Featured

What Employers Are Required To Report Health Insurance On W2

Many employers are eligible for transition relief for tax year 2012 and beyond until the IRS issues final guidance for this reporting requirement. W-2 Reporting Rule 7.

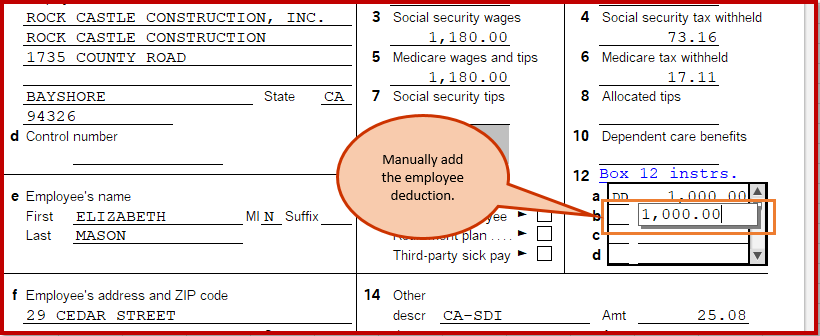

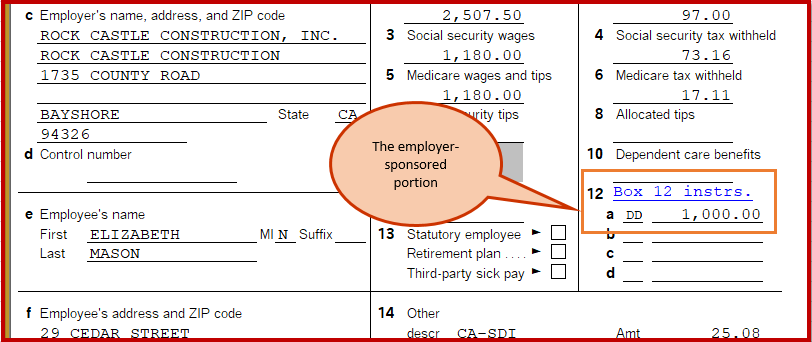

Reporting On Form W 2 The Cost Of Employer Sponsored Health Coverage Leavitt Group News Publications

Reporting On Form W 2 The Cost Of Employer Sponsored Health Coverage Leavitt Group News Publications

The 250 W-2s include those for all employees whether the employer classified them as full.

What employers are required to report health insurance on w2. Code to require that employers report the aggregate cost of applicable employer-sponsored coverage on employee Forms W-2 in Box 12 using a DD code. Employers who file 250 or more W-2s in any given year are required to furnish the IRS and their employees with health insurance information on the following years W-2s. This means that employers who filed more than 250 W-2s.

However American Indian government entities are exempt from this requirement. Employers who issued at least 250 W-2s in 2013 must report health care costs on 2014 W-2s. Employers who provide insured health plans are required to report health care coverage costs even if they are not subject to federal COBRA requirements.

Notice 2011-28 provides a few exceptions to the reporting requirements. This reporting requirement applies to employers who issued at least 250 W-2s the prior year and it applies to both grandfathered and non-grandfathered plans. Initially employers were supposed to comply with this reporting requirement by listing this information on each employees Form W-2 beginning on or after January 1 2011.

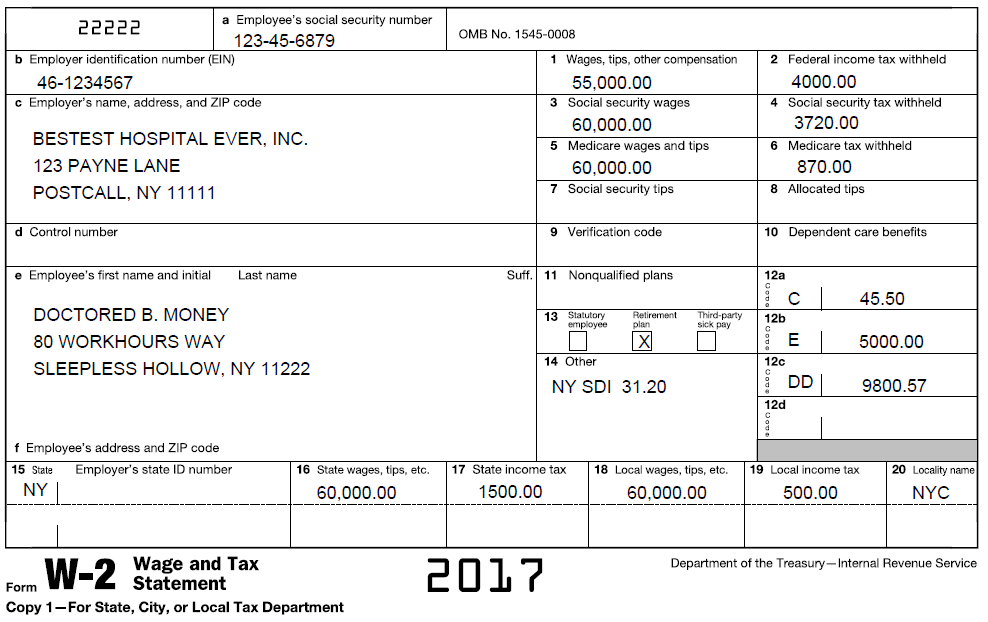

33 lignes 2. In addition large employers as defined by the IRS must give an annual report to employees on form 1095-C and file that report with the IRS. It is included in Box 12 in order to provide comparable consumer information on the cost.

Group health plan coverage for most employees and family members such as spouses and children will have to be reflected on an employees Form W-2. Many employers are required to report the cost of an employees health care benefits in Box 12 of Form W-2 using Code DD to identify the amount. The Affordable Care Act requires employers to report the cost of coverage under an employer-sponsored group health plan on an employees Form W-2 Wage and Tax Statement in Box 12 using Code DD.

The ACA And Reporting Health Insurance On W-2 Forms. Businesses nonprofits and public entities must provide health insurance under a group health plan. Employers who filed 250 or more W-2 forms in the previous calendar year must report.

This reporting is for informational purposes only intended to provide useful and comparable consumer information to employees on the cost of their health coverage. For now the value of the employers contribution to healthcare is not taxable. Health Insurance Cost on W-2 - Code DD.

For example if you filed 250 or more W-2s in 2016 then the IRS will expect to see health insurance information on your employees 2017 W-2s in Box 12 with code DD. Large employers must report the total cost of employer-sponsored. Requires employers to report the aggregate cost of all applicable employer-sponsored coverage on employees Form W-2.

Also they must verify compliance with the IRS. Under transitional relief guidelines issued so far only employers who issue 250 or more W2 forms in a calendar year are required to report this information. Eventually all employers who provide health insurance to their employees will be required to report this information on the employees W2.

This is a requirement of the Affordable Care Act. To provide employees with useful consumer information regarding the value of their health care benefits the Affordable Care Act ACA requires employers providing applicable employer-sponsored coverage under a group health plan to report the value of the health care coverage on their employees W-2 Wage and Tax Statement Forms. This amount is reported for informational purposes only and is NOT taxable.

Form W-2 Reporting Requirements The Affordable Care Act ACA requires employers to report the aggregate cost of employer-sponsored group health plan coverage on their employees Forms W-2. Employers contributing to a multiemployer plan eg based on employer contributions of or dollars and cents per hour. The Affordable Care Act of 2010 requires employers to report the aggregate cost of employer-sponsored health coverage annually on IRS Form W-2.

This amount is not taxable and. Employers Required to Report In general all employers including governmental entities churches and tax-exempt organizations are required to provide informational reporting of the value of health benefits provided to employees. Employers required to report must do so before issuing employees W-2s which are due to employees no later than January 31 2020.

All employers must report the cost of employer-provided health benefits to employees on Form W-2 and file W-2 forms for all employees with the Social Security Administration. Which employers must report the cost of healthcare coverage on employees W-2s. The purpose of the reporting requirement is to provide information to employees regarding how much their health coverage costs.

Https Support Businessasap Com Article 261 S Corporation Officer Health Insurance

W 2 Reporting Requirements For Employer Provided Health Coverage Faqs

W 2 Reporting Requirements For Employer Provided Health Coverage Faqs

The Cost Of Health Care Insurance Taxes And Your W 2

The Cost Of Health Care Insurance Taxes And Your W 2

.png?width=800&name=2017%20W-2%20FORM%20(2).png) W 2 Reporting Required For Nanny Tax Free Healthcare Benefits

W 2 Reporting Required For Nanny Tax Free Healthcare Benefits

What Is Form W 2 An Employer S Guide To The W 2 Tax Form Gusto

What Is Form W 2 An Employer S Guide To The W 2 Tax Form Gusto

S Corporation Reminder Before You Finalize Your Year End Payroll Don T Forget To Include Shareholder Medical Insurance Premiums In W 2 Wages Wegner Cpas

S Corporation Reminder Before You Finalize Your Year End Payroll Don T Forget To Include Shareholder Medical Insurance Premiums In W 2 Wages Wegner Cpas

A Beginner S Guide To S Corp Health Insurance The Blueprint

A Beginner S Guide To S Corp Health Insurance The Blueprint

Reporting On Form W 2 The Cost Of Employer Sponsored Health Coverage Leavitt Group News Publications

Reporting On Form W 2 The Cost Of Employer Sponsored Health Coverage Leavitt Group News Publications

Understanding Your W 2 Health Care Cost Reporting Requirements

Understanding Your W 2 Health Care Cost Reporting Requirements

Quick Tip How Much Of Your Health Insurance Premium Is Your Employer Paying Aca Signups

Comments

Post a Comment