Featured

What Is Group Term Life Insurance

Advertentie Unlimited access to Term Life Insurance market reports on 180 countries. As the name itself suggests a group term life insurance is designed to offer life insurance to a group of people under a single policy.

Jyoti Samuhik Myadi Jeevan Beema Group Term Life Plan Jyoti Life Insurance Company Ltd

Jyoti Samuhik Myadi Jeevan Beema Group Term Life Plan Jyoti Life Insurance Company Ltd

Group term insurance plan is specifically designed for businesses companies societies and associations.

What is group term life insurance. This plan helps the employer to pay off his liability toward gratuity as well the life of the employee. Tap into millions of market reports with one search. Once the policyholder pays the premium every member will be provided with the benefits of group term insurance.

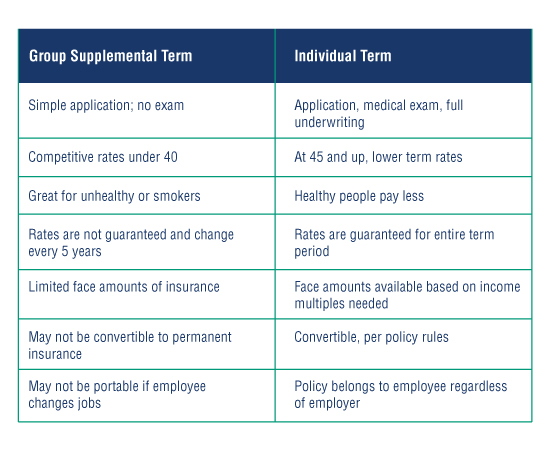

Employees can purchase additional supplemental group term life insurance usually through payroll deductions. The group insurance scheme is not limited to employer-employee groups. Term insurance is the most common form of group life insurance.

If you are a salaried professional you may be offered group term life insurance by your employer. The amount of coverage available to. Advertentie Unlimited access to Term Life Insurance market reports on 180 countries.

It provides life coverage to all the members of the specific group or company. A form of term life insurance coverage that provides a return of some of the premiums paid during the policy term if the insured person outlives the duration of the term life insurance policy. The coverage offered through a group plan varies among employers.

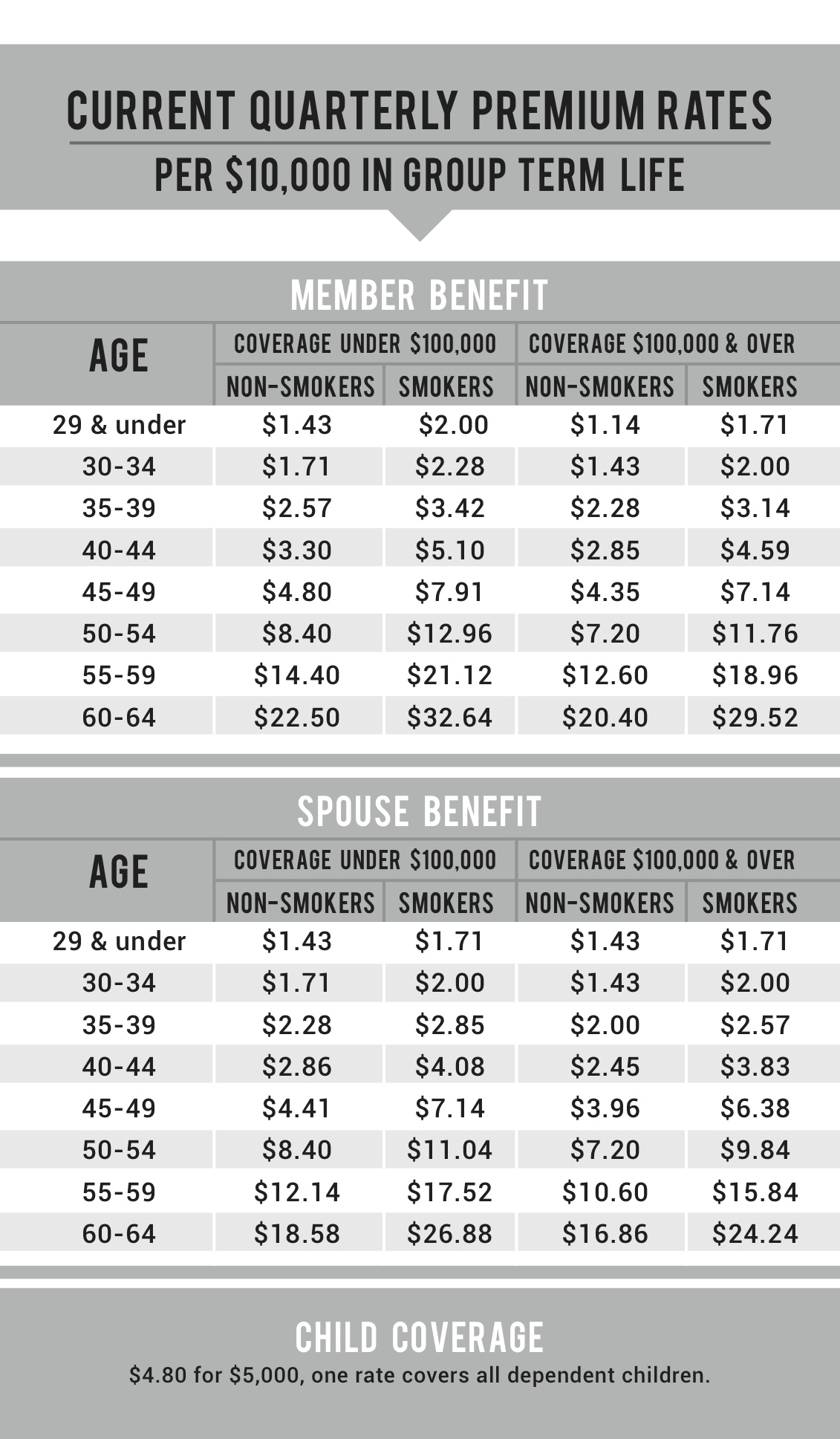

Group Term Life Insurance Plans as the name implies are intended to provide life insurance to a group of individuals under a standard scheme. Its features and benefits are the subject of discussion in this article. The premium is based on the number of members and the age group which they belong to.

As a result participation is high among employees. A group life insurance policy is a type of life insurance that provides coverage to an entire group of people under one contract. Term life insurance is just what its name suggests.

Its a life insurance policy you buy for a certain number term of years. The benefits offered by group life insurance policies are the same as the individual term insurance plan. The most common group is a company.

In most cases the employer pays all or a portion of the premium or membership in the organization provides a premium discount. Group term life insurance is a type of term insurance whereby the life insurer issues the employer a Master Contract with coverage extended to employees. A group term life insurance is one of the cheapest financial products on offer.

If you wish to buy additional. Workplace Group Term Life Insurance Many employers provide group term life insurance as an employee benefit. Group Term Life Insurance.

In most cases these policies are owned by an employer or entity and the policy provides coverage to their employees. You buy it for your family. But its not the kind of policy that you really buy for yourself.

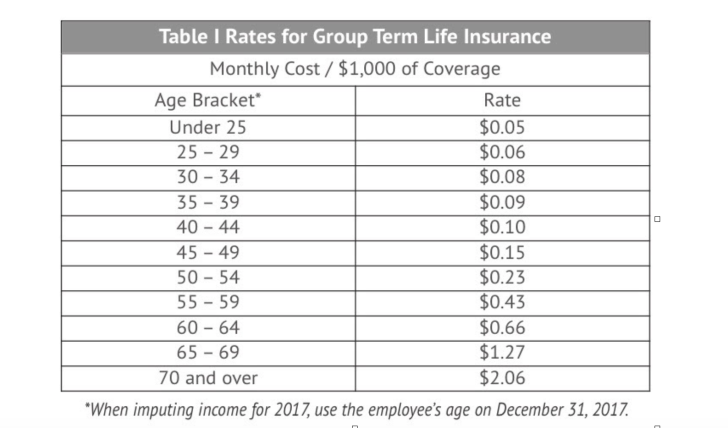

Tap into millions of market reports with one search. Employers are allowed to provide up to 50000 in tax-free coverage. How Group Term Life Insurance Works Coverage Amounts.

Here are some of the benefits of group term life insurance policies. In this policy a lump sum benefits are payable to the beneficiary in case of the death of the employee during the period of the plan. How Does Group Term Life Insurance Work.

Group term life insurance is a type of life insurance policy that an employer or company offers to their employees. Your employer may provide a certain amount of coverage free of charge. When group term insurance is provided through your employer the employer usually pays for most and in some cases all of the premiums.

Typical terms include 10 20 or 30 years. Group term life insurance is a life insurance policy that is offered to employees of a company or members of an organization. A group insurance is not limited to employer-employee group only because it extends to other groups like banks NGOs etc.

In the majority of cases the company will pay for all or a percentage of the group life insurance premium. The insurer gives the option to choose the sum assured. Group term life insurance is relatively inexpensive compared to buying your own individual life insurance policy.

Group term life insurance is a type of term insurance in which one contract is issued to cover multiple people. Group term life is typically provided in the form of yearly renewable term insurance. Still it is often applied to other grou.

All You Need To Know About Group Term Life Insurance Myaccountgo

Know Which Term Life Insurance Is Best Group Term Life Insurance

Know Which Term Life Insurance Is Best Group Term Life Insurance

Group Life Insurance Policies Truelifequote

Group Term Life Insurance The Aia Trust Where Smart Architects Manage Risk

Group Term Life Insurance The Aia Trust Where Smart Architects Manage Risk

What Is Group Term Life Insurance What To Know Duggu24

What Is Group Term Life Insurance What To Know Duggu24

Ncflex Group Term Life Insurance Youtube

Ncflex Group Term Life Insurance Youtube

Golocalprov Smart Benefits Imputed Income For Group Term Life Insurance

Golocalprov Smart Benefits Imputed Income For Group Term Life Insurance

Group Term Life Insurance A Compliance Primer Crystal Company

Group Term Life Insurance A Compliance Primer Crystal Company

Individual Life Insurance Vs Group Term Life Insurance Financial Benefit Services Employee Benefit Solutions

Individual Life Insurance Vs Group Term Life Insurance Financial Benefit Services Employee Benefit Solutions

Is Group Life Insurance A Good Deal Llis

Is Group Life Insurance A Good Deal Llis

Group Term Life Insurance Compass Rose Benefits Group

Group Term Life Insurance Compass Rose Benefits Group

Camlife Group Term Life Insurance

Camlife Group Term Life Insurance

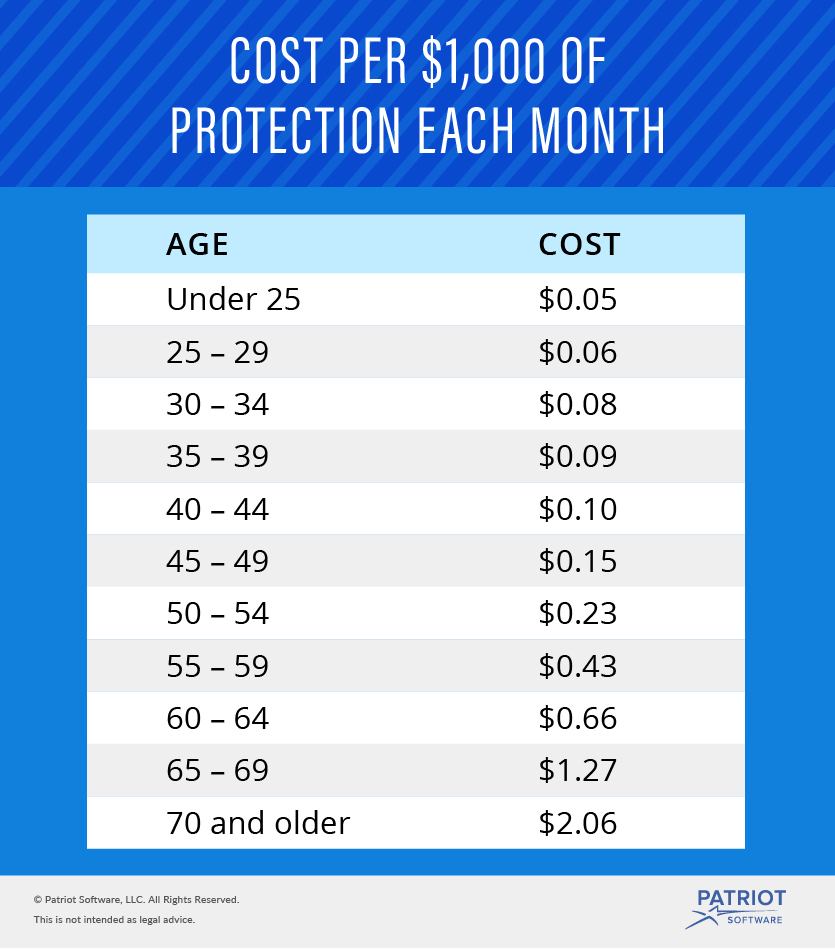

Easy Guide To Group Term Life Insurance Tax Tax Table Example

Easy Guide To Group Term Life Insurance Tax Tax Table Example

How Does Group Term Life Insurance Work Securenow

How Does Group Term Life Insurance Work Securenow

Comments

Post a Comment