Featured

Epo Medical Insurance

While each has its own set of benefits exclusive provider organization EPO plans are one of the most attractive options. An EPO has higher deductibles A deductible is the amount you pay out of pocket before your insurance company covers its portion of your medical bills.

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

HMO stands for Health Maintenance Organization and EPO stands for Exclusive Provider Organization.

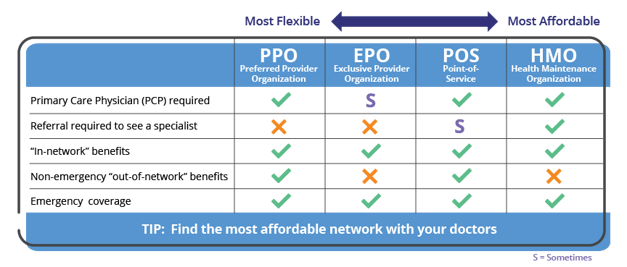

Epo medical insurance. An EPO is a type of health plan that offers a full-network of doctors and hospitals from which to choose. The most common types of health insurance plans include HMO PPO and EPO. Its principle difference is that the members must use network resources to get insurance coverage and to reach the plans deductibles and out-of-pocket limit.

An EPO is a hybrid between an HMO and PPO plan. Under the policy general practitioners and specialists fees and the. Your insurance will not cover any costs you get from going to someone outside of that network.

An exclusive provider organization or EPO is a health insurance plan that only allows you to get health care services from doctors hospitals and other care providers who are within your network. - Free Quote - Fast Secure - 5 Star Service - Top Providers. When considering their difference the HMO can be termed as an insured product which means that the insurance.

Check out our affordable health plans and calculate your premium. Advertentie Zilveren Kruis healthcare insurance is the foremost collective healthcare insurer. Basically an EPO is a much smaller PPO.

- Free Quote - Fast Secure - 5 Star Service - Top Providers. Learn more about EPO insurance how it differs from other plans and why you should speak with a health insurance broker. EPO Health InsuranceWhat It Is and How It Works Point of Service POS POS plans resemble HMOs but are less restrictive in that youre allowed under certain circumstances to get care out-of-network as you would with a PPO.

What is an EPO plan. Check out our affordable health plans and calculate your premium. An EPO plan may be right for you if.

EPO stands for Exclusive Provider Organization plan. Tap into millions of market reports with one search. As a member of an EPO you can use the doctors and hospitals within the EPO network but cannot go outside the network for care.

EPO employees their spouses children and other dependants within the meaning of the Service Regulations are insured as from the date of entry into service against expenditure incurred in case of sickness accidents pregnancy and confinement. Get the Best Quote and Save 30 Today. Advertentie Unlimited access to Health Insurance market reports on 180 countries.

EPO employees their spouses children and other dependants within the meaning of the Service Regulations are insured as from the date of entry into service against expenditure incurred in case of sickness accidents pregnancy and confinement. If they go to a provider in-network they have limited out-of-pocket costs. You do not want to get a referral to see a specialist.

Advertentie Zilveren Kruis healthcare insurance is the foremost collective healthcare insurer. If your deductible is 1000 your insurance company will not cover any costs until you pay the first 1000 yourself. Difference Between HMO and EPO HMO vs EPO HMO and EPO are both health insurance schemes.

Like a HMO an EPO gives your employees access to a select network of medical providers. There are no out-of-network benefits. Get the Best Quote and Save 30 Today.

The EPO is an important type of healthcare network. Advertentie Compare Top Expat Health Insurance In Ireland. It works in Medicare as well as Marketplace health insurance.

Well there are several technical differences between HMO and EPO. An EPO Exclusive Provider Organization insurance plan is a network of individual medical care providers or groups of medical care providers who have entered into written agreements with an insurer to provide health insurance to subscribers. Tap into millions of market reports with one search.

Healthcare insurance at the EPO. But lower premiums A premium is a fee you pay to your insurance company for a health plan. Advertentie Compare Top Expat Health Insurance In Ireland.

Advertentie Unlimited access to Health Insurance market reports on 180 countries.

Epo Health Plans Independence Blue Cross Ibx

Pin On Obama Care Health Insurance

Pin On Obama Care Health Insurance

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between An Hmo Vs Ppo Xcelhr

Epo Vs Ppo Difference And Comparison Diffen

Epo Vs Ppo Difference And Comparison Diffen

Exclusive Provider Organization Epo Insurance 101 Medicaid Info Org

Know Your Options Individual Health Insurance In Tennessee

Know Your Options Individual Health Insurance In Tennessee

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Medical Plans County Of San Luis Obispo

Medical Plans County Of San Luis Obispo

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

The Insurance Basics Cf Foundation

The Insurance Basics Cf Foundation

Epo Health Insurance Plan What You Need To Know My Calchoice

Epo Health Insurance Plan What You Need To Know My Calchoice

Ppo Epo Hmo Which Is The Best Safe Policies Insurance

Ppo Epo Hmo Which Is The Best Safe Policies Insurance

Comments

Post a Comment