Featured

Medicare Part K

Enrollment in Plan K increased by 28 from 2014 to 2015 according to a report. Medigap Plan K is one of two Medigap plans that includes a yearly out-of-pocket limit which is 6220 in 2021.

Your maximum out-of-pocket expense for Medicare-covered deductibles and coinsurance is limited.

Medicare part k. Total Number of Fee-for-Service Beneficiaries. Part A deductible Part A hospice care coinsurance or copayment Part B copayment or coinsurance First. Medicare Part C.

50 Part A hospice care coinsurance or copayment. You have reasonable out-of-pocket costs when you need medical care similar to typical Medicare Advantage plans. Together Medicare Parts A and B are called Original Medicare Medicare Part B.

What Does Plan K Cover. 401 as of 9302020. One of several supplemental plans Part K might be a good option for you depending on your medical needs.

Medicare Part B usually charges a coinsurance and copayments for doctor. Plan K does not pay any of the Part B excess when you see a provider that does not accept Medicare. JK processes FFS Medicare Part A and Part B claims for Connecticut Maine Massachusetts New Hampshire New York Rhode Island and Vermont.

This plan is designed to help reduce the out of pocket. If you are interested in Plan K be sure to ask if its available where you live. Medigap Plan K offers 50 coverage for most of the types of benefits.

50 Hospice coverage for Part A coinsurance. Part B medical coverage covers things like doctor visits outpatient services X-rays and lab tests and preventive screenings. Medicare Supplement Plan K Benefits.

Partial Benefits Yearly Out-of-Pocket Spending Limit. Part A coinsurance and hospital costs for up to an additional 365 days after Medicare benefits are exhausted. Ask if Medicare will cover them.

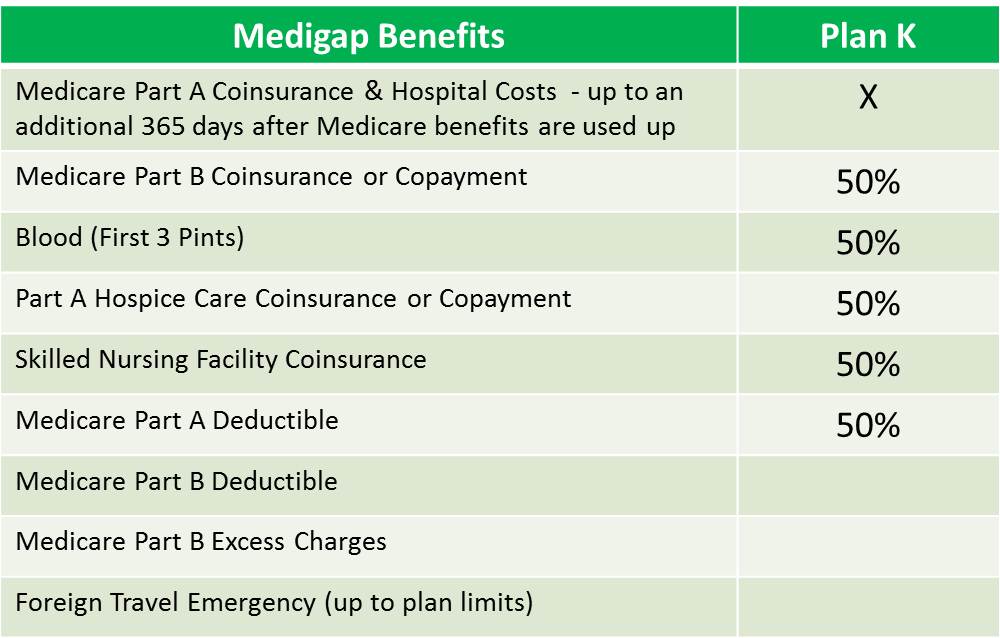

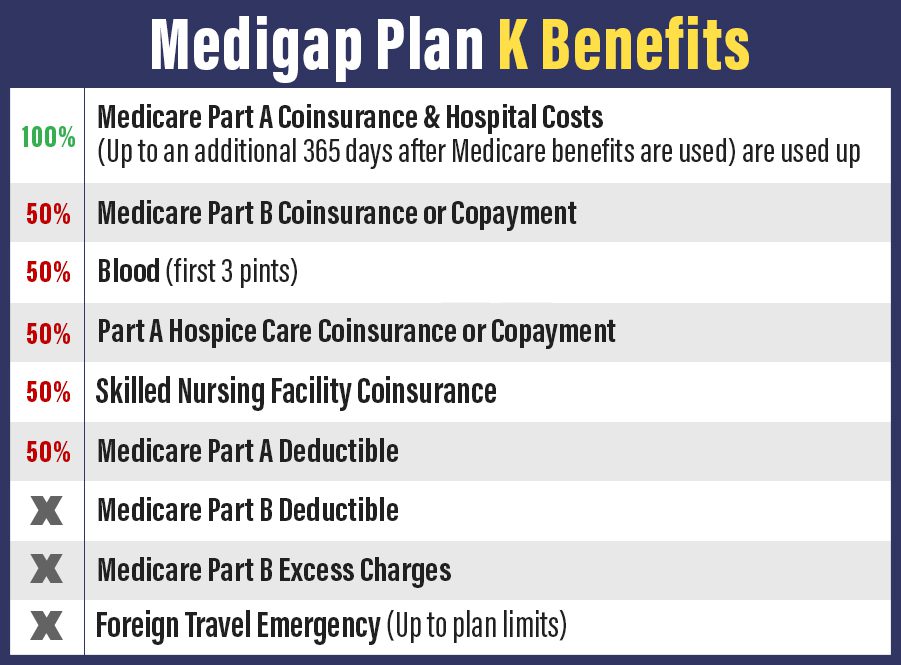

For the rest of the benefits that Plan K. Medicare Part B copayment or coinsurance The first three pints of blood for a covered medical procedure Medicare Part A hospice care coinsurance or copayment Skilled Nursing Facility care coinsurance Medicare Part A deductible. Medicare Part A Coinsurance.

2 ways to find out if Medicare covers what you need. Part A hospital coverage covers things like inpatient hospital stays some home health care and skilled nursing facility care. Medicare Supplement Plan K coverage provides.

After your out-of-pocket costs have reached this limit which includes the yearly Part B deductible Medigap Plan K may cover 100 of your Medicare-covered costs for the rest of. Medicare Part B Coinsurance and Copayment. Medicare Supplement Plan K.

Plan K covers 100 of the Medicare Part A hospital coinsurance benefit. Plan K also may pay 50 of the following expenses. Medicare Part A is known as hospital insurance and it includes cost-sharing measures like.

50 skilled nursing facility. If so youll have to read and sign a notice. First 3 Pints of Blood.

12 rânduri For Plans K and L after you meet your out-of-pocket yearly limit and your yearly. Coverage normally includes all of Parts A and B a prescription. Plan K does not pay the Part B annual deductible of 18500 once per year.

100 Part A deductible. Medigap Plan Ks benefits pay 50 of several cost-sharing expenses in Original Medicare which may include the following costs and benefits. Medicare Supplement Plan K is one of the cost-sharing plans available to Medicare beneficiaries.

The notice says that you may have. 100 coverage for Part A hospitalization coinsurance plus coverage for 365 days after Medicare benefits end. You may need something thats usually covered but your provider thinks that Medicare wont cover it in your situation.

Medicare Part A. The Benefits of a Medicare Supplement Plan K or L. Talk to your doctor or other health care provider about why you need certain services or supplies.

Plan K only pays 50 of the 136400 Part A Deductible. Also known as Medicare Advantage Part C is an alternative to traditional Medicare coverage. The parts of Medicare cover different services.

50 blood first 3 pints. For 2020 it is 5880 with Plan K and 2940 with Plan L. The benefits that Medigap Plan K covers in full are Part A coinsurance for hospital costs up to 365 days beyond the use of Medicare benefits foreign travel emergency to plan limits and Part B coinsurance for preventive care.

Heres a breakdown of the costs Medigap Plan K will cover. Plan K has many of the other benefits that Medigap plans offer but with a lower premium. Original Medicare offers basic coverage for certain hospital and medical needs but some individuals find that they need more assistance with their expenses.

4100647 as of 9302020 Total Number of Physicians. 130061 as of 9302020 Total Number of Medicare Hospitals. Medicare Plan K is the Medicare Supplement that covers the Part A hospital deductible while also covering about 50 of the other gaps in Medicare.

You pay 50 or 682 per benefit period.

Medicare Supplement Plan K My Medicare Supplement Plan

Medicare Supplement Plan K My Medicare Supplement Plan

Medicare Plan K Quotes And Coverage Medicare Supplement Plan K

Medicare Plan K Quotes And Coverage Medicare Supplement Plan K

Comparison Chart Of All 10 Medicare Supplement Plans Policies

Comparison Chart Of All 10 Medicare Supplement Plans Policies

What Is Medicare Plan K Which Medigap Plan Is Best Youtube

What Is Medicare Plan K Which Medigap Plan Is Best Youtube

Medigap Plans Comparison Chart Texas Medicare Plan

Medigap Plans Comparison Chart Texas Medicare Plan

Medigap Plan K Medicare Supplement Plan K

Other Medigap Plans Medigap Plans C D And More 65medicare Org

Other Medigap Plans Medigap Plans C D And More 65medicare Org

Medicare Supplement Insurance Plan K Medigap Plan K Costs Benefits

Medicare Supplement Insurance Plan K Medigap Plan K Costs Benefits

Transamerica Medicare Supplement Plans For Baby Boomers

Transamerica Medicare Supplement Plans For Baby Boomers

Medicare Supplement Plan K An Alternative To Medicare Advantage

Medigap Plan K Tupelo Ms Bobby Brock Insurance

Medigap Plan K Tupelo Ms Bobby Brock Insurance

Medicare Plan K Quotes And Coverage Medicare Supplement Plan K Medicare Supplement Plans Medicare Supplement Medicare

Medicare Plan K Quotes And Coverage Medicare Supplement Plan K Medicare Supplement Plans Medicare Supplement Medicare

Comments

Post a Comment