Featured

Will Medicare Pay For Life Alert

Does Medicare Cover Medical Alert Systems. Does medicare pay for life alert buttons If you are a senior citizen who is faced with mounting housing payments maintenance and medical costs Medicare offers housing assistance options.

Does Medicare Cover Life Alert Medicare Plan Finder

Does Medicare Cover Life Alert Medicare Plan Finder

If you are enrolled in Medicare Part A and Part B Original Medicare and want to obtain Life Alert or another.

Will medicare pay for life alert. Medical Care Alert is another company that offers an affordable in-home system for low-income seniors. Approximately 64 million seniors receive insurance coverage via Medicare a federal health insurance program for citizens who are elderly or disabled. A Mobile Alert with GPS and Auto Fall Detection that Works Everywhere.

Unfortunately though Medicare does not cover medical alert systems. 45 years ago we founded the medical alert service industry and are still the 1 medical alert service in the. As a UnitedHealthcare Medicare Advantage member you are eligible to receive the Philips Lifeline medical alert service at no cost to you.

There are other ways to pay for a medical alert. Serving all of Alabama. This national insurance program covers essential expenses such as prescription medication and hospitalization but it generally doesnt provide coverage for medical alert.

Unfortunately Original Medicare doesnt cover medical alert systems. Part B of Original Medicare covers durable medical equipment such as hospital beds canes walkers and blood sugar meters. Although Original Medicare doesnt cover Life Alert some Medicare Advantage plans also called Medicare Part C may cover Life Alert medical alert systems and other personal emergency response system PERS systems as an added benefit.

While TRICARE For Life TFL covers what it calls Durable Medical Equipment medical alert systems dont fall under this umbrella. Additionally senior military retirees who enroll in Tricare For Life and opt for a Medicare Part C plan may be able to obtain coverage for a medical alert system through a private provider. Medicare wont pay for medical alert systems but Medicare Advantage or Medicaid may help pay for some or all of the costs.

Medicare insurance makes the argument that these devices are not necessary for health and that care facilities or in-home care can. According to the Centers for Disease Control falls are the leading cause of injury-related death among adults age 65 and. According to Philips Lifeline active AARP members can save 15 on their monthly medical alert system monitoring fee.

Still that shouldnt stop you from getting a system. Medicare coverage is often only provided for services or supplies that are deemed to be medically necessary. Some Medicare Supplement insurance carriers may provide a discount on the cost of a medical alert system.

Original Medicare doesnt cover Life Alert. If seniors need more coverage to improve the quality of their life the ability to lead an independent life and flexibility they can sign up for a suitable Medicare Advantage Plan. AARPs discount list is updated regularly so its always worth checking to see if more medical alert companies have been added before signing up for an emergency call monitoring service.

One loophole for TFL members could be that they continue to pay for their Medicare Part B premiums and enroll in a Medicare Part C plan also known as a Medicare Advantage Plan that may contribute to the cost of Medical Alert Systems as a plan. The best way to see if this. Does Medicare Cover Medical Alert Systems.

Live Life Mobile Medical Alert - Available and Paid for with Veteran Benefits. You can sign up for your Humana Medicare Advantage plan benefit starting January 1st 2020. The cost to you will depend on your Advantage plan and the Life Alert coverage options.

However you may have some luck getting coverage from Medicare Part C also known as Medicare Advantage. Contacting a device company directly to ask about discounts can provide. In most cases Original Medicare plans do not provide coverage for medical alert systems.

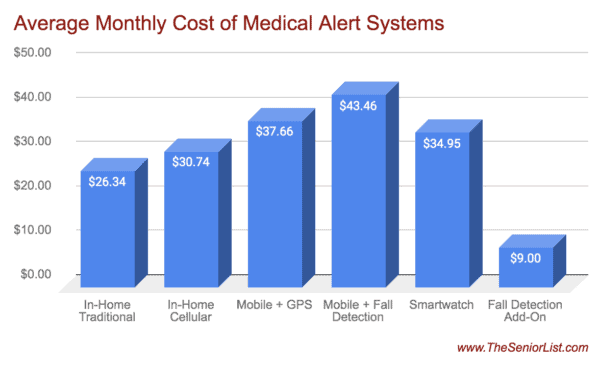

Nursing home help assisted living subsidized senior housing or housing supportive services. What Medicare Coverage Options are Available for Life Alert. In comparison to other medical alert prices most medical alert costs range between 2495 and 4995 monthly.

While Medicare doesnt cover them many carriers offer some form of coverage for medical alert systems for seniors. This means AARP members could pay only 4671 per month for. This is a supplemental health plan that offers private coverage for seniors who already receive Medicare.

Does Medicare Cover Medical Alert Systems. 1 By that definition you might expect Medicare to cover medical alert systems. Medicare Advantage plans might offer coverage for Life Alert.

Have your Humana member card on hand. Click here to check your eligibility and to enroll in the Philips Lifeline medical alert service. Several housing options are.

We were also disappointed that Life Alert doesnt provide fall detection which we consider a standard service in the industry. 866 205-4872 Web. Seniors who are independent physically and have a low to moderate income may qualify for non-Medicare-.

Medicare Part B covers medical tests and medical equipment yet it generally doesnt pay for medical alert systems. Since Medicare part A and B do not pay for Life Alert response systems or other emergency response services elderly patients may need to check other options available for the coverage.

Life Alert Medical Alert System Cost Pricing In 2021

Life Alert Medical Alert System Cost Pricing In 2021

Does Medicare Cover The Cost Of Medical Alert Systems 2021

Does Medicare Cover The Cost Of Medical Alert Systems 2021

Does Medicare Cover Life Alert Ez Insure

Does Medicare Cover Life Alert Ez Insure

Help For Caregivers Choosing Medical Alert Systems

Help For Caregivers Choosing Medical Alert Systems

Will Medicare Cover Life Alert Costs

Will Medicare Cover Life Alert Costs

Will Medicare Medicaid Pay For A Medical Alert Device

Will Medicare Medicaid Pay For A Medical Alert Device

Does Medicare Cover The Cost Of Medical Alert Systems 2021

Does Medicare Cover The Cost Of Medical Alert Systems 2021

Does Medicare Cover Life Alert In 2021 Find Out Here

Does Medicare Cover Life Alert In 2021 Find Out Here

Does Medicare Cover Wearable Alert Devices Medicarefaq

Does Medicare Cover Wearable Alert Devices Medicarefaq

Are Medical Alert Systems Covered By Medicare

Are Medical Alert Systems Covered By Medicare

Does Medicare Pay For Medical Alert Systems The Senior List

Does Medicare Pay For Medical Alert Systems The Senior List

Does Medicare Cover The Cost Of Medical Alert Systems 2021

Does Medicare Cover The Cost Of Medical Alert Systems 2021

Does Medicare Pay For Medical Alert Systems The Senior List

Does Medicare Pay For Medical Alert Systems The Senior List

Comments

Post a Comment