log in or sign up to leave a comment Log In Sign Up. With an EPO you typically dont need a referral to see a specialist which makes it more flexible than an HMO.

PPO health plans are typically more expensive than HMO plans. An exclusive provider organization EPO plan is situated between an HMO and PPO in terms of flexibility and costs. If your PCP cant treat the problem they will refer you to an in-network specialist.

Other than on preventative visits you will need to pay. HDHPs make up about one-third of employer-sponsored plans and are seen as a lower-cost health insurance option for. Depending upon the PPOs terms of coverage a doctor or hospital outside the preferred provider list will cost more than those in the network.

The organization will typically pay a range of 70 to 80 percent of accrued expenses with the patient paying the remaining balance out-of-pocket. Premiums and out-of-pockets costs for HMO plans are usually lower than a PPO. HMO PPO EPO POS.

With the growing need for managed care plans HMO and PPO plans have gained popularity over traditional fee-for-service plans where coverage is provided regardless of provider or hospital used. Explain the difference between HMO and PPO. With a PPO plan you can see a specialist without a referral.

PPOs are the most common type of health plan in the employer-sponsored health insurance market while HMOs lead the way in the individual insurance market. Asked Mar 30 2019 in Health Professions by Sanchez. As mentioned above Differences between HMO Health Maintenance Organization and PPO Preferred Provider Organization plans include network size ability to see specialists costs and out-of-network coverage.

Which Plan Is Best. If the alphabet soup of health insurance jargon still has you scratching your head take heart. Hmo Ppo Directoryare acronyms for the different types of managed care plans available in most areas.

Which of the following is probably true regarding Jim and Kendras health care. When considering a HMO plan it is more restrictive than the POS. After you reach the out-of-pocket maximum the insurance company will pay 100 percent of covered services.

Posted by 4 minutes ago ELI5 whats the difference between HMO PPO and HSA health insurance. In addition with a HMO you might have a low deductible or even a no deductible health plan. Difference Between HMO and POS HMO vs POS POS or Point of Service and HMO or Health Maintenance Organization are the various types of Managed Healthcare Plans in the US.

ELI5 whats the difference between HMO PPO and HSA health insurance. Lets take a look at some of the most common differences between these two types of health insurance plans. The biggest differences between an HMO and a PPO plan are.

HMO PPO EPO POS. Asked Aug 7 2019 in Social Work Human Services by SarahC. Briefly describe PPO and HMO plans.

Jim has an HMO plan and Kendra has a PPO insurance policy. Compared to PPOs HMOs cost less. Lets take a look at some of the most Page 1625.

HMOs offered by employers often have lower cost-sharing requirements ie lower deductibles copays and out-of-pocket maximums than PPO options offered by the same employer although HMOs sold in the individual insurance market often have out-of-pocket costs that are just as high as the available PPOs. HMOs have lower premiums and out-of-pocket expenses but less. 7 Differences Between an HMO vs.

However like an HMO there are no out-of-network benefits. Which Plan Is Best. A PPO might say it covers 60 percent.

What S The Difference Between An Hmo And A Ppo Aspen Wealth Management

What S The Difference Between An Hmo And A Ppo Aspen Wealth Management

Hmo Vs Ppo Health Insurance Plans Selecting The Right Plan For Your Needs San Diego Financial Literacy Center

Difference Between Hmo And Ppo Difference Between

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

What Is The Difference Of Hmo And Ppo Health Insurance Hmo Vs Ppo Youtube

What Is The Difference Of Hmo And Ppo Health Insurance Hmo Vs Ppo Youtube

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Hmo Vs Ppo What S The Difference

Hmo Vs Ppo What S The Difference

What S The Difference Between Hmo And Ppo

What S The Difference Between Hmo And Ppo

Hmo Vs Ppo Selecting The Right Plan For Your Employees Clarity Benefit Solutions

Hmo Vs Ppo Selecting The Right Plan For Your Employees Clarity Benefit Solutions

Comments

Post a Comment