Featured

How Does Kaiser Deductible Work

A coinsurance is a percentage of the full cost of a service. If youre about to have a knee replacement which averages about 34000 and your deductible is 5000 youre going to have to pay the full deductible The hospital might ask you to pay all or part of it upfront or they might bill you after they submit the claim to your insurer but theres no getting around the fact that youre going to have to pay the full 5000.

Http Info Kaiserpermanente Org Info Assets Deductibleplans Pdfs Dhmo Faq Hra Pdf

Your insurance would cover the remaining 4000 minus any coinsurance that might be.

How does kaiser deductible work. Deductible plans generally offer lower monthly premiums in exchange for higher out-of-pocket payments for covered services1 once you meet an annual medical deductible youll be eligible to receive covered services for a coinsurance payment or copayment. How a deductible works. Members will pay 100 of the doctor office visits radiology services lab tests.

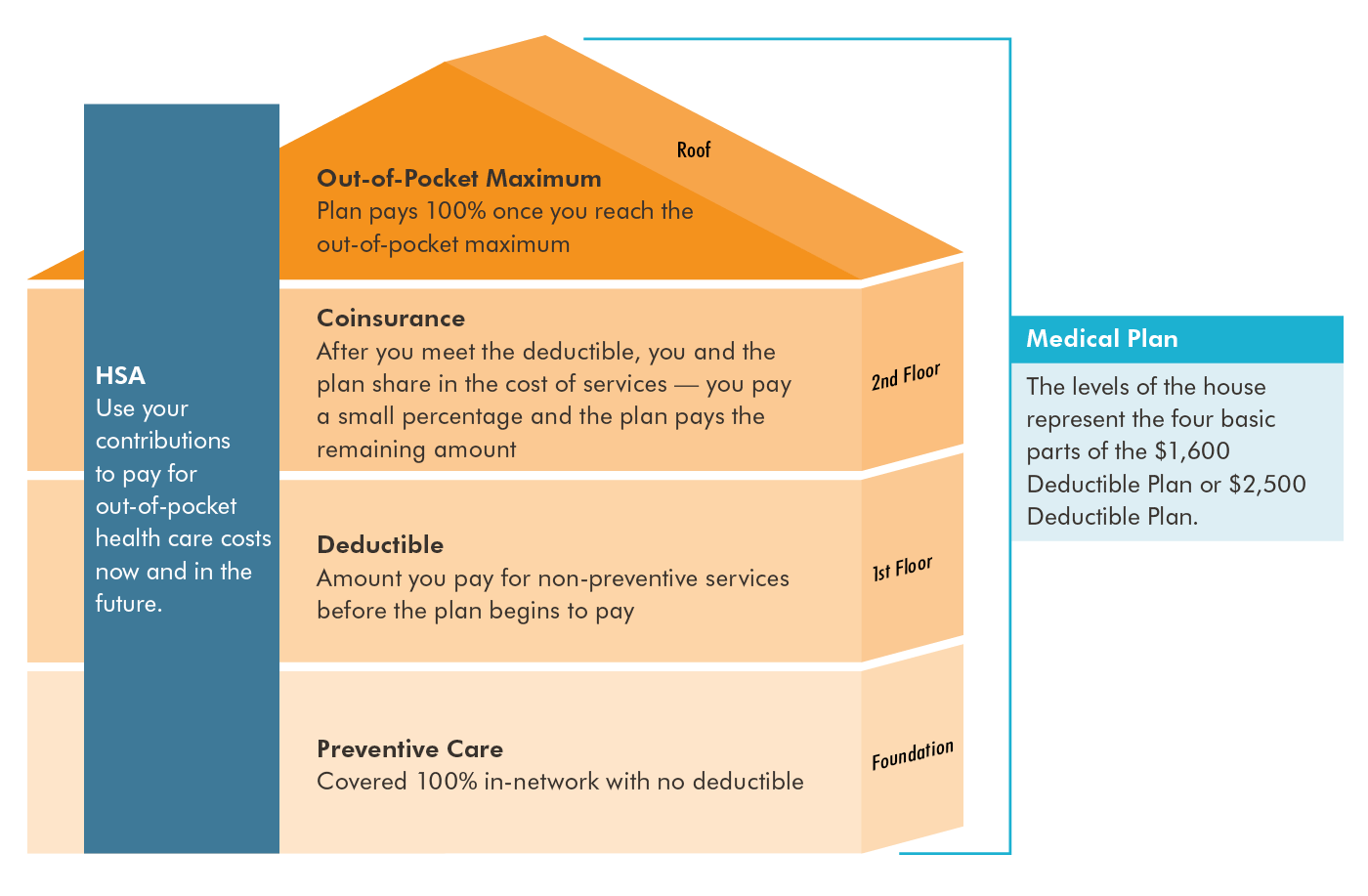

This plan requires a member to meet the calendar year deductible FIRST before ANY plan benefits will be paid except covered preventive services. How DeDuCtiBLe PLans work How to meet your deductible. As a deductible plan member youll pay the full charges for covered services until you reach a set amount.

With some plans you may pay a copay or coinsurance for certain services even before you reach your deductible. You might have to pay the remaining 20 out of pocket and purchase a stand-alone prescription drug plan. Whats a deductible HMO plan.

The Kaiser Permanente Deductible HMO Plan with HRA combines access to Kaiser Permanentes health care services with a health reimbursement arrangement HRA account that allows you to use employer-contributed tax-free dollars to pay for qualified medical expenses. If your plan has a 1000 annual deductible and you use a covered healthcare service that costs 200 youll pay 200 fully out of pocket and have 800 remaining for your annual deductible. Depending on your plan you may pay copays or coinsurance for some services.

A deductible on the other hand only has to be paid if you use the insurance. Whats the Deductible HMO Plan with HRA. With a deductible plan you pay full charge for certain covered services until your expenses meet an annual deductible.

How a Health Insurance Deductible Works Lets look at a quick example. A Kaiser ophthalmologist could make around 500K in private practice if she sees the same number of patients with the same new-to-follow-up ratio. Original Medicare doesnt cover all expenses.

Original Medicare Parts A and B together only covers about 80 of hospital and medical expenses. If you see an out-of-network doctor youll typically have to pay in full for your copay during the visit cover the cost of the medical bill and then file a claim to be reimbursed by your PPO plan. If playback doesnt begin shortly try restarting your device.

After you reach your deductible youll start paying less a copay or coinsurance for the rest of the year. After you reach your deductible youll usually start paying just a copay or coinsurance. If playback doesnt begin shortly try restarting your device.

Premium prices increase with each additional person you add to your insurance plan. So Kaiser is actually paying their ophthalmologists 40 less than what they should make. How does a deductible plan work.

How does your deductible plan work. And Kaiser does not allow for negotiation of. If you have an HDHP linked to an HSA you can use your HSA to pay your VA copayments for non-service-connected care.

We may bill and accept reimbursement from High Deductible Health Plans HDHPs for medical care and services to treat your non-service-connected conditions. Videos you watch may be added to the TVs watch history and. Your health insurance deductible is the total amount of money you pay for a medical expense before your insurance takes over to cover the remaining balance.

You pay the full cost for certain services until you reach a set amount for the year your deductible. With a deductible plan you pay the full cost for many services until you reach a set amount for the year your deductible. Individual and Family Plans DEDUCTIBLE PLANS How deductible plans work Deductible plans generally offer lower monthly premiums in exchange for paying more out of your own pocket for services covered by your health plan.

The typical costs of a PPO plan can include higher monthly premiums and out-of-pocket costs. Known as your deductible. 10 Things Youll Want To Know.

You may also need to pay a deductible before your coverage benefits begin. How does a High-deductible Health Plan HDHP work-. A copay is a set amount you pay for a service.

After you reach your deductible you typically just pay a copay or coinsurance. High-Deductible Health Plans Explained. For example if you have a medical bill of 5000 and your insurance policy has a deductible of 1000 you would pay that 1000 out of your own pocket.

Kaiser makes everyone see a certain number of patients with 30-40 new consults and 60-70 follow-ups. The Deductible First HDHP plan provides a 21 savings compared to the current Kaiser Permanente 10 Copay Plan. A high-deductible health plan is a health insurance plan that can save you money with lower premiums and a tax break on health savings accounts.

Http Info Kaiserpermanente Org Info Assets Washington Oregon Deductible Plans Pdfs Nw Understanding Your Costs 263mmc Pdf

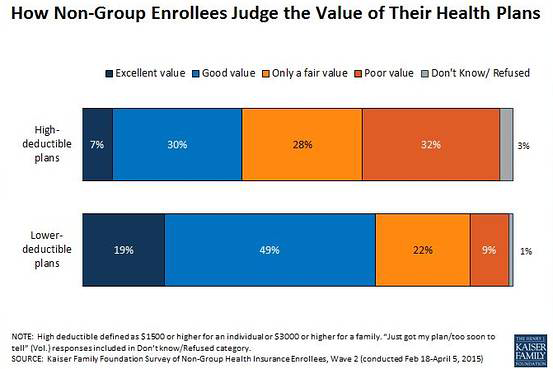

The Value Trade Off In High Deductible Health Plans Kff

The Value Trade Off In High Deductible Health Plans Kff

Https Www Orcity Org Sites Default Files Fileattachments Human Resources Page 4231 Paying For Care Brochure Nw 2013 Pdf

Http Info Kaiserpermanente Org Info Assets Colorado Deductible Plans Pdfs Co Wageworks Hra Faq Pdf

Hawaii Deductible The Kaiser Permanente Select Plan

Comparing Health Plan Types Kaiser Permanente

Hawaii Deductible The Kaiser Permanente Select Plan

How Does A High Deductible Health Plan Hdhp Work Kaiser Permanente Youtube

How Does A High Deductible Health Plan Hdhp Work Kaiser Permanente Youtube

Understand Your Deductible Plan Costs Kaiser Permanente

Understand Your Deductible Plan Costs Kaiser Permanente

Https Info Kaiserpermanente Org Info Assets Deductibleplans Pdfs Dhmo Faq Hra 82487 Pdf

Comparing Health Plan Types Kaiser Permanente

Https Account Kp Org Business Broker Ca Plans Ever Lg Deductible Hmo Plans Faqs Ca En Pdf

How Is Aflac Different From Major Medical Aflac

How Is Aflac Different From Major Medical Aflac

Comments

Post a Comment