Featured

Is There A Penalty For Not Getting Medicare Part D

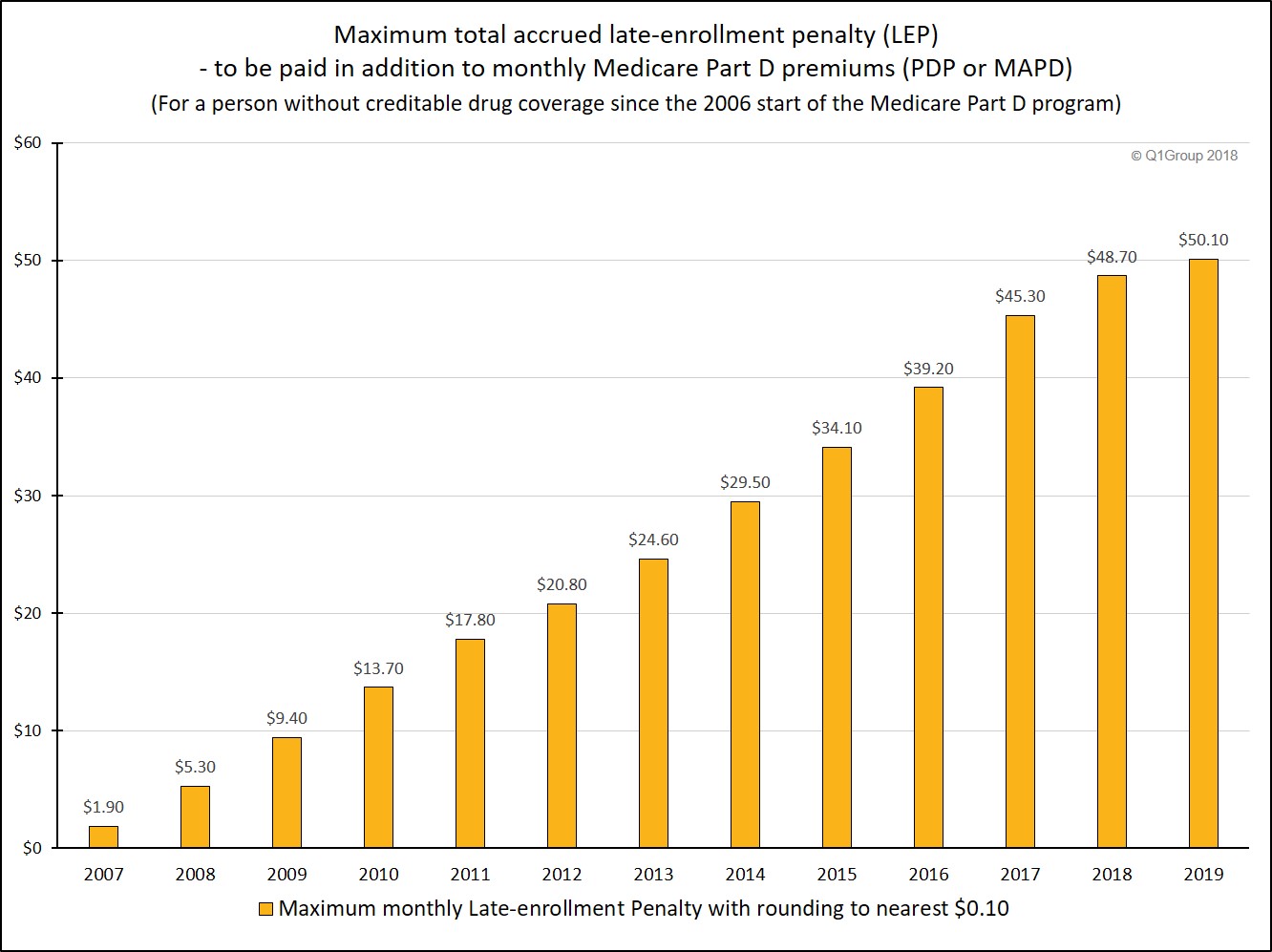

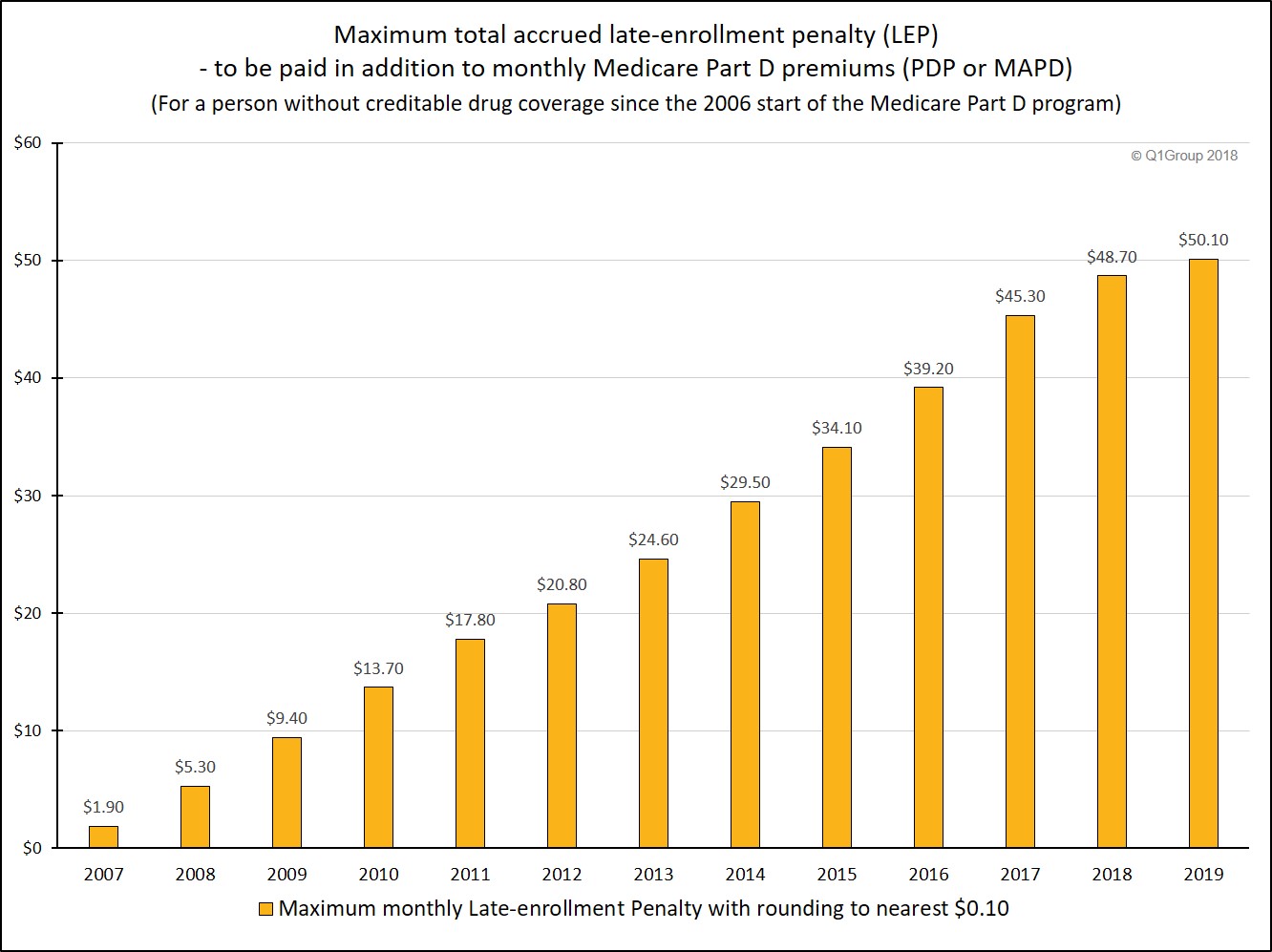

If you wait past this window to enroll a late enrollment penalty for Medicare Part D will be added to your monthly premium. Since the national base beneficiary premium may increase each year the penalty.

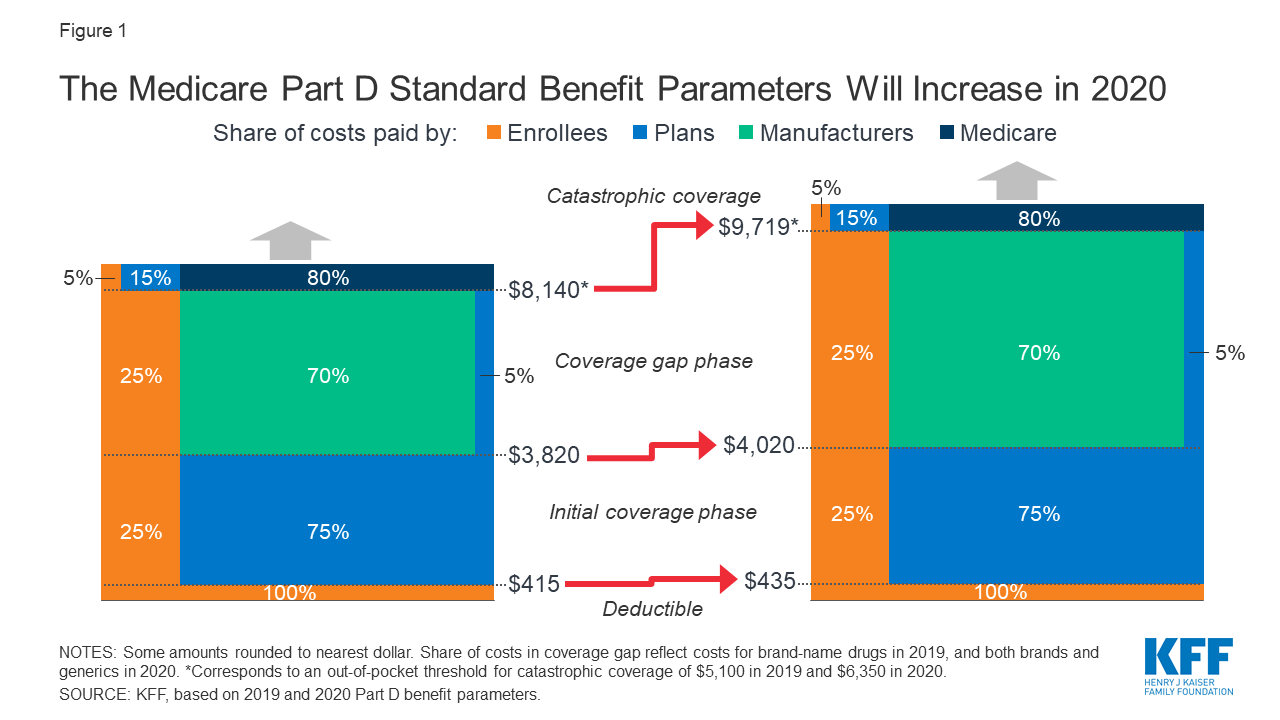

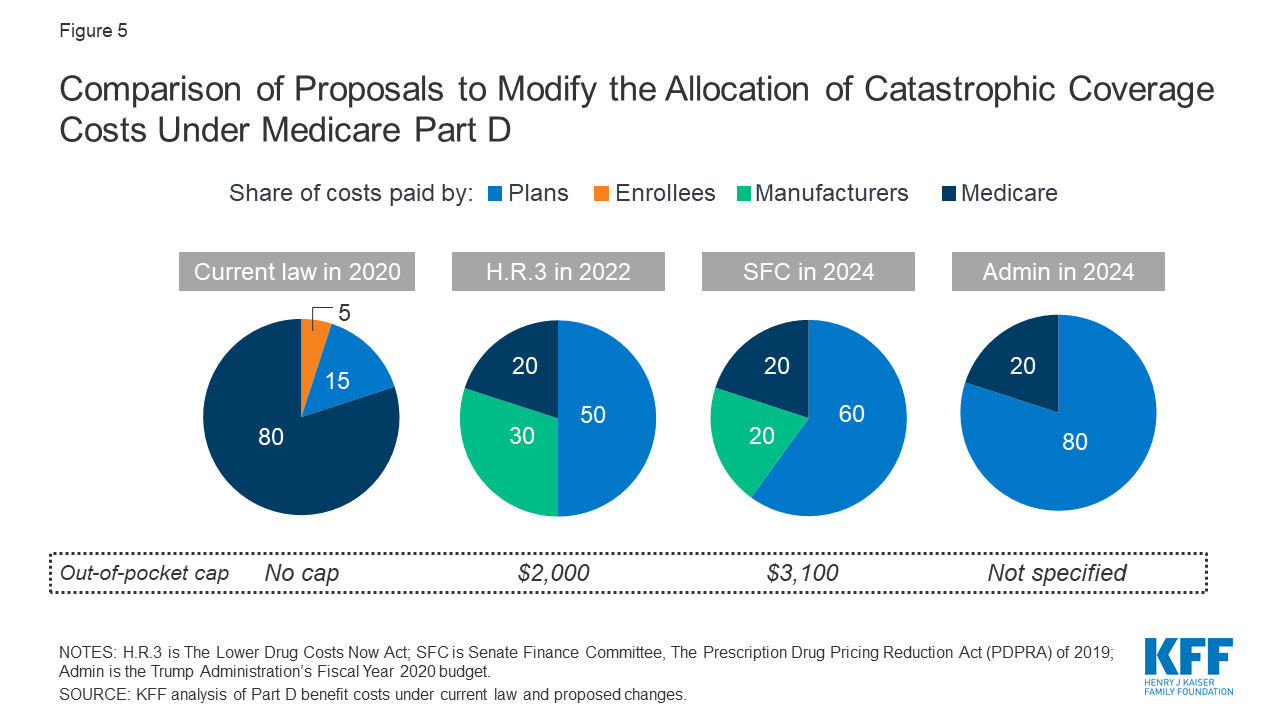

How Will The Medicare Part D Benefit Change Under Current Law And Leading Proposals Kff

How Will The Medicare Part D Benefit Change Under Current Law And Leading Proposals Kff

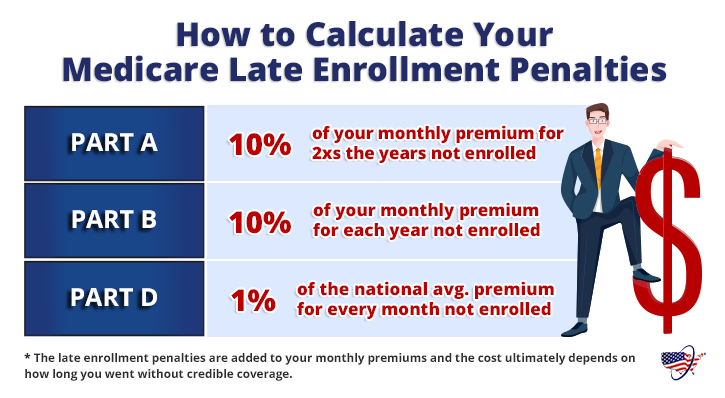

Part A late enrollment penalty.

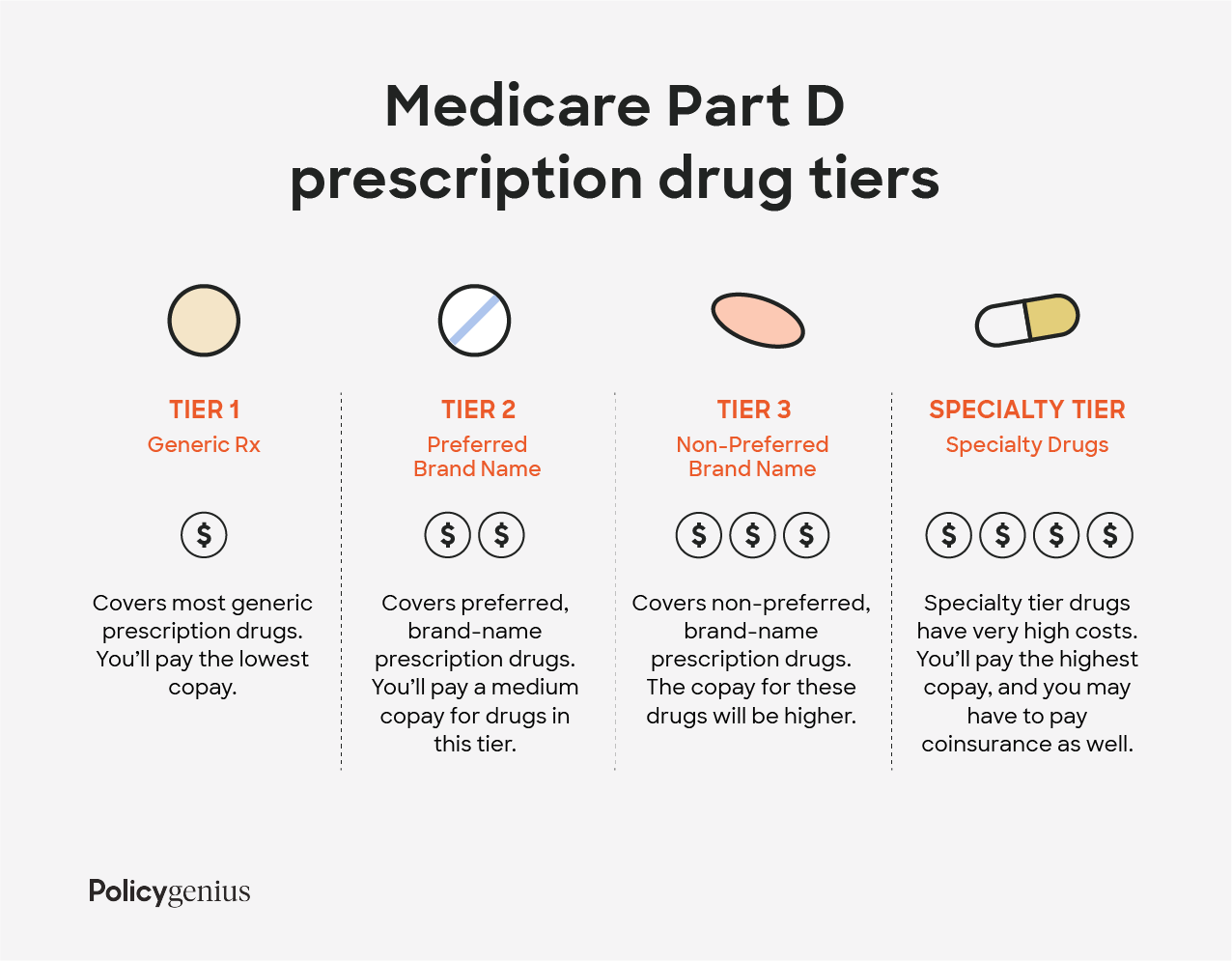

Is there a penalty for not getting medicare part d. For example if you didnt have Part D or creditable. Medicare Part D Medicare Part D is prescription drug coverage that you get from private Medicare-approved insurance companies. In a Medicare drug plan may owe a late enrollment penalty if he or she goes without Part D or other creditable prescription drug coverage for any continuous period of 63 days or more in a row after the end of his or her Initial.

If you multiply 132 x the current average premium that would give you an additional 44 to pay on top of the 3306. If you went 11 years without coverage that equates to 132 months. Although your Part B premium amount is based on your income your penalty is calculated based on the base Part B premium.

The penalty is calculated by multiplying 1 of the national base beneficiary premium 3306 in 2021 times the number of full uncovered months you didnt have Part D or creditable coverage. You decided not to get Medicare Part when you turned 65 which was in February of 2011. 3274 x 114 3732.

In general youll have to pay this penalty for as long as you have a Medicare drug. If you dont meet one of the four requirements above for a period of 63 days or more in a row you will face a penalty that requires some complicated math to figure out. Medicare calculates the penalty by multiplying 1 of the national base beneficiary premium 3306 in 2021 times the number of full uncovered months you didnt have Part D or creditable coverage.

Your Initial Enrollment Period ended December 2016. Currently the late enrollment penalty is calculated by multiplying 1 of the national base beneficiary premium 3274 in 2020 by the number of full uncovered months that you were eligible but didnt enroll in Medicare drug coverage and went without other creditable prescription drug coverage. Your monthly premium would be 70 higher for as long as you have Medicare 7 years x 10.

Youll have to pay the higher premium for twice the number of years you didnt sign up. The Part D late enrollment penalty is a penalty thats addied in addition to the national base benefificary Part D premium. Heres your Part D penalty calculation.

Even though you werent covered a total of 27 months this included only 2 full 12-month periods. You waited to sign up for Part B until March 2019 during the General Enrollment Period. That means you havent had Part D drug coverage for 114 months.

The monthly premium is rounded to the nearest 10 and added to your monthly Part D. However you could find a Part D. The Part D penalty is 1 of the average premium for every month you went without coverage.

For every month you dont have Part D or creditable coverage youre assessed a penalty of 1 of the national base beneficiary premium. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. The monthly premium is rounded to the nearest 10 and added to your monthly Part D.

The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. The penalty is rounded to 970 which youll pay along with your premium each month. Your coverage starts July 1 2019.

Since the base Part B premium in 2021 is 14850 your monthly premium with the penalty will be 25245 14850 x 07 14850. The amount is 1 for every month you went without coverage when first eligible. Your Part B premium penalty is 20 of the standard premium and youll have to pay this penalty for as long as you have Part B.

What is the Medicare Part D Late Enrollment Penalty. If you have creditable prescription drug coverage when you first become eligible for Medicare generally you can keep it without paying the late enrollment penalty if you sign up for Part D later. The late enrollment penalty is added to your monthly Part D premium for as long as you have Medicare.

The final amount is rounded to the nearest 10 and added to your monthly premium. Some people have to buy Part A because they dont qualify for premium-free Part A. Penalties for not signing up for Medicare.

Once you enroll in Part D youll pay this penalty. This penalty is added to your monthly Part D premium for as long as you have a Medicare drug plan. Its optional yet theres a late enrollment penalty if you dont sign up when youre first eligible for Medicare and decide at some later date that you want this coverage.

This fee is 1 percent of the. Medicare calculates the late-enrollment penalty by multiplying the 1 penalty rate of the national base beneficiary premium 3306 in 2021 by the number of full uncovered months you were eligible to enroll in a Medicare Prescription Drug Plan but did not assuming. If you have to buy Part A and you dont buy it when youre first eligible for Medicare your monthly premium may go up 10.

How To Avoid The Part D Penalty

How To Avoid The Part D Penalty

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

Penalties For Not Signing Up For Medicare Part D What Is The Part D Penalty

Penalties For Not Signing Up For Medicare Part D What Is The Part D Penalty

How Will The Medicare Part D Benefit Change Under Current Law And Leading Proposals Kff

How Will The Medicare Part D Benefit Change Under Current Law And Leading Proposals Kff

What If I Did Not Get Medicare Part D During My Initial Enrollment

What If I Did Not Get Medicare Part D During My Initial Enrollment

2019 Medicare Part D Late Enrollment Penalties Will Decrease By 5 23 But Maximum Penalties Can Reach 601 Per Year

2019 Medicare Part D Late Enrollment Penalties Will Decrease By 5 23 But Maximum Penalties Can Reach 601 Per Year

Your Guide To Medicare Part D For 2021 Policygenius

Your Guide To Medicare Part D For 2021 Policygenius

/medicare-part-d-coverage-4589853-ada67299bb5a4d3eb70e32dd66bcab0f.png) What Does Medicare Part D Cover

What Does Medicare Part D Cover

Medicare Drug Coverage Penalty How The Part D Penalty For Not Enrolling Works

Medicare Drug Coverage Penalty How The Part D Penalty For Not Enrolling Works

/medicare-part-d-eligibility-4589763-1670217de0f843d5a368218e33b28067.png) An Overview Of Medicare Eligibility And Benefits

An Overview Of Medicare Eligibility And Benefits

How To Avoid Medicare Penalties Part B And Part D Penalties Explained

How To Avoid Medicare Penalties Part B And Part D Penalties Explained

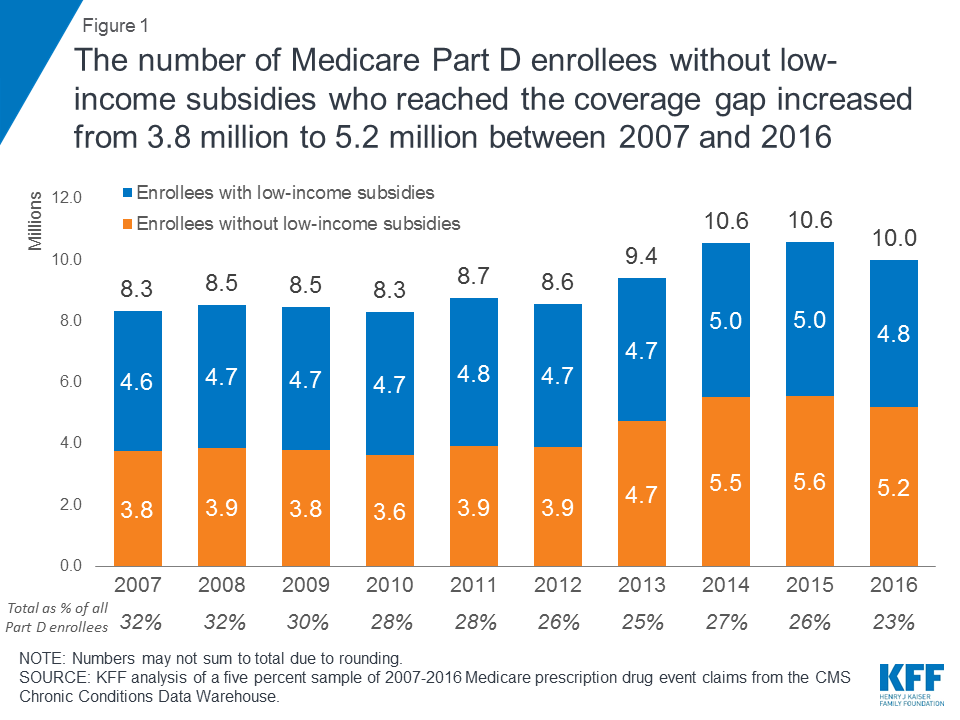

Closing The Medicare Part D Coverage Gap Trends Recent Changes And What S Ahead Kff

Closing The Medicare Part D Coverage Gap Trends Recent Changes And What S Ahead Kff

How To Sign Up For Medicare Understanding Medicare Enrollment

How To Sign Up For Medicare Understanding Medicare Enrollment

Find Medicare Part D Prescription Drug Plan Coverage

Find Medicare Part D Prescription Drug Plan Coverage

Comments

Post a Comment