Featured

Medicare Part B Plan F

You will never pay the standard 15 excess charges that doctors under Medicare are allowed to charge for Part B services. Medicare Supplement Plan F and all plans that cover Part B coinsurancecopayments pays toward prescription medications that are covered under Medicare Part B.

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Think of this new option as the standard Plan F with extra bonuses.

Medicare part b plan f. Innovative Plan F pays Part A and Part B. Medicare Part B excess charges. As of January 1 2020 Medigap plans sold to new people with Medicare arent allowed to cover the Part B deductible.

Medicare Part B covers injectable or infusion drugs given in a clinical setting. Like many other Medigap policies Plan F also covers Part B copayments and the deductible. If you qualified for Medicare before January 1 2020 you may still be able to buy Plan F.

Plan F also covers the Medicare Part B annual deductible. Because of this Plans C and F are not available to people new to Medicare starting on January 1 2020. Youll need to enroll in Medicare Part D for that.

The same applies to Plan C. However neither Original Medicare nor Plan F cover outpatient prescriptions. If you already have either of these 2 plans or the high deductible version of Plan F or are covered by one of these plans before January 1 2020 youll be able to keep your plan.

The same rules apply with this deductible that you would need to pay it before you can get any benefits from Part B of Medicare. You are eligible to buy Medicare Part F the first day of the month in which you meet both of the following conditions. Plan G does not cover the Part B deductible the Part B deductible for 2018 is 183.

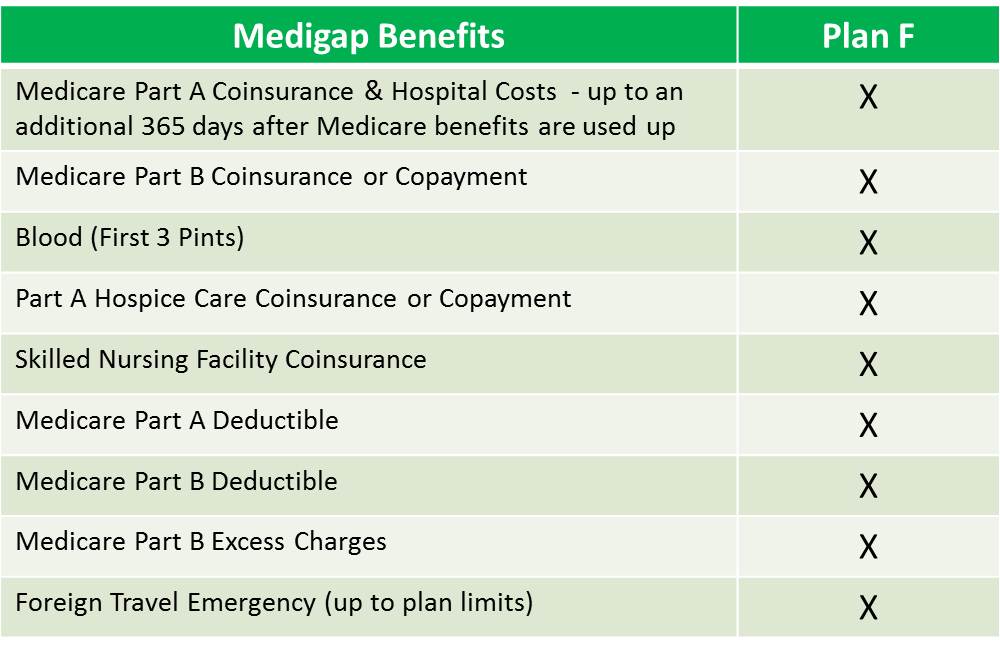

Find out the average cost of Plan F and learn about Medigap coverage options. First three pints of blood 100 of Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits have been. Medicare Supplement Insurance Medigap Plan F offers more benefits than other standardized Medigap plans.

You are enrolled in Medicare Part B. Plan F is one of two Medicare Supplement plans that covers Part B excess charges what some doctors charge above what Medicare pays for a service. Extras include benefits for hearing and vision care.

Whether you need all of the benefits of Plan F depends on your circumstances and your budget. Choose any doctor from over 900000 physicians in the United States. Like other Medicare supplement plans Plan F.

Here are the extensive benefits that Medicare Supplement Plan F and the high-deductible Plan F provide. Plan F also covers 80 percent of the cost of medically necessary care while youre traveling in a foreign country. Any medications under Medicare Part D however will not be covered.

Plan F is one of the 10 types of Medigap plans. Plan C is the other. Plan F and Plan C are not available to beneficiaries who became eligible for Medicare on or after January 1 2020.

Plan F basic benefits like. The new version of Plan F is comprehensive. If Medicare pays its 80 share on such a drug your Plan F will cover the rest of it.

Medicare Supplement Plans F and G are identical with the exception of one thing. In recent years several insurance carriers took Plan F and gave it a makeover. That means you could see a doctor with little to no money out of your own pocket.

However once the Part B deductible for Plan G is paid for you essentially have Plan F. Under age 65 with disability must be enrolled in Medicare Part A and Part B. Medicare Supplement Plan F.

Meaning if Medicare includes it so does the Medigap policy. This change applies to Medicare Supplement insurance plans that cover the Medicare Part B annual deductible Plan F and Plan C. Speak with a licensed insurance agent 1-862-286-9564 TTY 711 247.

Plan F is the only plan that covers all nine standardized benefit areas while Plan B covers five of them. Part B excess charges the 15 above the Medicare allowable amount that providers can charge. Medicare Plan F covers all Part B excess charges.

First three pints of blood per calendar year. Starting in 2020 new rules prohibit Medigap policies from covering. It covers all of the 20 that Medicare Part B normally leaves for you to pay.

This means that you will have to pay 183 annually before Plan G begins to cover anything. In addition Plan F provides coverage for skilled nursing facility care Medicare Part A and B deductibles and international travel medical emergency help. It covers a wide breadth of expenditures that original Medicare doesnt pay for.

Because the plan also covers costs in excess of Medicare-approved amounts you may have no out-of-pocket costs for hospital and doctors office care with this plan. If you already have Plan F you can generally keep it. This deductible is only 198 and most Medigap plans will not cover it.

What benefits are covered under Medicare Supplement Plan F.

Medicare Plan L Medigap Plan L Boomer Benefits

Medicare Plan L Medigap Plan L Boomer Benefits

Medigap Plan F Medicare Supplement Plan F 65medicare Org

Medigap Plan F Medicare Supplement Plan F 65medicare Org

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Supplement Plan F 7 Essential Facts You Must Know Clear Medicare Solutions

Medicare Supplement Plans Seniorquote Insurance Services

Medicare Supplement Plans Seniorquote Insurance Services

Comparing Medicare Supplement Plan F G Medicarehaven Com

Comparing Medicare Supplement Plan F G Medicarehaven Com

Medicare Supplement Medigap Plan F What Is Medicare Plan F

Medicare Supplement Medigap Plan F What Is Medicare Plan F

What Is Medicare Supplement Plan F Gomedigap

What Is Medicare Supplement Plan F Gomedigap

Medicare Supplement Plan Comparison Medicare Nationwide

Medicare Supplement Plan Comparison Medicare Nationwide

Comparison Of The Medicare Supplement Plan F And Plan G Medicare Supplement Plans Medicare Supplement Medicare

Comparison Of The Medicare Supplement Plan F And Plan G Medicare Supplement Plans Medicare Supplement Medicare

Best Medicare Supplement Plan F Rates Benefits Medigap Plan F Comparison

Best Medicare Supplement Plan F Rates Benefits Medigap Plan F Comparison

Comments

Post a Comment