Featured

- Get link

- X

- Other Apps

2020 Healthcare Subsidy Calculator

The tax subsidy program serves to help lower the cost of health insurance for low and middle-income Californians. These income levels certainly extend well into the middle class but if you find yourself with an income thats just slightly too high for premium subsidies you could end up paying a very significant chunk of your income for your health.

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

Enter the required information into the fields below then calculate your results.

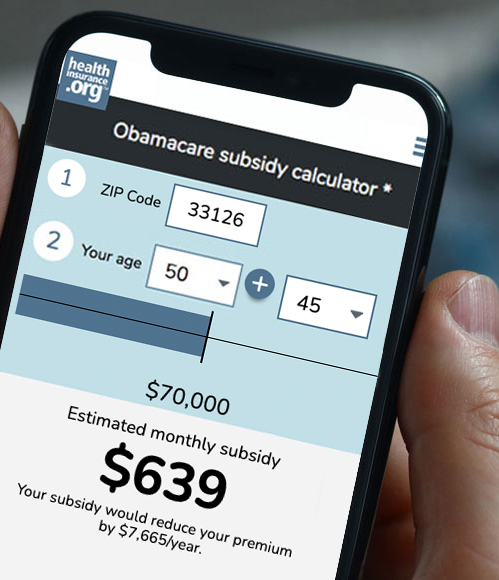

2020 healthcare subsidy calculator. You may qualify for a 2020 premium subsidy if your yearly income is between. The calculator below provides estimates only you wont know your exact credit until you apply for the Marketplace. About the 2020 2021 Obamacare Subsidy Calculator The purpose of this subsidy calculator is to provide Americans with the ability to quickly determine if they are eligible for subsidized health insurance under the Affordable Care Act.

In 2020 those who make between 400 to 600 of the FPL are eligible. Including the right people in your household. The law created a system that provides financial help to low and middle income families in the form of a subsidy.

To figure out how Toms income compares to FPL use. To receive a PTC you must split the uprights between making too little and too much income. Again subsidies have increased for 2021 and will remain larger in 2022 due to the American Rescue Plan.

Could you get a federal subsidy for health insurance. Learn more about who to include in your household. The estimation of your childcare subsidy will be based on the information you provide.

Learn more about estimating income and see what to include. How much you may claim. FPL for 2020 used for 2020 coverage is 12760 for a single individual.

That number has dropped from 0 to to 85 for two years. Prior to 2021 you were expected to spend from 2 to 983 of your household income toward health insurance. The CERS provides both a base subsidy and in some cases a lockdown support amount.

The base subsidy rate applies to a maximum of 75000 in eligible expenses per location and an overall maximum of 300000 in expenses for you and any affiliated entities per claim period. Use the ObamaCare subsidy calculator below to get an idea of what kind of cost assistance you are eligible for under the Affordable Care Act when you buy a health insurance marketplace plan. About the 2020 2021 Obamacare Subsidy Calculator The purpose of this subsidy calculator is to provide Americans with the ability to quickly determine if they are eligible for subsidized health insurance under the Affordable Care Act.

Use this tool to help calculate someones income. 2020 Obamacare Premium Tax Calculator By A Noonan Moose on October 28 2019 In 2020 the federal government will once again offer a Premium Tax Credit PTC to qualifying taxpayers who buy health coverage from an approved health insurance exchange. Income FPL x 100.

If any information provided is inaccurate the estimation could be incorrect. You may qualify for a premium subsidy AND a cost share reduction if your yearly income is between. The American Rescue Plan also opened a Special Enrollment Period on the federal Health Insurance Marketplace.

Previously those who made above 400 of the federal poverty line FPL were not eligible for premium tax credits. Use our income calculator to make your best estimate. How the subsidy is calculated.

This Calculator could. Premium and subsidy calculator for the Affordable Care Act Obamacare This Subsidy Calculator is based on formulas and regulations defined by the Affordable Care Act ACAObamacare. Under California health insurance law California rolled out a new tax subsidy program in 2020.

Your eligible cap rate and the cost of the. The law created a system that provides financial help to low and middle income families in the form of a subsidy. This Subsidy Calculator is based on formulas and regulations defined by the Affordable Care Act ACAObamacare.

The average subsidy amount in 2020 was 492month which covered the large majority of the average 576month premium note that both of these amounts are lower than they were in 2019. Subsidies are primarily based on two criteria. However the results from this childcare subsidy calculator are only indicative and informative.

24000 12760 x 100 188. So when we talk about premium subsidy eligibility for 2021 were looking at the enrollees projected 2021 income versus the federal poverty level numbers for 2020. With this calculator you can enter your income age and family size to estimate your eligibility for subsidies and how much you could spend on health insurance.

The Child Care Subsidy rates that take effect on 13 July 2020 for Financial Year 2021 FY21 are being used. Count yourself your spouse if youre married plus everyone youll claim as a tax dependent including those who dont need coverage. This subsidy calculator is provided by My1HR a licensed Web Based Entity WBE which is certified by the Centers for Medicare and Medicaid Services CMS to connect consumers directly with the federal health insurance Exchange at HealthCare.

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

2019 Health Insurance Marketplace Calculator Kff

2019 Health Insurance Marketplace Calculator Kff

Will You Receive An Obamacare Premium Subsidy Healthinsurance Org

Will You Receive An Obamacare Premium Subsidy Healthinsurance Org

Obamacare Subsidy Calculator Obamacare Rates For 2020 2021

Obamacare Subsidy Calculator Obamacare Rates For 2020 2021

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Subsidy Calculator Are You Eligible For A Subsidy Ehealth

Subsidy Calculator Are You Eligible For A Subsidy Ehealth

Aca Open Enrollment What If You Make Too Much For A Subsidy The New York Times

Aca Open Enrollment What If You Make Too Much For A Subsidy The New York Times

Obamacare S Subsidy Cliff Eliminated For 2021 And 2022 Healthinsurance Org

Obamacare S Subsidy Cliff Eliminated For 2021 And 2022 Healthinsurance Org

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

We Claim Our Son But Not Our Daughter On Our Taxes How Are Premium Subsidies Calculated For Families Like Ours Healthinsurance Org

We Claim Our Son But Not Our Daughter On Our Taxes How Are Premium Subsidies Calculated For Families Like Ours Healthinsurance Org

Comments

Post a Comment