Featured

- Get link

- X

- Other Apps

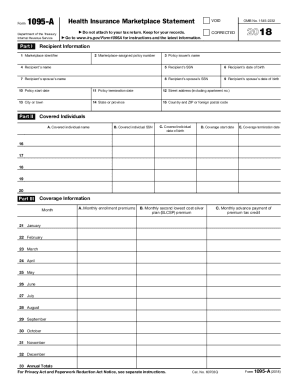

Marketplace 1095 A Form 2018

If you didnt get the form online or by mail contact the Marketplace Call Center How to use Form 1095-A. As the form is to be completed by the Marketplaces individuals cannot complete and use Form 1095-A available on IRSgov.

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

3 things to know about Form 1095-A.

Marketplace 1095 a form 2018. To start the blank utilize the Fill Sign Online button or tick the preview image of the form. Dont file until you have an accurate 1095-A. Individuals receiving a completed Form 1095-A from the Health Insurance Marketplace will use the information received on the form.

Health Insurance Marketplaces use Form 1095-A to report information on enrollments in a qualified health plan in the individual market through the Marketplace. Tips on how to complete the 1095 a 2018 form online. If two or more tax filers are enrolled in one policy each tax filer receives a statement reporting coverage of only the members of that.

How to complete any IRS 1095-A 2018 2015 1095 A on the internet. During tax season Covered California sends two forms to members. On the site together with the document just click Begin immediately along with complete towards the writer.

The advanced tools of the editor will direct you through the editable PDF template. If anyone in your household had Marketplace health coverage in 2020 you should have already received Form 1095-A Health Insurance Marketplace Statement. Use your hints to be able to fill in established track record job areas.

Employer-Provided Health Insurance Offer and Coverage. Name of employee f. For instructions and the latest information.

Marketplaces use Form 1095-A to furnish the required statement to recipients. As the form is to be completed by the Marketplaces individuals cannot complete and use Form 1095-A available on IRSgov. If you cant find your 1095-A.

If there are errors contact the Call. The eFile tax app will automatically select the tax forms for you to complete in order to report your 1095-A. Do not attach to your tax return.

Health Insurance Marketplaces use Form 1095-A to report information on enrollments in a qualified health plan in the individual market through the Marketplace. If your form is accurate youll use it to reconcile your premium tax credit. The federal IRS Form 1095-A Health Insurance Marketplace Statement.

Youll need it to complete your 2018 federal income tax return. Part I Employee. Department of the Treasury Internal Revenue Service.

Enter your official contact and identification details. If anyone in your household had a Marketplace plan in 2018 youll get Form 1095-A Health Insurance Marketplace Statement by early February. It may be available in your HealthCaregov account as soon as mid-January.

Store this form with your important tax information. A 1095-A Health Insurance Marketplace Statement is a form you receive from the Health Insurance Marketplace or Health Insurance Exchange at healthcaregov if you and your family members purchased health insurance through the Marketplace for some or all of the year. Keep for your records.

If anyone in your household had Marketplace coverage in 2017 you can expect to get a Form 1095-A Health Insurance Marketplace Statement in the mail by mid-February. How to check your Form 1095-A. It comes from the Marketplace not the IRS.

The 1095 is used to help you fill out forms like form 8962 for tax credits and is used to prove you had coverage. A separate Form 1095-A must be furnished for each policy and the information on the Form 1095-A should relate only to that policy. As the form is to be completed by the Marketplaces individuals cannot complete and use Form 1095-A available on IRSgov.

Add your own personal details and speak to info. The California Form FTB 3895 California Health Insurance Marketplace Statement. Youll also get a copy by US.

Look for Form 1095-A. 15 Zeilen Instructions for Form 1095-A Health Insurance Marketplace Statement 2018 Form 1095. If anyone in your household had a Marketplace plan in 2020 you should get Form 1095-A Health Insurance Marketplace Statement by mail no later than mid-February.

Form 1095-A is provided here for informational purposes only. You must have your 1095-A before you file. Health Insurance Marketplaces use Form 1095-A to report information on enrollments in a qualified health plan in the individual market through the Marketplace.

Use the California Franchise Tax Board forms finder to view this form. Dont file your taxes until you have an accurate 1095-A. Form 1095-A is provided here for informational purposes only.

Get your Form 1095-A Health Insurance Marketplace Statement Find it in your HealthCaregov account select your 2018 application not your 2019 application and select Tax forms from the menu on the left. If anyone in your household had Marketplace health insurance in 2018 you should have already received Form 1095-A Health Insurance Marketplace Statement in the mail. February 01 2018 Had 2017 Marketplace coverage.

It includes information about Marketplace plans anyone in your household had in 2018. A copy is sent to you and the IRS. If a 1095-A the kind the marketplace sends was never sent out to the policy holder then it could cause issues.

1095 A Form Fill Out And Sign Printable Pdf Template Signnow

1095 A Form Fill Out And Sign Printable Pdf Template Signnow

Breakdown Form 1095 A Liberty Tax Service

Breakdown Form 1095 A Liberty Tax Service

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png) About Form 1095 A Health Insurance Marketplace Statement Definition

About Form 1095 A Health Insurance Marketplace Statement Definition

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

2020 Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

2020 Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

Didn T Get A 1095 A Or Ecn You Can File Taxes Without Them

Didn T Get A 1095 A Or Ecn You Can File Taxes Without Them

Https Info Nystateofhealth Ny Gov Sites Default Files Tax 20credits 20form 201095 A 20and 20b 20january 202018 Pdf

Look For Form 1095 A In The Mail Or Online In Your Marketplace Account If You Had 2017 Marketplace Insurance Healthcare Gov

Look For Form 1095 A In The Mail Or Online In Your Marketplace Account If You Had 2017 Marketplace Insurance Healthcare Gov

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Comments

Post a Comment